Navigating the complexities of health insurance and taxes can be daunting. Understanding whether your health insurance premiums are taxable significantly impacts your overall tax liability. This guide provides a clear and concise overview of the tax implications of health insurance premiums, covering various scenarios, from employer-sponsored plans to self-employment situations. We’ll explore the nuances of different health insurance plans and how state and local laws can further influence your tax obligations.

This exploration will demystify the often-confusing world of health insurance premium taxability, equipping you with the knowledge to accurately report your premiums and avoid potential penalties. We’ll examine the deductibility of premiums, the impact on taxable income, and the crucial differences between various health insurance plan types. Whether you’re an employee, self-employed individual, or simply curious about the subject, this guide offers valuable insights into a critical aspect of personal finance and tax compliance.

Taxability of Health Insurance Premiums

The tax treatment of health insurance premiums varies significantly across countries, influenced by factors such as the specific type of plan, the individual’s tax bracket, and the country’s overall healthcare system. Generally, the goal of tax policies regarding health insurance is to encourage health coverage and manage healthcare costs effectively. Understanding these variations is crucial for individuals and businesses to accurately calculate their tax liabilities.

In many countries, premiums paid for employer-sponsored health insurance are often tax-advantaged. This means that the premiums are either deducted from taxable income before calculating the tax owed, or the employer’s contribution is not considered part of the employee’s taxable income. Conversely, premiums paid for individually purchased plans may or may not be tax deductible, depending on the specific tax laws of the country and the individual’s circumstances. For example, some countries allow deductions for premiums paid for plans that meet specific criteria, such as those covering certain medical conditions or providing a minimum level of coverage.

Tax Deductibility of Health Insurance Premiums: Examples

Let’s consider some illustrative scenarios. In the United States, premiums paid for employer-sponsored health insurance are generally not included in an employee’s taxable income. However, self-employed individuals may be able to deduct the cost of their health insurance premiums as a business expense. In contrast, in Canada, premiums for most health insurance plans are not tax deductible, as the country has a publicly funded healthcare system. The UK’s National Health Service (NHS) is also publicly funded, thus eliminating the tax deductibility aspect for the majority of the population. However, supplementary private health insurance premiums are typically not tax deductible.

Types of Health Insurance Plans and Tax Implications

The type of health insurance plan significantly influences its tax treatment. For instance, a High Deductible Health Plan (HDHP) in the US, paired with a Health Savings Account (HSA), often offers tax advantages. Contributions to an HSA are tax-deductible, the investment earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. Traditional health insurance plans, on the other hand, might not provide the same tax benefits. The tax implications also vary depending on whether the plan is employer-sponsored or self-purchased, impacting the eligibility for tax deductions or credits.

Specific Country Considerations

It’s crucial to understand that the tax implications of health insurance premiums are highly jurisdiction-specific. Tax laws and regulations are constantly evolving, making it essential to consult with a tax professional or refer to the most up-to-date official government resources for accurate and current information. For instance, a country might offer tax credits for individuals purchasing specific types of health insurance plans, based on income level or family size. These credits effectively reduce the overall tax burden for qualifying individuals.

Employer-Sponsored Health Insurance

Employer-sponsored health insurance is a significant benefit offered by many companies to their employees. Understanding the tax implications of this benefit is crucial for both the employer and the employee, as it affects their overall financial picture. This section will clarify the tax treatment of premiums and explore related accounts like FSAs and HSAs.

Tax Implications for Employers and Employees

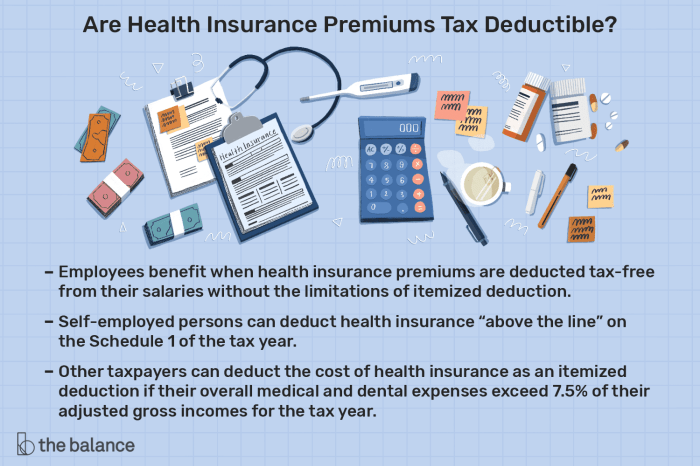

Employer-provided health insurance premiums are generally considered a non-taxable fringe benefit for employees. This means the employee does not have to report the value of the employer’s contribution to their taxable income. However, this is only true for the employer’s contribution; any premiums paid by the employee are considered taxable income. For the employer, premiums paid are considered a deductible business expense, reducing their overall tax liability. This mutually beneficial arrangement incentivizes employers to offer health insurance and provides employees with valuable coverage without the full tax burden. The value of the employer’s contribution is not reported on the employee’s W-2 form.

Comparison of Employer and Employee Premium Payments

The key difference lies in taxability. Premiums paid by the employer are excluded from the employee’s taxable income, while premiums paid by the employee are included. This means that an employee effectively pays less in taxes for coverage provided by their employer compared to purchasing similar coverage on their own. For example, if an employer pays $500 per month in premiums and the employee pays $100, only the $100 paid by the employee is subject to income tax and payroll tax. This significant tax advantage is a primary reason why employer-sponsored health insurance is so popular.

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

FSAs and HSAs are tax-advantaged accounts that can be used to pay for eligible medical expenses. However, they differ significantly in their rules and eligibility requirements. Understanding these differences is essential for maximizing tax benefits and effectively managing healthcare costs.

| Account Type | Contribution Limits | Tax Advantages | Eligibility Requirements |

|---|---|---|---|

| Flexible Spending Account (FSA) | Annual limits set by the employer; unused funds typically forfeit at the end of the year. | Pre-tax contributions reduce taxable income. | Offered by employers; employee must enroll and make contributions. |

| Health Savings Account (HSA) | Annual limits set by the IRS; funds roll over year to year. | Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. | Must be enrolled in a high-deductible health plan (HDHP) and meet other eligibility requirements. |

Self-Employed Individuals and Health Insurance

Self-employed individuals face a unique challenge when it comes to health insurance: they are responsible for securing and paying for their own coverage. Unlike employees who often receive employer-sponsored plans, the self-employed must navigate the complexities of the individual health insurance market and understand the tax implications. Fortunately, the IRS offers tax deductions to help offset the cost of health insurance premiums. This section details the deductions available, the necessary documentation, and a step-by-step guide for claiming them.

Self-employed individuals can deduct the amount they paid for health insurance premiums as a business expense. This deduction reduces their taxable income, ultimately lowering their overall tax liability. The deduction is claimed on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). It’s crucial to understand that only premiums paid for health insurance for yourself, your spouse, and your dependents are deductible. Premiums paid for other individuals are not eligible for this deduction.

Deductible Health Insurance Premiums for the Self-Employed

The self-employed can deduct the amount they paid in health insurance premiums during the tax year. This deduction is taken above the line, meaning it reduces your adjusted gross income (AGI). This is advantageous because it can lower your tax liability more significantly than itemized deductions. The amount you can deduct is limited to the amount you actually paid. For example, if your annual health insurance premiums were $7,200, you can deduct the full $7,200. It’s important to note that you cannot deduct premiums if you or your spouse were eligible to participate in an employer-sponsored health plan.

Required Documentation for Claiming the Deduction

To successfully claim the health insurance premium deduction, you’ll need to gather specific documentation. This ensures the IRS can verify the accuracy of your deduction. Failing to provide adequate documentation could result in delays or rejection of your claim.

The key document is Form 1095-A, Health Insurance Marketplace Statement. This form provides details of your health insurance coverage, including the premiums paid during the tax year. You should also retain all your premium payment receipts, bank statements showing payments, or any other proof of payment. Keeping organized records is essential for a smooth tax filing process. These records should be retained for at least three years in case of an audit.

Step-by-Step Guide to Claiming the Deduction

Claiming the deduction involves several straightforward steps. Accuracy and thoroughness are key to a successful claim. Following these steps will help ensure a smooth and accurate tax filing.

- Gather your documents: Collect Form 1095-A and all your premium payment records.

- Complete Schedule C (Form 1040): Enter your business income and expenses. On Line 16, “Other expenses,” include your health insurance premiums. Be sure to keep a detailed record of this expense for your records.

- Attach supporting documentation: Include copies of Form 1095-A and your payment receipts with your tax return.

- File your tax return: Submit your completed tax return, including Schedule C and supporting documentation, by the tax deadline.

Impact of Health Insurance Premiums on Taxable Income

Understanding how health insurance premiums affect your taxable income is crucial for accurate tax filing. The impact depends largely on whether your premiums are paid by your employer or yourself, and the specific tax laws in your jurisdiction. Generally, the deduction of premiums leads to a lower taxable income and therefore, lower tax liability.

The calculation of taxable income, when considering health insurance premiums, involves several factors. Primarily, the source of premium payment (employer or self-funded) significantly alters the tax implications. Employer-sponsored plans often treat premiums differently than those purchased individually or through the marketplace. Furthermore, the type of health insurance plan (e.g., HSA-compatible plans) and any applicable tax credits or deductions can also modify the calculation. Finally, your overall income level will determine your eligibility for certain tax benefits.

Deductible Health Insurance Premiums and Taxable Income Reduction

The ability to deduct health insurance premiums directly impacts your taxable income. For self-employed individuals, premiums paid are often deductible as a business expense, directly reducing their adjusted gross income (AGI). This lower AGI subsequently lowers their overall taxable income. For example, a self-employed individual with a $10,000 income and $2,000 in health insurance premiums would have a taxable income of $8,000 after the deduction, resulting in a lower tax bill compared to someone without the deduction. This is a significant advantage as it reduces the tax burden on those who shoulder the full cost of their health insurance.

Employer-Sponsored Health Insurance and Taxable Income

While you generally don’t directly deduct employer-sponsored health insurance premiums from your taxable income, the premiums paid by your employer are considered a non-taxable benefit. This means the value of the employer’s contribution to your health insurance isn’t included in your gross income, effectively lowering your taxable income indirectly. For instance, if your employer contributes $5,000 annually towards your health insurance, this amount is not added to your wages for tax purposes, reducing your overall tax liability. This is a key difference from self-funded plans, where the entire premium is a deductible expense.

Tax Credits and Deductions for Health Insurance

Several tax credits and deductions are available to help offset the cost of health insurance, particularly for individuals and families with moderate to low incomes. These credits and deductions reduce your tax liability, indirectly impacting your taxable income. The Affordable Care Act (ACA) offers premium tax credits to individuals purchasing insurance through the marketplace, making coverage more affordable. The exact amount of the credit depends on income and the cost of insurance. For example, a family earning $50,000 annually might receive a $2,000 tax credit, reducing their tax bill by that amount. Similarly, other deductions might be available depending on the individual circumstances.

Tax Implications of Different Health Insurance Plans

Understanding the tax implications of various health insurance plans is crucial for both employers and employees. The type of plan you have, whether it’s employer-sponsored or purchased individually, and the structure of your premiums significantly impact how your health insurance costs affect your taxable income. This section will explore the tax treatment of different common health insurance plan types.

Tax Implications of HMO Plans

Health Maintenance Organizations (HMOs) typically offer lower premiums than other plans in exchange for a more restricted network of doctors and hospitals. The tax treatment of HMO premiums generally mirrors that of other health insurance plans; premiums paid by employers are generally tax-free to employees, while premiums paid by self-employed individuals may be deductible as a business expense. However, specific tax implications can vary depending on the plan details and individual circumstances. For example, some HMO plans may include additional features that could impact taxability.

Tax Implications of PPO Plans

Preferred Provider Organizations (PPOs) offer more flexibility than HMOs, allowing access to a wider network of healthcare providers, but usually at a higher premium cost. Similar to HMOs, employer-sponsored PPO premiums are generally excluded from an employee’s taxable income. For self-employed individuals, premiums are typically deductible as a business expense. The higher premiums compared to HMOs might result in a larger deduction for the self-employed, but this also means higher out-of-pocket costs.

Tax Implications of EPO Plans

Exclusive Provider Organizations (EPOs) are similar to HMOs in that they offer a limited network of providers, but unlike HMOs, they typically don’t require a primary care physician referral to see specialists. The tax treatment of EPO premiums generally aligns with that of HMO and PPO plans. Employer-sponsored premiums are usually tax-free to employees, and self-employed individuals can generally deduct premiums as a business expense. The key difference lies in the cost-benefit analysis; the lower premiums of an EPO compared to a PPO might offset the limitations on provider choice.

Key Tax Considerations for Different Health Insurance Plan Types

The following table summarizes key tax considerations for each plan type. Remember that specific tax laws are subject to change, and consulting a tax professional is always recommended for personalized advice.

| Plan Type | Employer-Sponsored Premiums | Self-Employed Premiums | Other Tax Considerations |

|---|---|---|---|

| HMO | Generally tax-free to employee | Generally deductible as a business expense | Specific plan features may affect taxability. |

| PPO | Generally tax-free to employee | Generally deductible as a business expense | Higher premiums may result in a larger deduction for the self-employed. |

| EPO | Generally tax-free to employee | Generally deductible as a business expense | Cost-benefit analysis should consider lower premiums against provider limitations. |

State and Local Tax Laws Regarding Health Insurance Premiums

The deductibility of health insurance premiums can vary significantly depending on your state and local tax laws. While the federal government offers certain tax benefits related to health insurance, states and localities may have their own rules impacting how premiums are treated for tax purposes. These variations can lead to differences in the overall tax burden for individuals and businesses. Understanding these nuances is crucial for accurate tax filing and potential tax savings.

State and local tax laws often interact with federal tax rules regarding health insurance. For instance, some states may offer additional deductions or credits beyond what’s available federally, while others might have stricter limitations on deductibility. This complexity highlights the importance of consulting state-specific tax guidelines or seeking professional tax advice.

Deductibility of Premiums for Self-Employed Individuals

Many states allow self-employed individuals to deduct the cost of health insurance premiums on their state income tax returns, mirroring the federal deduction available under the self-employment tax. However, the specific rules, such as qualifying self-employment income thresholds and documentation requirements, can vary considerably across states. For example, California might require specific forms to be filed alongside the state return, while New York might have a different set of criteria for eligibility. These variations necessitate careful review of each state’s individual tax code.

State-Specific Tax Credits for Health Insurance

Some states offer tax credits to residents who purchase health insurance through the state marketplace or other qualifying programs. These credits can directly reduce the amount of state income tax owed, effectively lowering the overall cost of health insurance. For instance, Massachusetts might provide a larger credit for lower-income individuals than Texas, reflecting differing state priorities and budgetary allocations. The availability and amount of these credits frequently change, so it’s essential to check the relevant state’s department of revenue website for the most up-to-date information.

State and Local Taxes on Employer-Sponsored Health Insurance

While employer-sponsored health insurance premiums are generally not directly taxed at the state level, some states may indirectly impact the tax situation. For example, states with higher overall income tax rates will ultimately increase the tax burden on employees even if the premiums themselves aren’t directly taxed. Furthermore, some states might tax the employer’s contribution to health insurance as part of the overall business income tax, though this is less common. The impact varies depending on the state’s overall tax structure and business tax regulations.

Penalties and Consequences for Incorrect Reporting

Accurately reporting health insurance premiums on your tax return is crucial. Inaccurate reporting, whether intentional or unintentional, can lead to significant penalties and complications with the IRS. Understanding the potential consequences and the process for correcting errors is vital for responsible tax compliance.

Incorrectly reporting health insurance premiums can result in several penalties. The most common is an underpayment penalty, which is assessed if you owe taxes and didn’t pay enough throughout the year through withholding or estimated tax payments. The penalty amount depends on how much you underpaid and for how long. Additionally, the IRS may charge interest on the unpaid tax amount. In cases of intentional misreporting, more severe penalties, including fraud penalties, can be levied, resulting in substantial fines and potential criminal prosecution. The severity of the penalties is determined by several factors, including the amount of the underpayment, the taxpayer’s history of tax compliance, and whether the error was intentional or due to negligence. For example, a small, unintentional error might result in a relatively small penalty, while a large, deliberate misrepresentation could lead to significant financial repercussions and legal consequences.

Amending Tax Returns

If you discover an error on your tax return related to health insurance premium deductions, you can amend it using Form 1040-X, Amended U.S. Individual Income Tax Return. This form allows you to correct mistakes and update your information. The IRS provides detailed instructions on how to complete Form 1040-X, and it’s important to accurately and thoroughly fill out all sections to avoid further complications. You should include supporting documentation, such as corrected insurance statements or explanations for the errors, to support your amended return. Filing an amended return is a straightforward process, but it’s crucial to act promptly to minimize any potential penalties and interest. Processing time for amended returns can vary, so it is advisable to file as soon as possible after discovering the error.

Resources for Taxpayers

Numerous resources are available to assist taxpayers in understanding and correctly reporting health insurance premium deductions. The IRS website (IRS.gov) offers comprehensive guidance, publications, and forms related to tax filing. The IRS also provides a toll-free telephone number and online chat support for taxpayers needing assistance. Furthermore, many tax preparation software programs offer guidance on health insurance premium deductions and will automatically calculate the correct amount based on your provided information. Tax professionals, such as CPAs and enrolled agents, can also provide expert assistance with tax preparation and ensure accurate reporting of health insurance premiums. Seeking professional assistance can be especially beneficial for taxpayers with complex tax situations or those who are unsure about the correct way to report their health insurance information. Finally, many community organizations and libraries offer free or low-cost tax assistance programs, particularly for low-income taxpayers.

Last Recap

In conclusion, the tax implications of health insurance premiums are multifaceted and depend on several factors, including employment status, the type of health insurance plan, and applicable state and local laws. Accurate reporting is paramount to avoid penalties and ensure compliance. By understanding the key aspects discussed in this guide, individuals can confidently navigate the complexities of health insurance premium taxability and manage their financial obligations effectively. Remember to consult with a tax professional for personalized advice tailored to your specific circumstances.

Common Queries

What is the difference between a Health Savings Account (HSA) and a Flexible Spending Account (FSA)?

HSAs are tax-advantaged savings accounts for those with high-deductible health plans, offering tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. FSAs are employer-sponsored accounts allowing pre-tax contributions for medical expenses, but funds typically expire at the end of the year and may have lower contribution limits.

Can I deduct health insurance premiums if I’m unemployed?

Depending on your country’s tax laws, you may be able to deduct health insurance premiums even if you are unemployed, provided you meet specific eligibility criteria. These criteria often involve demonstrating a certain level of income or having a qualifying health condition. Check with your country’s tax agency for specifics.

What happens if I make a mistake on my tax return regarding health insurance premiums?

If you discover an error, you should file an amended tax return (usually Form 1040-X in the US) as soon as possible. The sooner you correct the error, the better, as penalties may be applied for late filing or underpayment.

Where can I find more information about health insurance premium taxability in my state/country?

Consult your country’s or state’s tax agency website for the most up-to-date and accurate information. You can also seek advice from a qualified tax professional.