Navigating the complexities of health insurance can be daunting, but understanding the potential for tax deductions on your premiums can significantly impact your financial well-being. This guide delves into the intricacies of health insurance premium tax deductibility, exploring eligibility criteria, documentation requirements, and the overall financial implications for both individuals and businesses. We’ll unravel the often-confusing rules surrounding this valuable tax benefit, empowering you to maximize your savings and plan effectively for your healthcare costs.

From the self-employed individual carefully scrutinizing their tax return to the large corporation managing employee benefits, the implications of health insurance premium tax deductibility are far-reaching. This guide provides a comprehensive overview, covering various scenarios and offering practical advice to help you understand your rights and responsibilities regarding this important aspect of tax planning. We’ll explore how different factors, such as income level, employment status, and the type of health insurance plan, influence your eligibility for deductions, ultimately leading to a clearer understanding of your potential tax savings.

Defining Health Insurance Premium Tax Deductibility

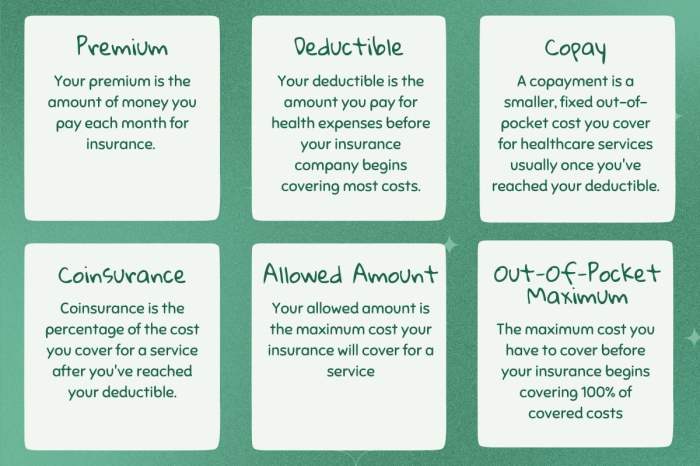

Tax deductibility for health insurance premiums refers to the ability to reduce your taxable income by the amount you paid in health insurance premiums. This effectively lowers your overall tax liability, providing a financial incentive for individuals and families to maintain health insurance coverage. The specifics of this deduction, however, vary significantly depending on your location and the type of health insurance plan.

Health insurance premium tax deductibility is a complex area with varying rules and regulations across different jurisdictions. Understanding these rules can significantly impact your tax burden and financial planning. This section will clarify the concept, explore the types of premiums eligible for deduction, and illustrate this with real-world examples.

Types of Tax-Deductible Health Insurance Premiums

Several types of health insurance premiums may qualify for tax deductions, although the specific eligibility criteria depend heavily on the governing tax laws. Generally, premiums paid for self-employed individuals, those with a qualifying health savings account (HSA), or those covered under certain employer-sponsored plans may be deductible. However, premiums for plans that offer comprehensive coverage are often more likely to be deductible than those with more limited benefits. The deductibility can also depend on the individual’s income level and filing status. For instance, a self-employed individual might deduct the full amount of premiums paid, while an employee participating in an employer-sponsored plan may only be able to deduct the portion they contribute personally.

Examples of Deductible and Non-Deductible Premiums

Let’s consider some scenarios. A self-employed freelance writer paying for their own health insurance can generally deduct the entire premium paid. Conversely, an employee whose employer covers the majority of their health insurance premiums would likely only be able to deduct the employee’s contribution, if any. Another example is a person contributing to a Health Savings Account (HSA). While the HSA contributions themselves are usually tax-deductible, the premiums for the high-deductible health plan paired with the HSA are also often eligible for tax deductions, depending on the specific plan and country. On the other hand, premiums paid for supplemental insurance policies like vision or dental plans may not always be deductible, depending on local tax regulations. It is crucial to consult with a tax professional or refer to the relevant tax guidelines for definitive answers.

International Comparison of Health Insurance Premium Tax Deductibility

Tax laws concerning health insurance premium deductibility vary significantly worldwide. The following table provides a simplified comparison, noting that these rules are subject to change and individual circumstances can greatly impact deductibility. This information is for illustrative purposes only and should not be considered definitive tax advice. Always consult with a local tax professional for accurate and up-to-date information.

| Country | Self-Employed Deductibility | Employee Deductibility | HSA/FSA Related Deductions |

|---|---|---|---|

| United States | Often fully deductible, depending on income and plan type | Usually only employee contributions are deductible | Contributions and sometimes premiums are deductible |

| Canada | Deductible as a business expense | Generally not deductible | Limited deductibility depending on provincial regulations |

| United Kingdom | Can be claimed as a business expense | Generally not deductible | No specific tax benefits for HSAs/FSAs |

| Australia | Deductible as a business expense | Generally not deductible | No direct tax benefits related to HSAs/FSAs |

Documentation and Reporting Requirements

Claiming a deduction for health insurance premiums requires careful record-keeping and accurate reporting on your tax return. Failing to provide the necessary documentation can result in delays or rejection of your claim. Understanding the process ensures a smooth and successful tax filing.

The specific documentation required and the method of reporting may vary slightly depending on your country and tax system. However, the general principles remain consistent. This section provides a general overview, and you should always consult your country’s specific tax guidelines and forms for precise instructions.

Necessary Documentation for Claiming the Deduction

To successfully claim the health insurance premium deduction, you will need to gather several key documents. These documents serve as proof of your payments and eligibility for the deduction. This typically includes your health insurance policy documents, proof of payment, and your tax identification information.

Generally, you’ll need:

- Form 1095-B or 1095-A (if applicable): These forms, provided by your insurance company or the Marketplace, confirm your health insurance coverage for the tax year. This is crucial for proving your eligibility for the deduction. Note that the availability and necessity of these forms depend on your specific health insurance plan and tax jurisdiction.

- Proof of Payment: This could be in the form of bank statements, canceled checks, receipts, or payment confirmations from your insurance provider, clearly showing the dates and amounts paid for your health insurance premiums. Maintain organized records to simplify the process.

- Tax Identification Number (TIN): This is your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), essential for identifying you on your tax return.

Reporting Health Insurance Premium Deductions on Tax Returns

The process of reporting health insurance premium deductions involves accurately entering the relevant information onto your tax return form. The specific location and method for reporting will vary depending on your tax form and jurisdiction. It is important to follow the instructions provided with your tax forms.

Generally, you’ll need to find the appropriate section on your tax form where medical expenses are reported. This often involves subtracting your adjusted gross income (AGI) from your total medical expenses. If the amount exceeds a certain threshold (which varies by country and jurisdiction), you may be able to deduct the excess amount.

Step-by-Step Guide to Reporting Deductions

A step-by-step guide is difficult to provide without knowing the specific tax form you are using. However, the general steps are as follows:

- Gather your documentation: Collect all necessary documents, including your health insurance policy, proof of payment, and tax identification number.

- Calculate your medical expenses: Total all your eligible medical expenses, including health insurance premiums.

- Determine your AGI: Calculate your adjusted gross income (AGI) as per the instructions on your tax form.

- Calculate the deductible amount: Subtract your AGI from your total medical expenses. Only the amount exceeding the AGI threshold is deductible. This threshold varies significantly by tax jurisdiction.

- Enter the information on your tax form: Locate the section on your tax form where medical expense deductions are reported. Carefully enter the calculated deductible amount.

- Review and file: Double-check your work for accuracy before filing your tax return.

Sample Tax Form Section

The exact location and labeling will vary based on your tax form. However, a hypothetical example might look like this:

Imagine a section of a tax form titled “Medical Expenses.” There would be lines for:

| Line Item | Description | Amount |

|---|---|---|

| 1 | Total Medical Expenses (including premiums) | $12,000 |

| 2 | Adjusted Gross Income (AGI) | $50,000 |

| 3 | Excess Medical Expenses (Line 1 – Line 2) | ($38,000) |

| 4 | Deductible Medical Expenses (Only the amount exceeding the AGI threshold) | $0 |

Note: This is a simplified example and does not reflect any specific tax law or form. The actual form and calculations will vary significantly depending on your location and tax situation. Always consult the instructions accompanying your tax forms.

Changes and Updates to Tax Laws

Tax laws regarding health insurance premium deductibility are not static; they evolve in response to various economic, social, and political factors. Understanding these changes is crucial for individuals and businesses to accurately plan for and manage their tax obligations. This section will explore potential future alterations, influencing factors, past examples, and a historical timeline of key adjustments.

Potential Future Changes in Health Insurance Premium Deductibility

Several factors could lead to future modifications in the deductibility of health insurance premiums. These include shifts in healthcare policy, budgetary concerns, and evolving societal views on healthcare access and affordability. For instance, a future administration might prioritize expanding healthcare access by altering the tax code to incentivize more individuals to obtain coverage, potentially increasing deductibility or creating new tax credits tied to premium payments. Conversely, budgetary constraints could lead to a reduction or elimination of premium deductibility as a means of reducing government spending. The ongoing debate about the role of government in healthcare financing will undoubtedly play a significant role in shaping future legislation.

Factors Influencing Changes to Health Insurance Premium Deductibility Laws

Several interconnected factors influence changes to health insurance premium deductibility laws. Economic conditions, such as budget deficits or surpluses, significantly impact the government’s ability and willingness to provide tax breaks. Political priorities, including a party’s stance on healthcare reform, also heavily influence legislation. Changes in the healthcare landscape itself, such as the rise of new technologies or significant shifts in healthcare costs, can necessitate adjustments to tax policies. Finally, public opinion and advocacy groups play a vital role in shaping the political debate and influencing legislative outcomes. For example, a strong advocacy campaign highlighting the financial burden of healthcare costs on families could lead to increased deductibility.

Examples of Past Changes and Their Impact

The history of tax laws related to health insurance premium deductibility is marked by periods of expansion and contraction. For instance, the Affordable Care Act (ACA) significantly impacted deductibility through the introduction of tax credits and subsidies for individuals purchasing insurance through the marketplaces. This led to increased healthcare coverage, but also impacted government spending. Conversely, past attempts to repeal or significantly alter the ACA reflected shifts in political priorities and resulted in uncertainty for individuals and businesses regarding their tax liabilities. These changes highlight the dynamic nature of healthcare tax policy and the need for continuous monitoring.

Historical Timeline of Key Changes in Tax Laws Related to Health Insurance Premium Deductions

| Year | Event | Impact |

|---|---|---|

| 1942 | Employer-sponsored health insurance plans become tax-exempt. | This incentivized employers to offer health insurance, laying the groundwork for the modern system. |

| 1954 | Self-employed individuals gain the ability to deduct health insurance premiums. | Expanded access to tax benefits for a wider segment of the population. |

| 2010 | The Affordable Care Act (ACA) is enacted. | Introduced tax credits and subsidies for individuals purchasing insurance through the marketplaces, significantly impacting deductibility and coverage rates. |

| 2017-Present | Ongoing debates and legislative attempts to modify or repeal the ACA. | Creates uncertainty regarding the future of tax benefits related to health insurance. |

Illustrative Examples of Deductible Premiums

Understanding how health insurance premiums are treated for tax purposes requires examining specific scenarios. This section provides examples to illustrate the tax deductibility of premiums and the resulting tax savings. Remember that specific rules and limitations may vary based on your country’s tax laws and your individual circumstances. Always consult a tax professional for personalized advice.

Example 1: Self-Employed Individual with a High-Deductible Health Plan

Let’s consider Sarah, a self-employed graphic designer. She purchased a high-deductible health plan (HDHP) with a monthly premium of $500. Her adjusted gross income (AGI) is $60,000. Assuming she can deduct the full amount of her premiums, this will reduce her taxable income. If her tax bracket is 22%, the tax savings calculation would be:

Annual Premium: $500/month * 12 months = $6000

Tax Savings: $6000 * 0.22 = $1320

This means Sarah’s tax liability is reduced by $1320 due to the deductible premiums. Note that this example assumes she meets all eligibility requirements for the deduction. This example only includes the premium itself; other medical expenses are not factored in.

Example 2: Family Plan and Additional Medical Expenses

John and Mary, a married couple, purchased a family health insurance plan with a monthly premium of $1200. Their AGI is $100,000. During the year, they also incurred $2,000 in unreimbursed medical expenses (doctor visits, prescription drugs). Assuming they can deduct the full premium and the medical expenses exceeding the applicable threshold (which varies by country and tax law), their tax savings would be calculated based on the combined deductible amount and their tax bracket.

Annual Premium: $1200/month * 12 months = $14400

Total Deductible Expenses (assuming medical expense threshold is met): $14400 + $2000 = $16400

Tax Savings (assuming a 28% tax bracket): $16400 * 0.28 = $4592

This calculation shows a significantly higher tax savings due to both the higher premium and additional medical expenses. Again, this is a simplified example and may not reflect the actual tax savings due to individual circumstances and tax law specifics.

Example 3: Non-Deductible Premiums: Employer-Sponsored Insurance

In contrast to self-employed individuals, employees who receive health insurance as a benefit from their employer generally cannot deduct the premiums paid by their employer. The premiums are considered a non-taxable fringe benefit. However, if an employee chooses a more expensive plan than the one offered by their employer, the difference in premium cost may be deductible in some circumstances, depending on the specific tax laws and regulations in place. This requires careful review of the applicable tax rules.

Visual Representation of Tax Savings

Imagine a simple bar graph. One bar represents the total taxable income before deducting premiums. A second, shorter bar represents the taxable income *after* deducting the premiums. The difference between the lengths of the two bars visually represents the amount of tax savings achieved through the premium deduction. The percentage reduction in taxable income is also clearly shown by the difference in bar length. The higher the premium and the higher the tax bracket, the larger the difference and the greater the visual representation of the tax savings.

Closing Notes

Understanding the intricacies of health insurance premium tax deductibility is crucial for optimizing your financial situation. By carefully reviewing your eligibility, gathering necessary documentation, and accurately reporting your deductions, you can significantly reduce your tax burden. This guide has provided a comprehensive overview of the key aspects involved, equipping you with the knowledge to navigate this complex area confidently. Remember to consult with a qualified tax professional for personalized advice tailored to your specific circumstances to ensure you’re maximizing your tax benefits and adhering to all applicable regulations.

FAQ Section

What constitutes a “qualifying” health insurance plan for tax deduction purposes?

This varies by country and jurisdiction. Generally, plans providing minimum essential coverage are eligible, but specific requirements regarding plan features and provider networks should be verified with local tax authorities or a tax professional.

Can I deduct premiums for my dependents’ health insurance?

Usually, yes, provided they are claimed as dependents on your tax return and meet the criteria for your jurisdiction’s tax laws. Specific rules apply, so check local regulations.

What happens if I overestimate my deductible premiums on my tax return?

You may be subject to an audit and may need to pay back the overclaimed amount, plus penalties and interest. Accurate record-keeping is essential.

Are there any limitations on the amount of health insurance premiums I can deduct?

Yes, most jurisdictions impose limits. These limits often depend on factors like income, filing status, and the type of plan. Consult your local tax laws or a tax professional for details.