Navigating the complexities of your W-2 form can feel like deciphering a secret code, especially when it comes to understanding how your health insurance premiums are reported. This seemingly small detail on your tax document can significantly impact your net income and overall tax liability. This guide will demystify the process, providing a clear explanation of how employer-sponsored and individual health insurance premiums are reflected on your W-2, and the tax implications involved.

We’ll explore the various ways health insurance premiums appear on your W-2, covering different plan types (HMO, PPO, HSA) and employer contribution levels. Understanding these nuances is crucial for accurately calculating your net income and ensuring you’re taking advantage of all available tax benefits. We’ll also delve into the tax implications for both employees and self-employed individuals, providing practical examples and a step-by-step guide to accurate reporting.

Comparing Different Health Insurance Plans and W-2 Reporting

Understanding how different health insurance plans are reported on your W-2 is crucial for accurate tax preparation and financial planning. The type of plan you have—HMO, PPO, or HSA—significantly impacts how your premiums are reflected on your tax documents. This section clarifies these differences and their implications.

W-2 Reporting Differences Between HMO, PPO, and HSA Plans

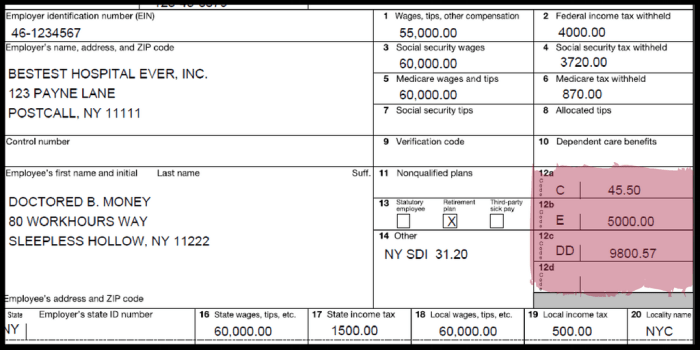

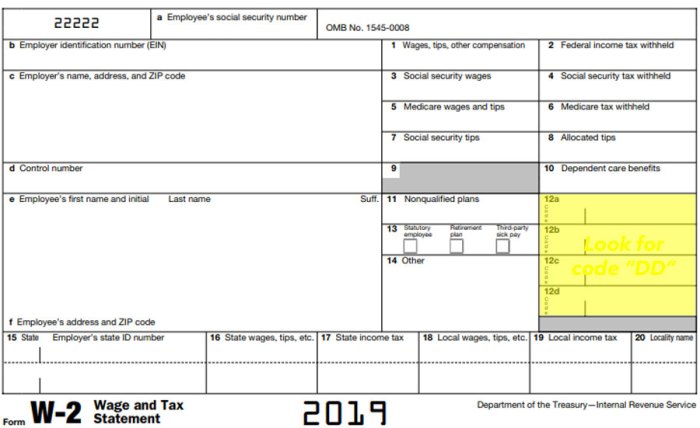

The way your health insurance premiums are reported on your W-2 form depends largely on the type of plan and whether your employer contributes. Generally, employer contributions are not taxable to you, while employee contributions are. However, the specifics of how this is reflected can vary. For example, with an HMO, the employer’s contribution might be listed separately from the employee’s, while with a PPO, they might be combined. HSA plans introduce another layer of complexity, as contributions to the HSA account itself are often tax-advantaged.

Impact of Health Insurance Plan Type on Reported Premium Amounts

The type of plan directly affects the reported premium amount. HMOs (Health Maintenance Organizations) typically have lower premiums but restrict your choice of doctors and specialists to those within their network. PPOs (Preferred Provider Organizations) generally offer higher premiums but provide more flexibility in choosing healthcare providers, both in and out of network. HSA (Health Savings Account) plans usually have lower premiums than PPOs, but require you to contribute to a dedicated savings account to pay for medical expenses. The reported premium will reflect the total premium cost, including employee and employer contributions, though the taxable portion will differ.

Impact of Employee Contributions Versus Employer-Only Contributions on the W-2

Employer-only contributions to your health insurance are not included in your taxable income and therefore do not appear on your W-2 as wages. However, employee contributions are considered taxable compensation and are reported on Box 1 of your W-2 form as wages. This means that only the portion of the premium you pay will be subject to income tax, social security tax, and Medicare tax. The employer’s contribution is a non-taxable benefit. For HSA plans, employer contributions to the HSA account may be reported separately, depending on the employer’s reporting practices.

Comparison Table of Premium Reporting Differences Across Various Plan Types

| Plan Type | Employer Contribution Reporting | Employee Contribution Reporting | Tax Implications |

|---|---|---|---|

| HMO | May be separately listed or included in Box 12 | Reported in Box 1 (Wages) | Employee contributions are taxable; employer contributions are not. |

| PPO | May be separately listed or included in Box 12 | Reported in Box 1 (Wages) | Employee contributions are taxable; employer contributions are not. |

| HSA | May be reported separately or not reported at all (depending on employer reporting practices); employer contributions to the HSA are often tax-advantaged | Reported in Box 1 (Wages), HSA contributions may be tax deductible | Employee contributions are taxable; employer contributions to the HSA are generally tax-advantaged. |

Final Thoughts

Successfully navigating the intricacies of health insurance premium reporting on your W-2 empowers you to take control of your finances and ensure accurate tax filing. By understanding how your premiums are reported and their tax implications, you can make informed decisions about your health insurance plan and maximize your financial well-being. Remember to consult with a tax professional for personalized advice tailored to your specific circumstances.

Clarifying Questions

What if my employer only partially covers my health insurance premiums?

The portion you pay will be listed as a pre-tax deduction, reducing your taxable income. The employer’s contribution will not be reflected on your W-2.

How are COBRA premiums reported on my W-2?

COBRA premiums, paid after leaving your employer, are generally not reported on your W-2. You’ll likely receive a separate 1099-MISC form detailing these payments.

Can I deduct health insurance premiums if I’m self-employed?

Yes, self-employed individuals can generally deduct health insurance premiums as a business expense on their tax return (Schedule C or Schedule 1). Specific rules and eligibility criteria apply.

What if there’s a discrepancy between my W-2 and my pay stubs regarding health insurance premiums?

Contact your payroll department immediately to resolve the discrepancy. Inaccurate reporting can lead to tax problems.