Navigating the world of health insurance can feel like deciphering a complex code, particularly when it comes to understanding the often-misunderstood concept of health insurance premiums. This seemingly simple term masks a multifaceted reality, influenced by a variety of factors that can significantly impact your monthly expenses. This guide aims to demystify the meaning of health insurance premiums, providing a clear and comprehensive overview of their components, influencing factors, and variations.

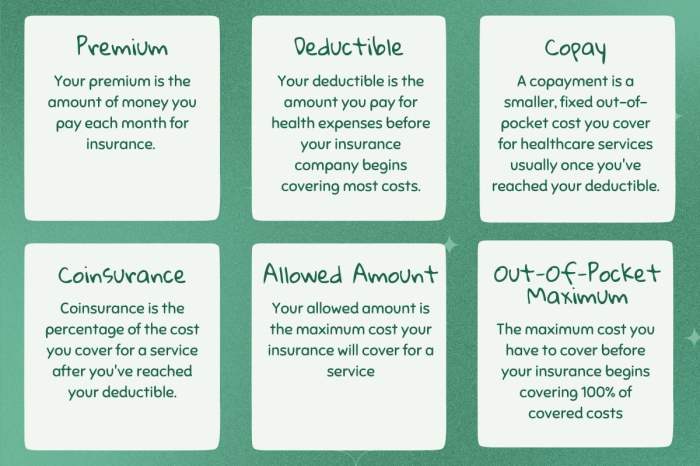

From the fundamental definition of a premium to the intricate details of its constituent parts, we will explore how age, location, family size, and the type of health plan selected all contribute to the final cost. We’ll also delve into how deductibles, co-pays, and out-of-pocket maximums interact with premiums to shape your overall healthcare financial responsibility. By the end, you’ll have a solid grasp of what constitutes a health insurance premium and how to make informed decisions based on your individual circumstances.

Defining Health Insurance Premiums

Health insurance premiums are essentially the regular payments you make to your insurance company in exchange for the coverage they provide. Think of it like a membership fee – you pay consistently to access the benefits of the plan when you need them. This ensures that you have financial protection against unexpected medical costs.

Components of a Health Insurance Premium

Several factors contribute to the final cost of your health insurance premium. These components work together to determine the overall price you pay. Understanding these elements can help you make informed decisions when choosing a plan. These include the costs associated with administering the plan, the expected claims payouts, and the profit margin the insurance company aims to achieve. The premium also reflects the level of risk associated with insuring a particular group of individuals.

Factors Influencing Premium Costs

Numerous factors influence the cost of your health insurance premium. Your age, location, and health status significantly impact the price. Pre-existing conditions, smoking habits, and the type of plan you choose also play a crucial role. For example, a smoker will generally pay a higher premium than a non-smoker due to the increased risk of health complications. Similarly, people living in areas with higher healthcare costs tend to have higher premiums. The level of coverage you select (e.g., a comprehensive plan versus a high-deductible plan) also directly affects your premium. The insurer’s administrative costs and profit margins also contribute to the final price.

Comparison of Health Insurance Plan Premiums

The following table illustrates how premiums can vary across different health insurance plans. Note that these are example costs and actual premiums will vary based on individual circumstances and location.

| Plan Type | Coverage Details | Premium Cost (Monthly) | Deductible |

|---|---|---|---|

| Bronze Plan | High deductible, low premium; covers essential health benefits. | $200 | $7,000 |

| Silver Plan | Moderate deductible, moderate premium; covers essential health benefits. | $350 | $4,000 |

| Gold Plan | Low deductible, high premium; covers essential health benefits. | $500 | $2,000 |

| Platinum Plan | Very low deductible, very high premium; covers essential health benefits. | $700 | $1,000 |

Components of Health Insurance Premiums

Understanding the cost of your health insurance premium requires understanding its constituent parts. Several factors contribute to the final price you pay, and these factors can vary significantly depending on your location, the insurer, and the specific plan you choose. This section breaks down the key components that influence your premium.

Several key factors contribute to the overall cost of your health insurance premium. These components interact in complex ways, and a change in one area can significantly impact the others. For example, a higher utilization of healthcare services in a given area will likely lead to higher premiums for everyone in that region.

Actuarial Assessment of Risk

Actuaries play a crucial role in determining health insurance premiums. They analyze vast amounts of data to predict the likelihood of policyholders needing healthcare services. This involves considering factors like age, location, health history, and lifestyle choices. Higher risk profiles, such as those with pre-existing conditions or those living in areas with higher rates of certain illnesses, generally lead to higher premiums. For instance, a smoker might pay more than a non-smoker due to a statistically higher risk of developing smoking-related illnesses.

Administrative Costs

A significant portion of your premium covers the administrative expenses of the insurance company. This includes salaries for employees, operating costs of offices and technology infrastructure, marketing and sales expenses, and the cost of claims processing and customer service. Larger insurance companies, with more extensive networks and more sophisticated technology, may have higher administrative costs than smaller, more regional companies. These costs are passed on to policyholders in the form of higher premiums.

Provider Network Costs

The cost of negotiating contracts with healthcare providers (doctors, hospitals, specialists) significantly impacts premiums. Plans with extensive networks of providers, offering a wider choice of doctors and facilities, typically have higher premiums. This is because the insurance company is paying higher reimbursement rates to maintain access to these providers. Conversely, plans with smaller, more limited networks may offer lower premiums, but at the cost of less choice for the policyholder.

Claims Costs

This is the largest component of the premium, representing the amount the insurer expects to pay out in claims for medical services used by its policyholders. Factors influencing claims costs include the health status of the insured population, the types of coverage offered (e.g., comprehensive vs. basic), and the cost of medical care in the area. A region with high healthcare costs will naturally lead to higher claims costs and therefore higher premiums for those insured in that area.

- Actuarial Assessment of Risk: This considers factors like age, location, health history, and lifestyle, impacting the predicted likelihood of healthcare utilization and thus the premium cost. Higher risk profiles result in higher premiums.

- Administrative Costs: Covers salaries, operating costs, marketing, claims processing, and customer service. These expenses are passed on to policyholders, contributing to the premium.

- Provider Network Costs: Reflects the cost of contracts with healthcare providers. Larger, more comprehensive networks generally lead to higher premiums due to higher reimbursement rates to providers.

- Claims Costs: Represents the insurer’s expected payouts for medical services. Influenced by the health status of the insured population, coverage type, and regional healthcare costs. This is often the largest component of the premium.

Understanding Premium Variations

Health insurance premiums aren’t a one-size-fits-all cost. Several factors significantly influence the amount you pay each month, making it crucial to understand these variations to choose a plan that best suits your needs and budget. These variations stem from the type of plan, the level of coverage selected, and individual circumstances.

Health Plan Type and Premium Costs

Different types of health insurance plans—HMOs, PPOs, and EPOs—offer varying levels of flexibility and cost. HMOs (Health Maintenance Organizations) typically have lower premiums because they emphasize preventative care and require you to choose a primary care physician (PCP) within their network. PPOs (Preferred Provider Organizations) generally have higher premiums but offer more flexibility, allowing you to see out-of-network providers, though at a higher cost. EPOs (Exclusive Provider Organizations) fall somewhere in between; they usually have lower premiums than PPOs but less flexibility than PPOs, requiring you to stay within their network for care. The trade-off between cost and flexibility is a key consideration when choosing a plan. For example, a young, healthy individual might opt for a lower-premium HMO, while a family with complex medical needs might prefer the broader access of a PPO, despite the higher premium.

Deductibles, Co-pays, and Out-of-Pocket Maximums’ Influence on Premiums

The relationship between premiums and cost-sharing elements like deductibles, co-pays, and out-of-pocket maximums is inverse. A higher deductible (the amount you pay before your insurance kicks in) generally leads to a lower premium. Similarly, higher co-pays (fixed amounts paid at the time of service) can also contribute to lower premiums. Conversely, a lower deductible and lower co-pays typically result in higher premiums. The out-of-pocket maximum (the most you’ll pay in a year) also plays a role; plans with lower out-of-pocket maximums often have higher premiums. Consider this example: Plan A has a $5,000 deductible and a $25 co-pay, resulting in a lower monthly premium. Plan B has a $1,000 deductible and a $50 co-pay, leading to a higher monthly premium. The choice depends on your risk tolerance and expected healthcare utilization.

Coverage Level and Premium Cost

The extent of coverage directly impacts premium costs. Comprehensive plans covering a wider range of services and benefits, such as extensive prescription drug coverage or mental health services, naturally come with higher premiums. Conversely, plans with more limited coverage, perhaps excluding certain types of care, will generally have lower premiums. For instance, a plan with extensive coverage for maternity care will cost more than a plan that offers limited or no maternity benefits. This highlights the need to assess your healthcare needs and choose a plan that aligns with those needs and your budget.

Pre-existing Conditions and Premium Costs

Under the Affordable Care Act (ACA), pre-existing conditions can no longer be used to deny coverage or increase premiums. However, in some cases, the timing of coverage can influence premiums. For example, an individual with a pre-existing condition that requires ongoing treatment might find that their premiums are higher initially than someone without such conditions. This is because insurers may need to account for potential future costs associated with the pre-existing condition, but it is illegal to deny coverage altogether. However, this initial higher cost should not be a barrier to obtaining necessary health insurance.

Last Word

Understanding your health insurance premium is crucial for effective financial planning and ensuring access to adequate healthcare. While the intricacies of premium calculation might seem daunting, this guide has provided a framework for comprehending the key elements. By considering the factors influencing premium costs and carefully comparing different plan options, you can make an informed choice that aligns with your budget and healthcare needs. Remember, proactive understanding empowers you to navigate the complexities of health insurance with confidence and clarity.

Popular Questions

What is the difference between a premium and a deductible?

A premium is your regular monthly payment for health insurance coverage. A deductible is the amount you pay out-of-pocket for healthcare services before your insurance coverage kicks in.

Can my premium change throughout the year?

Generally, premiums are set for a policy year, but they can change if you make significant changes to your plan (e.g., adding family members) or if your insurer adjusts rates. You’ll typically receive notification of any premium changes.

How often are health insurance premiums paid?

Premiums are usually paid monthly, but some insurers may offer options for quarterly or annual payments.

What happens if I don’t pay my health insurance premium?

Failure to pay your premium can lead to your coverage being canceled. This means you would be responsible for the full cost of any healthcare services.

Are there tax benefits associated with health insurance premiums?

In many countries, you may be able to deduct a portion of your health insurance premiums from your taxable income, depending on your specific circumstances and the laws in your jurisdiction. Consult a tax professional for details.