Navigating the complexities of tax deductions can feel like traversing a maze, especially when it comes to healthcare expenses. Many are unaware that, depending on various factors, their health insurance premiums might be eligible for tax deductions, potentially leading to significant savings. This guide unravels the intricacies of health insurance premium tax deductibility, offering clarity and practical advice for maximizing your tax benefits.

We’ll explore the eligibility criteria across different countries, delve into the calculation methods for both employed and self-employed individuals, and illuminate the impact on your overall tax liability. Furthermore, we’ll provide step-by-step guidance on navigating the relevant tax forms and procedures, highlighting common pitfalls to avoid costly mistakes. Ultimately, understanding this often-overlooked deduction can empower you to make informed financial decisions and optimize your tax return.

Tax Deductibility Eligibility

The tax deductibility of health insurance premiums is a significant benefit for many individuals and families, offering potential savings on their annual tax liability. However, the eligibility criteria for this deduction vary considerably depending on the country’s specific tax laws and regulations. Understanding these rules is crucial for maximizing tax benefits and ensuring compliance.

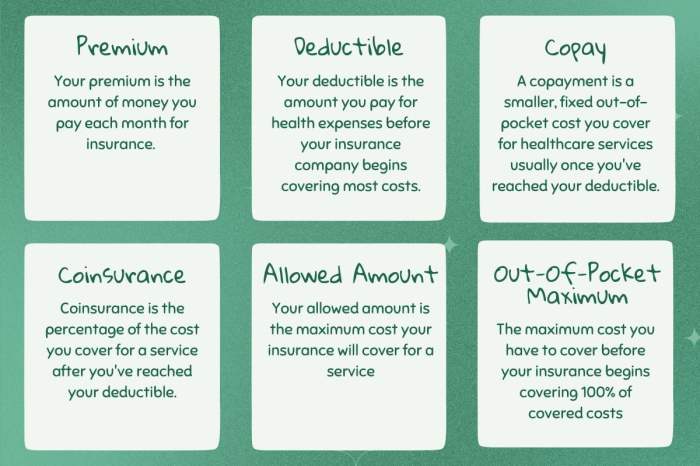

Eligibility for deducting health insurance premiums hinges on several factors, including the type of health insurance plan, the individual’s income level, and the specific requirements set by the relevant tax authority. Generally, plans that meet the minimum requirements set by the government or regulatory bodies are eligible. These requirements often focus on the comprehensiveness of the coverage provided.

Qualifying and Ineligible Health Insurance Plans

Determining whether a health insurance plan qualifies for premium tax deductibility requires careful examination of its features and comparison against the specific criteria Artikeld in the relevant tax legislation. For example, in many countries, plans that provide basic healthcare coverage, including hospitalization, doctor visits, and prescription drugs, are typically eligible. Conversely, plans that primarily offer supplemental coverage, such as cosmetic procedures or wellness programs that are not considered essential medical care, may not qualify. Another factor is the type of plan. Employer-sponsored plans often have different rules compared to individually purchased plans. For example, in some jurisdictions, only premiums paid for self-purchased plans might be deductible.

Required Documentation for Claiming the Deduction

To successfully claim the health insurance premium deduction, taxpayers typically need to provide supporting documentation to their tax authorities. This usually includes a copy of their health insurance policy, showing the details of the coverage, premiums paid, and the policy period. Proof of payment, such as bank statements or receipts, is also usually required. Some countries may require additional forms or certificates to be completed and submitted along with the tax return. It is advisable to check the specific requirements of the relevant tax authority to avoid delays or rejection of the claim.

Comparison of Tax Deductibility Rules Across Countries

| Country | Eligibility Criteria | Deductible Amount | Required Documentation |

|---|---|---|---|

| United States | Self-employed individuals, those with qualifying health savings accounts (HSAs), or those purchasing plans through the marketplace may be eligible depending on income and plan type. | Varies depending on plan type and income. May be limited to a certain percentage of income. | Form 1095-A (if applicable), insurance policy details, proof of payment. |

| Canada | Premiums for private health insurance are generally not tax deductible, except under specific circumstances such as those with disabilities or severe medical conditions. | Limited to specific situations; otherwise, not deductible. | Medical documentation supporting the claim for deductibility. |

| United Kingdom | Generally, health insurance premiums are not tax deductible for individuals. However, some employers may offer plans as a benefit and the cost may be covered pre-tax. | Not generally deductible for individuals. | Not applicable for individual claims. |

Calculating the Deductible Amount

Calculating the deductible amount for your health insurance premiums can seem complex, but understanding the process simplifies tax preparation. The method varies slightly depending on your employment status – whether you’re self-employed or employed by a company. The key is to accurately determine the eligible premiums and apply the correct limitations.

Self-employed individuals and those employed by a company calculate their deduction differently. Self-employed individuals deduct their health insurance premiums as an above-the-line deduction on their tax return, while employees typically itemize their deductions on Schedule A. However, both groups must adhere to specific rules and limitations.

Self-Employed Deduction Calculation

Self-employed individuals can deduct the amount they paid in health insurance premiums for themselves, their spouse, and their dependents. This deduction is taken above the line, meaning it reduces your adjusted gross income (AGI) before calculating your taxable income. This results in a larger tax benefit compared to itemizing.

To illustrate, consider a self-employed individual with a net profit of $50,000 and annual health insurance premiums of $8,000. Their deduction would be the full $8,000, reducing their taxable income to $42,000. However, the deductible amount is limited to the amount of your self-employment income. If the self-employment income was $6,000, only $6,000 would be deductible.

Employee Deduction Calculation

Employees who pay for health insurance premiums through payroll deductions or directly may be able to deduct these premiums if they itemize deductions on Schedule A (Form 1040). Itemizing is beneficial when the total of your itemized deductions (including medical expenses, charitable contributions, state and local taxes, etc.) exceeds your standard deduction. This is often the case for individuals with high medical expenses.

Let’s consider an employee with an AGI of $75,000 and annual health insurance premiums of $12,000. They cannot deduct the full $12,000. Medical expense deductions are subject to a 7.5% AGI threshold. In this case, 7.5% of $75,000 is $5,625. Only the premiums exceeding this amount ($12,000 – $5,625 = $6,375) would be deductible as part of their itemized medical expenses. If their total itemized deductions were less than their standard deduction, they would not benefit from deducting the health insurance premiums.

Step-by-Step Guide to Calculating the Deduction

A step-by-step guide to calculating the deductible amount involves these steps:

- Determine your employment status: Are you self-employed or employed by a company?

- Gather your documentation: Collect your tax forms (W-2 or 1099) and health insurance premium statements.

- Calculate your eligible premiums: Determine the premiums paid for yourself, your spouse, and your dependents.

- For self-employed individuals: Compare your total eligible premiums to your net self-employment income. The deductible amount is the lower of the two.

- For employees: Calculate 7.5% of your adjusted gross income (AGI). Subtract this amount from your eligible premiums. Only the resulting amount (if positive) is deductible as part of your itemized medical expenses.

- Include the deduction on your tax return: For self-employed individuals, this is on Schedule C (Form 1040). For employees, this is on Schedule A (Form 1040) if itemizing.

Remember to consult a tax professional for personalized advice, as tax laws can be complex and change.

Impact on Tax Liability

The tax deductibility of health insurance premiums significantly reduces your overall tax liability. This reduction is because the deductible amount lowers your taxable income, resulting in a smaller tax bill. The extent of this reduction depends on your individual tax bracket and the amount of your premiums.

The effect of the deduction is most pronounced for individuals in higher tax brackets. This is because a higher tax bracket means a larger percentage of each dollar of income is taxed. Therefore, the deduction of a fixed premium amount will result in a larger tax savings for those in higher brackets compared to those in lower brackets.

Tax Savings Across Income Brackets

To illustrate, let’s consider three hypothetical individuals with different annual incomes and health insurance premiums:

Let’s assume a standard health insurance premium of $5,000 per year. We’ll use simplified tax brackets for illustrative purposes. Actual tax brackets and rates vary by year and location, and should be consulted from official government sources.

| Individual | Annual Income | Tax Bracket (Simplified Example) | Taxable Income (Without Deduction) | Taxable Income (With Deduction) | Tax Savings (Approximate) |

|---|---|---|---|---|---|

| A | $30,000 | 15% | $30,000 | $25,000 | $750 |

| B | $60,000 | 25% | $60,000 | $55,000 | $1250 |

| C | $100,000 | 35% | $100,000 | $95,000 | $1750 |

Note: These are simplified examples and do not account for all tax deductions or credits. Actual tax savings may vary.

Visual Representation of Tax Liability Reduction

A bar chart can effectively visualize the reduction in tax liability. The chart would have two sets of bars for each income bracket: one representing the tax liability without the deduction and another representing the tax liability with the deduction.

The horizontal axis (x-axis) would represent the three income brackets (e.g., Low, Medium, High), and the vertical axis (y-axis) would represent the tax liability in dollars. For each income bracket, there would be two bars side-by-side. The taller bar would represent the tax liability *without* the health insurance premium deduction, and the shorter bar would represent the tax liability *with* the deduction. The difference in height between the two bars for each income bracket visually represents the tax savings achieved due to the deduction. The chart would clearly show that the difference (tax savings) increases as the income bracket increases. A legend would clearly label each bar.

Tax Forms and Filing Procedures

Claiming the deduction for health insurance premiums on your tax return requires understanding the relevant tax forms and adhering to the correct filing procedures. This section Artikels the necessary forms, guidance on completion, and the process for submitting your tax return. Remember, specific forms and procedures may vary depending on your country and tax jurisdiction. Always consult the official guidelines from your tax authority.

Relevant Tax Forms

The specific tax form used to claim the health insurance premium deduction depends on your location and tax system. In many countries, this deduction is claimed on the primary individual or household income tax return. For example, in the United States, taxpayers typically use Form 1040, Schedule 1 (Additional Income and Adjustments to Income), to report this deduction. Other countries might have equivalent forms with similar sections for medical expense deductions. It’s crucial to identify the correct form for your specific tax jurisdiction.

Completing the Tax Form

Accurately completing the tax form is essential to ensure your deduction is processed correctly. Generally, you’ll need to provide information such as your name, social security number (or equivalent identifier), the total amount of health insurance premiums paid during the tax year, and any other relevant details requested by the form. Supporting documentation, such as your insurance policy statement showing premium payments, is often required. The instructions accompanying the tax form provide specific guidance on data entry and formatting. For example, on the US Form 1040, Schedule 1, the premium amount would be entered in the appropriate line item designated for medical expense deductions. Careful review of the instructions is essential to avoid errors.

Filing Procedures

The procedure for filing your tax return with the claimed deduction varies depending on your location. Typically, you will need to gather all necessary documentation, including your completed tax form and supporting evidence of premium payments. The tax return is then submitted electronically or by mail, following the instructions provided by your tax authority. Deadlines for filing tax returns vary, so it’s crucial to meet the deadline to avoid penalties. In the United States, for instance, taxpayers can file electronically through tax preparation software or through a tax professional. They can also mail in a paper return. Confirmation of receipt is often advisable to avoid later disputes.

Example of a Correctly Completed Form (Illustrative Example – US Form 1040, Schedule 1)

While a visual representation of a filled-out form cannot be provided here, consider this example: Assume a taxpayer paid $5,000 in health insurance premiums during the tax year. On Form 1040, Schedule 1, line 29 (Medical expense deduction), they would enter “$5,000”. This amount would then be carried over to the main Form 1040 to calculate their adjusted gross income (AGI). The exact line numbers and procedures may differ based on the tax year and specific form revision. Always refer to the official instructions for the relevant tax year. The taxpayer would also keep a copy of their insurance statements as supporting documentation in case of an audit.

Common Mistakes and Pitfalls

Claiming a tax deduction for health insurance premiums can be straightforward, but errors are common, potentially leading to penalties and delays in receiving your refund. Understanding these potential pitfalls and implementing preventative measures is crucial for a smooth tax filing process. This section Artikels common mistakes, potential penalties, and solutions to avoid these issues.

Incorrect Documentation

Failing to maintain proper documentation is a frequent error. The IRS requires substantiation for all deductions claimed. This includes copies of your health insurance premium payment receipts, Form 1095-A (if applicable), and any other relevant documents proving your eligibility for the deduction. Simply remembering you paid premiums is insufficient; you must have verifiable proof. Without adequate documentation, the IRS may disallow your deduction, resulting in a higher tax liability. Keeping organized records throughout the year, such as using a dedicated folder or spreadsheet to track premium payments and related documents, is essential.

Misunderstanding Eligibility Requirements

Many taxpayers mistakenly believe they are eligible for the deduction when they are not. Eligibility criteria vary depending on the type of health insurance plan and individual circumstances. For example, those who are eligible for employer-sponsored health insurance but choose not to enroll may not be eligible to deduct their premiums from a separate plan. Carefully reviewing the IRS guidelines and understanding your specific circumstances is vital before claiming the deduction. Consulting a tax professional if unsure about your eligibility is recommended.

Inaccurate Calculation of Deductible Amount

Incorrectly calculating the deductible amount is another common mistake. This might involve overlooking certain expenses, misinterpreting the rules regarding self-employment taxes, or making errors in calculating the adjusted gross income (AGI). The deductible amount is determined by specific formulas and factors, and even a small calculation error can significantly impact your refund. Using tax software or consulting a tax professional can minimize the risk of calculation errors. Double-checking all figures before filing is crucial.

Failure to File the Correct Forms

Filing the incorrect tax forms is a serious error. The specific forms required depend on the type of health insurance coverage and your filing status. Submitting the wrong forms or failing to include necessary supporting documentation can lead to delays in processing your return and potential penalties. Understanding which forms are required for your specific situation and completing them accurately is essential.

Penalties for Incorrect Filing

The penalties for incorrect filing related to the health insurance premium deduction can vary. They may include interest charges on any underpaid taxes, penalties for negligence or intentional disregard of tax rules, and even potential audits. The severity of the penalties depends on the nature and extent of the errors. To avoid these penalties, it is crucial to ensure accuracy in all aspects of the deduction claim.

Solutions and Preventative Measures

Several preventative measures can minimize the risk of errors. These include:

- Maintain meticulous records of all health insurance premium payments throughout the year.

- Carefully review the IRS guidelines to ensure eligibility for the deduction.

- Utilize tax software or consult a tax professional for accurate calculation of the deductible amount.

- Ensure you file the correct tax forms with all necessary supporting documentation.

- Keep copies of all filed documents for your records.

Frequently Asked Questions

This section addresses common questions regarding the tax deductibility of health insurance premiums.

- Can I deduct premiums for my spouse and children? The deductibility extends to premiums paid for eligible dependents, subject to specific rules and limitations.

- What if I paid my premiums late? Late payments might still be deductible, provided you can prove the payments were made within the tax year.

- Are all health insurance premiums deductible? No, only premiums for certain types of plans and under specific circumstances qualify for the deduction.

- What if I made a mistake on my tax return? You can file an amended return (Form 1040-X) to correct any errors.

- Where can I find more information? The IRS website and publications offer comprehensive guidance on health insurance premium deductions.

Changes in Tax Laws and Regulations

The deductibility of health insurance premiums is not static; it’s subject to change based on evolving government policies and economic conditions. Understanding the potential for these changes is crucial for taxpayers to effectively plan their finances and minimize their tax burden. Future alterations to tax laws could significantly impact the amount of premium deduction available, affecting the overall tax liability for individuals and families.

Tax law changes regarding health insurance premium deductibility can have a profound effect on taxpayers. These changes may alter the eligibility criteria, the maximum deductible amount, or even eliminate the deduction altogether. Such alterations could lead to higher tax bills for some, while others might see little to no change depending on their individual circumstances and income levels. The complexity of the tax code necessitates staying informed about any updates.

Impact of Potential Future Changes

Future changes in tax laws could take several forms. For instance, Congress might adjust the income thresholds for eligibility, meaning that higher-income individuals could lose the deduction entirely or have a reduced deduction amount. Alternatively, the maximum amount of premiums that can be deducted could be lowered, resulting in less tax savings for everyone. Another possibility is the introduction of new limitations based on the type of health insurance plan. For example, deductions might be restricted for those enrolled in plans deemed “luxury” plans by the government. These changes would require taxpayers to re-evaluate their strategies for tax planning and may necessitate adjustments to their budgets.

Examples of Past Tax Law Changes

The Affordable Care Act (ACA), enacted in 2010, significantly impacted the landscape of health insurance and its tax implications. Prior to the ACA, the deductibility of health insurance premiums was often subject to more restrictive rules and limitations. The ACA expanded eligibility for health insurance subsidies and tax credits, impacting how individuals could deduct premiums. Before the ACA, self-employed individuals faced more stringent requirements for deducting health insurance premiums compared to those employed by companies that offered group health plans. The ACA aimed to level the playing field, although the complexities of the legislation and its interpretation have led to ongoing challenges for taxpayers and tax professionals alike. Another example is the frequent adjustments to the standard deduction amounts which indirectly affects the tax benefit of itemizing health insurance premiums. These changes highlight the dynamic nature of tax law and the need for continuous monitoring of relevant regulations.

Conclusive Thoughts

Successfully claiming a deduction for your health insurance premiums can offer substantial financial relief, reducing your overall tax burden. By carefully understanding the eligibility requirements, mastering the calculation process, and diligently completing the necessary tax forms, you can effectively leverage this valuable tax benefit. Remember to consult with a tax professional for personalized advice tailored to your specific circumstances, ensuring you maximize your savings and avoid potential penalties.

Question Bank

What if I have multiple health insurance plans?

Deductibility rules vary by country and plan type. Generally, only premiums for qualifying plans are deductible. You may need to determine which plan qualifies based on your country’s tax laws.

Can I deduct premiums if I’m covered under my spouse’s plan?

This depends on your country’s tax laws. Some jurisdictions allow deductions only for premiums paid directly by the taxpayer, while others may have different rules based on filing status.

What happens if I make a mistake on my tax form?

Errors can lead to delays in processing your return and potentially penalties. Amend your return as soon as possible if you discover a mistake. Consult a tax professional for guidance.

Where can I find the relevant tax forms for my country?

Tax forms are typically available on the website of your national tax authority. You can search online using s like “[your country] tax forms” or visit the relevant government agency’s website.