The looming specter of health insurance premium increases in 2025 is causing considerable anxiety for individuals, families, and employers alike. This comprehensive analysis delves into the multifaceted factors driving these increases, examining the interplay of rising healthcare costs, evolving government policies, and emerging industry trends. Understanding these contributing elements is crucial for navigating the complexities of healthcare affordability and developing effective strategies for mitigation.

We will explore the diverse impacts these increases will have on different demographics, from age and location to income levels and family structures. Furthermore, we’ll investigate potential government interventions, explore cost-management strategies for both individuals and employers, and offer a glimpse into the future trajectory of healthcare premiums. This in-depth examination aims to equip readers with the knowledge necessary to understand and address the challenges presented by escalating health insurance costs.

Future Predictions and Trends

Predicting the future of healthcare premiums is inherently complex, influenced by a multitude of interacting factors. While precise figures are impossible, analyzing current trends and emerging technologies allows for a reasonable forecast of potential increases and shifts in the healthcare landscape beyond 2025.

Projected Premium Increases Beyond 2025

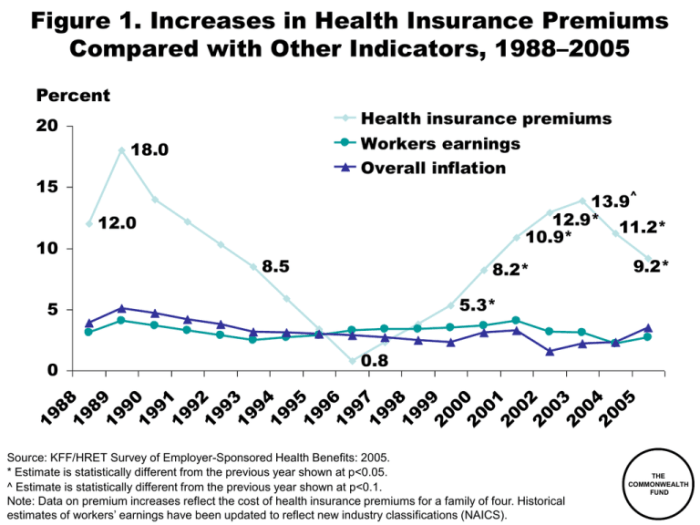

Several factors suggest continued premium increases beyond 2025, though the rate may fluctuate. Inflationary pressures on healthcare providers, rising drug costs, and an aging population all contribute to escalating expenses. For example, the Kaiser Family Foundation projects continued double-digit increases in employer-sponsored health insurance premiums in some sectors, mirroring the trend observed in recent years. This projection assumes a continuation of current healthcare utilization patterns and pricing mechanisms. Significant policy changes or technological breakthroughs could alter this trajectory.

Emerging Trends Influencing Premiums

The healthcare industry is undergoing a period of significant transformation. The increasing prevalence of chronic diseases like diabetes and heart disease, coupled with an aging population, is driving up healthcare utilization and costs. Furthermore, the shift towards value-based care, while aiming to improve efficiency, may initially lead to increased administrative costs as providers adapt to new reimbursement models. This transition could temporarily increase premiums before potential long-term cost savings are realized.

Technological Advancements and Cost Impacts

Technological advancements offer both opportunities and challenges. While telehealth and remote patient monitoring can potentially reduce costs by improving access and efficiency, the initial investment in infrastructure and training can be substantial. Similarly, the development and adoption of new pharmaceuticals and treatments can significantly impact costs. For instance, the introduction of groundbreaking cancer therapies, while life-saving, often comes with a high price tag, influencing overall premium costs. The long-term impact of AI in diagnostics and treatment remains to be seen, with potential for both cost reduction and increased complexity.

Impact of Changing Demographics

The aging population presents a significant challenge to the long-term sustainability of the healthcare system. Older individuals generally require more healthcare services, driving up demand and potentially leading to higher premiums for all. This effect is compounded by the shrinking workforce relative to the growing elderly population, potentially straining resources and increasing costs. For example, the increasing number of individuals over 65 in many developed countries already exerts significant pressure on healthcare systems, which is expected to intensify in the coming decades.

Long-Term Sustainability of the Current Healthcare System

The long-term sustainability of the current healthcare system hinges on addressing several key challenges. Controlling costs through improved efficiency, promoting preventative care, and addressing the social determinants of health are crucial. Furthermore, innovative payment models and a focus on value-based care are necessary to incentivize cost-effective practices. Without significant reform, the continued rise in healthcare costs could make premiums increasingly unaffordable for many, threatening the accessibility and affordability of healthcare for future generations. This requires a multifaceted approach involving policymakers, healthcare providers, and individuals.

Final Thoughts

In conclusion, the anticipated health insurance premium increase in 2025 presents a significant challenge demanding a multi-pronged approach. While rising healthcare costs and broader economic factors play a substantial role, proactive strategies involving government regulation, employer initiatives, and individual responsibility are crucial for mitigating the impact. By understanding the contributing factors, demographic disparities, and potential future trends, individuals, employers, and policymakers can work collaboratively towards ensuring affordable and accessible healthcare for all.

FAQ

What are the main reasons for the expected increase in health insurance premiums in 2025?

Several factors contribute, including rising healthcare costs (hospital stays, procedures), increased prescription drug prices, higher utilization of healthcare services, and administrative expenses. Inflation also plays a significant role.

Will the increase affect all insurance plans equally?

No, the impact will vary depending on the plan type, coverage level, location, and individual circumstances. Some plans may experience larger increases than others.

What can I do to lower my health insurance costs?

Consider enrolling in a high-deductible health plan (HDHP) with a health savings account (HSA), carefully review your plan’s coverage, utilize preventative care services, and explore options for negotiating lower healthcare bills.

Are there any government programs to help with rising premiums?

Yes, depending on your location and income, subsidies and tax credits may be available to help offset the cost of health insurance premiums. Check with your local government agencies for eligibility.