The seemingly relentless climb of health insurance premiums is a concern impacting millions. This increase isn’t merely a matter of numbers; it’s a reflection of complex interplay between healthcare costs, government regulations, and economic factors. Understanding these dynamics is crucial for both individuals navigating healthcare choices and policymakers striving for a more affordable and accessible system.

This analysis delves into the multifaceted reasons behind rising premiums, exploring their effects on consumers, healthcare providers, and the broader healthcare landscape. We will examine potential solutions and long-term trends, providing a comprehensive overview of this critical issue.

Understanding the Increase

Health insurance premium increases are a complex issue affecting millions. Several interconnected factors contribute to these rising costs, impacting individuals and families across the nation. Understanding these factors is crucial for navigating the healthcare landscape effectively.

Several key factors drive the upward trend in health insurance premiums. These include increased healthcare utilization, the rising cost of prescription drugs, advancements in medical technology, and administrative expenses associated with managing insurance plans.

Inflation’s Impact on Healthcare Costs

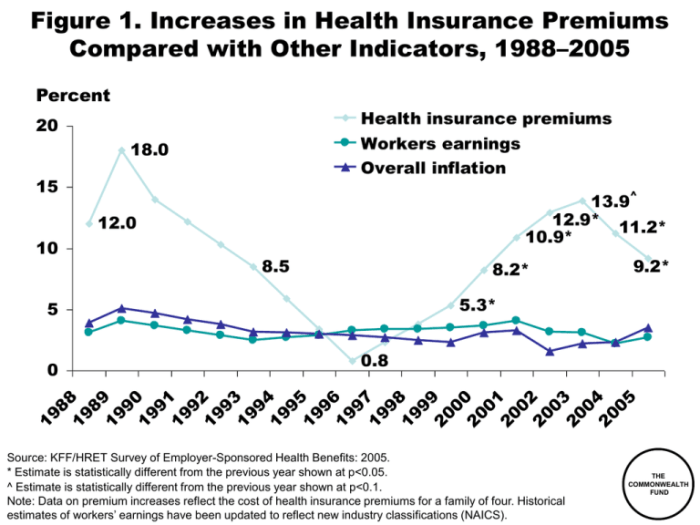

Inflation significantly impacts healthcare costs and, consequently, premium increases. As the general price level rises, the cost of medical services, supplies, and personnel also increases. This upward pressure on healthcare expenses directly translates into higher premiums for consumers. For example, a 5% inflation rate could easily translate to a similar percentage increase in hospital bills, physician fees, and other medical costs, necessitating a corresponding premium adjustment to maintain insurance solvency.

Government Regulations and Premium Adjustments

Government regulations play a significant role in shaping health insurance premiums. These regulations, while often intended to protect consumers and improve the healthcare system, can sometimes inadvertently contribute to higher costs. Regulations aimed at expanding coverage, such as those requiring insurers to cover pre-existing conditions, can increase the risk pool and necessitate higher premiums to maintain profitability. Conversely, regulations aimed at controlling costs, such as those limiting price increases for certain medications, may reduce the overall cost of care but can also lead to other indirect cost increases.

Examples of Legislation Impacting Premium Costs

The Affordable Care Act (ACA), for instance, significantly impacted the health insurance market. While expanding coverage to millions, it also introduced regulations that influenced premium costs. These regulations included mandates for essential health benefits, restrictions on medical loss ratios, and the establishment of health insurance marketplaces. The ACA’s impact on premiums has been a subject of ongoing debate, with various studies offering different perspectives on its net effect. Another example would be state-level legislation mandating specific coverage for certain treatments or procedures, which can also influence premium adjustments depending on the specific requirements and the size of the affected population.

State-by-State Premium Increase Comparison

The following table presents hypothetical data illustrating the variation in premium increases across different states. These figures are illustrative and do not reflect actual data. Actual premium increases vary significantly based on numerous factors, including the specific plan, the insurer, and the demographics of the insured population.

| State | Average Premium Increase (2023) | Average Premium Increase (2024) (Projected) | Contributing Factors |

|---|---|---|---|

| California | 6% | 7% | High healthcare utilization, rising prescription drug costs |

| Texas | 5% | 6% | Increased demand, higher hospital costs |

| Florida | 4% | 5% | Moderate growth in healthcare costs |

| New York | 8% | 9% | High drug costs, increased regulatory burdens |

Impact on Consumers

Premium increases directly affect the affordability of healthcare for individuals and families. The rising cost of health insurance can create significant financial strain, forcing individuals to make difficult choices between essential needs and healthcare access. This impact is particularly pronounced for those with lower incomes, who may already struggle to meet basic living expenses.

Effect of Premium Increases on Individual Healthcare Affordability

Higher premiums can lead to decreased healthcare utilization. Individuals may delay or forgo necessary medical care due to cost concerns, resulting in potentially worse health outcomes in the long run. This is especially true for preventative care, which is often more affordable in the short-term but can prevent costly illnesses down the line. For example, skipping annual checkups might lead to undetected conditions that require far more expensive treatment later. The financial burden of unexpected medical expenses, coupled with increased premiums, can push individuals into medical debt, impacting their credit score and overall financial well-being.

Challenges Faced by Low-Income Families Due to Rising Premiums

Low-income families often face disproportionately high challenges when premiums increase. They may have limited savings and struggle to afford even the smallest unexpected medical bills. Increased premiums can force them to choose between paying for healthcare and covering other essential needs such as housing, food, and transportation. This can create a vicious cycle of poor health and financial instability. For instance, a family might choose to forgo needed medication for a chronic condition, leading to worsening health and potentially higher healthcare costs in the future. Subsidies and government assistance programs can help, but they are often insufficient to fully offset the impact of substantial premium increases.

Strategies Consumers Can Use to Mitigate the Impact of Higher Premiums

Consumers can employ several strategies to lessen the financial burden of increased premiums. These include carefully comparing plans from different insurers to find the most affordable option that meets their needs, exploring options like high-deductible health plans (HDHPs) coupled with health savings accounts (HSAs), and taking advantage of any available subsidies or government assistance programs. Negotiating payment plans with insurers or exploring options for financial assistance from healthcare providers can also be beneficial. Finally, actively managing one’s health through preventative care can help reduce the likelihood of costly medical emergencies.

Comparison of Different Types of Health Insurance Plans and Their Associated Costs

Different health insurance plans offer varying levels of coverage and cost-sharing. HMOs (Health Maintenance Organizations) typically have lower premiums but restrict access to specialists and require referrals. PPOs (Preferred Provider Organizations) generally have higher premiums but offer more flexibility in choosing doctors and specialists. EPOs (Exclusive Provider Organizations) are similar to HMOs but may offer slightly more flexibility. High-deductible health plans (HDHPs) have lower premiums but require individuals to pay a larger deductible before insurance coverage kicks in. The best plan for an individual depends on their specific health needs, budget, and risk tolerance. A thorough comparison of plans and their associated costs, considering factors like deductibles, co-pays, and out-of-pocket maximums, is crucial.

Decision-Making Process for Choosing a Health Insurance Plan Given Budget Constraints

The following flowchart illustrates the decision-making process:

[Diagram description: A flowchart begins with “Assess Health Needs and Budget.” This leads to two branches: “Budget Allows for Comprehensive Coverage?” Yes leads to “Choose a PPO or similar plan.” No leads to “Explore High-Deductible Plans (HDHPs) with HSA?” Yes leads to “Consider HDHP with HSA to save on premiums and build savings for future medical expenses.” No leads to “Compare HMO and EPO plans to find most affordable option meeting minimum needs.” All paths eventually lead to “Enroll in Chosen Plan.”]

Provider Perspectives

Premium increases significantly impact healthcare providers, creating a complex interplay of financial pressures and adjustments to maintain service delivery. The ripple effect extends beyond simple reimbursement rate changes, impacting operational strategies and ultimately, patient access to care.

The relationship between premium increases and provider reimbursement is often indirect but consequential. Insurers, facing higher costs, may negotiate lower reimbursement rates with providers to maintain profitability. This means hospitals and clinics receive less money for the same services, squeezing their already tight margins. This dynamic is further complicated by the increasing administrative burden associated with navigating complex insurance networks and billing processes.

Reimbursement Rate Reductions and Administrative Costs

Rising administrative costs pose a considerable challenge for healthcare providers. The complexities of electronic health records (EHR) systems, insurance claim processing, and regulatory compliance add substantial overhead. These costs are often passed on to patients through higher co-pays or deductibles, but they also directly reduce the amount available for patient care. For example, a small clinic might spend a significant portion of its revenue on billing software and staff, reducing the funds available for hiring additional nurses or purchasing new equipment. Larger hospitals face similar pressures, but on a much larger scale, impacting their ability to invest in infrastructure upgrades or advanced medical technologies.

Provider Adaptation Strategies

Faced with these financial constraints, healthcare providers are adopting various strategies to adapt. Many are consolidating, merging with larger systems to gain economies of scale and improve negotiating power with insurers. Others are focusing on value-based care models, shifting from fee-for-service reimbursement to models that reward quality of care and improved patient outcomes. This often involves implementing innovative care management programs and investing in technology to improve efficiency and reduce costs. Some providers are also exploring alternative revenue streams, such as telehealth services or expanding into specialized areas with higher reimbursement rates.

Financial Implications for Different Provider Types

The financial implications of premium increases vary significantly across different provider types. Large hospital systems, with their diversified revenue streams and greater negotiating leverage, may be better positioned to absorb the impact than smaller clinics or individual physician practices. Individual practices, in particular, often face significant financial pressure, potentially leading to closures or consolidation. Clinics may find themselves caught in the middle, facing pressure from both insurers and patients to maintain affordability while managing increasing operational costs. The financial burden is not uniformly distributed; it disproportionately affects smaller, independent providers who lack the resources to navigate complex insurance negotiations and absorb financial losses.

Potential Consequences of Unchecked Premium Increases

The continued unchecked rise in premiums could have severe consequences for healthcare access.

- Reduced provider networks: Insurers may narrow their networks to control costs, limiting patient choices.

- Increased patient costs: Higher premiums translate to higher deductibles and co-pays, making care unaffordable for many.

- Provider closures: Smaller practices may be forced to close, reducing access to care, especially in underserved areas.

- Delayed or forgone care: Patients may delay or forgo necessary care due to high out-of-pocket costs.

- Reduced quality of care: Providers may be forced to cut corners to manage costs, potentially compromising patient safety and outcomes.

Long-Term Trends and Predictions

Predicting future health insurance premium costs requires considering a complex interplay of factors. While precise forecasting is impossible, analyzing current trends and likely future developments allows for plausible scenarios and informed speculation about the trajectory of premium growth over the next five years. This analysis will explore several key drivers and their potential impact.

Factors Influencing Premium Growth

Several key factors will significantly influence health insurance premium costs over the next five years. These include inflation, utilization rates, pharmaceutical costs, and technological advancements. Inflation’s direct impact on healthcare provider costs and administrative expenses will inevitably translate into higher premiums. Increased utilization, driven by an aging population and advances in medical technology leading to more complex treatments, will also contribute to rising costs. The ever-increasing cost of prescription drugs, particularly novel biologics, represents a substantial challenge. Conversely, technological advancements offer the potential to mitigate some of these cost pressures.

Technological Advancements and Cost Management

Technological advancements hold considerable promise for managing healthcare costs and premiums. Telemedicine, for instance, can increase access to care while reducing the need for expensive in-person visits. Data analytics can identify high-risk individuals, enabling proactive interventions and preventing costly hospitalizations. Artificial intelligence (AI) can assist in diagnosis and treatment planning, potentially improving efficiency and outcomes. The adoption and effective implementation of these technologies will be crucial in controlling healthcare spending.

Innovative Approaches to Controlling Healthcare Spending

Innovative approaches to healthcare delivery and payment models are essential for controlling spending. Value-based care models, which incentivize providers to focus on quality and efficiency rather than simply the volume of services provided, are gaining traction. Bundled payments for specific procedures or conditions can encourage providers to coordinate care and reduce unnecessary costs. Increased transparency in pricing and the use of comparative effectiveness research can empower consumers to make informed decisions and drive competition among providers. For example, the success of Kaiser Permanente’s integrated system demonstrates the potential for effective cost management through vertical integration and coordinated care.

Projected Premium Growth Scenarios

The graph illustrates three potential scenarios for premium growth over the next five years. The high-growth scenario assumes persistently high inflation and a significant increase in healthcare utilization, resulting in a steep upward trajectory. The moderate-growth scenario assumes moderate inflation and relatively stable utilization rates, leading to a more gradual increase. The low-growth scenario reflects a combination of low inflation and successful cost-containment measures, including widespread adoption of technology and innovative payment models, resulting in the slowest rate of premium increase. These scenarios are illustrative and depend on numerous unpredictable factors. For example, the unexpected emergence of a major pandemic could drastically alter the predicted trajectory.

Solutions and Mitigation Strategies

Addressing the persistent rise in health insurance premiums requires a multifaceted approach encompassing policy reforms, cost-containment strategies, and innovative healthcare delivery models. This section explores potential solutions and mitigation strategies to make healthcare more affordable and accessible.

Policy Recommendations for Controlling Healthcare Costs

Controlling healthcare costs is crucial to mitigating premium increases. Several policy recommendations can be implemented to achieve this. These include strengthening the negotiation power of insurers with pharmaceutical companies and healthcare providers to secure lower prices for drugs and services. Furthermore, incentivizing preventative care and promoting healthy lifestyles can reduce the overall burden of chronic diseases, leading to lower healthcare utilization and costs. Finally, promoting transparency in healthcare pricing and billing practices can empower consumers to make informed decisions and encourage providers to adopt more cost-effective practices. For example, requiring hospitals to publicly disclose their pricing for common procedures could drive competition and encourage cost reduction.

Examples of Successful International Initiatives

Several countries have successfully implemented initiatives to manage healthcare expenses. Singapore’s integrated healthcare system, characterized by a strong emphasis on primary care and cost-sharing mechanisms, has effectively contained healthcare costs while maintaining high quality of care. Similarly, the National Health Service (NHS) in the United Kingdom, while facing its own challenges, demonstrates the potential of a single-payer system to control costs through bulk purchasing and centralized resource allocation. In contrast, the Swiss system, with its mandatory health insurance but competitive market structure, shows the potential of market-based approaches to manage costs, though it’s worth noting that Switzerland has a higher per capita expenditure than many other comparable nations. These examples highlight the diversity of effective approaches, and their relative successes depend heavily on the specific context and national priorities.

Comparative Analysis of Health Insurance Market Regulation

Different approaches to regulating health insurance markets have varying degrees of effectiveness in controlling costs and ensuring access. Strict price controls, while potentially lowering premiums in the short term, can lead to reduced provider participation and limitations in service availability. Conversely, a completely deregulated market can result in high premiums and limited coverage for vulnerable populations. A balanced approach that combines regulatory oversight with market competition, such as that found in some European countries, may offer a more sustainable solution. For example, Germany’s system of statutory health insurance with regulated prices and a supplemental private insurance market represents a mixed model that balances cost control with consumer choice.

Policy Brief: Improving Healthcare Affordability and Access

This policy brief Artikels strategies to improve healthcare affordability and access. The core tenets include: (1) Expanding access to affordable health insurance through subsidies and tax credits, targeting low- and middle-income families. (2) Strengthening primary care to prevent costly hospitalizations through investments in preventative care and community-based health services. (3) Implementing value-based care models that reward providers for quality of care rather than quantity of services. (4) Promoting transparency in healthcare pricing and billing. (5) Investing in health information technology to improve efficiency and reduce administrative costs. Successful implementation requires a collaborative effort between government, insurers, healthcare providers, and consumers, with ongoing monitoring and evaluation to ensure effectiveness. The success of such a plan will be measured by improved health outcomes, increased access to care, and a slowdown in the rate of premium increases. The Swiss model, with its mandated insurance but market competition, provides a relevant, though not perfect, example of a system attempting to balance these competing objectives.

Final Wrap-Up

The rising cost of health insurance premiums presents a significant challenge demanding a multi-pronged approach. While individual strategies can help mitigate the impact, lasting solutions require a collaborative effort involving policymakers, healthcare providers, and insurers to address the underlying cost drivers and ensure affordable and accessible healthcare for all. Continued monitoring of trends and proactive implementation of innovative cost-containment measures are vital for navigating this ongoing challenge.

FAQs

What are some common reasons for denials of health insurance claims?

Common reasons for claim denials include missing or incomplete paperwork, services not covered by the plan, pre-authorization requirements not met, or exceeding the plan’s limits.

Can I appeal a denied health insurance claim?

Yes, most health insurance plans have an appeals process. Review your plan’s documentation for instructions on how to file an appeal.

How can I find affordable health insurance?

Explore options like marketplace plans (often subsidized based on income), employer-sponsored plans, and Medicaid or Medicare if eligible. Comparing plans and understanding your needs are crucial.

What is the difference between a deductible and a copay?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A copay is a fixed fee you pay at the time of service.