Navigating the complexities of health insurance can feel like deciphering a foreign language. At the heart of this system lies the health insurance premium – the recurring payment securing your access to medical care. This guide unravels the intricacies of premium calculation, payment methods, and the various factors influencing their cost, empowering you to make informed decisions about your health coverage.

From understanding the core components of a premium to exploring the impact of government subsidies and plan variations, we aim to provide a clear and concise overview. This exploration will cover everything from the basics of premium definitions to the nuances of premium adjustments and appeals, leaving you better equipped to manage your healthcare finances.

Defining Health Insurance Premiums

Health insurance premiums are the recurring payments you make to your insurance company in exchange for coverage under your chosen health plan. These payments ensure that you have access to medical care when needed, protecting you from potentially catastrophic healthcare costs. Understanding what makes up your premium and the factors influencing its cost is crucial for making informed decisions about your health insurance.

Core Components of Health Insurance Premiums

A health insurance premium is comprised of several key elements. The insurer uses a complex actuarial process to calculate these costs, balancing the expected payouts for claims against the premiums collected. These elements include administrative costs, which cover the insurer’s operational expenses such as salaries, technology, and marketing; the cost of claims, which represents the amount the insurer anticipates paying out for medical services used by policyholders; and the insurer’s profit margin, which accounts for the company’s desired return on investment. The balance of these elements directly influences the final premium amount.

Factors Influencing Premium Costs

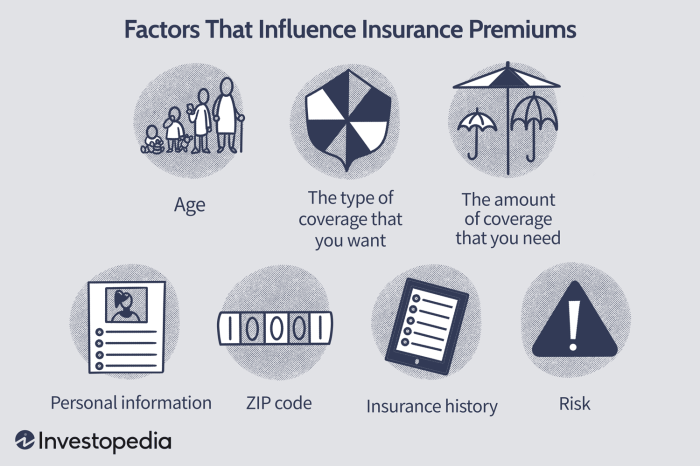

Numerous factors influence the cost of health insurance premiums. Individual characteristics play a significant role; age, generally, older individuals tend to have higher premiums due to increased healthcare utilization. Location also matters; premiums in areas with high healthcare costs tend to be higher. Lifestyle choices, such as smoking or obesity, can lead to higher premiums as these factors increase the risk of health problems. The type of plan chosen, the level of coverage selected (e.g., deductible, copay, out-of-pocket maximum), and the insurer’s own risk assessment also significantly impact the premium. Finally, the overall health of the insured population within the plan’s pool influences the cost for all participants.

Impact of Different Plan Types on Premiums

Different health insurance plans offer varying levels of coverage and cost structures, directly affecting premiums. HMO plans, for example, typically have lower premiums than PPO plans due to their more restrictive network of providers. However, this lower premium comes with the trade-off of limited choice in healthcare providers. PPO plans, offering greater flexibility in provider selection, usually come with higher premiums. High-deductible health plans (HDHPs) often have lower premiums but require the policyholder to pay a substantial amount out-of-pocket before the insurance coverage kicks in. Conversely, plans with lower deductibles and co-pays generally have higher premiums.

Premium Comparison Table for Various Coverage Levels

The following table illustrates how premiums can vary based on different coverage levels. These are hypothetical examples and actual premiums will vary depending on the insurer, location, and individual circumstances.

| Plan Type | Deductible | Monthly Premium | Out-of-Pocket Maximum |

|---|---|---|---|

| HMO Bronze | $6,000 | $300 | $7,000 |

| HMO Silver | $4,000 | $400 | $6,000 |

| PPO Gold | $2,000 | $600 | $4,000 |

| PPO Platinum | $1,000 | $800 | $3,000 |

Premium Payment Methods and Schedules

Paying your health insurance premiums on time is crucial to maintaining continuous coverage. Understanding the various payment methods and schedules available, as well as the consequences of late payments, is essential for responsible health insurance management. This section details common payment options and the implications of missed payments.

Common Premium Payment Methods

Several methods exist for paying health insurance premiums, offering flexibility to suit individual circumstances. These typically include direct debit from a bank account, credit or debit card payments (often online via the insurer’s website or app), and mailing a check or money order. Some insurers may also accept payments via electronic funds transfer or through third-party payment processors. The convenience and associated fees vary across methods. Choosing the most convenient and cost-effective option is vital for consistent premium payments.

Consequences of Late or Missed Premium Payments

Failure to pay premiums on time can lead to significant repercussions. The most immediate consequence is the interruption or cancellation of your health insurance coverage. This means you’ll be responsible for the full cost of any medical services you receive. Additionally, insurers may impose late payment fees, potentially impacting your credit score. Reinstating coverage after a lapse may also require a new application and potentially a higher premium. In some cases, a waiting period before coverage resumes might be enforced. For example, a person might face a 30-day waiting period for pre-existing conditions to be covered after reinstating their policy.

Premium Payment Plans and Options

Many insurers offer various payment plans to accommodate different financial situations. These plans often allow you to spread your annual premium payments into smaller, more manageable monthly, quarterly, or semi-annual installments. However, it’s important to note that some plans might include additional administrative fees. For example, a monthly payment plan might have a small processing fee added to each payment. It is crucial to carefully review the terms and conditions of any payment plan before opting for it to ensure you understand all associated costs.

Premium Payment Process Flowchart

The premium payment process can be visualized as follows:

[Imagine a flowchart here. The flowchart would begin with “Enroll in Health Insurance Plan.” This would lead to two branches: “Choose Payment Method” (leading to options like “Direct Debit,” “Credit/Debit Card,” “Mail Check”) and “Set Up Payment Schedule” (leading to options like “Monthly,” “Quarterly,” “Annual”). Both branches would converge at “Make Payment.” From “Make Payment,” one branch leads to “Payment Successful” (leading to “Coverage Maintained”), and the other leads to “Payment Failed/Late” (leading to “Late Fee,” “Coverage Interruption,” “Reinstatement Process”).]

Factors Affecting Premium Calculation

Several interconnected factors influence the calculation of health insurance premiums. Understanding these factors can help individuals make informed choices about their coverage and budget accordingly. These factors are often weighted differently by insurance companies, leading to variations in premium costs across different plans and individuals.

Demographic Factors Influencing Premium Rates

Age, location, and family size are key demographic factors that significantly impact health insurance premiums. Older individuals generally pay higher premiums due to a statistically higher likelihood of needing more extensive healthcare services. Geographic location plays a crucial role, reflecting variations in healthcare costs across different regions. Areas with higher healthcare provider costs and a higher prevalence of certain diseases will typically have higher premiums. Similarly, larger families often result in higher premiums as the potential for multiple claims increases.

Impact of Health History and Pre-existing Conditions

An individual’s health history and the presence of pre-existing conditions are major determinants of premium costs. Individuals with a history of chronic illnesses or conditions requiring ongoing treatment typically face higher premiums. This is because insurance companies assess the increased likelihood of future claims associated with these conditions. The severity and frequency of past claims also play a significant role. For example, someone with a history of multiple hospitalizations will likely pay more than someone with a clean health record. The Affordable Care Act (ACA) in the United States, for instance, prohibits insurers from denying coverage or charging higher premiums based solely on pre-existing conditions, but health history still influences premium calculations.

Premium Variations Based on Deductible and Copay Options

Deductibles and copays are significant factors influencing premium costs. A higher deductible, representing the amount an individual pays out-of-pocket before insurance coverage begins, usually results in a lower premium. Conversely, a lower deductible correlates with a higher premium. Similarly, copays, the fixed amount paid at the time of service, can affect premiums. Plans with lower copays typically have higher premiums, reflecting the increased cost-sharing responsibility assumed by the insurance company. For example, a plan with a $5,000 deductible and a $50 copay will likely have a lower premium than a plan with a $1,000 deductible and a $25 copay.

Hierarchical Structure of Factors Influencing Premiums

The relative influence of these factors can be organized hierarchically. At the top level are factors related to the individual’s health status, including pre-existing conditions and health history. These factors carry the most weight in premium determination. The second level encompasses demographic factors like age and location, which significantly influence the risk pool and associated costs. Finally, the choice of plan features, such as deductible and copay amounts, affects premiums at the lowest level, allowing individuals some degree of control over their premium costs through plan selection. The precise weighting of these factors varies among insurance providers and depends on various market and regulatory influences.

Understanding Premium Subsidies and Tax Credits

Government assistance significantly impacts the affordability of health insurance for many individuals and families. Subsidies and tax credits reduce the cost of monthly premiums, making health coverage accessible to a broader population. Understanding these programs is crucial for navigating the complexities of health insurance.

Government subsidies and tax credits directly lower the cost of health insurance premiums. Subsidies are typically provided as direct payments to the insurance company, reducing the amount the insured person owes. Tax credits, on the other hand, reduce the amount of income tax owed, effectively providing a financial offset for premium payments. The amount of assistance received depends on several factors, primarily income and family size.

Eligibility Criteria for Premium Assistance

Eligibility for premium assistance programs, such as those offered through the Affordable Care Act (ACA) marketplaces, is primarily determined by income. Applicants must have income within a specific range, usually expressed as a percentage of the Federal Poverty Level (FPL). Family size also plays a crucial role; larger families generally qualify for higher levels of assistance. Citizenship or legal immigration status is another factor, with specific requirements varying by program. In some cases, individuals may qualify for exemptions based on hardship or other extenuating circumstances. It is important to check the specific eligibility requirements for the applicable program in your area.

Examples of Subsidy Impact on Premium Costs

Let’s consider two hypothetical examples to illustrate how subsidies can significantly reduce out-of-pocket costs. Imagine a family of four with an annual income of $50,000. Without a subsidy, their monthly premium for a silver plan might be $1,000. With a subsidy, this could be reduced to $300, saving them $700 per month or $8,400 annually. Another example could involve a single individual earning $25,000 per year. Their monthly premium might be $500 without a subsidy, but with a subsidy, it could be reduced to $150, representing a monthly savings of $350 and an annual savings of $4,200. These are illustrative examples, and actual savings will vary depending on individual circumstances and the specific plan chosen.

Illustrative Subsidy Amounts Based on Income

The following table provides a simplified illustration of how subsidy amounts might vary based on income level. Remember that these figures are for illustrative purposes only and actual subsidy amounts will vary considerably depending on the specific program, location, plan chosen, and family size. Consult official government resources for accurate and up-to-date information.

| Annual Income (Household) | Income as % of FPL | Estimated Monthly Subsidy (Example) | Estimated Monthly Premium After Subsidy (Example) |

|---|---|---|---|

| $25,000 | 150% | $350 | $150 |

| $40,000 | 200% | $200 | $300 |

| $60,000 | 250% | $50 | $450 |

| $80,000 | 300% | $0 | $500 |

Illustrative Examples of Premium Structures

Understanding the structure of health insurance premiums requires examining the various components and how they interact. This section provides illustrative examples to clarify the complexities involved in premium calculations and the differences between various plan types.

A sample health insurance premium structure can be broken down into several key components. These include the base premium, which reflects the insurer’s cost of providing coverage to a specific demographic group. This base premium is then adjusted based on factors such as age, location, tobacco use, and the chosen plan type (e.g., HMO, PPO). Additional charges may be added for dependents. The final premium is the sum of all these components.

Sample Premium Structure Breakdown

Let’s consider a hypothetical individual, Sarah, a 35-year-old non-smoker living in a mid-sized city. She is choosing between two plans: a Bronze HMO and a Silver PPO. The base premium for her age and location is $300 per month. Because she chooses a Silver plan (higher coverage than Bronze), her base premium increases to $400. Because she opts for the PPO (which offers more provider choices), an additional $50 is added, resulting in a monthly premium of $450. If she added a dependent, a further $200 would be added to her monthly cost.

Impact of Plan Type on Premium

The choice between an HMO (Health Maintenance Organization) and a PPO (Preferred Provider Organization) significantly impacts the premium. HMOs typically have lower premiums because they restrict access to care to a specific network of providers. PPOs, offering broader provider choices and more flexibility, generally have higher premiums to reflect the increased cost to the insurer. In Sarah’s example, the PPO option is more expensive than the HMO option, reflecting the added flexibility.

Interaction of Deductibles, Co-pays, and Out-of-Pocket Maximums

Deductibles, co-pays, and out-of-pocket maximums interact with the premium to determine the overall cost of healthcare coverage. A higher premium often corresponds to a lower deductible, co-pay, and out-of-pocket maximum, signifying a greater share of costs covered by the insurance. Conversely, a lower premium usually means a higher deductible, co-pay, and out-of-pocket maximum, meaning the insured individual bears a larger portion of the healthcare expenses.

For example, Sarah’s Bronze HMO plan might have a $5,000 deductible, a $25 co-pay for doctor visits, and a $7,500 out-of-pocket maximum. Her Silver PPO plan might have a $2,500 deductible, a $50 co-pay for doctor visits, and a $5,000 out-of-pocket maximum. While the Silver PPO has a higher premium, the lower deductible and out-of-pocket maximum could ultimately result in lower overall healthcare costs if she requires significant medical care during the year.

Cost Breakdown Comparison: Bronze HMO vs. Silver PPO

To visualize the difference, consider a simplified cost breakdown. This illustration uses hypothetical values for the sake of comparison. The actual costs will vary based on individual circumstances and the specific plan details.

Plan: Bronze HMO

Monthly Premium: $400

Annual Premium: $4800

Deductible: $5000

Co-pay (Doctor Visit): $25

Out-of-Pocket Maximum: $7500

Plan: Silver PPO

Monthly Premium: $450

Annual Premium: $5400

Deductible: $2500

Co-pay (Doctor Visit): $50

Out-of-Pocket Maximum: $5000

This comparison highlights that while the Silver PPO has a higher monthly premium, its lower deductible and out-of-pocket maximum could lead to lower overall costs depending on the individual’s healthcare utilization.

Outcome Summary

Ultimately, understanding your health insurance premium is key to responsible healthcare planning. By grasping the factors that influence premium costs and familiarizing yourself with payment options and potential subsidies, you can secure the most appropriate and affordable coverage for your needs. This knowledge empowers you to navigate the complexities of health insurance with confidence and make well-informed choices regarding your healthcare future.

Common Queries

What happens if I miss a health insurance premium payment?

Missing payments can lead to a lapse in coverage, meaning you’ll be responsible for all medical expenses until your payment is made and coverage is reinstated. Late fees may also apply.

Can I negotiate my health insurance premium?

While you can’t directly negotiate the base premium, you can often find ways to lower your overall cost by choosing a plan with a higher deductible or opting for a less comprehensive coverage level.

How often are health insurance premiums typically paid?

Most health insurance premiums are paid monthly, but some insurers offer options for quarterly or even annual payments.

What is a premium subsidy, and how do I qualify?

A premium subsidy is government assistance to help lower the cost of health insurance premiums. Eligibility is based on income and family size, determined through the marketplace or relevant government programs.