Navigating the complexities of health insurance can be daunting, but understanding how to leverage health insurance premium deductions can significantly impact your annual tax liability. This guide offers a clear and concise explanation of health insurance premium deductions, covering eligibility criteria, calculation methods, and potential pitfalls to avoid. Whether you’re self-employed, employed by a company with limited benefits, or simply looking to optimize your tax situation, this information will prove invaluable.

We will explore the nuances of pre-tax versus post-tax deductions, demonstrating how these choices affect your overall financial well-being. Through practical examples and clear explanations, we aim to demystify the process of claiming these deductions, empowering you to make informed decisions and maximize your tax savings.

Defining Health Insurance Premium Deduction

Health insurance premium deduction refers to the ability to reduce your taxable income by the amount you pay for health insurance premiums. This means less of your earnings are subject to income tax, ultimately resulting in lower tax liability. Essentially, it allows you to use pre-tax dollars to pay for your health insurance, rather than using after-tax dollars.

This deduction is a valuable benefit, especially for individuals and families with significant healthcare costs. It effectively lowers the overall cost of health insurance by reducing the amount of income tax owed.

Types of Health Insurance Premium Deductions

There are primarily two main ways to deduct health insurance premiums: through employer-sponsored plans and through self-employed or individual plans. With employer-sponsored plans, premiums are often deducted pre-tax from your paycheck. For self-employed individuals or those purchasing individual plans, premiums can be deducted as an above-the-line deduction on your tax return, depending on eligibility requirements and the type of plan.

Pre-tax versus Post-tax Premium Deductions

The key difference lies in when the deduction occurs. Pre-tax deductions reduce your taxable income *before* taxes are calculated, leading to greater savings. Post-tax deductions, on the other hand, reduce your taxable income *after* taxes have been calculated, resulting in less significant tax savings. Pre-tax deductions are generally more advantageous.

For example, imagine you pay $500 monthly for health insurance. With a pre-tax deduction, this $500 is removed from your gross income before taxes are calculated. With a post-tax deduction, the $500 is deducted after taxes, meaning you’ve already paid taxes on the full amount of your income.

Tax Advantages of Premium Deductions

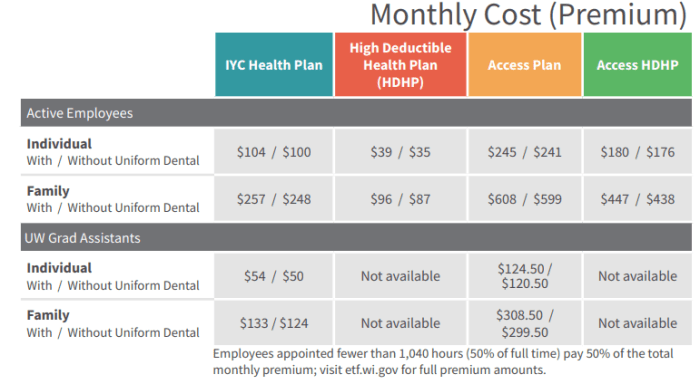

The following table illustrates the potential tax savings associated with pre-tax health insurance premium deductions. These figures are for illustrative purposes only and actual savings will vary based on individual tax brackets and premium amounts. Consult a tax professional for personalized advice.

| Deduction Type | Tax Bracket | Annual Premium | Tax Savings (Estimate) |

|---|---|---|---|

| Pre-tax deduction (Employer-sponsored) | 22% | $6000 | $1320 (22% of $6000) |

| Pre-tax deduction (Self-employed, eligible) | 12% | $4000 | $480 (12% of $4000) |

| Post-tax deduction | 22% | $6000 | Less than $1320 (actual savings depend on various factors) |

| No deduction | N/A | $6000 | $0 |

Eligibility Criteria for Premium Deduction

Claiming a deduction for health insurance premiums hinges on meeting specific eligibility requirements, which vary significantly depending on your location and the specific tax laws in place. These requirements often involve income limits, types of insurance plans, and the provision of supporting documentation. Understanding these criteria is crucial to ensuring a successful claim.

Eligibility Criteria: United States

In the United States, the eligibility for deducting health insurance premiums is primarily determined by self-employment status and participation in a qualified health savings account (HSA). Self-employed individuals can deduct the amount they paid in health insurance premiums as a business expense, reducing their taxable income. However, this deduction is taken on Schedule C (Profit or Loss from Business) and is subject to limitations. For those enrolled in an HSA-compatible high-deductible health plan (HDHP), contributions made to the HSA are also deductible, offering further tax advantages. Specific income limits for HSA contributions exist and are adjusted annually. The necessary documentation includes Form 1099-MISC (if applicable) showing payments made for health insurance, receipts for premium payments, and proof of HSA contributions.

- Self-employment status.

- Participation in an HSA-compatible HDHP (for HSA deduction).

- Income below the HSA contribution limits.

Eligibility Criteria: Canada

In Canada, the eligibility for deducting medical expenses, which can include health insurance premiums in certain situations, is based on the total amount of medical expenses incurred during the tax year. The deduction is not a direct deduction for premiums but rather a deduction against taxable income based on exceeding a specific threshold of medical expenses as a percentage of net income. This means that only the portion of medical expenses exceeding a certain percentage of net income (typically 3% for 2023) can be claimed. The specific percentage may vary from year to year. Health insurance premiums are often included as part of these medical expenses. Required documentation includes receipts for premium payments and other medical expenses, along with tax returns and supporting income documentation.

- Total medical expenses exceeding a specified percentage of net income.

- Proper documentation of medical expenses (including insurance premiums).

- Compliance with Canada Revenue Agency (CRA) guidelines.

Calculating the Deductible Amount

Determining the exact amount you can deduct for health insurance premiums involves understanding your specific circumstances and applicable tax laws. This calculation isn’t a one-size-fits-all process, as it depends on factors like your adjusted gross income (AGI), the type of health insurance plan, and any applicable limitations.

The calculation itself is relatively straightforward, though. It involves determining your eligible premium expenses and then applying the appropriate percentage based on your AGI. This percentage is determined by your tax bracket and the applicable tax laws for your region.

Premium Deduction Calculation

Let’s illustrate with a numerical example. Suppose your total health insurance premiums for the year were $10,000. Further, let’s assume that after calculating your AGI, you are eligible for a 10% deduction. The calculation would be:

Deductible Amount = Total Premiums Paid × Deduction Percentage

Deductible Amount = $10,000 × 0.10 = $1,000

In this scenario, you could deduct $1,000 from your taxable income. Remember that this is a simplified example; the actual deduction percentage will vary based on your AGI and the relevant tax regulations.

Tax Savings Calculation

Calculating the tax savings from the premium deduction depends on your marginal tax rate. Your marginal tax rate is the tax rate you pay on the last dollar of your income.

Tax Savings = Deductible Amount × Marginal Tax Rate

For example, if your marginal tax rate is 22%, and your deductible amount is $1,000 (as calculated above), your tax savings would be:

Tax Savings = $1,000 × 0.22 = $220

This means that by deducting $1,000 in health insurance premiums, you would reduce your tax liability by $220.

Limitations and Restrictions on Deductible Amounts

Several factors can limit the deductible amount. These limitations often depend on the specific tax laws in your jurisdiction. For instance, there might be a maximum amount you can deduct, regardless of your actual premium payments. Also, the type of health insurance plan might influence the deductible amount; for example, self-employed individuals might have different deduction rules compared to those with employer-sponsored plans.

Additionally, certain AGI thresholds may exist. If your AGI exceeds a certain level, your eligibility for the deduction might be reduced or eliminated entirely. It is crucial to consult the current tax guidelines to understand any applicable limits.

Impact of Different Tax Laws

Tax laws governing health insurance premium deductions vary across jurisdictions and are subject to change. For example, some countries might offer a flat deduction amount, while others use a percentage-based system linked to AGI. The specific rules and regulations can be complex and differ significantly, requiring careful review of the current tax legislation for your specific location and circumstances. Changes in tax laws can directly affect the deductible amount and the resulting tax savings.

Resources and Further Information

Navigating the complexities of health insurance premium deductions can be challenging, but thankfully, several resources are available to provide guidance and support. Understanding where to find reliable information and what assistance is offered can significantly simplify the process.

This section Artikels the various resources available to help individuals understand and successfully claim their health insurance premium deductions. We will cover where to find relevant information online and what support systems are in place to assist those who need it.

Government Websites and Authoritative Sources

Many government websites offer comprehensive information regarding health insurance premium deductions. These sites typically provide detailed explanations of the eligibility criteria, the calculation process, and the necessary documentation required to support a claim. They also often include downloadable forms, frequently asked questions (FAQs), and contact information for further assistance. Some websites may even offer interactive tools or calculators to help individuals estimate their potential deduction. These official government resources ensure the information provided is accurate and up-to-date, offering a reliable foundation for understanding the deduction process.

Support for Claiming Deductions

Several avenues of support exist for individuals who need assistance with claiming health insurance premium deductions. Tax professionals, such as certified public accountants (CPAs) or enrolled agents, can provide expert guidance on navigating the complexities of the tax code and ensuring accurate claim filings. Many community organizations and non-profit groups offer free or low-cost tax preparation services, specifically targeting individuals with low to moderate incomes. These services can be particularly helpful for those who are unfamiliar with tax regulations or who require assistance with completing the necessary forms. Furthermore, many health insurance providers offer customer support to answer questions about premiums and provide documentation needed for tax purposes.

Appealing a Rejected Deduction Claim

If a health insurance premium deduction claim is rejected, there is usually a formal appeals process. This process typically involves submitting additional documentation or providing clarification on aspects of the original claim. The appeals process usually Artikels specific timelines and procedures that must be followed. It’s crucial to carefully review the reasons for the rejection and gather all necessary supporting evidence before initiating the appeal. Contacting the relevant tax authority or the insurance provider directly is often the first step in initiating an appeal. Detailed instructions on how to appeal are usually available on the relevant government websites or from the tax authority itself.

Ending Remarks

Effectively utilizing health insurance premium deductions is a crucial step in responsible financial planning. By understanding the eligibility requirements, calculation methods, and potential challenges, individuals can significantly reduce their tax burden and allocate their resources more effectively. Remember to meticulously review your specific circumstances and consult with a tax professional if needed to ensure accurate claim submission and maximize your tax advantages. Taking proactive steps to understand and utilize these deductions can translate into substantial long-term financial gains.

Key Questions Answered

Can I deduct premiums for my spouse or dependents?

Deductibility for dependents often depends on their status (e.g., qualifying child) and your country’s tax laws. Check your region’s specific guidelines.

What happens if my deduction claim is rejected?

Most tax agencies provide an appeals process. Review the rejection notice carefully, gather any supporting documentation, and follow the Artikeld appeal procedure.

Are there any penalties for inaccurate claims?

Yes, inaccurate or fraudulent claims can result in penalties, including interest and additional taxes. Accurate record-keeping is essential.

How do I prove my premium payments for deduction purposes?

Retain copies of your insurance policy, premium payment receipts, and any other documentation showing premium payments throughout the year.