Navigating the complexities of health insurance can feel like deciphering a foreign language. Understanding the average cost of premiums is crucial for making informed decisions about your healthcare coverage. This guide unravels the key factors influencing premium costs, providing a clear picture of what shapes your monthly payments and how you can potentially find more affordable options. We’ll explore various plan types, delve into the components of your premium, and examine future trends to help you gain a comprehensive understanding of this vital aspect of healthcare financing.

From the impact of age and location to the influence of pre-existing conditions and family size, we will dissect each element that contributes to the final cost. We’ll also compare different plan types, highlighting the trade-offs between cost and coverage. By the end, you’ll be equipped with the knowledge to confidently navigate the world of health insurance premiums.

Factors Influencing Health Insurance Premium Costs

Several key factors contribute to the variation in health insurance premium costs. Understanding these factors empowers consumers to make informed decisions about their coverage and budget accordingly. These factors interact in complex ways, meaning that the cost for one individual can differ significantly from another’s even with seemingly similar circumstances.

Age and Health Insurance Premiums

Age significantly impacts health insurance premiums. Older individuals generally face higher premiums due to an increased likelihood of needing more extensive healthcare services. The following table illustrates average premium differences across various age groups, although specific figures vary widely based on plan type, location, and other factors. These figures are illustrative and should not be taken as precise representations of all plans.

| Age Range | Average Premium (USD) | Premium Increase (%) | Notes |

|---|---|---|---|

| 18-25 | 300 | 0% | Young adults often have lower premiums due to generally better health. |

| 26-35 | 350 | 16.7% | Slight increase reflecting the beginning of some age-related health concerns. |

| 36-45 | 450 | 50% | More pronounced increase as the risk of chronic conditions rises. |

| 46-55 | 600 | 100% | Significant increase due to higher healthcare utilization probability. |

| 56-65 | 800 | 166.7% | Premiums substantially increase before eligibility for Medicare. |

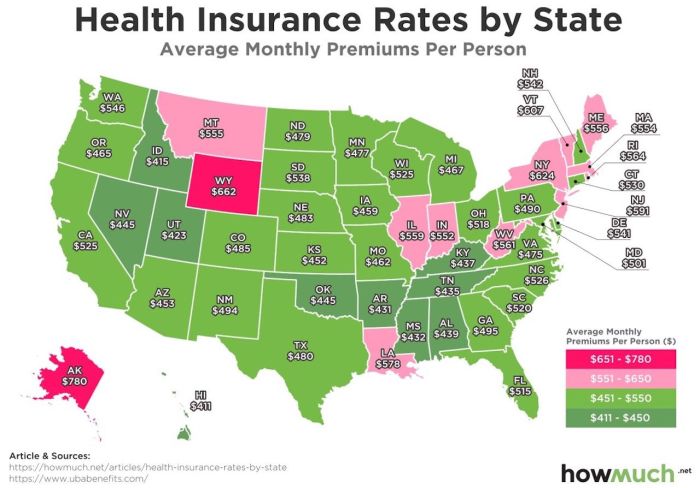

Geographic Location and Premium Costs

Geographic location plays a crucial role in determining health insurance premium costs. Variations stem from differences in healthcare provider costs, state regulations, and the prevalence of specific health conditions within a region.

Below is a comparison of premiums in three different states:

- State A (e.g., California): Higher premiums due to high healthcare costs, a large population, and a high concentration of specialists.

- State B (e.g., Texas): Moderate premiums reflecting a balance between healthcare costs and the size of the population.

- State C (e.g., Iowa): Lower premiums due to lower healthcare costs and a smaller population, leading to less competition among providers.

Health Status and Pre-existing Conditions

An individual’s health status and pre-existing conditions significantly influence premium costs. Insurers assess risk based on medical history. Those with pre-existing conditions, such as diabetes or heart disease, typically face higher premiums because they are statistically more likely to require costly medical care. For example, someone with a history of heart disease might see a premium 50% higher than someone with no such history, while someone with diabetes might experience a 30% increase.

Family Size and Dependents

Adding dependents to a health insurance plan generally increases the overall premium. The cost increase is not simply additive; it often involves a non-linear relationship where adding more dependents results in proportionally larger premium increases.

| Number of Dependents | Premium Change (%) |

|---|---|

| 0 | 0% |

| 1 | 25% |

| 2 | 50% |

| 3 or more | 75% or more |

Types of Health Insurance Plans and Their Average Costs

Understanding the different types of health insurance plans and their associated costs is crucial for making informed decisions about your healthcare coverage. The average premiums vary significantly depending on the plan type, your location, age, and health status. This section will Artikel the average costs and key features of several common plan types.

Average Premiums for HMO, PPO, EPO, and POS Plans

The four most common types of health insurance plans—HMO, PPO, EPO, and POS—each offer a different balance between cost and flexibility. Average premiums vary considerably, reflecting the differing levels of coverage and access to care.

| Plan Type | Average Monthly Premium (Estimate) | Key Features |

|---|---|---|

| HMO (Health Maintenance Organization) | $450 – $700 | Lower premiums, requires choosing a primary care physician (PCP) within the network, referrals needed for specialists, typically lower out-of-pocket costs when using in-network providers. |

| PPO (Preferred Provider Organization) | $600 – $900 | Higher premiums, greater flexibility in choosing doctors and specialists (in-network and out-of-network), no referrals usually needed, higher out-of-pocket costs when using out-of-network providers. |

| EPO (Exclusive Provider Organization) | $500 – $800 | Premiums generally fall between HMO and PPO, requires using in-network providers, no referrals usually needed for specialists within the network. Out-of-network coverage is typically very limited or nonexistent. |

| POS (Point of Service) | $550 – $850 | Combines features of HMO and PPO, requires a PCP, referrals may be needed for specialists, offers some out-of-network coverage but usually at a higher cost. |

Note: These are average estimates and actual premiums can vary widely based on individual circumstances and location. It is essential to obtain quotes from multiple insurers for accurate pricing.

Average Cost of High-Deductible Health Plans (HDHPs) with and without HSAs

High-deductible health plans (HDHPs) offer lower premiums in exchange for higher deductibles and out-of-pocket maximums. These plans often pair well with Health Savings Accounts (HSAs).

| Plan Type | Average Monthly Premium (Estimate) | Typical Deductible | Typical Out-of-Pocket Maximum |

|---|---|---|---|

| HDHP without HSA | $300 – $500 | $1,500 – $7,000 (Individual); $3,000 – $14,000 (Family) | $2,500 – $10,000 (Individual); $5,000 – $20,000 (Family) |

| HDHP with HSA | $300 – $500 | $1,500 – $7,000 (Individual); $3,000 – $14,000 (Family) | $2,500 – $10,000 (Individual); $5,000 – $20,000 (Family) |

The HSA contribution offers tax advantages, allowing pre-tax dollars to be saved for healthcare expenses. While the initial costs are lower, individuals must be prepared to cover a significant portion of their healthcare costs out-of-pocket until the deductible is met.

Premium Differences Between Individual and Family Plans

The cost of family health insurance plans is significantly higher than individual plans. Adding family members increases the overall risk for the insurance company, leading to higher premiums. The exact increase varies depending on the number of family members and their ages.

Adding a spouse and children to an individual plan typically results in a substantial premium increase, often more than doubling the monthly cost. However, the overall cost per person may still be lower than purchasing individual plans for each family member.

For example, an individual plan might cost $400 per month, while a family plan covering a spouse and two children could cost $1200-$1500 per month. While the family plan is more expensive overall, the cost per person is reduced compared to buying three separate individual plans.

Understanding the Components of Health Insurance Premiums

Health insurance premiums are not a single, monolithic cost. Instead, they represent a complex interplay of several factors, each contributing significantly to the final price you pay. Understanding these components is crucial for making informed decisions about your health insurance coverage.

Several key factors influence the overall cost of your health insurance premium. These can be broadly categorized as administrative costs, provider network costs, and claims expenses. A simplified visual representation of these components might be a pie chart. Imagine a circle representing the total premium. The largest segment, perhaps 50-60%, would represent claims expenses – the money paid out by the insurer to cover your medical care and that of other policyholders. A smaller segment, say 20-30%, would represent provider network costs; the amount the insurer pays to secure contracts with doctors, hospitals, and other healthcare providers within its network. The remaining segment, approximately 10-20%, would represent administrative costs, encompassing things like marketing, customer service, and the insurer’s operational overhead.

Government Subsidies and Tax Credits

Government subsidies and tax credits play a vital role in making health insurance more affordable for eligible individuals and families. These programs reduce the out-of-pocket cost of premiums, particularly for those with lower incomes. The Affordable Care Act (ACA) significantly expanded access to these subsidies. For example, a family earning $50,000 annually might receive a substantial subsidy that reduces their monthly premium by several hundred dollars, whereas a family earning $100,000 might receive a smaller subsidy or none at all, depending on their state and plan. The exact amount of the subsidy varies based on income, location, and the chosen health insurance plan.

Insurer Premium Rate Determination

Insurers use a sophisticated process to determine premium rates, combining risk assessment and actuarial modeling. Risk assessment involves evaluating the likelihood of policyholders needing medical care. Factors considered include age, health status (pre-existing conditions), geographic location (access to healthcare and cost of care), and lifestyle choices (smoking, etc.). Actuarial modeling uses statistical methods to predict future healthcare costs based on historical data and risk assessments. Insurers then use this information to calculate premiums that are expected to cover claims expenses, administrative costs, and provide a reasonable profit margin. For instance, a 30-year-old healthy individual living in a rural area might receive a lower premium than a 65-year-old with pre-existing conditions living in a major metropolitan area, reflecting the differing risk profiles.

Trends and Future Projections for Health Insurance Premium Costs

Predicting the future of health insurance premiums requires considering several interconnected factors. While precise figures are impossible, analyzing current trends and influencing elements allows for reasonable projections and a better understanding of potential cost impacts on consumers. The following sections will explore projected changes, the impact of rising healthcare costs, and the influence of potential legislative shifts.

Projected Changes in Average Health Insurance Premiums

Over the next five years, various industry reports suggest a continued upward trend in average health insurance premiums. The Kaiser Family Foundation (KFF), for example, consistently publishes data on employer-sponsored health insurance costs. Their projections, based on historical data and economic modeling, often indicate increases ranging from 3% to 7% annually, depending on factors such as plan type, location, and the health status of the insured population. This translates to a significant cumulative increase over five years, potentially doubling or even tripling the premiums in certain cases. For instance, a premium of $700 per month could rise to between $810 and $1,150 per month within five years under these projections. These projections, while not precise, serve as a reasonable estimate based on current trends. Actual increases may vary based on unforeseen events and policy changes.

Impact of Rising Healthcare Costs on Future Premium Increases

Rising healthcare costs are the primary driver of increasing health insurance premiums. Several factors contribute to this upward pressure. The increasing cost of prescription drugs, particularly specialty medications, significantly impacts premiums. Technological advancements in medical treatments, while often beneficial, frequently come with higher costs. An aging population requiring more healthcare services further exacerbates the problem. Additionally, administrative overhead and the complexities of the healthcare system contribute to rising costs that are then passed on to consumers through higher premiums. For example, the increasing use of advanced imaging technologies, while improving diagnostic accuracy, also adds to overall healthcare expenditures. These increased costs, ultimately, necessitate higher premiums to maintain insurance solvency.

Potential Effects of New Healthcare Legislation or Policy Changes

Changes in healthcare legislation and policy can significantly influence the trajectory of health insurance premium costs. For instance, expansion of Medicaid coverage could increase the insured population, potentially lowering average premiums due to economies of scale. However, it could also increase costs if the expansion leads to a greater demand for services. Conversely, policies that limit coverage or increase cost-sharing could lead to lower premiums in the short term but may result in poorer health outcomes and potentially higher costs in the long run. The Affordable Care Act (ACA), for example, initially led to premium increases in some areas as insurers adapted to the expanded coverage requirements, but also resulted in a decrease in the number of uninsured Americans. Future legislative changes could similarly lead to complex and potentially unpredictable effects on premium costs. Any significant policy changes would require detailed analysis to fully predict their impact on consumers.

Closure

Understanding the average cost of health insurance premiums is a multifaceted journey, requiring careful consideration of numerous factors. While the ultimate cost is personalized, this guide provides a solid foundation for informed decision-making. By recognizing the influence of age, location, health status, and plan type, you can better anticipate your expenses and explore options to optimize your healthcare coverage. Remember to regularly review your policy and explore available resources to ensure you’re receiving the most appropriate and cost-effective plan for your needs.

Expert Answers

What is the difference between an HMO and a PPO plan?

HMOs typically offer lower premiums but require you to choose a primary care physician (PCP) who manages your care and referrals to specialists. PPOs generally have higher premiums but offer more flexibility in choosing doctors and specialists without referrals.

Can I negotiate my health insurance premium?

Directly negotiating premiums is typically not possible. However, you can explore different plans, compare quotes, and consider factors like HSA eligibility to potentially lower your overall healthcare costs.

How often do health insurance premiums change?

Premiums usually change annually, often reflecting changes in healthcare costs and utilization patterns. Your premium may also change if you change plans or add/remove dependents.

What factors influence the deductible amount?

The deductible amount is determined by the specific health insurance plan you choose. Higher deductible plans typically have lower premiums, while lower deductible plans generally have higher premiums.