Navigating the complexities of tax deductions can be daunting, especially when it comes to healthcare. This guide unravels the intricacies of health care insurance premiums tax deductibility, offering a clear understanding of eligibility, claiming procedures, and the potential financial benefits. We’ll explore the differences between employee and self-employed deductions, examine various health insurance plan types, and discuss potential future changes in tax laws. Ultimately, this guide aims to empower you with the knowledge to maximize your tax savings.

The deductibility of health insurance premiums significantly impacts both individuals and families, potentially leading to substantial tax savings. Understanding the nuances of these deductions, however, requires navigating varying regulations and eligibility criteria. This guide provides a comprehensive overview, covering everything from determining eligibility and gathering necessary documentation to understanding the implications of different health insurance plan types and anticipating potential future changes in tax legislation. Real-world examples and case studies further illustrate the practical applications of this crucial tax benefit.

Impact of Health Insurance Premium Deductibility on Tax Liability

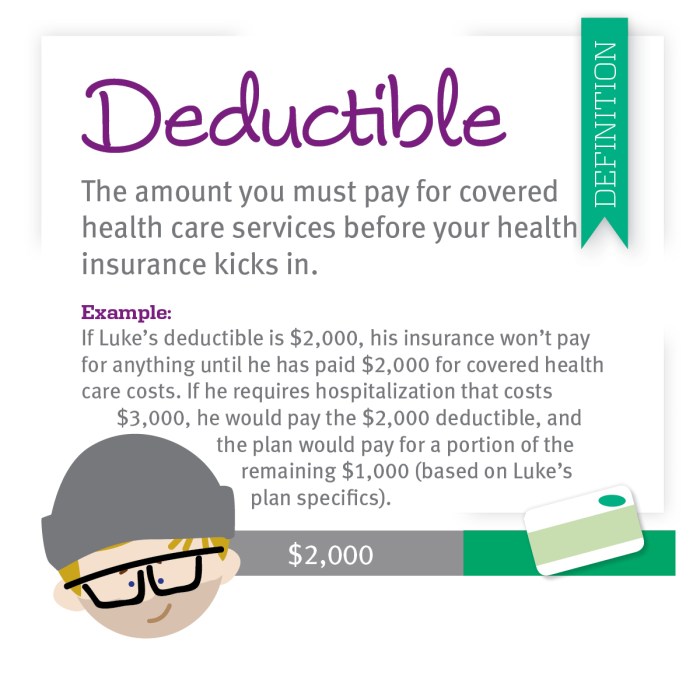

The deductibility of health insurance premiums offers a significant tax advantage to many individuals and families, directly impacting their overall tax liability. This deduction allows taxpayers to reduce their taxable income by the amount of their premiums paid, resulting in a lower tax bill. The extent of this reduction depends on several factors, including the taxpayer’s income, filing status, and the amount of premiums paid.

The deductibility of health insurance premiums effectively lowers the amount of income subject to taxation. This means that the more you pay in premiums, the greater the potential reduction in your tax liability. The actual savings will vary depending on your individual tax bracket. Those in higher tax brackets will generally see a larger dollar amount saved compared to those in lower tax brackets, as a higher percentage of their income is taxed at higher rates.

Premium Deduction and Tax Liability Reduction Across Income Levels

The impact of the health insurance premium deduction is demonstrably different across various income levels. Consider these examples, assuming a standard deduction and simplified tax calculations for illustrative purposes:

| Taxpayer Income | Premium Paid | Taxable Income (after deduction) | Approximate Tax Savings (Illustrative) |

|---|---|---|---|

| $40,000 | $3,000 | $37,000 | $300 – $600 (depending on tax bracket and other deductions) |

| $80,000 | $6,000 | $74,000 | $1,200 – $1,800 (depending on tax bracket and other deductions) |

| $120,000 | $9,000 | $111,000 | $2,700 – $4,000 (depending on tax bracket and other deductions) |

Note: These are simplified examples and do not account for all potential tax deductions or credits. Actual tax savings will vary based on individual circumstances and applicable tax laws. Consult a tax professional for personalized advice.

Hypothetical Scenario Illustrating Financial Benefits

Imagine a family of four with an annual household income of $75,000. Their total health insurance premiums for the year amount to $10,000. Without the premium deduction, their taxable income would be $75,000. However, with the deduction, their taxable income is reduced to $65,000. Assuming a combined federal and state tax rate of 25%, the tax savings would be approximately $2,500 ($10,000 x 0.25). This $2,500 represents a significant reduction in their overall tax burden, allowing them to allocate those funds elsewhere. This illustrates how a seemingly small tax break can have a meaningful impact on household finances.

Eligibility Criteria for Deductibility

Claiming a deduction for health insurance premiums requires meeting specific criteria set by the tax authorities. Failure to meet these requirements will result in the inability to claim the deduction, potentially increasing your overall tax liability. Understanding these criteria is crucial for accurate tax filing.

Eligibility for the health insurance premium deduction hinges on several factors, primarily focusing on the type of health insurance plan, the individual’s tax filing status, and the proper documentation. The specific rules and regulations can vary depending on the country and its tax laws; therefore, consulting the relevant tax authority’s guidelines is always recommended.

Self-Employed Individuals and Small Business Owners

This deduction is typically available to self-employed individuals and small business owners who purchase their own health insurance. This is because they are not receiving health insurance coverage through an employer. For example, a freelance writer who purchases a private health insurance plan can typically deduct the premiums paid. The specific requirements for self-employment status vary depending on the jurisdiction. The key is that the individual is considered to be working for themselves, rather than being employed by another entity.

Documentation Required for Deduction

Supporting documentation is essential to substantiate the deduction claim. Without proper documentation, the tax authorities may disallow the deduction, resulting in a higher tax bill. It’s important to keep all relevant documents organized and readily accessible during tax season.

Checklist of Necessary Documents

It is crucial to maintain a thorough record of all expenses related to your health insurance premiums. This documentation serves as irrefutable proof of your eligibility for the deduction. Missing any of these documents could delay processing or even result in rejection of your claim.

- Form 1095-B or 1095-A (if applicable): These forms provide information about your health insurance coverage. Form 1095-B is issued by health insurance providers, while 1095-A is for those enrolled in the Health Insurance Marketplace.

- Copies of premium payment receipts or bank statements showing payments made for health insurance premiums. These should clearly show the date, amount, and the payer.

- Taxpayer identification number (TIN): This is necessary to connect the payment to the individual claiming the deduction.

- Self-employment tax return (if applicable): This form demonstrates your self-employment status and income, which is often a requirement for claiming this deduction.

Implications of Not Meeting Eligibility Criteria

Failure to meet the eligibility criteria for the health insurance premium deduction will prevent the taxpayer from claiming this deduction. This directly translates to a higher tax liability, as the deductible amount will not reduce the taxpayer’s taxable income. For example, if an individual mistakenly claims the deduction without meeting the requirements, they may face penalties and interest charges on the unpaid taxes. Therefore, it is essential to verify eligibility before claiming the deduction.

Final Review

Successfully claiming the deduction for health care insurance premiums can result in considerable financial relief. By carefully reviewing the eligibility requirements, understanding the documentation needed, and staying informed about potential legislative changes, taxpayers can confidently navigate the process and maximize their tax benefits. This guide has provided a framework for understanding this often-complex aspect of tax law, empowering you to make informed decisions and optimize your tax situation. Remember to consult with a qualified tax professional for personalized advice based on your specific circumstances.

FAQ Overview

Can I deduct premiums for my spouse or dependents?

Generally, yes, if they are claimed as dependents and meet other eligibility requirements. Specific rules may vary depending on your country and tax laws.

What if I’m partially self-employed?

The deductibility of your premiums may depend on the percentage of your income derived from self-employment. Consult tax guidelines or a professional for clarification.

What happens if I overestimate the deduction?

You may be required to pay additional taxes and potentially penalties. Accurate record-keeping is crucial.

Are there any income limits for claiming this deduction?

Income limits may apply depending on your country and specific tax laws. Check your country’s tax regulations for details.

Where can I find the most up-to-date information on tax laws related to this deduction?

Consult the official website of your country’s tax authority or a qualified tax professional for the most current and accurate information.