Hazard insurance premiums are a critical aspect of protecting your property and assets from unforeseen events. Understanding the factors that influence these premiums is crucial for securing adequate coverage at a manageable cost. This guide delves into the intricacies of hazard insurance premiums, providing a clear and concise overview of the key components, influencing factors, and strategies for effective management.

From the basic components of premium calculation to advanced strategies for cost reduction, we will explore the various aspects that contribute to the overall cost of hazard insurance. We’ll also examine the role of government regulations and the impact of different insurance providers on pricing and coverage options.

Strategies for Managing Premiums

Managing hazard insurance premiums effectively is crucial for maintaining a healthy financial position. High premiums can strain budgets, while inadequate coverage leaves you vulnerable to significant financial losses. Understanding the various strategies available to control these costs is essential for both individuals and businesses.

Methods for Reducing Hazard Insurance Premium Costs

Several approaches can significantly lower your hazard insurance premiums. These methods often involve proactive risk management and careful consideration of your policy details.

- Improve your property’s safety features: Installing security systems, smoke detectors, fire sprinklers, and impact-resistant windows can demonstrably reduce the risk of loss and, consequently, your premium. Insurance companies often offer discounts for these upgrades.

- Maintain a good credit score: Insurers often use credit scores as an indicator of risk. A higher credit score generally translates to lower premiums, reflecting a perceived lower likelihood of claims.

- Bundle your insurance policies: Combining your hazard insurance with other types of insurance, such as auto or homeowner’s insurance, from the same provider can often lead to significant discounts.

- Shop around and compare quotes: Different insurers use varying assessment methods and offer different rates. Obtaining quotes from multiple companies ensures you find the most competitive premium for the coverage you need.

- Consider higher deductibles: Opting for a higher deductible can reduce your premium, as you’re accepting a larger share of the financial responsibility in case of a claim. This strategy requires careful consideration of your financial capacity to cover a larger deductible in the event of a loss.

Benefits and Drawbacks of Increasing Deductibles

Increasing your insurance deductible is a common strategy to lower premiums, but it involves a trade-off.

- Benefits: A higher deductible directly reduces your premium. The insurer assumes less risk, resulting in lower costs for you.

- Drawbacks: Should a claim arise, you’ll have to pay a larger amount out-of-pocket before the insurance coverage kicks in. This can create financial hardship if you experience a significant loss.

For example, a homeowner might choose a $2,000 deductible instead of a $500 deductible to save on premiums, understanding that they would need to cover the first $2,000 of any damage before the insurance company would pay out. This is a viable strategy for those with significant savings and a low risk tolerance for smaller claims.

A Plan to Lower Premium Expenses

Implementing a comprehensive plan to reduce premium expenses involves a multi-pronged approach.

- Assess your current policy: Review your current coverage to ensure it aligns with your needs and identify areas where you might have over-insurance.

- Improve risk mitigation: Implement safety measures to reduce the likelihood of claims (e.g., security systems, fire alarms).

- Obtain multiple quotes: Compare quotes from several insurance providers to find the most competitive pricing.

- Negotiate with your insurer: Discuss your risk mitigation efforts and explore the possibility of discounts.

- Consider increasing your deductible: Evaluate the financial implications of a higher deductible and weigh it against the premium savings.

Comparison of Risk Mitigation Strategies’ Effectiveness on Premium Costs

Different risk mitigation strategies vary in their impact on premium costs. While some, like installing security systems, may lead to substantial discounts, others, like maintaining a good credit score, might yield more modest savings. The effectiveness also depends on the insurer’s specific underwriting criteria. For example, a homeowner installing a sophisticated security system might receive a larger discount than one simply improving their landscaping to reduce fire risks, even though both actions mitigate hazards. The precise savings will depend on factors such as the type of insurance, the insurer, and the specific risk reduction measures implemented.

Illustrating Premium Variations

Understanding how hazard insurance premiums vary is crucial for making informed decisions. Several factors interact to determine the final cost, and visualizing these relationships helps clarify the process. This section will illustrate premium variations through a graphical representation and a hypothetical scenario, highlighting the impact of coverage levels and risk factors. We will also explore the cost-saving potential of bundling insurance policies.

Premium variations are primarily driven by the level of coverage desired and the assessed risk profile of the insured. Higher coverage generally translates to higher premiums, while factors influencing risk directly impact the cost. Bundling insurance policies can provide significant cost savings by leveraging economies of scale offered by insurance providers.

Coverage and Premium Cost Relationship

The relationship between coverage and premium cost can be visualized using a simple line graph. The horizontal axis (x-axis) represents the level of coverage, which could be expressed as a percentage of the insured value or a specific monetary amount. For example, it could range from 50% to 100% coverage. The vertical axis (y-axis) represents the premium cost in dollars. The graph would show a generally positive linear relationship; as the level of coverage increases, the premium cost increases proportionally. The line might not be perfectly straight, however, as insurance companies may offer discounts or tiered pricing structures for certain coverage levels. For instance, there might be a slight decrease in the rate of premium increase at higher coverage levels due to economies of scale in risk management for the insurer.

Risk Factors and Premium Variability

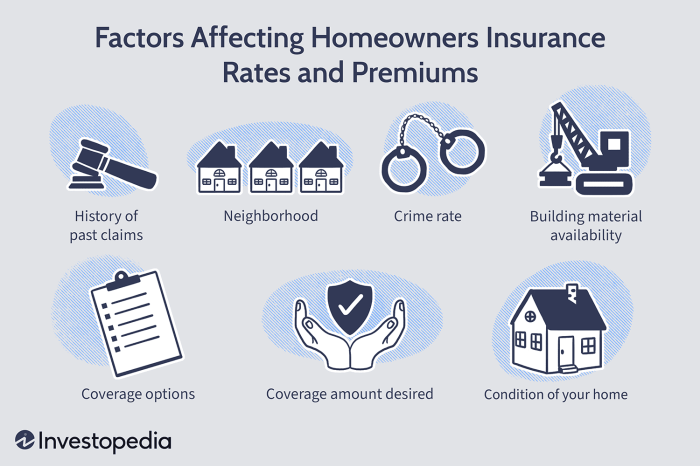

Consider a hypothetical scenario involving two homeowners, Alice and Bob, both seeking homeowner’s insurance. Alice lives in a low-crime, fire-resistant neighborhood with a modern, well-maintained home equipped with a state-of-the-art security system. Bob, on the other hand, lives in a high-crime area with an older home that lacks many modern safety features. Even if both seek the same level of coverage, Bob’s higher risk profile—due to location and property condition—will result in a significantly higher premium than Alice’s. Other risk factors, such as the homeowner’s claims history and credit score, could further influence the variability. For instance, a homeowner with a history of filing claims might face higher premiums compared to one with a clean record. Similarly, a lower credit score can sometimes correlate with a higher insurance premium.

Bundling Insurance Policies and Premium Costs

Bundling multiple insurance policies, such as homeowner’s and auto insurance, with the same provider often leads to reduced overall premium costs. Insurance companies frequently offer discounts for bundling policies, reflecting economies of scale and reduced administrative costs. This discount can be a significant percentage of the total premium, making bundling a financially attractive option. For example, a homeowner might receive a 10-15% discount on their total premium by bundling their home and auto insurance. The exact discount varies depending on the insurer and the specific policies bundled. This approach streamlines the administrative process for both the insurer and the insured, ultimately benefiting both parties.

Legal and Regulatory Aspects

Government regulations significantly influence the hazard insurance market, impacting premiums and coverage availability for consumers. These regulations aim to balance the interests of insurers, consumers, and the broader public, ensuring market stability and consumer protection. The interplay between insurance laws and market forces ultimately shapes the cost and availability of hazard insurance.

Insurance laws directly affect pricing and coverage by setting minimum standards for policy provisions, reserving requirements, and rate regulation. These regulations can limit insurers’ ability to charge excessively high premiums or offer insufficient coverage, protecting consumers from unfair practices. Conversely, overly restrictive regulations can limit competition and potentially lead to higher premiums due to reduced market efficiency.

The Role of Government Regulation in Shaping Premiums

Government intervention in the hazard insurance market takes many forms, including rate regulation, solvency requirements, and market conduct oversight. Rate regulation, for instance, can involve direct setting of premiums or approval of proposed rates by insurers. This process aims to prevent insurers from exploiting market power and charging excessive premiums. Solvency requirements ensure insurers maintain adequate capital reserves to meet their obligations, protecting policyholders from insurer insolvency. Market conduct oversight focuses on ensuring fair and ethical business practices by insurers, including accurate advertising and claims handling. The level of government involvement varies significantly across jurisdictions, influencing the resulting premium levels and market dynamics. For example, states with stricter rate regulation might see lower premiums but potentially less innovation and insurer participation, compared to states with more deregulated markets.

Impact of Insurance Laws on Pricing and Coverage

Insurance laws dictate the minimum coverage requirements for certain types of hazards, such as earthquake or flood insurance, and can mandate the inclusion of specific provisions within policies. These requirements can directly increase premiums as insurers must factor in the increased risk and potential payout costs. For instance, regulations requiring broader coverage for certain perils, such as wind damage, could lead to higher premiums for consumers, even if they are not directly impacted by that peril. Conversely, limitations on the types of coverage offered or exclusions for certain hazards might reduce premiums but also leave consumers vulnerable to significant financial losses in the event of an unforeseen event. This creates a trade-off between affordability and comprehensive protection.

Implications of Different Regulatory Models on Consumer Costs

Different regulatory models lead to varying consumer costs for hazard insurance. States with highly regulated markets often have lower average premiums but might also experience limited insurer competition and potentially slower innovation in product offerings. Conversely, states with less stringent regulations might see higher average premiums, but potentially more competitive pricing and a wider range of policy options. The “best” regulatory model is a subject of ongoing debate, balancing the need for consumer protection with the promotion of a healthy and competitive insurance market. The optimal balance often depends on the specific characteristics of the local hazard environment and the overall economic context. For example, a state with a high risk of hurricanes might benefit from stricter regulations to ensure sufficient coverage, even if it leads to higher premiums, whereas a state with lower risk might find a more deregulated market more appropriate.

Summary

Navigating the world of hazard insurance premiums can seem daunting, but with a clear understanding of the key factors involved, you can make informed decisions to protect your assets effectively and affordably. By carefully considering your risk profile, comparing provider options, and implementing cost-saving strategies, you can secure the right level of coverage without unnecessary financial burden. Remember to regularly review your policy and adjust your coverage as needed to maintain optimal protection.

Key Questions Answered

What is the difference between hazard insurance and other types of insurance?

Hazard insurance specifically covers damage or loss caused by unforeseen events like fire, wind, or hail. Other insurance types, such as liability insurance, cover different risks.

Can I negotiate my hazard insurance premium?

While you can’t directly negotiate the base rate, you can explore options to lower your premium through increased deductibles, bundling policies, or implementing risk mitigation measures.

How often are hazard insurance premiums reviewed?

Premiums are typically reviewed annually, and adjustments may be made based on factors like claims history, changes in coverage, and market conditions.

What happens if I fail to pay my hazard insurance premium?

Non-payment can lead to policy cancellation, leaving you without coverage. It’s crucial to maintain timely payments.