Graded premium life insurance offers a unique approach to securing your family’s financial future. Unlike traditional level premium policies, graded premium insurance starts with lower initial premiums that gradually increase over a set period, typically five to ten years. This structure can be particularly appealing to younger individuals or those facing budget constraints, allowing them to secure coverage while managing their immediate financial obligations. This guide will delve into the intricacies of graded premium life insurance, exploring its benefits, drawbacks, and suitability for various life stages.

We’ll examine how these increasing premiums work, comparing them to level premium and other life insurance types. We will also consider the impact of policy riders, factors influencing policy costs, and provide practical steps to help you determine if a graded premium policy aligns with your individual needs and financial goals. Ultimately, understanding the nuances of graded premium life insurance empowers you to make informed decisions about protecting your loved ones.

Definition and Characteristics of Graded Premium Life Insurance

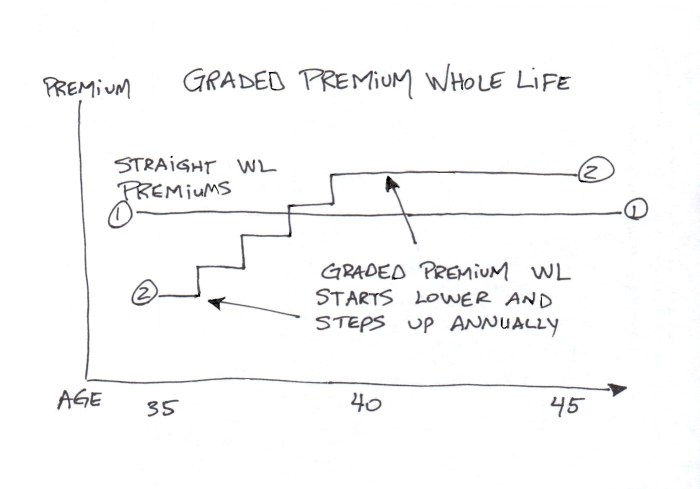

Graded premium life insurance is a type of permanent life insurance policy that offers a unique approach to premium payments. Unlike level premium policies where premiums remain constant throughout the policy’s term, graded premium policies feature lower premiums in the initial years, gradually increasing over a specified period before leveling off. This structure aims to make the policy more affordable in the early years, particularly beneficial for individuals with tighter budgets during their younger years or career building stages.

Graded premium life insurance policies share many characteristics with other permanent life insurance options, including a cash value component that grows tax-deferred over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. However, the defining feature is the graduated premium payment schedule.

Premium Payment Structure

The defining characteristic of a graded premium life insurance policy is its escalating premium schedule. Premiums start low and increase incrementally over a predetermined period, typically 5 to 10 years, after which they remain level for the remainder of the policy’s duration. This phased increase allows policyholders to manage their finances more effectively during the early years when financial resources may be limited. The rate of increase is specified in the policy contract and is generally consistent and predictable. For example, a policy might start with premiums of $500 annually, increasing by $50 each year for five years, ultimately reaching a level premium of $750 annually.

Comparison with Level Premium Life Insurance

Level premium life insurance policies maintain a consistent premium payment throughout the policy’s life. This provides predictability and stability in budgeting for insurance costs. In contrast, graded premium policies offer lower initial premiums but ultimately result in higher total premium payments over the policy’s life compared to a level premium policy with the same death benefit. The choice between the two depends on individual financial circumstances and priorities. Someone prioritizing affordability in the early years might prefer a graded premium policy, while someone who values consistent, predictable payments might opt for a level premium policy.

Beneficial Scenarios for Graded Premium Life Insurance

Graded premium life insurance can be particularly advantageous in situations where individuals anticipate an increase in income over time. Young professionals, for instance, might find the lower initial premiums appealing as they establish their careers and income grows. Similarly, individuals facing temporary financial constraints may benefit from the lower initial premiums, providing crucial life insurance coverage while easing the immediate financial burden. Consider a young family starting a business: the lower initial premiums allow them to secure coverage while focusing on building their enterprise. Once the business becomes profitable, the gradually increasing premiums become manageable. Another example is a newly married couple buying a house, where the initial lower premiums of graded premium life insurance can be beneficial alongside mortgage payments.

Illustrative Examples

Graded premium life insurance, with its initially lower premiums and subsequent increases, presents a unique financial planning tool. Understanding its application requires examining scenarios where it proves advantageous and others where alternative options might be more suitable. The following examples illustrate the diverse situations where a graded premium policy could be a good fit, or conversely, where it might fall short.

Young Professional Benefiting from Graded Premium Insurance

Consider Anya, a 28-year-old software engineer earning a comfortable salary but anticipating significant career advancement and increased income within the next five to ten years. Anya is health-conscious and wants life insurance to protect her family in the event of her untimely death. A traditional level-premium policy might strain her current budget, but a graded premium policy allows her to secure substantial coverage now, with premiums that increase gradually alongside her expected salary growth. This approach ensures she has adequate protection while managing her finances effectively during her early career stages. By the time her premiums reach their maximum level, her increased income will comfortably absorb the higher cost. This strategy avoids the potential need to reduce coverage or struggle with high premiums early in her career.

Scenario Where Graded Premium Might Not Be Optimal

Conversely, consider Robert, a 60-year-old retiree with a fixed income and limited savings. Robert needs life insurance to cover estate taxes and provide for his spouse. A graded premium policy, with its increasing premiums, would likely be unsuitable for him. His fixed income may not accommodate the escalating costs, potentially jeopardizing his ability to maintain the policy over time. For Robert, a level-premium policy, perhaps with a lower death benefit, or a term life insurance policy, would offer a more financially viable and sustainable solution, given his age and financial constraints. His fixed income stream is unlikely to support the increasing premiums associated with a graded premium policy over his remaining lifespan.

Hypothetical Policy Structures

The structure of a graded premium policy significantly influences the premium schedule. Below are two hypothetical examples illustrating this variance:

Policy Structure A: Gentle Increase

This policy features a relatively slow premium increase over the first ten years, rising by approximately 5% annually. After ten years, the premium levels off, remaining constant for the remainder of the policy term. This structure is designed to be more manageable for individuals anticipating steady income growth. For example, a 30-year-old might start with a premium of $500 annually, gradually increasing to approximately $814 by year 10, then remaining at that level.

Policy Structure B: Steeper Initial Increase

This policy demonstrates a more aggressive premium increase in the early years. Premiums might increase by 10% annually for the first five years, followed by a slower 3% annual increase for the next five years, before leveling off. This approach might suit someone with a projected rapid income increase in the initial years. For instance, a policy could start at $400 annually, rising to approximately $800 within five years and then to roughly $950 within ten years before stabilizing. This structure would require more careful financial planning, as the initial increase is substantial.

Final Conclusion

Graded premium life insurance presents a viable option for individuals seeking affordable life insurance coverage, particularly in the early stages of their careers or when facing budgetary limitations. While the increasing premiums are a key characteristic, the potential long-term savings and the ability to secure significant coverage can outweigh this factor for many. However, careful consideration of the rising premiums, policy terms, and comparison with alternative insurance products is crucial before committing to a policy. By understanding the benefits, drawbacks, and suitability for your specific circumstances, you can make an informed decision that best protects your financial well-being and secures your family’s future.

FAQ Insights

What happens if I can’t afford the increasing premiums?

Most policies allow for several options if premiums become unaffordable, such as reducing coverage, converting to a paid-up policy (with reduced coverage), or taking out a loan against the policy’s cash value (if applicable). It’s crucial to contact your insurance provider immediately to discuss available options.

Can I change my policy later?

The possibility of changing your policy depends on the specific terms and conditions of your contract. Some policies allow for adjustments, while others may have limitations. Review your policy document carefully or contact your insurer to understand your options.

How does graded premium life insurance compare to term life insurance?

Graded premium offers lifelong coverage (permanent) unlike term life insurance, which provides coverage for a specific period. While initial premiums are lower for graded premium, they increase over time, whereas term life premiums remain level. The best choice depends on your individual needs and financial circumstances.