Life insurance is a cornerstone of financial planning, but the sheer variety of policies can be overwhelming. This guide delves into the intricacies of flexible adjustable premium life insurance, a type of policy offering unique advantages and challenges compared to traditional term or whole life options. We’ll explore how this type of insurance works, its benefits and drawbacks, and how to determine if it’s the right choice for your individual circumstances. Understanding the nuances of premium adjustments, policy features, and long-term financial implications is crucial for making an informed decision.

Flexible adjustable premium life insurance provides the adaptability to adjust your premium payments based on your changing financial situation, offering a degree of control not found in traditional policies. This flexibility can be particularly beneficial during periods of financial uncertainty, allowing you to maintain coverage even when your income fluctuates. However, it’s essential to understand the potential downsides, such as the risk of insufficient coverage due to lowered premiums or higher costs in the long run if not managed effectively.

Defining “Flexible Adjustable Premium Life Insurance”

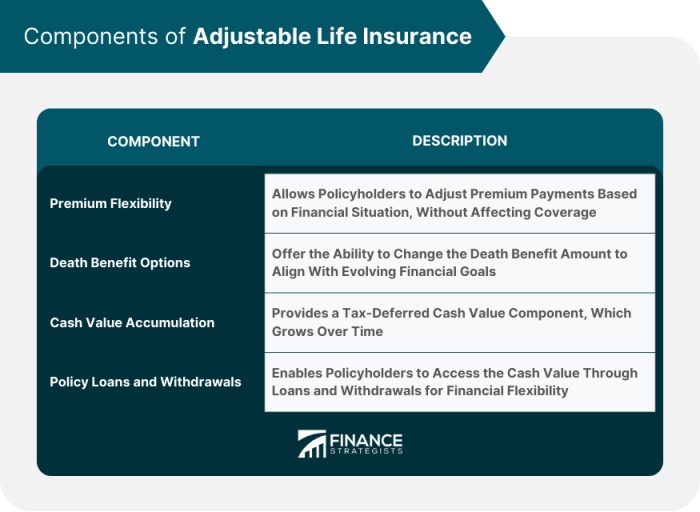

Flexible adjustable premium life insurance offers a unique blend of coverage and financial flexibility, appealing to those who anticipate changes in their income or financial goals over time. Unlike traditional life insurance policies, it provides the policyholder with the ability to adjust both their premium payments and, in some cases, their death benefit. This adaptability makes it a potentially attractive option for individuals navigating life’s uncertainties.

Flexible adjustable premium life insurance policies are permanent life insurance policies, meaning they offer lifelong coverage as long as premiums are paid. However, the key differentiating factor lies in their adaptability. Policyholders can increase or decrease their premium payments within specified limits, depending on their financial circumstances. This flexibility contrasts sharply with the fixed premium structures of traditional term and whole life insurance. The death benefit can also be adjusted in some plans, though this usually requires more complex adjustments and may not always be an option.

Premium Adjustments in Practice

Premium adjustments are usually subject to policy terms and conditions, and they are not unlimited. For instance, a policyholder might be able to increase their premium payments to accelerate the growth of the policy’s cash value component. This is particularly useful if they experience a period of higher income. Conversely, if financial circumstances become tighter, they might reduce their premiums, though this could impact the cash value accumulation and potentially reduce the death benefit if the policy is not properly maintained. The insurance company will have minimum and maximum premium thresholds. Falling below the minimum premium will typically lead to a reduction in coverage, while exceeding the maximum premium will result in a faster accumulation of cash value. Imagine a scenario where a policyholder starts with a moderate premium, then increases it after a promotion, and later reduces it when facing unexpected medical expenses. The flexibility allows for this financial navigation.

Comparison of Life Insurance Types

The following table highlights the key differences between flexible adjustable premium life insurance and other common types of life insurance:

| Policy Type | Premium Flexibility | Death Benefit | Cash Value |

|---|---|---|---|

| Flexible Adjustable Premium | Adjustable within policy limits | Potentially adjustable, often fixed | Accumulates over time, influenced by premium payments |

| Term Life Insurance | Fixed | Fixed for the policy term | None |

| Whole Life Insurance | Fixed | Fixed | Accumulates tax-deferred |

| Universal Life Insurance | Flexible | Can be adjusted within policy limits, often fixed | Accumulates over time, influenced by premium payments and interest rates |

Benefits and Drawbacks

Flexible adjustable premium life insurance offers a compelling blend of flexibility and coverage, but it’s crucial to understand both its advantages and potential downsides before committing. This policy type allows for adjustments to both premium payments and death benefit amounts, providing a degree of customization unavailable with traditional life insurance plans. However, this flexibility comes with certain considerations that impact the overall cost and suitability for different individuals.

Advantages of Flexible Adjustable Premium Life Insurance

This type of insurance provides several key benefits to consumers. The most significant advantage is the inherent flexibility. Policyholders can adjust their premiums to align with their changing financial circumstances. For example, during periods of lower income, premiums can be reduced (within policy limits), and increased again when financial stability returns. Similarly, the death benefit can often be adjusted upwards as financial needs change, such as the arrival of children or a significant increase in assets requiring protection. This adaptability makes it a potentially attractive option for individuals whose income or financial goals fluctuate over time. Another advantage is the potential for cash value accumulation. Some flexible adjustable premium policies build cash value over time, which can be borrowed against or withdrawn, offering a source of funds for emergencies or other needs.

Disadvantages and Risks of Flexible Adjustable Premium Life Insurance

While offering flexibility, this type of policy also presents potential drawbacks. The most significant risk is the potential for increased premiums. If premiums are lowered, the death benefit might also decrease, or the policy might lapse entirely if payments are consistently insufficient. Additionally, the ability to adjust premiums doesn’t mean the cost will always be low. Premium adjustments are subject to the insurer’s underwriting guidelines and may lead to higher premiums than anticipated in the long run. The cash value accumulation, while a benefit, is typically slower than with some other investment vehicles, and its growth is subject to market fluctuations and the insurer’s investment performance. Finally, the complexity of these policies can make them difficult to understand, potentially leading to uninformed decisions about premium and death benefit adjustments.

Scenarios Where This Insurance is Particularly Beneficial

Flexible adjustable premium life insurance is particularly well-suited for individuals whose financial situations are likely to change significantly over time. For example, entrepreneurs whose income fluctuates depending on business performance might find this policy beneficial, allowing them to adjust premiums according to their revenue. Similarly, young professionals starting their careers, anticipating future income growth, could benefit from the option to increase their death benefit as their income and family responsibilities grow. Parents with young children might also find it beneficial, as they can adjust coverage to match their children’s growing needs and financial responsibilities.

Potential Downsides for Individuals with Fluctuating Incomes

While designed for fluctuating incomes, consistent, unpredictable income fluctuations can present challenges. If income drops significantly and repeatedly, maintaining sufficient premiums to avoid policy lapse becomes a major concern. The need for frequent premium adjustments can also add complexity and administrative burden, requiring careful financial planning and monitoring to avoid unintended consequences like increased premiums or reduced death benefit. This necessitates diligent tracking of financial changes and proactive communication with the insurance provider to ensure the policy remains viable. Failure to do so can lead to costly lapses or reductions in coverage at the most inopportune times.

Financial Considerations

Understanding the financial aspects of flexible adjustable premium life insurance is crucial for making informed decisions. Premium costs are not static; they fluctuate based on several interacting factors, and careful consideration of these factors is vital to ensure the policy aligns with your long-term financial goals. This section details the key elements influencing premium costs and provides a framework for estimating long-term expenses.

Factors Influencing Premium Costs

Several interconnected factors determine the cost of your flexible adjustable premium life insurance policy. These factors are not independent; they influence each other, creating a complex interplay that shapes your overall premium.

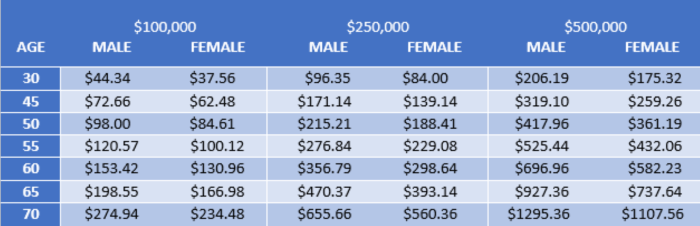

Primarily, the insurer assesses your risk profile. This includes your age, health status (including medical history and lifestyle choices), and the desired coverage amount. A younger, healthier individual applying for a smaller death benefit will typically receive a lower premium than an older person with pre-existing conditions seeking higher coverage. The insurer also considers the type of policy (e.g., term life vs. whole life) and any riders added (e.g., accidental death benefit). Finally, the current interest rate environment influences the insurer’s investment strategies and, consequently, the premiums they can offer.

Impact of Age, Health, and Coverage Amount on Premiums

Age is a significant factor. Premiums generally increase with age because the risk of mortality rises. Health significantly impacts premiums. Individuals with pre-existing conditions or unhealthy lifestyles will likely pay higher premiums due to the increased risk to the insurer. Finally, the coverage amount directly correlates with the premium; a larger death benefit necessitates a higher premium.

For example, a 30-year-old healthy non-smoker might pay significantly less for a $500,000 policy than a 50-year-old with a history of heart disease seeking the same coverage. Similarly, increasing the coverage amount from $500,000 to $1,000,000 will result in a higher premium, even for the same individual. These are illustrative examples; actual premiums vary significantly based on the specific insurer and policy details.

Premium Adjustments and Their Long-Term Impact

The flexibility of adjustable premium policies allows for changes in premium payments over time. Increasing the premium payment can accelerate the policy’s cash value accumulation, while decreasing it might lead to a slower growth rate or even a potential lapse in coverage if the minimum premium is not met. It is important to understand that any adjustments will affect the long-term cost and the overall value of the policy.

Consider this scenario: An individual initially pays a low premium to start, but later increases it significantly. This will reduce the length of time it takes to reach a specified cash value, but will also increase the total amount paid in premiums. Conversely, initially paying a high premium and later lowering it might result in a slower cash value growth but ultimately lower overall cost compared to someone who starts with a low premium and continually increases it over the policy’s life.

Estimating the Long-Term Cost of a Flexible Adjustable Premium Life Insurance Policy

Estimating the long-term cost requires a systematic approach.

- Obtain a detailed policy illustration: The insurer will provide a projection of future premium payments, cash value growth, and death benefit based on various assumptions (e.g., premium adjustment scenarios, interest rate projections).

- Analyze different premium adjustment scenarios: Explore various scenarios, including maintaining a consistent premium, increasing it periodically, or decreasing it. The illustration should show the impact of each scenario on the overall cost and cash value.

- Factor in potential expenses: Consider additional fees or charges associated with the policy, such as administrative fees or surrender charges if you withdraw funds early.

- Assess your financial capacity: Ensure that the chosen premium payment schedule aligns with your current and projected financial situation. Regularly review and adjust your premium payments as your financial circumstances change.

- Seek professional advice: Consult a financial advisor to help you analyze the policy illustration and make informed decisions about premium adjustments and the long-term financial implications of your choice.

Illustrative Examples

Understanding the practical applications of flexible adjustable premium life insurance is crucial. The following scenarios illustrate how this type of policy can adapt to various life stages and financial situations.

A Young Family’s Benefit

A young couple, Sarah and Mark, expecting their first child, decide on a flexible adjustable premium life insurance policy. Their current income allows for a moderate premium, providing a substantial death benefit to protect their growing family. Should they experience a period of reduced income, such as a parental leave, they can temporarily lower their premium payments without losing their coverage, although the death benefit might be reduced proportionally. As their income increases with career progression, they can raise their premiums to increase their death benefit, ensuring adequate coverage for their family’s future needs. This flexibility allows them to tailor their insurance protection to their evolving financial circumstances.

Premium Adjustment Following Income Change

Consider John, a policyholder with a flexible adjustable premium life insurance policy. His annual premium is currently $5,000, providing a $500,000 death benefit. Due to an unexpected job loss, John’s income significantly decreases. He contacts his insurance provider and adjusts his premium to $3,000 annually. This reduction naturally results in a lower death benefit, perhaps reduced to $300,000. Once John secures a new, higher-paying job, he can increase his premium to $6,000, potentially restoring or even exceeding his initial death benefit of $500,000, depending on policy terms and his age. This demonstrates the policy’s responsiveness to fluctuating income levels.

Long-Term Financial Impact of Regular Adjustments

Imagine Maria, who consistently adjusted her premiums upwards over 20 years. She started with a $2,000 annual premium and a $200,000 death benefit. Each year, as her income grew, she increased her premium by approximately 5%, leading to a significant increase in her death benefit over time. This strategy, coupled with the compounding effect of interest credited to the cash value component (if applicable), resulted in a substantially higher death benefit than if she had maintained a constant premium. While precise figures depend on the specific policy and interest rates, her death benefit could have grown to well over $500,000 after two decades, offering considerable financial security for her beneficiaries.

Infographic Design: Flexible Adjustable Premium Life Insurance

The infographic would use a clean, modern design with a color palette emphasizing trustworthiness and security (blues and greens).

The layout would be divided into three main sections:

Section 1: Policy Overview (Top Section): This section would feature a concise definition of flexible adjustable premium life insurance. A simple illustration of a flexible graph showing premium and death benefit adjustments would be included. Key terms such as “adjustable premiums,” “flexible death benefit,” and “cash value” (if applicable) would be clearly defined with short, easy-to-understand explanations.

Section 2: Benefits & Drawbacks (Middle Section): This section would use a two-column layout, one column highlighting benefits (e.g., flexibility, affordability, potential cash value growth) and the other illustrating drawbacks (e.g., potential for premium increases, lower death benefit during low-income periods, complexity compared to term life insurance). Each point would be accompanied by a small icon for visual clarity.

Section 3: Illustrative Example (Bottom Section): This section would visually represent the scenario of a young couple (as described above) adjusting their premiums over time. A timeline would visually demonstrate premium increases alongside corresponding increases in death benefit. A simple bar chart showing the growth of the death benefit over time would further reinforce the point. The overall visual style would aim for simplicity and clarity, using charts and graphs to present complex financial concepts in an accessible way.

Last Point

Ultimately, the decision of whether or not to opt for flexible adjustable premium life insurance hinges on a careful assessment of your individual financial situation, risk tolerance, and long-term goals. By understanding the policy’s features, potential benefits, and associated risks, you can make an informed choice that aligns with your needs and provides the appropriate level of financial protection for your loved ones. Remember to compare quotes from multiple insurers and consult with a financial advisor to ensure you select a policy that offers the best value and meets your specific requirements.

FAQ Corner

What happens if I consistently lower my premiums and die before the policy’s full term?

If your death benefit is lower than the amount of coverage you need, your beneficiaries may receive less than expected. It’s crucial to maintain an appropriate level of coverage to ensure adequate financial protection.

Can I increase my premiums at any time?

Generally, yes, but there may be limitations. Check your policy’s terms and conditions for specific rules and potential restrictions on premium increases.

What factors influence the ability to adjust premiums?

Your insurer’s policy guidelines, your current policy value, and your overall health status can all influence the extent to which you can adjust premiums. Some policies may have minimum and maximum premium limits.

Are there tax implications associated with flexible adjustable premium life insurance?

Yes, tax implications can vary depending on the specific policy and your location. Consult with a tax advisor for personalized guidance.