The prospect of owning a home often involves navigating the complexities of mortgages, and for those utilizing FHA loans, understanding FHA Mortgage Insurance Premium (MIP) removal is crucial. This comprehensive guide delves into the intricacies of eliminating this often significant monthly expense, exploring eligibility criteria, available methods, financial implications, and potential pitfalls. Whether you’re a seasoned homeowner or a first-time buyer, understanding MIP removal can significantly impact your long-term financial well-being.

This exploration will equip you with the knowledge to make informed decisions about your FHA loan and potentially unlock substantial savings. We’ll examine various pathways to MIP removal, from refinancing strategies to understanding the eligibility requirements, and ultimately empower you to navigate this process effectively.

FHA Mortgage Insurance Premium (MIP) Removal Eligibility

Understanding the requirements for FHA mortgage insurance premium (MIP) removal is crucial for homeowners seeking to eliminate this ongoing cost. MIP protects the lender against potential losses, but once certain conditions are met, it can be removed, leading to significant savings. This section details the eligibility criteria and processes involved.

MIP Removal Scenarios

MIP removal is not automatic; it depends on specific circumstances and meeting certain requirements. Generally, MIP removal is possible when a homeowner reaches a certain loan-to-value (LTV) ratio. This ratio compares the outstanding loan balance to the current appraised value of the home. Achieving a sufficiently low LTV typically signifies reduced risk for the lender. Other scenarios might involve refinancing to a conventional loan, which inherently eliminates the need for FHA insurance.

Determining Eligibility for MIP Removal

Determining eligibility for MIP removal involves a step-by-step process:

1. Assess Your Current Loan-to-Value Ratio (LTV): This requires obtaining a recent appraisal of your home’s value. Divide your outstanding loan balance by the appraised value. The result is your LTV.

2. Check Your Loan Type and Year: MIP removal rules vary slightly depending on when your FHA loan was originated. Loans originated before certain dates might have different requirements.

3. Review FHA Requirements for Your Loan: The FHA publishes guidelines specifying the LTV threshold for MIP cancellation. This threshold typically falls below 80%, but it can vary. You can find this information on the FHA website or by contacting your lender.

4. Request a MIP Cancellation: If your LTV meets the FHA requirements, you’ll need to formally request MIP cancellation from your lender. This typically involves providing documentation such as the appraisal and your loan details.

5. Await Lender Processing: Your lender will review your request and determine if you meet all the necessary criteria. If approved, the MIP will be removed from your monthly mortgage payments.

Eligibility Criteria Comparison

| Loan Type | Original Loan Date | LTV Requirement for MIP Removal | Other Requirements |

|---|---|---|---|

| FHA Streamline Refinance | Before 2009 | Typically 78% | Loan must be current; borrower must meet credit standards. |

| FHA Streamline Refinance | After 2009 | Typically 78% | Loan must be current; borrower must meet credit standards. |

| FHA Cash-Out Refinance | Any | Typically 80% or lower | Requires an appraisal; credit score requirements may apply. |

| Conventional Loan Refinance | Any | Not Applicable (No MIP) | Meet lender’s credit and income requirements. |

MIP Removal Methods

There are several pathways homeowners can take to eliminate their FHA mortgage insurance premium (MIP). The most common methods involve refinancing or reaching a specific loan-to-value (LTV) ratio. Understanding these methods and their associated requirements is crucial for homeowners seeking MIP removal.

Refinancing to Remove MIP

Refinancing your FHA loan is a primary method for removing MIP. This involves obtaining a new mortgage with different terms, potentially including the removal of MIP. The success of this method hinges on several factors, primarily achieving a high enough LTV ratio through home appreciation or paying down the principal balance. A significant advantage of refinancing is the potential to secure a lower interest rate, potentially saving money in the long run. However, refinancing entails closing costs and the potential for increased overall borrowing costs if the new loan’s interest rate is higher. Furthermore, the eligibility criteria for MIP removal through refinancing may vary depending on the lender and the specific loan program. For example, some lenders may require a specific credit score or debt-to-income ratio to approve a refinance for MIP removal.

Reaching an 80% LTV Ratio

Achieving an 80% loan-to-value ratio is another method to remove MIP on some FHA loans. This occurs when the homeowner’s equity in their home reaches 20% or more of the home’s appraised value. This can be achieved through paying down the principal balance of the loan over time or through an increase in the home’s appraised value due to market appreciation. This method is entirely dependent on market conditions and the homeowner’s ability to consistently make mortgage payments. It’s important to note that the appraisal process is crucial, as the appraised value determines the LTV ratio. A lower than expected appraisal can delay or prevent MIP removal.

Streamline Refinance

A Streamline Refinance is a simplified refinance process specifically designed for existing FHA borrowers. It typically involves less stringent documentation requirements and a faster closing process compared to a standard refinance. This can make it a more attractive option for homeowners seeking to remove MIP, especially those who qualify for the 80% LTV ratio requirement. However, it’s important to understand that the availability of Streamline Refinances and their specific eligibility criteria can vary depending on the lender and market conditions.

Flowchart Illustrating MIP Removal Pathways

The following flowchart visually represents the different pathways to MIP removal:

[Imagine a flowchart here. The flowchart would begin with a “Start” box. From there, an arrow would lead to a decision box: “Is LTV ≥ 80%? (Yes/No)”. If “Yes,” an arrow would lead to a “MIP Removed” box. If “No,” an arrow would lead to another decision box: “Refinance Option Available? (Yes/No)”. If “Yes,” an arrow would lead to a “Refinance to Remove MIP” box. If “No,” an arrow would lead to a “Explore Other Options” box, potentially suggesting further principal payments or waiting for home appreciation. All boxes would be clearly labeled, and arrows would indicate the flow of the process.]

Alternatives to MIP Removal

While removing FHA mortgage insurance premiums (MIP) is a significant goal for many homeowners, it’s not the only path to lowering monthly mortgage payments. Several alternative strategies can achieve similar results, each with its own set of advantages and disadvantages. Understanding these options allows homeowners to make informed decisions based on their individual financial situations and long-term goals.

Refinancing to a Conventional Loan

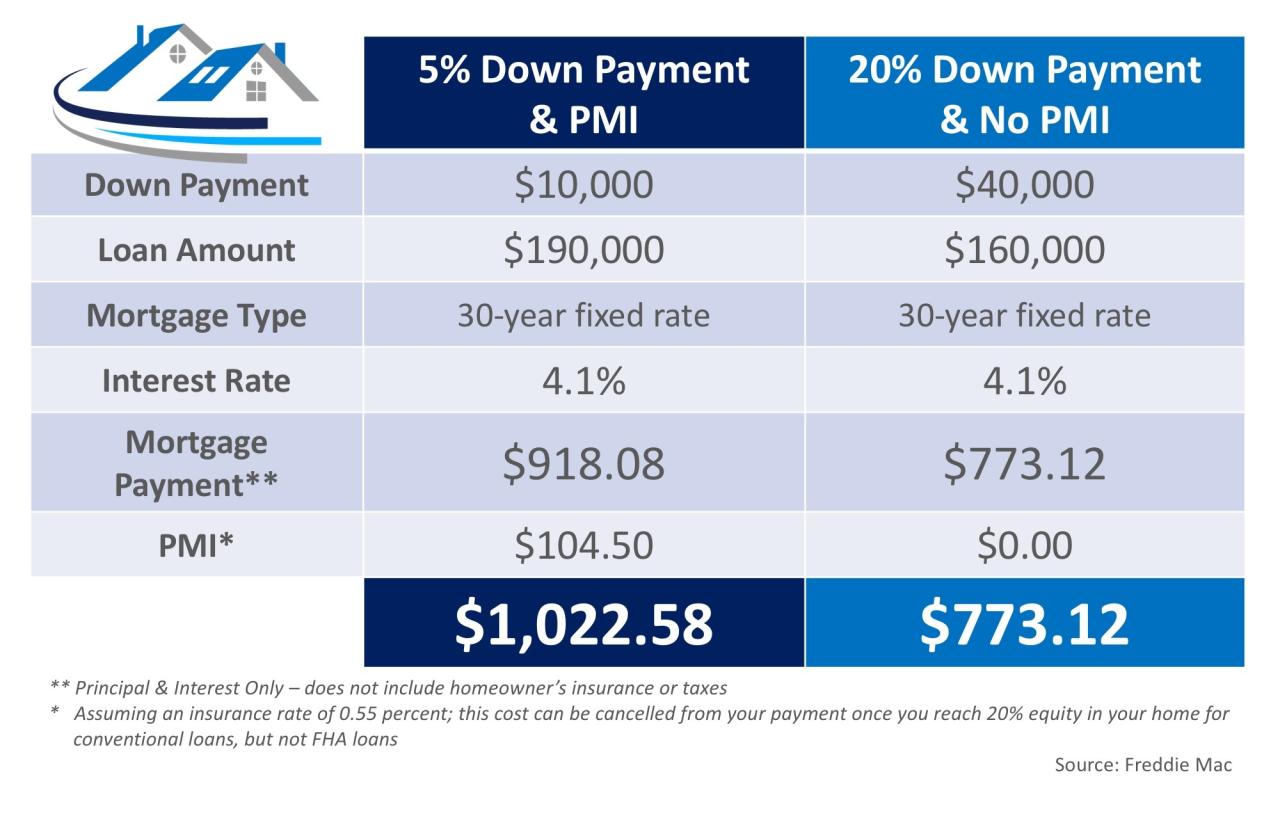

Refinancing your FHA loan to a conventional loan is a common strategy to eliminate MIP payments. Once you’ve built sufficient equity in your home (typically 20%), you may qualify for a conventional loan with a lower interest rate and no MIP. This can significantly reduce your monthly payment. However, refinancing involves closing costs, which can offset some of the savings in the short term. Additionally, your credit score and income will be reassessed, and you may not qualify for a better interest rate than your current FHA loan, negating the benefits.

Loan Modification

A loan modification involves negotiating with your lender to change the terms of your existing FHA loan. This could include extending the loan term, reducing the interest rate, or converting to a different loan type. While a loan modification might lower your monthly payment, it often comes with increased total interest paid over the life of the loan. The process can also be lengthy and complex, requiring extensive documentation and negotiation. Success is not guaranteed.

Reducing Principal

Making extra principal payments on your mortgage can shorten the loan term and reduce the total interest paid. Even small extra payments, made regularly, can significantly impact the overall cost of the loan and reduce your monthly payments over time. This strategy requires discipline and a commitment to making additional payments, but it doesn’t involve any fees or the complexities of refinancing or loan modification. However, the immediate reduction in monthly payments is less dramatic compared to refinancing or loan modification.

Interest Rate Reduction

While less directly related to MIP removal, securing a lower interest rate on your existing FHA loan can effectively reduce your monthly payment. This can be achieved by shopping around for better rates from different lenders or by refinancing with a lender offering a more competitive interest rate. This approach requires careful consideration of closing costs and the potential benefits of a lower interest rate compared to the costs involved. A lower interest rate will result in lower monthly payments but the overall amount of interest paid may not be reduced as dramatically as with other strategies.

Summary of Alternatives

The following table summarizes the key features of each alternative to MIP removal:

| Alternative | Pros | Cons | Cost/Effectiveness |

|---|---|---|---|

| Refinancing to Conventional Loan | Eliminates MIP, potentially lower interest rate | Closing costs, credit check, may not qualify for better rate | High effectiveness, moderate cost |

| Loan Modification | Lower monthly payments (potentially) | Increased total interest, complex process, not guaranteed | Moderate effectiveness, low cost (except for potential legal fees) |

| Reducing Principal | Reduces total interest paid, shorter loan term | Requires discipline, slower reduction in monthly payments | High effectiveness, low cost |

| Interest Rate Reduction | Lower monthly payments | Closing costs (if refinancing), may not find a significantly better rate | Moderate effectiveness, moderate cost |

Wrap-Up

Successfully navigating FHA mortgage insurance premium removal requires careful planning and a thorough understanding of the process. By weighing the financial implications, exploring various methods, and considering potential challenges, homeowners can make informed decisions that align with their long-term financial goals. This guide has provided a framework for understanding the complexities of MIP removal, ultimately empowering you to pursue homeownership with greater financial clarity and security.

FAQ

What happens if I miss a payment during the MIP removal process?

Missing a payment can jeopardize your eligibility for MIP removal and potentially lead to penalties. Maintain consistent on-time payments throughout the process.

Can I remove MIP if I have a short sale in my history?

A short sale may negatively impact your eligibility, depending on the circumstances and how long ago it occurred. Consult with a mortgage professional for guidance.

How long does the MIP removal process typically take?

The processing time varies, but it can generally take several weeks to months. Factors such as application completeness and lender processing times contribute to the overall timeline.

Are there any credit score requirements for MIP removal?

While specific credit score requirements vary by lender, a higher credit score generally increases your chances of approval and securing favorable terms.