Securing a home is a significant financial undertaking, and understanding the intricacies of mortgage insurance is crucial for prospective homeowners. This guide delves into the FHA Mortgage Insurance Premium (MIP), a key component of Federal Housing Administration-backed loans. We’ll unravel the complexities of MIP calculations, explore its impact on overall mortgage costs, and compare it to Private Mortgage Insurance (PMI). By the end, you’ll possess a clearer understanding of how MIP affects your financial landscape and empowers you to make informed decisions about your home purchase.

From the upfront premium to the annual payments, we will dissect the various aspects of FHA MIP, providing practical examples and insightful comparisons to help you navigate this crucial element of the home-buying process. We aim to demystify the process, equipping you with the knowledge needed to confidently manage your mortgage financing.

FHA Mortgage Insurance Premium

The Federal Housing Administration (FHA) mortgage insurance premium (MIP) is an insurance policy protecting lenders against losses if a borrower defaults on their FHA-insured loan. It’s a crucial component of FHA loans, enabling lenders to offer mortgages to borrowers who might not otherwise qualify for a conventional loan. This protection allows for more accessible homeownership for a wider range of individuals.

FHA Mortgage Insurance Premium Components

The FHA MIP consists of two main components: an upfront premium and an annual premium. Understanding the differences between these premiums is essential for accurately budgeting for your FHA mortgage.

Upfront Mortgage Insurance Premium Calculation

The upfront premium is a one-time payment, typically paid at closing. It’s calculated as a percentage of the base loan amount. Currently, the upfront MIP is 1.75% of the base loan amount for most borrowers. This amount can be paid at closing or financed into the loan, increasing the total loan amount. For example, on a $300,000 loan, the upfront MIP would be $5,250 ($300,000 x 0.0175). This increases the total loan amount to $305,250 if financed.

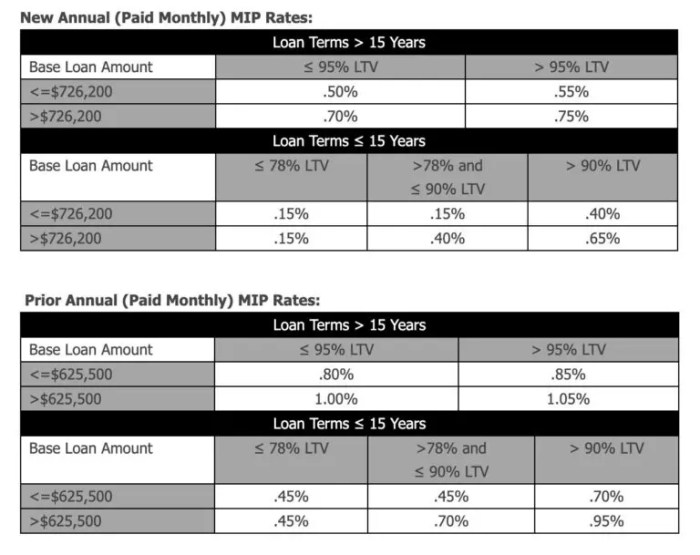

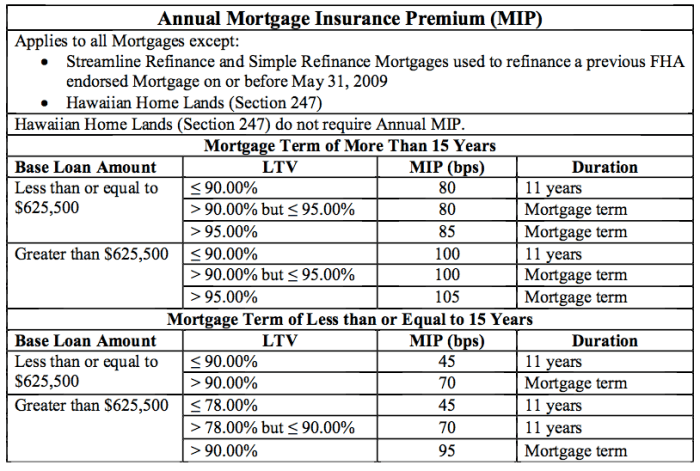

Annual Mortgage Insurance Premium Calculation

The annual premium is paid monthly as part of your mortgage payment. The amount is calculated as a percentage of the outstanding loan balance, and the rate varies depending on the loan term and other factors. The calculation is generally based on the outstanding loan balance and a fixed annual premium rate, which is then divided by 12 to determine the monthly payment. For example, with a $300,000 loan and a current annual MIP rate of 0.85%, the annual premium would be $2,550 ($300,000 x 0.0085). This translates to a monthly payment of approximately $212.50 ($2,550/12). It’s important to note that the annual premium rate and calculation may change over time based on FHA guidelines.

Upfront vs. Annual Premiums

| Feature | Upfront Premium | Annual Premium | Notes |

|---|---|---|---|

| Payment Timing | One-time payment at closing (or financed) | Paid monthly with mortgage payment | Financed upfront premiums increase the total loan amount. |

| Calculation | Percentage of the base loan amount (currently 1.75%) | Percentage of the outstanding loan balance (rate varies) | Rates are subject to change based on FHA guidelines. |

| Impact on Payment | Increases the total loan amount if financed, otherwise a lump sum payment at closing. | Increases the monthly mortgage payment. | Consider the total cost over the loan term. |

| Repayment | Not repaid separately; included in the loan if financed. | Paid monthly until the loan is paid off or the MIP is canceled (depending on loan term and other factors). | Cancellation may occur after a certain equity threshold is reached. |

Who Pays the FHA MIP?

The FHA Mortgage Insurance Premium (MIP) is paid by the borrower, the individual obtaining the FHA-insured loan. This payment protects the lender against potential losses if the borrower defaults on the loan. Understanding who pays and the implications of the MIP is crucial for prospective homebuyers utilizing FHA loans.

The borrower’s responsibility for the FHA MIP directly impacts their monthly mortgage payments. The premium is typically added to the monthly payment, increasing the overall cost of homeownership. This added cost needs to be factored into the borrower’s budget to ensure affordability and avoid financial strain. Failure to make MIP payments can lead to delinquency and potential foreclosure, just as with any other mortgage payment. The exact amount of the MIP depends on several factors, including the loan-to-value ratio (LTV) and the loan term.

MIP Waiver and Cancellation

Certain circumstances allow for the waiver or cancellation of the annual MIP. For loans with a down payment of at least 10%, the annual MIP may be eliminated after 11 years of on-time payments. This is a significant financial benefit for borrowers who meet this threshold. For loans with down payments less than 10%, the annual MIP is typically required for the life of the loan, although there may be options for refinancing into a conventional loan to remove the MIP once sufficient equity has been built.

Factors Affecting MIP Payment

The amount of the MIP isn’t fixed; it’s dynamic and depends on several factors. A higher loan-to-value ratio (LTV) generally results in a higher MIP. Similarly, the loan term influences the total amount paid over the life of the loan; a longer loan term will mean a longer period of paying the MIP. It’s essential for borrowers to understand how these factors affect their overall mortgage costs. A mortgage professional can help calculate the precise MIP amount based on the individual borrower’s circumstances.

Impact of FHA MIP on Mortgage Costs

The FHA Mortgage Insurance Premium (MIP) significantly impacts the overall cost of a mortgage. While it allows borrowers with lower credit scores or smaller down payments to access homeownership, understanding its financial implications is crucial for long-term financial planning. The MIP adds to your monthly payments and can also extend the overall cost of your home loan significantly.

The FHA MIP is a fee paid by borrowers to protect the lender against potential losses if the borrower defaults on their loan. This premium is calculated as a percentage of the loan amount and is typically paid monthly as part of the mortgage payment. However, the structure and duration of the MIP can vary depending on the loan type and down payment. For loans with a down payment of less than 10%, the MIP is usually paid for the life of the loan, whereas loans with a down payment of 10% or more typically require an upfront MIP and an annual MIP for 11 years.

Examples of FHA MIP’s Impact on Total Mortgage Costs

Let’s illustrate how the MIP affects the total cost with a few examples. Consider two scenarios: a 30-year fixed-rate mortgage of $300,000 at a 6% interest rate. Scenario A represents a loan with a 3.5% down payment (requiring an annual MIP), while Scenario B represents a loan with a 10% down payment (requiring an upfront MIP and an annual MIP for 11 years).

| Scenario | Down Payment | Loan Amount | Annual MIP (Estimate) | Monthly MIP (Estimate) |

|---|---|---|---|---|

| A (Less than 10% down) | $10,500 | $289,500 | 0.8% | $193 |

| B (10% down) | $30,000 | $270,000 | 0.55% (for 11 years) | $124 (for 11 years) |

Note: These are estimated figures and actual MIP amounts may vary depending on the lender and specific loan terms. The annual MIP is calculated as a percentage of the outstanding loan balance each year.

Long-Term Financial Implications of FHA MIP

The long-term impact of the MIP can be substantial. In Scenario A, the annual MIP is paid for the entire 30-year loan term. This results in a significantly higher total cost compared to a conventional loan without MIP. In Scenario B, while the annual MIP is only paid for 11 years, it still adds to the overall cost of the loan. Over the life of the loan, the cumulative cost of the MIP can amount to tens of thousands of dollars, representing a considerable financial burden.

Hypothetical Scenario Comparing Mortgages With and Without MIP

To further illustrate the financial differences, let’s compare a hypothetical scenario. We will assume a $250,000 loan at a 6% interest rate for 30 years.

| Feature | Conventional Loan (No MIP) | FHA Loan (with MIP – 3.5% down payment) |

|---|---|---|

| Down Payment | $25,000 (10%) | $8,750 (3.5%) |

| Loan Amount | $225,000 | $241,250 |

| Monthly Principal & Interest | $1349 | $1442 |

| Estimated Monthly MIP | $0 | $160 (Example) |

| Total Monthly Payment (Estimate) | $1349 | $1602 |

| Total Interest Paid (Estimate) | $245,640 | $305,000 (including MIP) |

This hypothetical scenario clearly demonstrates that while an FHA loan allows for a lower down payment, the additional cost of the MIP significantly increases the total amount paid over the life of the loan.

Comparing FHA MIP to PMI (Private Mortgage Insurance)

Both FHA Mortgage Insurance Premium (MIP) and Private Mortgage Insurance (PMI) protect lenders against losses if a borrower defaults on their mortgage. However, they differ significantly in their application, cost, and overall impact on the homebuyer. Understanding these differences is crucial for borrowers seeking the best financing option.

While both FHA MIP and PMI serve a similar purpose – protecting the lender – they operate under different frameworks and have distinct characteristics. The key differences lie in the eligibility requirements, the length of the insurance, and the overall cost structure. Borrowers with diverse financial situations will find one more suitable than the other, depending on their credit score, down payment, and loan-to-value ratio.

Key Differences Between FHA MIP and PMI

The following points highlight the main distinctions between FHA MIP and PMI, allowing for a more informed decision-making process when choosing a mortgage.

- Eligibility: FHA loans are designed for borrowers with lower credit scores and smaller down payments (as low as 3.5%), making FHA MIP accessible to a wider range of applicants. PMI, on the other hand, typically requires a higher credit score and a larger down payment (usually more than 20%).

- Insurance Coverage: FHA MIP insures the entire loan amount, providing more comprehensive protection to the lender. PMI usually covers only the portion of the loan exceeding 80% of the home’s value.

- Cost: FHA MIP is generally more expensive upfront and has an ongoing annual premium, unlike PMI which might be canceled once the loan-to-value ratio reaches 80%. However, the total cost will depend on the loan amount, interest rate, and loan term.

- Loan-to-Value Ratio (LTV): FHA MIP is required even with a down payment, while PMI is typically only required if the LTV exceeds 80%. Once the LTV drops below 80% (usually through paying down the principal), PMI is often cancelled. FHA MIP, however, can have longer-term requirements depending on the loan.

- Upfront Premium: FHA loans require an upfront MIP paid at closing, typically 1.75% of the loan amount. PMI does not typically have a comparable upfront cost, although some lenders might incorporate it into the closing costs.

- Annual Premium: FHA MIP involves an annual premium, typically paid monthly as part of the mortgage payment. The annual premium can vary depending on the loan term and other factors. PMI also involves an annual premium, but its duration is shorter if the LTV falls below 80%.

Circumstances Favoring FHA MIP or PMI

The choice between FHA MIP and PMI depends heavily on the borrower’s individual financial situation and circumstances.

- Choose FHA MIP if: You have a lower credit score, a smaller down payment, and need a more accessible mortgage option. The higher overall cost might be outweighed by the ease of qualifying for the loan.

- Choose PMI if: You have a higher credit score, a larger down payment (above 20%), and prefer potentially lower overall costs over the long term, even if the initial down payment is larger. The potential for PMI cancellation once the LTV reaches 80% can make it more appealing to some borrowers.

Factors Affecting FHA MIP Calculation

The FHA Mortgage Insurance Premium (MIP) isn’t a fixed amount; several factors influence its calculation, ultimately impacting the borrower’s monthly mortgage payment. Understanding these factors allows for better financial planning and a clearer picture of the overall cost of an FHA loan. The primary factors are the loan’s characteristics, the borrower’s creditworthiness, and the loan-to-value ratio.

The FHA utilizes a complex formula to determine the MIP, considering various aspects of the loan and the borrower’s profile. This ensures a risk-based approach, with higher-risk loans carrying a higher premium. The system is designed to protect the FHA’s insurance fund against potential defaults.

Credit Score’s Role in Determining the Premium

A borrower’s credit score significantly influences the FHA MIP. Higher credit scores generally correlate with a lower MIP. This is because borrowers with excellent credit history are statistically less likely to default on their loan. For example, a borrower with a credit score above 700 might qualify for a lower upfront MIP and a reduced annual premium compared to a borrower with a score below 620. The FHA uses a tiered system, assigning different MIP rates based on credit score ranges. A higher credit score often translates to substantial savings over the life of the loan.

Impact of the Loan-to-Value Ratio (LTV) on the Premium Amount

The loan-to-value ratio (LTV), which represents the loan amount as a percentage of the home’s appraised value, is another critical factor affecting the FHA MIP. A higher LTV indicates a greater risk for the lender, as a larger portion of the home’s value is financed by the loan. Consequently, loans with higher LTVs typically incur higher MIPs. For instance, a loan with an LTV of 90% (meaning the borrower is financing 90% of the home’s value) will generally have a higher MIP than a loan with an LTV of 80%. This reflects the increased risk of default associated with larger loan amounts relative to the property’s value. Borrowers with smaller down payments (and therefore higher LTVs) should expect to pay a higher MIP.

Illustrative Examples of FHA MIP Calculations

Understanding how FHA MIP is calculated can be complex, as the specifics depend on several factors, including the loan amount, loan-to-value ratio (LTV), and the type of mortgage. The following examples illustrate the calculation process for different scenarios. Remember that these examples are for illustrative purposes only and actual calculations may vary slightly depending on the lender and current FHA guidelines.

Example 1: Upfront and Annual MIP on a Purchase Loan

This example demonstrates the calculation of both the upfront and annual MIP for a purchase loan with a relatively high loan-to-value ratio.

Let’s assume a borrower is purchasing a home for $300,000 with a 10% down payment ($30,000). The loan amount is therefore $270,000. The loan is a 30-year fixed-rate mortgage.

Step 1: Calculate the Upfront MIP. The upfront MIP is typically 1.75% of the loan amount for loans with an LTV ratio greater than 90%. For loans with LTV ratios of 90% or less, the upfront MIP may be less than 1.75%.

Upfront MIP = 1.75% of $270,000 = $4,725

This amount is typically paid at closing.

Step 2: Calculate the Annual MIP. The annual MIP is a percentage of the loan amount and is paid monthly. The rate varies depending on the loan term and LTV. For this example, let’s assume an annual MIP rate of 0.85% (this rate can change).

Annual MIP = 0.85% of $270,000 = $2,295

Step 3: Calculate the Monthly MIP. To find the monthly MIP, divide the annual MIP by 12.

Monthly MIP = $2,295 / 12 = $191.25 (approximately)

This amount is added to the monthly mortgage payment.

| Item | Amount |

|---|---|

| Loan Amount | $270,000 |

| Upfront MIP | $4,725 |

| Annual MIP | $2,295 |

| Monthly MIP | $191.25 |

Example 2: Lower LTV, Reduced MIP

This example illustrates a scenario with a lower LTV ratio, resulting in a lower MIP.

Let’s assume a $250,000 loan with a 20% down payment ($50,000), resulting in a loan amount of $200,000. Again, we assume a 30-year fixed-rate mortgage. Because the LTV is 80%, the upfront MIP might be waived or significantly reduced, and the annual MIP rate may also be lower, let’s say 0.55% for this example.

Step 1: Calculate the Upfront MIP. Assuming the upfront MIP is waived for this LTV, the upfront MIP is $0.

Step 2: Calculate the Annual MIP. Annual MIP = 0.55% of $200,000 = $1,100

Step 3: Calculate the Monthly MIP. Monthly MIP = $1,100 / 12 = $91.67 (approximately)

| Item | Amount |

|---|---|

| Loan Amount | $200,000 |

| Upfront MIP | $0 |

| Annual MIP | $1,100 |

| Monthly MIP | $91.67 |

Example 3: Refinance with Existing Equity

This example shows a refinance scenario where the borrower has built significant equity.

Assume a borrower refinances a $200,000 mortgage with a current loan balance of $150,000. The home is worth $250,000. The LTV is therefore 60% ($150,000/$250,000). Let’s assume, in this case, both the upfront and annual MIP are waived due to the low LTV.

Step 1: Calculate the Upfront MIP. Upfront MIP = $0 (waived)

Step 2: Calculate the Annual MIP. Annual MIP = $0 (waived)

Step 3: Calculate the Monthly MIP. Monthly MIP = $0

| Item | Amount |

|---|---|

| Loan Amount | $150,000 |

| Upfront MIP | $0 |

| Annual MIP | $0 |

| Monthly MIP | $0 |

Resources for Understanding FHA MIP

Understanding the intricacies of FHA Mortgage Insurance Premium (MIP) can be challenging. Fortunately, several reputable sources offer comprehensive information to help borrowers navigate this aspect of FHA loans. Accessing accurate and up-to-date information is crucial for making informed financial decisions.

Finding reliable information about FHA MIP is essential for prospective homebuyers. The following resources provide detailed explanations, calculations, and answers to common questions. Utilizing these resources will empower borrowers to confidently understand their FHA loan costs and make well-informed choices.

Government Websites

The official government websites are primary sources for accurate and current information regarding FHA MIP. These sites provide detailed explanations of the program, calculation methods, and relevant regulations. Consulting these sources directly ensures access to the most authoritative information available.

- The U.S. Department of Housing and Urban Development (HUD): HUD’s website is the definitive source for all things FHA. It provides comprehensive information on FHA loan programs, including detailed explanations of MIP, eligibility requirements, and current rates. Look for sections specifically dedicated to FHA loan insurance.

- The Federal Housing Administration (FHA): While technically a part of HUD, the FHA’s website often offers more focused information on the FHA loan insurance program itself. This can be a useful resource for finding specific details on MIP calculations and payment schedules.

Financial Institutions

Many financial institutions specializing in FHA loans offer educational resources and tools to help borrowers understand MIP. These institutions often provide simplified explanations, calculators, and comparisons to help clarify the process. However, it is crucial to remember that these institutions may have a vested interest in promoting FHA loans, so it’s always advisable to cross-reference information with official government sources.

- Mortgage lenders: Reputable mortgage lenders who offer FHA loans often provide resources explaining MIP on their websites or through their loan officers. They can answer specific questions about how MIP applies to individual loan scenarios. However, remember to verify any information provided with official government sources.

- Credit unions: Similar to mortgage lenders, many credit unions offering FHA loans provide educational materials about MIP to their members. These resources can be particularly helpful for first-time homebuyers.

Final Thoughts

Navigating the world of FHA mortgages requires a thorough understanding of the FHA Mortgage Insurance Premium. While the MIP adds to the overall cost, it also enables many borrowers to access homeownership who might not otherwise qualify. By carefully considering the factors influencing MIP calculations, comparing it to PMI, and utilizing the resources provided, you can make an informed decision about whether an FHA loan with its associated MIP is the right choice for your financial situation. Remember to explore all your options and consult with financial professionals for personalized guidance.

Essential Questionnaire

What happens to the FHA MIP if I pay off my loan early?

Generally, you’ll continue paying the annual MIP until you reach a certain loan-to-value ratio (LTV), typically 78%, or you refinance into a loan without MIP. Early payoff doesn’t automatically cancel the MIP.

Can I deduct FHA MIP from my taxes?

No, FHA MIP is not tax-deductible.

How does my credit score impact my FHA MIP?

A higher credit score can sometimes result in a lower annual MIP rate, though this isn’t always guaranteed. It’s one factor among many.

Is FHA MIP only for first-time homebuyers?

No, FHA loans and the associated MIP are available to both first-time and repeat homebuyers who meet the eligibility requirements.