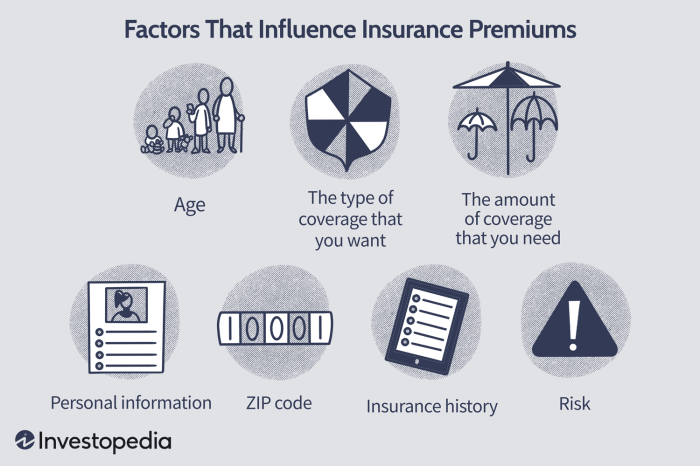

Securing life insurance is a crucial financial decision, offering peace of mind for loved ones. However, understanding the intricacies of premium calculations can be challenging. This guide delves into the key factors that significantly influence the cost of your life insurance policy, empowering you to make informed choices.

From your age and health status to lifestyle choices and the type of policy you select, numerous variables contribute to the final premium. We’ll explore each factor in detail, providing clear explanations and examples to illustrate their impact. By the end, you’ll possess a comprehensive understanding of how these elements interact to determine your insurance costs.

Age

Age is a primary factor influencing life insurance premiums. Insurers assess the risk of you passing away within the policy’s term, and statistically, the older you are, the higher that risk becomes. This increased risk directly translates into higher premiums. Younger individuals generally enjoy lower premiums due to their statistically lower mortality risk.

Premium increases across different age groups are not linear; they accelerate as you age. The largest jumps often occur in later middle age and beyond, reflecting the increased probability of health complications and mortality. This is not to say that younger people are without risk, but the likelihood of major health events increases significantly with age.

Premium Differences Across Age Groups

The following table illustrates how premiums for a standard term life insurance policy can vary based on age. These are illustrative examples and actual premiums will depend on various other factors including health, lifestyle, and the specific insurer.

| Age | Premium Amount (Annual) | Premium Increase Percentage (Compared to Age 25) | Reason for Increase |

|---|---|---|---|

| 25 | $500 | 0% | Lower risk of death within the policy term. |

| 35 | $650 | 30% | Increased risk of health issues and mortality compared to age 25. |

| 45 | $1000 | 100% | Significant increase in the likelihood of major health problems and higher mortality rates. |

| 55 | $1800 | 260% | Substantially higher risk of death and increased prevalence of chronic illnesses. |

| 65 | $3500 | 600% | Very high risk of death and significantly increased healthcare costs. Many insurers may have stricter underwriting or limited policy options at this age. |

Health Status

Your health status significantly impacts your life insurance premium. Insurers assess your risk of needing a payout, and individuals with pre-existing conditions or lifestyle factors that increase risk will generally pay higher premiums. This assessment is crucial for the financial stability of the insurance company.

The underwriting process involves a thorough review of your medical history, lifestyle choices, and current health. This includes reviewing medical records, conducting physical examinations (sometimes), and potentially requiring additional tests. Based on this assessment, the insurer assigns a risk score, which directly influences the premium you’ll pay. Those deemed higher risk will pay more to compensate for the increased likelihood of a claim.

Pre-existing Medical Conditions and Premium Rates

Pre-existing medical conditions substantially affect life insurance premiums. Conditions like diabetes, heart disease, cancer, and chronic respiratory illnesses can lead to significantly higher premiums or even result in the application being declined. The severity and stage of the condition play a crucial role. For example, a person with well-managed type 2 diabetes might face a moderate premium increase, while someone with a history of heart attack might face a substantial increase or denial depending on the insurer’s risk assessment. Similarly, a history of cancer, particularly if it has recurred or is in an advanced stage, would likely result in a very high premium or application denial.

Underwriting Process and Health Assessments

The underwriting process involves several steps to assess the applicant’s health. This typically begins with an application form requesting detailed medical history, including past illnesses, hospitalizations, surgeries, and current medications. Applicants may be required to undergo a medical examination, including blood tests and other assessments to determine their overall health. The insurer then uses this information, along with actuarial tables and risk models, to calculate the appropriate premium. This process is designed to fairly assess risk and ensure the financial solvency of the insurance company.

Hypothetical Premium Comparison

Let’s consider two hypothetical individuals applying for a $500,000 life insurance policy at age 40:

Individual A: Healthy, non-smoker, with a clean medical history. Their premium might be around $1,000 per year.

Individual B: Diagnosed with type 2 diabetes, manages it with medication and diet, but has a history of high blood pressure. Their premium might be $2,000 or more per year, reflecting the increased risk associated with diabetes and hypertension.

This illustrates how a pre-existing condition, even one well-managed, can substantially increase the cost of life insurance. The exact difference will vary based on several factors including the specific insurer, policy type, and the individual’s overall health profile.

Lifestyle Choices

Lifestyle choices significantly impact your life expectancy and, consequently, your life insurance premium. Insurers carefully consider these factors because they directly influence the risk of early death or prolonged illness. Understanding how your lifestyle affects your premium can help you make informed decisions about your insurance coverage.

Insurers assess risk by analyzing various lifestyle factors, ultimately determining the likelihood of you needing to make a claim. Healthier habits generally translate to lower premiums, reflecting a reduced risk profile for the insurance company. Conversely, unhealthy habits increase premiums due to a higher perceived risk.

Impact of Smoking on Life Insurance Premiums

Smoking is a major risk factor for numerous health problems, including heart disease, lung cancer, and stroke. Therefore, smokers typically face substantially higher life insurance premiums compared to non-smokers. The increased risk is directly reflected in the pricing. For example, a 35-year-old non-smoking male might qualify for a premium of $50 per month for a $500,000 policy, while a similarly aged male smoker might pay double or more, perhaps $100 or even $150 per month, for the same coverage. This difference highlights the significant financial impact of smoking on insurance costs. The higher premium compensates the insurer for the increased likelihood of an early claim.

Impact of Alcohol Consumption on Life Insurance Premiums

Excessive alcohol consumption increases the risk of liver disease, heart problems, and various cancers. While moderate drinking might not significantly affect premiums, heavy or binge drinking will likely lead to higher premiums or even policy rejection. For instance, an individual who regularly consumes excessive amounts of alcohol might be categorized as a higher-risk applicant, resulting in a premium increase of 20-30% compared to someone with moderate or no alcohol consumption. The specific impact depends on the level and frequency of alcohol use, as assessed through medical questionnaires and potentially blood tests.

Impact of Exercise and Physical Activity on Life Insurance Premiums

Regular physical activity significantly reduces the risk of many chronic diseases. Individuals who maintain a healthy weight and engage in regular exercise generally qualify for lower premiums. For example, a 40-year-old who regularly exercises and maintains a healthy BMI might receive a discounted premium, potentially 10-15% lower than someone of the same age and health status who is sedentary and overweight. Insurers recognize the positive correlation between physical fitness and longevity, which translates into lower risk and lower premiums for policyholders.

Coverage Amount

The amount of life insurance coverage you choose significantly impacts your premium. A larger death benefit means a higher premium, while a smaller death benefit results in a lower premium. This relationship is generally linear; the more coverage you want, the more you’ll pay. Understanding this dynamic is crucial for finding the right balance between protection and affordability.

The relationship between coverage amount and premium cost is straightforward: more coverage equals higher premiums. This is because the insurance company is assuming a greater financial risk by promising a larger payout upon your death. The premium acts as the payment for this risk. Think of it like this: a larger mortgage requires a larger monthly payment; similarly, a larger death benefit necessitates a larger premium payment.

Premium Impact of Coverage Adjustments

Increasing or decreasing your coverage directly affects your premium. For instance, if you currently have a $500,000 policy and increase it to $1,000,000, expect a substantial increase in your premium. Conversely, reducing your coverage to $250,000 will lower your premium. The exact amount of the increase or decrease depends on several factors, including your age, health, and the type of policy, but the fundamental relationship remains consistent. For example, a 35-year-old male in good health might see his annual premium increase by approximately $300-$500 to double his coverage from $500,000 to $1,000,000, depending on the insurer and policy type. Reducing coverage by half might lower his premium by a similar amount.

Graphical Representation of Death Benefit and Premium Cost

A graph illustrating this correlation would show a positive linear relationship. The horizontal axis (x-axis) would represent the death benefit amount (in dollars), while the vertical axis (y-axis) would represent the annual premium cost (in dollars). The line representing the relationship would start at the origin (0,0) and slope upwards to the right. As the death benefit (x-axis) increases, the premium cost (y-axis) would increase proportionally along a relatively straight line. The slope of the line would reflect the rate at which the premium increases per dollar of increased coverage. Deviations from a perfectly straight line might occur due to factors such as policy type or insurer pricing strategies, but the overall trend would remain a positive linear correlation.

Family History

Your family’s medical history plays a significant role in determining your life insurance premiums. Insurance companies understand that genetic predispositions can increase your risk of developing certain diseases, impacting your life expectancy and, consequently, the cost of your policy. A thorough review of your family’s health history is a standard part of the underwriting process.

Insurers assess the likelihood of you inheriting genetic traits that increase your susceptibility to specific illnesses. This assessment isn’t about blaming genetics; it’s about statistically evaluating risk. The more prevalent certain conditions are within your family, the higher the perceived risk, potentially resulting in higher premiums or even a denial of coverage in extreme cases.

Impact of Genetic Predispositions on Premiums

A family history of conditions like heart disease, cancer, stroke, or diabetes can significantly influence your life insurance premiums. The presence of multiple family members affected by these conditions, particularly at younger ages, increases the perceived risk to the insurance company. For example, if several close relatives (parents, siblings) experienced heart attacks before age 60, your premiums might be higher than someone with a family history free of such occurrences. This is because the likelihood of you developing heart disease is statistically increased.

Examples of Family Medical Histories Leading to Higher Premiums

A family history of multiple instances of specific cancers (breast, colon, lung) at relatively young ages is likely to result in higher premiums. Similarly, a strong family history of Alzheimer’s disease or other neurodegenerative conditions may also lead to higher premiums due to the potential for earlier onset and increased healthcare costs. A history of diabetes in multiple family members, especially if it developed early in life, might also increase premiums due to associated health complications and shorter life expectancy. Conversely, a family history free of major illnesses generally leads to more favorable premium rates.

Summary

Ultimately, the cost of life insurance is a personalized calculation, reflecting your unique circumstances and risk profile. While some factors, like age, are beyond your control, others, such as lifestyle choices, offer opportunities for positive influence. By carefully considering these factors and understanding their impact on premiums, you can navigate the insurance market effectively and secure the most suitable and affordable coverage for your needs.

User Queries

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period (term), typically at a lower premium than whole life insurance. Whole life insurance offers lifelong coverage, but premiums are generally higher and build cash value.

Can I lower my premiums if I improve my health?

Possibly. Some insurers offer premium discounts or adjustments based on improvements in health factors like quitting smoking or managing a chronic condition. Contact your insurer to inquire about possibilities.

How often are life insurance premiums reviewed?

This depends on the type of policy. Term life insurance premiums are typically fixed for the policy term. Whole life insurance premiums usually remain level throughout the policy’s duration.

What if I have a family history of heart disease?

A family history of heart disease can increase your premiums, as it indicates a higher risk. Insurers will assess this alongside other factors to determine your overall risk profile.

Does my occupation affect my life insurance premium?

Yes, high-risk occupations (e.g., firefighters, police officers) often lead to higher premiums due to increased risk of death or injury.