Securing your family’s financial future is a top priority, and term life insurance plays a crucial role. Understanding how to estimate term life insurance premiums is key to making an informed decision. This guide unravels the complexities of premium calculations, empowering you to navigate the process with confidence and choose a policy that aligns with your needs and budget.

From the influence of age and health to the impact of policy length and riders, we’ll explore the factors that shape your premium. We’ll also provide practical advice on obtaining accurate estimates and comparing quotes from different insurers, ensuring you get the best possible value for your investment.

Factors Influencing Term Life Insurance Premiums

Several key factors determine the cost of your term life insurance premiums. Understanding these factors can help you make informed decisions when purchasing a policy. This section will explore the major influences on premium calculations.

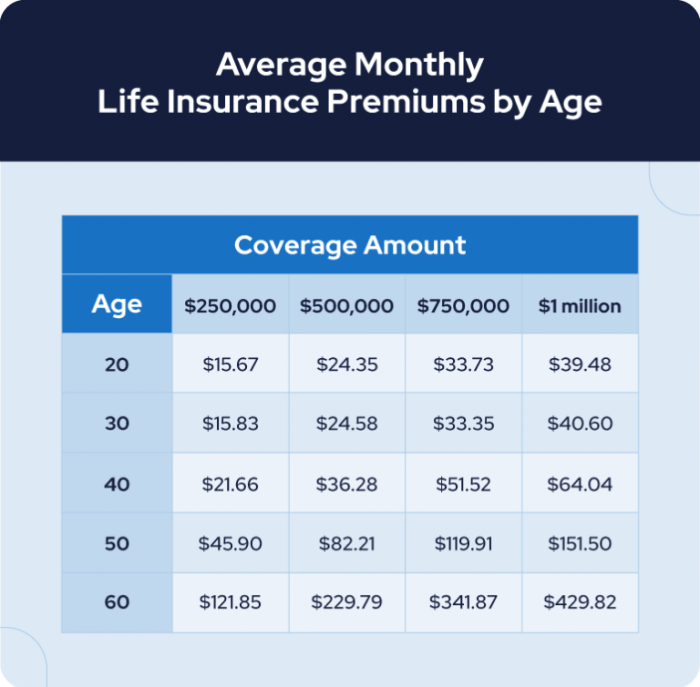

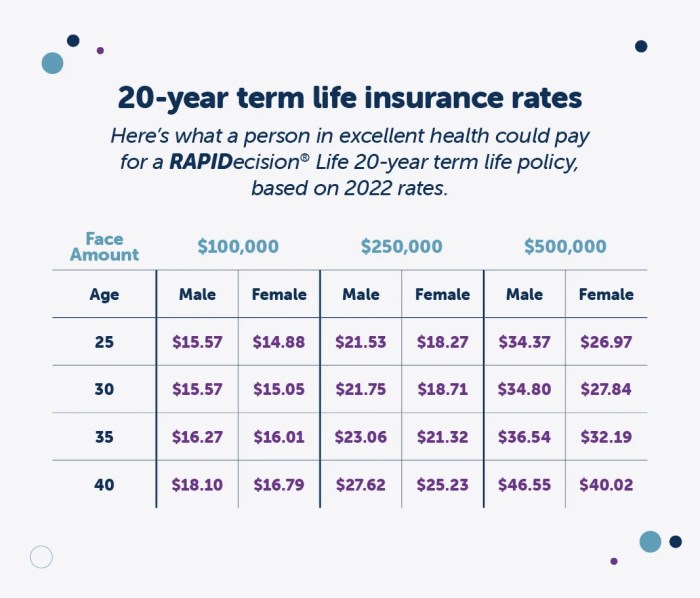

Age’s Impact on Premiums

Age is a significant factor affecting term life insurance premiums. Younger individuals generally receive lower premiums than older applicants. This is because statistically, younger people have a lower risk of death within the policy term. For example, a 30-year-old might pay significantly less than a 50-year-old for the same coverage amount and policy length, reflecting the increased mortality risk associated with aging. The difference can be substantial; a $500,000, 20-year term policy might cost a 30-year-old around $25 per month, while the same policy for a 50-year-old could cost upwards of $75 per month, or even more, depending on other factors.

Health Conditions and Premium Calculations

Pre-existing health conditions substantially influence premium calculations. Insurers assess the risk associated with each condition, adjusting premiums accordingly. Those with health issues are often considered higher risk and therefore pay more.

| Health Condition | Impact on Premiums | Example | Potential Premium Increase Percentage |

|---|---|---|---|

| High Blood Pressure | Increased premiums | A person with consistently high blood pressure may face higher premiums due to increased risk of heart disease and stroke. | 10-30% |

| Diabetes | Increased premiums | Individuals with diabetes are at a higher risk of various complications, leading to higher premiums. | 20-50% |

| Smoking | Significantly increased premiums | Smoking significantly increases the risk of lung cancer, heart disease, and other life-threatening illnesses, resulting in substantially higher premiums. | 50-100% or more |

| Heart Disease | Significantly increased premiums | A history of heart disease or related conditions will likely lead to very high premiums or even policy denial. | 100%+ or policy denial |

Smoking Habits and Premium Rates

Smoking is a major factor impacting premiums. Insurers consider smoking a significant health risk due to its strong correlation with various life-threatening diseases. A non-smoker will generally receive much lower premiums compared to a smoker. For instance, a non-smoking 35-year-old might pay $30 per month for a specific policy, while a smoker of the same age and health status might pay double or even triple that amount. The difference reflects the increased mortality risk associated with smoking.

Policy Coverage Amount and Premium Costs

The amount of life insurance coverage directly influences the premium cost. Higher coverage amounts generally mean higher premiums. This relationship is typically linear; a doubling of coverage will usually result in approximately a doubling of the premium cost. A graph illustrating this would show a positive linear relationship, with the x-axis representing coverage amount and the y-axis representing the premium cost. The line would ascend steadily from the origin, indicating a direct and proportional increase in premium with increased coverage.

Other Influencing Factors

Several other factors can influence your term life insurance premiums.

- Occupation: High-risk occupations (e.g., firefighters, police officers) may lead to higher premiums due to increased risk of injury or death.

- Family History: A family history of specific diseases (e.g., heart disease, cancer) can increase your premiums as it suggests a higher genetic predisposition.

- Lifestyle Choices: Factors like diet, exercise, and alcohol consumption can also influence premium calculations.

Understanding Different Term Lengths and Their Premiums

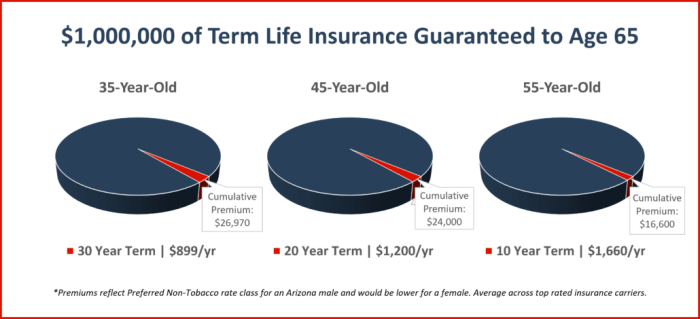

Choosing the right term length for your life insurance policy is a crucial decision, significantly impacting both your monthly premiums and the overall cost of coverage. Understanding the differences between common term lengths—such as 10, 20, and 30 years—is essential for making an informed choice that aligns with your financial goals and life stage. This section will explore the premium variations associated with different term lengths, helping you weigh the advantages and disadvantages of each option.

The cost of term life insurance is directly related to the length of coverage. Longer terms generally mean higher premiums due to the increased risk the insurance company assumes over a longer period. However, the cost per year might be lower for longer terms compared to shorter terms. Let’s examine this relationship more closely.

Term Length Premium Comparison

The following table illustrates a hypothetical comparison of premiums for 10-year, 20-year, and 30-year term life insurance policies for a healthy 35-year-old male seeking $500,000 in coverage. Remember that actual premiums will vary based on individual factors such as health, lifestyle, and the specific insurance company.

| Term Length | Annual Premium | Total Premium (Over Term) | Average Annual Cost |

|---|---|---|---|

| 10-Year | $500 | $5000 | $500 |

| 20-Year | $650 | $13000 | $650 |

| 30-Year | $750 | $22500 | $750 |

As the table demonstrates, while the annual premium increases with longer term lengths, the total premium paid over the life of the policy increases substantially. A shorter term like 10 years offers lower overall costs, but less coverage over time. A longer term like 30 years provides longer coverage, but at a significantly higher overall cost.

Impact of Term Length on Overall Cost

The relationship between term length and overall cost is directly proportional. A longer term means more years of coverage, leading to higher total premiums. For example, if a 30-year term policy costs $750 annually, the total cost will be $22,500 over 30 years. A 10-year policy with an annual premium of $500 would cost $5,000 over the 10 years. The longer you need coverage, the higher the total cost will be, even if the annual premium might seem lower on a per-year basis for longer terms.

Advantages and Disadvantages of Term Lengths

The choice between shorter and longer term lengths involves trade-offs. Carefully consider the following points to determine the best option for your individual circumstances.

- Shorter Term Lengths (e.g., 10-year):

- Advantage: Lower overall cost. Ideal if you anticipate needing coverage for a specific, shorter period (e.g., paying off a mortgage).

- Disadvantage: Coverage expires, requiring renewal or purchase of a new policy, potentially at a higher rate due to age.

- Longer Term Lengths (e.g., 20-year or 30-year):

- Advantage: Provides longer-term coverage without the need for renewal during the policy period, offering peace of mind.

- Disadvantage: Higher overall cost. May not be the most cost-effective if your need for coverage is limited to a shorter time frame.

Comparing Quotes from Different Insurers

Shopping for term life insurance involves more than just finding the first policy that seems affordable. A thorough comparison of quotes from multiple insurers is essential to securing the best coverage at the most competitive price. Failing to do so could result in overpaying for inadequate protection.

Comparing quotes from different insurers allows you to assess the overall value proposition of each policy. This involves considering not only the premium cost but also the extent of coverage, the length of the term, and the inclusion of any valuable additional features. By comparing these factors across several insurers, you can make an informed decision that aligns with your specific needs and budget.

Quote Comparison Table

The following table illustrates a comparison of quotes from three hypothetical insurers – Insurer A, Insurer B, and Insurer C – for a 30-year-old male seeking $500,000 in coverage over a 20-year term.

| Insurer | Annual Premium | Coverage Amount | Policy Features |

|---|---|---|---|

| Insurer A | $800 | $500,000 | Accidental Death Benefit, Waiver of Premium |

| Insurer B | $750 | $500,000 | Accidental Death Benefit |

| Insurer C | $900 | $500,000 | Accidental Death Benefit, Waiver of Premium, Guaranteed Insurability Option |

Interpreting Key Information in Insurance Quotes

Understanding the details within an insurance quote is crucial for making a sound financial decision. Let’s examine a sample quote excerpt to highlight key elements.

Sample Quote Excerpt:

Policyholder: John Doe

Age: 35

Coverage Amount: $750,000

Policy Term: 20 Years

Annual Premium: $1,200

Death Benefit: $750,000 (payable to beneficiary upon death during the policy term)

Premium Payment Method: Annual

Policy Effective Date: October 26, 2024

Policy Expiration Date: October 26, 2044

Riders: Accidental Death Benefit ($750,000)

Exclusion: Suicide within the first two years.

The highlighted information within the sample quote represents the core elements to focus on. The policyholder’s details, coverage amount, policy term, and annual premium are fundamental to understanding the cost and extent of protection. The death benefit clarifies the amount paid to the beneficiary upon the insured’s death. The policy’s effective and expiration dates establish the coverage period. Finally, riders (additional benefits) and exclusions (specific circumstances not covered) must be carefully reviewed. The presence of an accidental death benefit rider increases the payout in case of accidental death. The exclusion regarding suicide within the first two years is a standard clause in many life insurance policies.

Understanding Policy Riders and Their Impact on Premiums

Term life insurance policies can be customized with various riders, which are essentially add-ons that modify the policy’s coverage and benefits. Understanding these riders and their impact on your premiums is crucial for making an informed decision about your life insurance needs. Adding riders typically increases the overall cost, but the added protection may be worth the extra expense depending on your individual circumstances.

Common Term Life Insurance Policy Riders

Several common riders can enhance a basic term life insurance policy. Each rider offers specific benefits, but comes with an additional premium. Carefully consider your needs and risk tolerance when choosing riders.

- Accidental Death Benefit Rider: This rider pays a multiple of the death benefit (e.g., double or triple) if the insured dies due to an accident. The additional premium reflects the increased risk the insurer assumes. For example, a $500,000 policy with a double indemnity rider would pay $1,000,000 in case of accidental death.

- Waiver of Premium Rider: This rider waives future premiums if the insured becomes totally disabled and unable to work. This protects the policy’s coverage even if the insured can no longer afford the premiums. The cost of this rider depends on factors such as the insured’s age and health.

- Guaranteed Insurability Rider: This rider allows the insured to purchase additional coverage at predetermined intervals (e.g., every 3 or 5 years) without undergoing a medical examination, regardless of changes in health. This is valuable for those anticipating future increases in financial responsibilities, such as having children or purchasing a home. The premium for this rider is relatively low initially, but increases with each additional purchase of coverage.

- Term Conversion Rider: This rider allows the policyholder to convert their term life insurance policy to a permanent life insurance policy (like whole life) without undergoing a medical exam, at a later date. The premium for the permanent policy will be higher than the term policy, but this rider offers flexibility. The cost of this rider varies based on the type of permanent policy selected.

Impact of Riders on Premium Costs

Adding riders inevitably increases the overall premium. The extent of the increase depends on several factors, including the type of rider, the amount of additional coverage, and the insured’s age and health. For instance, adding a double indemnity rider to a $250,000 term life insurance policy might increase the annual premium by 10-20%, while a waiver of premium rider might add another 5-15%. These percentages are illustrative and can vary significantly depending on the insurer and individual circumstances.

Value Proposition of Adding Riders

The decision of whether or not to add riders involves weighing the increased cost against the potential benefits.

Accidental Death Benefit Rider: Value Proposition

Arguments for: Provides significant financial protection for unexpected accidental death, offering peace of mind for families.

Arguments against: Relatively low probability of accidental death; the additional premium might be better allocated elsewhere if budget is tight.

Waiver of Premium Rider: Value Proposition

Arguments for: Protects the policy’s coverage during periods of disability, ensuring financial security for the family.

Arguments against: May be unnecessary if the insured has adequate disability insurance or significant savings.

Guaranteed Insurability Rider: Value Proposition

Arguments for: Allows for increased coverage in the future without medical underwriting, accommodating changing life circumstances and potential health issues.

Arguments against: The added premium might be a burden if not carefully planned, especially over the long term.

Term Conversion Rider: Value Proposition

Arguments for: Provides flexibility to convert to a permanent policy later, offering lifelong coverage if needed.

Arguments against: Premiums for the permanent policy will be significantly higher; a separate permanent policy might be a more cost-effective option depending on the circumstances.

Ultimate Conclusion

Estimating term life insurance premiums doesn’t have to be daunting. By understanding the key factors influencing costs, obtaining accurate estimates, and comparing quotes, you can secure affordable and adequate coverage for your loved ones. Remember, proactive planning and informed decision-making are vital to safeguarding your family’s financial well-being. Take control of your future, and choose a policy that offers peace of mind.

Commonly Asked Questions

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period (term), while whole life insurance offers lifelong coverage with a cash value component.

Can I get an estimate without providing personal information?

While a precise estimate requires personal details, many online calculators offer general ranges based on age and coverage amount. However, for an accurate quote, you’ll need to provide more comprehensive information.

How often are term life insurance premiums reviewed?

Premiums for term life insurance are typically fixed for the duration of the policy term. They do not increase annually like some other types of insurance.

What happens if I develop a health condition after purchasing a policy?

Existing policies generally remain in effect, but changes in health status usually won’t affect the premium during the policy term. However, future applications for new policies may be impacted.