Securing your family’s financial future through life insurance is a significant decision, and understanding the nuances of premium structures is crucial. This guide delves into the question of whether whole life insurance premiums increase with age, exploring the factors that influence premium calculations and providing a clear comparison to other insurance types. We’ll examine how age, mortality risk, and policy features interact to shape your overall cost, offering insights to help you make an informed choice.

The complexities of whole life insurance can seem daunting, but by understanding the fundamental principles and exploring various scenarios, you can gain a clearer perspective on how premiums evolve over time. This knowledge empowers you to select a policy that aligns with your long-term financial goals and provides the appropriate level of protection for your loved ones.

Understanding Whole Life Insurance Premiums

Whole life insurance premiums represent the cost of maintaining a lifelong death benefit. Unlike term life insurance, which covers a specific period, whole life insurance offers coverage for your entire life, provided premiums are paid. Understanding the structure and factors influencing these premiums is crucial for making informed financial decisions.

Whole Life Insurance Premium Structure

Whole life insurance premiums are typically level premiums, meaning they remain consistent throughout the policy’s duration. This predictability is a key advantage, offering financial stability and budgeting ease. However, the initial premium is carefully calculated based on several factors, and this initial cost reflects the long-term commitment of the insurer.

Factors Influencing Initial Premium Determination

Several factors influence the initial premium calculation. These include the insured’s age, health status, gender, smoking habits, the desired death benefit amount, and the specific policy features selected. Younger, healthier individuals with fewer risk factors typically qualify for lower premiums. Conversely, individuals with pre-existing health conditions or engaging in high-risk activities may face higher premiums. The death benefit amount directly impacts the premium; a larger death benefit requires a higher premium. Additional policy riders, such as long-term care benefits or accidental death benefits, also influence the overall premium cost.

Components of a Whole Life Insurance Premium

A whole life insurance premium is comprised of several key components. A significant portion covers the cost of the death benefit, which is the primary function of the policy. A portion also contributes to the policy’s cash value component, which grows tax-deferred over time. Finally, a portion covers the insurer’s administrative costs and expenses associated with managing the policy. The exact proportion of each component varies depending on the insurer and the specific policy details.

Level vs. Increasing Premium Whole Life Policies

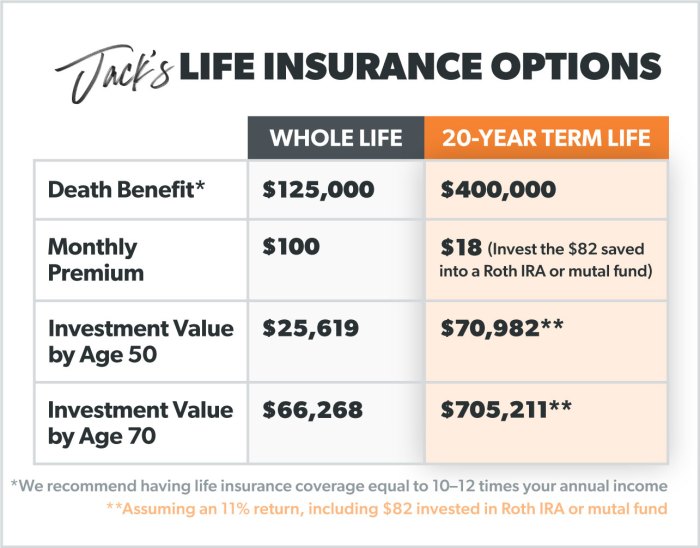

The following table compares level and increasing premium whole life insurance policies. While less common, increasing premium policies offer lower initial costs but steadily increase over time.

| Policy Type | Premium Structure | Cost Over Time | Advantages/Disadvantages |

|---|---|---|---|

| Level Premium Whole Life | Fixed premium throughout the policy’s life | Consistent and predictable cost | Advantages: Predictable budgeting, financial stability. Disadvantages: Higher initial cost compared to increasing premium policies. |

| Increasing Premium Whole Life | Premiums increase annually or periodically | Lower initial cost, but increases over time, potentially significantly | Advantages: Lower initial cost. Disadvantages: Less predictable budgeting, potential for significantly higher costs in later years, risk of non-affordability. |

Age and Premium Relationship

Whole life insurance premiums are inextricably linked to the age of the insured. The older you are when you purchase a policy, the higher your premiums will generally be. This is a fundamental principle driven by actuarial science and the increasing likelihood of death with advancing age.

The core reason for this correlation lies in the concept of mortality risk. Insurance companies base their premium calculations on extensive mortality tables, which statistically predict the probability of death within a specific age range. As individuals age, their statistical risk of death increases. To offset this increased risk, insurers charge higher premiums to compensate for the greater likelihood of having to pay out a death benefit.

Mortality Risk and Premium Calculation

Mortality risk is the cornerstone of whole life insurance premium determination. Actuaries use sophisticated models incorporating factors like age, gender, health status, and lifestyle to assess the probability of death within a specific timeframe. These probabilities are then factored into the premium calculation, ensuring the insurer maintains a sustainable financial position while providing the promised death benefit. A higher mortality risk translates directly into a higher premium to account for the increased probability of a claim.

Premium Variation Across Age Ranges

Let’s consider a hypothetical example of a healthy 30-year-old male purchasing a $100,000 whole life insurance policy. His initial annual premium might be around $500. If the same individual waited until age 40 to purchase the same policy, the annual premium could increase to approximately $800, reflecting the higher mortality risk associated with the older age. Delaying the purchase until age 50 could result in an even higher premium, perhaps around $1,500 or more, depending on the insurer and policy specifics. These figures are illustrative and will vary significantly depending on the insurer, policy type, and individual health profile.

Premium Growth Trajectory Over a Lifetime

The following chart visually depicts a sample premium growth trajectory for a $100,000 whole life insurance policy purchased at age 30.

| Age | Annual Premium |

|---|---|

| 30 | $500 |

| 40 | $800 |

| 50 | $1500 |

| 60 | $2500 |

| 70 | $4000 |

This chart illustrates a general upward trend in premiums over time. The x-axis represents the insured’s age, and the y-axis represents the annual premium amount. The data points show a progressively steeper increase in premiums as the insured ages, reflecting the escalating mortality risk. It’s crucial to remember that this is a simplified representation and actual premium increases can vary based on numerous factors. The chart’s visual representation is a simple line graph, showcasing the positive correlation between age and premium cost. The line starts at a relatively low point at age 30 and steadily rises, showing an increasingly sharp incline as the age increases.

Premium Adjustments and Policy Features

While whole life insurance premiums are generally level, meaning they remain consistent throughout the policy’s duration, certain circumstances can lead to adjustments. Understanding these potential changes and how policy features influence premiums is crucial for informed decision-making. This section will detail the factors that can affect your whole life insurance premiums.

Premium adjustments are rare in traditional whole life policies but can occur under specific circumstances. These adjustments are typically not arbitrary increases but are often tied to specific policy provisions or changes in the insurer’s financial standing. It’s important to note that these adjustments are subject to strict regulatory oversight to protect policyholders.

Circumstances Leading to Premium Adjustments

Premium adjustments are uncommon in standard whole life insurance policies. However, they might occur due to unforeseen circumstances impacting the insurer’s financial health, or due to specific policy provisions. For example, some policies might include clauses allowing for adjustments based on significant changes in mortality rates or interest rates. Such adjustments are typically clearly Artikeld in the policy documents. Additionally, if a policyholder exercises certain options within the policy, such as increasing the death benefit, this might trigger a premium adjustment. Finally, some insurers may offer policies with adjustable premiums, though these are less common than level-premium policies. It is vital to carefully review the policy contract to understand the potential for and limitations on premium adjustments.

Comparison of Premium Adjustment Processes Across Whole Life Products

Different whole life insurance products may handle premium adjustments differently. For instance, a participating whole life policy might offer dividends that could offset premium increases, while a non-participating policy would not have this feature. Policies with guaranteed level premiums will have no premium adjustments, unless specified in the contract. Policies with adjustable premiums, however, offer more flexibility, but this flexibility also comes with the potential for greater premium fluctuations. The specific process for any adjustments will be clearly detailed in the policy contract. It’s crucial to compare the terms and conditions of various policies to understand the potential for and the process of premium adjustments before making a purchase.

Impact of Policy Riders or Add-ons on Premium Costs

Adding riders or add-ons to a whole life insurance policy will almost always increase the premium. These riders provide additional coverage or benefits beyond the basic death benefit. For example, a long-term care rider adds coverage for long-term care expenses, increasing the overall premium. Similarly, a waiver of premium rider, which waives future premiums if the insured becomes disabled, will also increase the premium. The cost of each rider will vary depending on the specific benefits provided and the insured’s age and health. Before purchasing riders, it’s essential to carefully weigh the added cost against the potential benefits they offer.

Policy Features Influencing Premiums

Several key policy features significantly influence the premium cost. Understanding these features is crucial for making informed decisions.

- Death Benefit Amount: A higher death benefit results in a higher premium.

- Policy Type: Participating whole life policies may have slightly higher premiums but offer the potential for dividends, while non-participating policies have level premiums without dividends.

- Age at Issue: Younger applicants generally receive lower premiums due to a longer life expectancy.

- Health Status: Applicants with pre-existing health conditions might face higher premiums or even be denied coverage.

- Policy Riders and Add-ons: As previously discussed, adding riders significantly impacts premium costs.

- Cash Value Accumulation: Policies with higher cash value accumulation potential often have higher premiums.

Wrap-Up

In conclusion, while the initial premium for whole life insurance is influenced by your age, the premium structure itself—level or increasing—significantly impacts your long-term costs. Understanding the interplay between age, mortality risk, policy features, and the overall cost trajectory is essential for making an informed decision. By carefully weighing the advantages and disadvantages of different policy types and considering your individual circumstances, you can choose a whole life insurance plan that provides adequate coverage and aligns with your financial capabilities throughout your life.

FAQ Resource

What factors besides age affect whole life insurance premiums?

Several factors influence premiums beyond age, including your health status, lifestyle choices (smoking, etc.), the death benefit amount, and the policy’s cash value features.

Can I change my whole life insurance policy after it’s issued?

Policy changes are often possible, but they may affect your premium. Consult your insurer about available options and potential premium adjustments.

Is it always cheaper to buy whole life insurance at a younger age?

Generally, yes, because your mortality risk is lower. However, affordability also depends on your financial situation and the specific policy features you choose.

What happens if I miss a premium payment on my whole life insurance?

Missing payments can lead to policy lapse or reduced coverage. Your insurer will typically provide a grace period, but it’s crucial to contact them immediately if you face payment difficulties.