Securing your family’s financial future is a paramount concern for many, and life insurance plays a crucial role in achieving this peace of mind. Among the various types of life insurance available, whole life insurance stands out for its unique features, particularly its promise of a guaranteed death benefit. But what exactly does this guarantee entail, and how does it affect the premiums you pay? This exploration delves into the intricacies of whole life insurance premiums, clarifying the concept of a guaranteed death benefit and addressing common misconceptions.

Understanding the structure of whole life insurance premiums is key to making informed decisions. We will examine how these premiums are calculated, the various payment options available, and the factors that influence their cost. Furthermore, we’ll compare whole life insurance to other types of life insurance, highlighting the key differences in premium stability and overall cost-effectiveness. By the end, you’ll have a clearer understanding of whether whole life insurance offers the financial security you seek.

Defining Whole Life Insurance

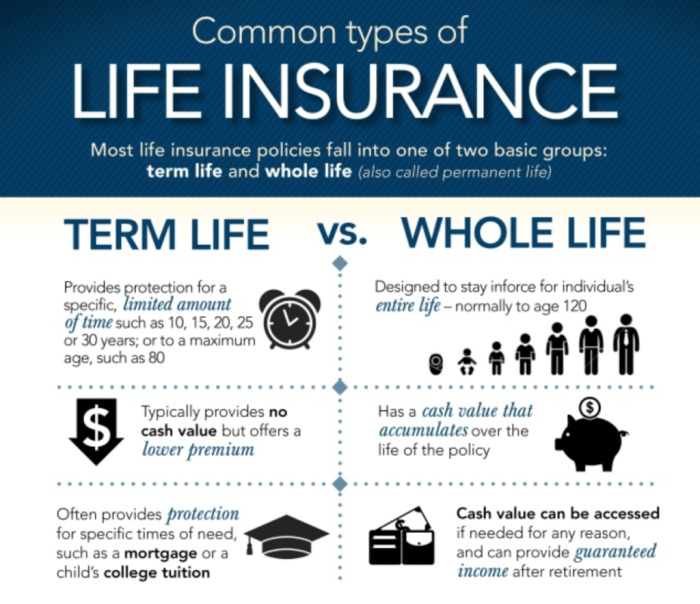

Whole life insurance is a type of permanent life insurance policy designed to provide lifelong coverage. Unlike term life insurance, which covers a specific period, whole life insurance remains in effect as long as premiums are paid. A key characteristic is its cash value component, which grows tax-deferred over time. This cash value can be borrowed against or withdrawn, offering financial flexibility.

Whole life insurance policies offer a combination of death benefit protection and a savings element. The death benefit is the amount paid to your beneficiaries upon your death, while the cash value component represents the accumulated savings within the policy. This dual function makes it a versatile financial tool, albeit one with higher premiums compared to term life insurance.

Whole Life Insurance Premium Components

The premium for a whole life insurance policy isn’t a single, simple figure. It’s comprised of several elements that contribute to the overall cost. Understanding these components is crucial for making an informed decision.

The premium primarily covers the cost of the death benefit, the cost of managing the policy, and the cost of building the cash value component. The proportion allocated to each component varies depending on the policy’s specifics and the insurer. For example, a policy emphasizing higher cash value accumulation will have a larger portion of the premium directed towards that aspect.

Whole Life Insurance Premium Calculation

Calculating whole life insurance premiums is a complex process, involving several factors considered by the insurance company. These factors influence the risk assessment and ultimately determine the premium amount.

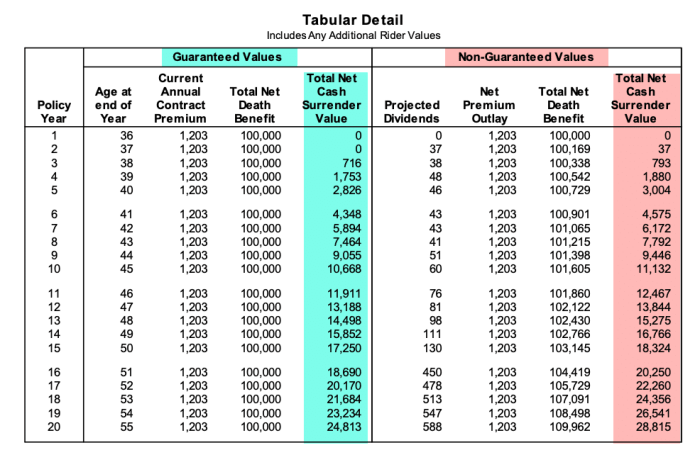

Several factors influence the premium calculation. These include the age and health of the insured, the desired death benefit amount, the policy’s cash value growth rate, and the insurer’s operating expenses and profit margins. Actuaries use sophisticated models and mortality tables to project future payouts and determine the appropriate premium to cover those potential liabilities. Younger, healthier individuals typically receive lower premiums than older, less healthy individuals because they present a lower risk to the insurance company. Similarly, a higher death benefit amount will naturally lead to a higher premium. The cash value accumulation rate, which is influenced by the policy’s investment performance (if applicable), also impacts the overall premium cost. Finally, the insurer’s administrative expenses and desired profit margins are factored into the premium calculation. The formula itself is proprietary to each insurance company and not publicly available, but the underlying principles remain consistent across the industry. It is important to remember that the premium is typically fixed and remains the same throughout the life of the policy, providing predictable costs for the insured.

Guaranteed Death Benefit

A cornerstone of whole life insurance is its guaranteed death benefit. This means the policy promises to pay a specific sum of money to your designated beneficiaries upon your death, regardless of market fluctuations or the policy’s cash value performance. This guaranteed payout provides crucial financial security for your loved ones, shielding them from potential economic hardship after your passing.

The death benefit in a whole life policy is paid out upon the death of the insured individual. Verification of death, typically through a death certificate, is required by the insurance company before the benefit is released. The process involves submitting the necessary documentation to the insurance company, which then processes the claim and disburses the funds to the named beneficiaries. There are no conditions or stipulations tied to the death itself; the benefit is payable regardless of the cause of death.

Death Benefit Payment Circumstances

The guaranteed death benefit is paid out only upon the confirmed death of the policyholder. The insurance company requires official documentation, such as a death certificate, to verify the death before releasing the funds. No other circumstances trigger the payout; for example, terminal illness or disability does not automatically activate the death benefit. The policy remains in effect until the death of the insured individual. The death benefit is paid to the beneficiaries named in the policy, usually a spouse, children, or other designated individuals. Beneficiaries can be changed at any time during the policy’s life, as long as the proper procedures are followed.

Examples of Guaranteed Death Benefit

Imagine a scenario where someone purchased a whole life policy with a $100,000 guaranteed death benefit. Regardless of whether the policy’s cash value increased or decreased over the years, or even if the market experienced significant downturns, the beneficiaries will still receive the full $100,000 upon the policyholder’s death. Another example involves a policyholder who dies unexpectedly due to an accident. The guaranteed death benefit is paid out in full, regardless of the unforeseen circumstances. This illustrates the core promise of whole life insurance: a guaranteed payout upon death, providing financial certainty for loved ones. Even if the policyholder had stopped paying premiums (resulting in the policy lapsing, which is a different matter), the guaranteed death benefit might still be payable, though potentially reduced depending on the policy terms.

Premium Structure and Variations

Whole life insurance premiums, unlike term life insurance, remain consistent throughout the policy’s duration, offering predictable financial planning. However, there’s flexibility in how you choose to pay these premiums, influencing both your immediate financial outlay and the overall cost over time. Understanding these variations is crucial for selecting a plan that aligns with your personal financial circumstances.

Premium payment options offer a range of choices designed to accommodate various financial situations and preferences. The choice between these options can significantly impact your monthly budget and the total amount paid over the life of the policy.

Whole Life Insurance Premium Payment Options

Several methods exist for paying whole life insurance premiums. The most common include single premium, level premium, and modified premium options. Each has advantages and disadvantages depending on individual financial goals and risk tolerance.

- Single Premium Whole Life Insurance: With this option, the entire premium is paid upfront in a lump sum. This method eliminates the need for future premium payments and provides immediate, complete coverage. However, it requires a substantial initial investment. A person inheriting a significant sum of money might choose this option to secure lifelong coverage.

- Level Premium Whole Life Insurance: This is the most common approach, involving fixed, regular premium payments throughout the policy’s life. The predictability of this method makes budgeting easier, offering a consistent financial commitment. Many people prefer this for its simplicity and financial stability.

- Modified Premium Whole Life Insurance: This option involves lower premiums during the initial years of the policy, gradually increasing to a higher level premium after a specified period (typically 5-10 years). This approach can be attractive to those with tighter budgets initially but who anticipate higher income in the future. A young professional starting their career might opt for this.

Factors Influencing Whole Life Insurance Premium Amounts

Several factors interact to determine the cost of a whole life insurance policy. Understanding these elements allows for a more informed decision-making process when choosing a plan.

- Age: Generally, younger individuals receive lower premiums due to their statistically longer life expectancy. Older applicants, facing a shorter life expectancy, pay higher premiums to reflect the increased risk for the insurer. A 30-year-old will typically pay significantly less than a 60-year-old for the same coverage amount.

- Health: Pre-existing health conditions and lifestyle factors (such as smoking) directly influence premium costs. Individuals with good health and healthy habits generally qualify for lower premiums. Applicants with significant health concerns may face higher premiums or even be denied coverage. A non-smoker with a clean bill of health will generally receive a more favorable rate compared to a smoker with hypertension.

- Death Benefit Amount: The larger the death benefit selected, the higher the premium will be. This reflects the increased financial obligation undertaken by the insurance company. A policy with a $500,000 death benefit will cost more than a policy with a $250,000 death benefit, all other factors being equal.

- Policy Features: Additional policy riders or features, such as accelerated death benefits or long-term care riders, can increase the overall premium cost. These riders provide added benefits but increase the insurer’s risk and therefore the cost to the policyholder.

Impact of Age and Health on Whole Life Insurance Premiums

Age and health status are two of the most significant factors determining the cost of whole life insurance. The insurer assesses the applicant’s risk profile based on these factors, using actuarial tables and medical information to calculate the premium.

The younger and healthier the applicant, the lower the premium will typically be, reflecting a lower risk to the insurer.

This is because statistically, younger and healthier individuals have a longer life expectancy, reducing the likelihood of a claim in the near future. Conversely, older applicants or those with pre-existing health conditions present a higher risk, leading to higher premiums to offset the increased probability of a claim. This principle underlines the importance of securing whole life insurance early in life, when premiums are typically more affordable.

Premium Changes and Adjustments

One of the key selling points of whole life insurance is its predictable cost. Unlike term life insurance, where premiums can increase significantly at renewal, whole life insurance typically offers fixed premiums for the life of the policy. This predictability allows for long-term financial planning and budgeting certainty. However, while the core premise is fixed premiums, there are some exceptions and nuances to consider.

Whole life insurance premiums are generally fixed and will not increase after the initial policy purchase. This is a defining characteristic that distinguishes it from other types of life insurance. The insurer calculates the premium based on your age, health, and the death benefit amount at the time of policy issuance. This premium remains constant throughout the life of the policy, providing financial security and stability.

Scenarios Affecting Premium Adjustments

While whole life insurance premiums are generally fixed, there are limited circumstances under which adjustments might occur. These are usually Artikeld in the policy’s fine print and are typically not common. For example, some policies might allow for a small, temporary adjustment if the insurer experiences unexpected, significant financial difficulties, though this is exceptionally rare and heavily regulated. Another scenario might involve policy riders or add-ons purchased later, which could lead to a small increase in the overall premium. It’s crucial to carefully review the policy documents to understand any potential exceptions. These adjustments, if any, are usually clearly explained within the policy terms and conditions.

Comparison of Premium Stability Across Life Insurance Types

The following table compares the premium stability of whole life insurance with other common types of life insurance:

| Type of Life Insurance | Premium Stability | Premium Changes | Typical Policy Length |

|---|---|---|---|

| Whole Life | Guaranteed level premiums | Rare exceptions possible due to specific policy clauses or riders | Lifetime |

| Term Life | Level premiums for a specific term | Premiums increase significantly at renewal | 10, 20, or 30 years, etc. |

| Universal Life | Adjustable premiums | Premiums can be increased or decreased, impacting the death benefit | Lifetime |

| Variable Life | Adjustable premiums | Premiums can be increased or decreased, based on market performance of the underlying investments | Lifetime |

Understanding Policy Documents

Navigating the intricacies of a whole life insurance policy document can seem daunting, but understanding key sections related to premiums is crucial for ensuring you’re fully aware of your financial obligations and the guarantees offered. This section will detail the essential parts of the policy document that clarify premium information and explain the significance of specific terminology.

The policy document, a legally binding contract, Artikels all the terms and conditions of your insurance coverage. The premium-related sections are typically found within the first few pages, often highlighted for easy reference. Understanding the language used is vital to avoid future misunderstandings.

Premium Schedule and Payment Details

This section specifies the amount of your premium, the frequency of payments (e.g., annually, semi-annually, quarterly, monthly), and the due dates. It will clearly state whether your premium is level (fixed) or adjusted (variable), a crucial distinction when considering long-term financial planning. The policy might also detail any grace periods allowed for late payments and the consequences of non-payment. A sample policy might state: “The annual premium for this policy is $1,500, payable in advance on January 1st of each year. A 30-day grace period is allowed for late payments.”

Guaranteed Premium Provisions

This section is paramount for understanding the long-term cost of your policy. It explicitly states whether your premiums are guaranteed to remain level for the life of the policy or if they are subject to change. Look for phrases such as “level premium,” “guaranteed premium,” or “fixed premium.” The absence of such explicit guarantees indicates that premiums might be subject to future adjustments, potentially increasing your costs over time. A policy might state: “This policy offers a guaranteed level premium of $2,000 annually for the lifetime of the insured.” This clearly indicates a fixed cost, providing predictable financial planning.

Definitions of Key Terms

Policy documents often include a glossary defining key terms. Familiarize yourself with terms like “level premium,” “guaranteed death benefit,” and “cash value,” as they are central to understanding the policy’s financial aspects. Understanding these definitions is critical for interpreting the implications of the premium structure. For instance, a policy might define “level premium” as: “A premium that remains constant throughout the policy’s duration, irrespective of the insured’s age or health status.” Conversely, a policy without this definition, or with a definition of a variable premium, will signal a different structure.

Illustrative Examples of Premium Guarantees

Let’s consider two hypothetical examples. Policy A explicitly states a “guaranteed level premium of $1000 per year for the life of the policy.” Policy B, on the other hand, only mentions an initial premium of $800, with a clause stating that premiums “may be adjusted based on company experience and market conditions.” Policy A offers a clear, predictable premium structure, while Policy B carries the risk of future premium increases. This highlights the importance of carefully reviewing this section.

Factors Affecting Premium Costs

Several key factors influence the cost of whole life insurance premiums. Understanding these elements allows individuals to make informed decisions when purchasing a policy and to potentially negotiate better rates. These factors interact in complex ways, and a change in one can significantly impact the overall premium.

The cost of your whole life insurance premium is not a fixed number; it’s calculated based on a variety of factors specific to your individual circumstances. Insurers use sophisticated actuarial models to assess risk and price accordingly. This means that seemingly small differences in your profile can lead to substantial variations in premium amounts.

Age

Age is a primary determinant of whole life insurance premiums. As you get older, your risk of mortality increases, leading to higher premiums. This is because statistically, older individuals are more likely to pass away within the policy’s coverage period. Insurers reflect this increased risk in their pricing structure. A 30-year-old will generally pay significantly less than a 50-year-old for the same coverage amount.

Health Status

Your health significantly impacts premium costs. Individuals with pre-existing health conditions or a family history of certain diseases will typically face higher premiums. This is because insurers assess the likelihood of future health issues and their potential impact on the policy’s payout. For example, someone with a history of heart disease might pay considerably more than someone with a clean bill of health. Conversely, maintaining a healthy lifestyle can lead to lower premiums, sometimes through discounts or preferred rates.

Amount of Coverage

The death benefit you choose directly correlates with your premium. A larger death benefit requires a higher premium because the insurer assumes a greater financial obligation. For example, a $500,000 policy will cost more than a $250,000 policy, all other factors being equal. This is a straightforward relationship: more coverage equals higher cost.

Policy Type and Features

Different types of whole life insurance policies offer varying features, which affect the premium. Policies with additional riders, such as long-term care or disability benefits, will generally have higher premiums. These riders provide extra coverage and therefore increase the insurer’s risk and cost. A simpler, no-frills whole life policy will typically be less expensive.

Lifestyle and Habits

Lifestyle factors, such as smoking, excessive alcohol consumption, and dangerous hobbies, can influence premium costs. Insurers consider these factors because they increase the risk of premature death. Smokers, for example, typically pay significantly higher premiums than non-smokers. Adopting healthier habits can potentially lead to lower premiums or eligibility for preferred rates.

Comparing Whole Life with Other Insurance Types

Choosing the right life insurance policy requires understanding the differences between various types. While whole life insurance offers a guaranteed death benefit and cash value accumulation, other options provide different levels of coverage and cost structures. Comparing whole life with term life and universal life insurance highlights these key distinctions.

Whole Life vs. Term Life Insurance Premium Structures

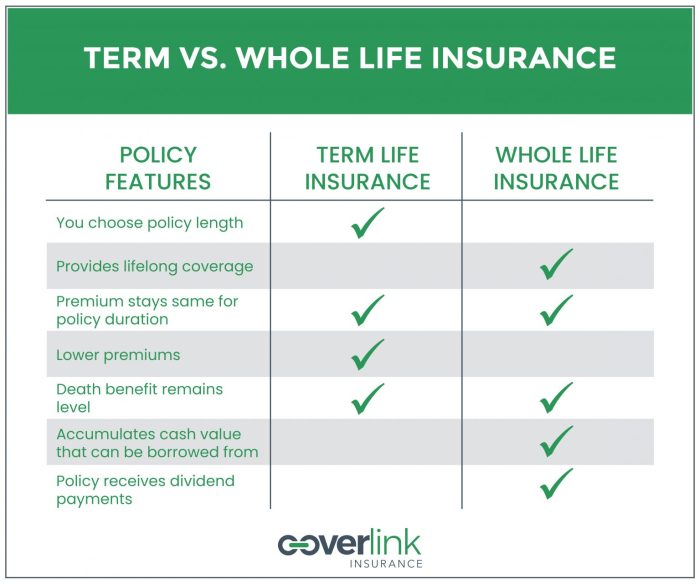

Whole life insurance and term life insurance represent fundamentally different approaches to life insurance coverage. The core difference lies in the duration of coverage and the associated premium structure. Whole life insurance provides lifelong coverage with a fixed premium that remains constant throughout the policy’s duration. In contrast, term life insurance offers coverage for a specified period (term), after which the policy expires. Term life insurance premiums are generally lower than whole life premiums during the policy term, but offer no coverage beyond that term and accumulate no cash value.

Whole Life vs. Universal Life Insurance Premium Structures

Both whole life and universal life insurance offer lifelong coverage and cash value accumulation. However, their premium structures differ significantly. Whole life insurance features a fixed, level premium, ensuring predictable payments throughout the policy’s life. Universal life insurance, on the other hand, typically involves flexible premiums, allowing policyholders to adjust their payments within certain limits. This flexibility comes with the trade-off of potential variability in the cash value growth and the possibility of the policy lapsing if premiums are insufficient to cover costs and mortality charges.

Key Differences in Premium Guarantees: Whole Life, Term Life, and Universal Life

| Feature | Whole Life | Term Life | Universal Life |

|---|---|---|---|

| Premium Guarantee | Guaranteed level premium for life | Guaranteed premium for the policy term, then expires | No guaranteed premium; premiums can be adjusted, but may increase or the policy may lapse |

| Death Benefit Guarantee | Guaranteed death benefit | Guaranteed death benefit for the policy term | Death benefit varies depending on cash value accumulation and policy performance |

| Cash Value Accumulation | Guaranteed cash value growth (though rate of growth may vary based on the policy’s performance) | No cash value accumulation | Cash value growth depends on investment performance and premiums paid |

| Coverage Duration | Lifelong coverage | Coverage for a specified term | Lifelong coverage, provided premiums are maintained |

Closure

In conclusion, while whole life insurance premiums are generally level and predictable, it’s crucial to carefully review the policy documents and understand all the terms and conditions. The guaranteed death benefit offers significant long-term security, but the cost should be carefully weighed against other life insurance options and your individual financial circumstances. Remember to consult with a qualified financial advisor to determine the best life insurance strategy to meet your specific needs and goals.

FAQs

What factors influence the initial premium for a whole life insurance policy?

Several factors determine your initial premium, including your age, health status, the amount of coverage you choose, and the specific insurance company. Higher coverage amounts and poorer health typically result in higher premiums.

Can I ever change the death benefit amount on my whole life insurance policy?

Most whole life policies allow you to adjust the death benefit amount, but this often involves changes to your premium payments. Consult your policy documents or your insurer for specific details.

What happens to the cash value component of a whole life policy if I die?

The cash value component is typically added to the death benefit, increasing the amount paid to your beneficiaries.

Are there any circumstances under which the death benefit might not be paid out?

Generally, the death benefit is guaranteed, barring instances of fraud or if the policy was voided due to non-payment of premiums or other breaches of contract.