Whole life insurance, known for its lifelong coverage and cash value accumulation, often presents a picture of fixed, unchanging premiums. However, the reality is more nuanced. This exploration delves into the intricacies of whole life insurance premium structures, examining whether and to what extent premiums can be adjusted to fit evolving financial circumstances. We’ll uncover the potential benefits and drawbacks of altering premium payments, considering the impact on cash value growth and overall policy performance.

Understanding premium flexibility is crucial for making informed decisions about this significant financial commitment. This discussion will clarify the different types of whole life policies, their respective premium structures, and the factors influencing premium adjustments. We’ll also examine the consequences of premium changes, including missed payments and the strategic use of policy loans and withdrawals.

Defining Whole Life Insurance

Whole life insurance provides lifelong coverage, offering a guaranteed death benefit payable to your beneficiaries upon your passing. Unlike term life insurance, which covers a specific period, whole life insurance remains in effect as long as premiums are paid. A key distinguishing feature is the cash value component that grows tax-deferred over time.

Whole life insurance policies are designed to provide both protection and a savings vehicle. The premiums paid are allocated to cover the death benefit and to build cash value. This cash value component grows over time, earning interest at a rate specified in the policy. The policyholder can borrow against this cash value or withdraw from it, though this will impact the death benefit and overall cash accumulation.

Cash Value Accumulation in Whole Life Insurance

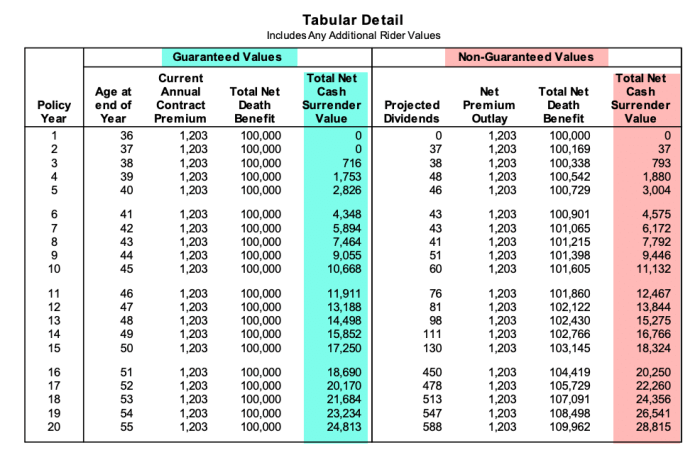

The cash value in a whole life policy accumulates through a combination of premium payments and investment earnings. A portion of each premium payment goes towards the death benefit, while the remainder is allocated to the cash value account. This cash value grows tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them. The growth rate is typically tied to a guaranteed minimum rate, often supplemented by additional interest credited based on the insurer’s investment performance. Policyholders should understand that the interest rate credited to the cash value is not fixed and may vary over time. For example, if a policyholder pays $1000 annually and $200 is allocated to the cash value account, with an interest rate of 3% that year, the cash value will increase by $6 (3% of $200) in addition to the $200 premium allocation.

Types of Whole Life Insurance Policies

Several variations of whole life insurance exist, each with its own features and cost structure. These variations typically differ in how the cash value grows and the flexibility offered to policyholders.

One common type is Straight Life Insurance, offering a fixed premium throughout the policy’s life, ensuring consistent coverage and predictable cash value growth. Another is Limited-Pay Whole Life, where premiums are paid for a specified period (e.g., 10 or 20 years), after which coverage continues for life, paid-up by the prior premiums. This option results in higher initial premiums but eliminates the need for future payments. Finally, Participating Whole Life policies often offer dividends, which are returns of surplus earnings generated by the insurance company. These dividends can be taken as cash, used to reduce premiums, added to the cash value, or left to accumulate further. The actual dividend amount isn’t guaranteed and varies annually depending on the insurer’s performance. For instance, a participating whole life policy might pay a dividend of $50 one year and $75 the next, based on the insurer’s financial results during those periods.

Premium Structures in Whole Life Insurance

Whole life insurance offers a unique premium structure compared to other life insurance policies. Understanding this structure is crucial for determining if this type of policy aligns with your financial goals and risk tolerance. The predictability and consistency of premiums are key features often highlighted by insurers.

The typical premium payment structure for whole life insurance is a level premium. This means that the premium amount remains constant throughout the policy’s duration, from the time you purchase the policy until your death. This contrasts sharply with term life insurance, where premiums typically increase as the policyholder ages. The fixed nature of whole life premiums provides financial planning certainty.

Level Premium Whole Life Insurance Compared to Other Types

Level premium whole life insurance differs significantly from term life insurance and universal life insurance. Term life insurance provides coverage for a specified period (term), with premiums increasing or the policy expiring at the end of the term. Universal life insurance, while offering lifelong coverage, has adjustable premiums, allowing for flexibility but also potentially leading to higher costs if premiums are not sufficient to cover the policy’s death benefit. Whole life insurance’s level premium structure offers a guaranteed level of coverage for life with a predictable cost. This stability is a major advantage for those seeking long-term financial security.

Factors Influencing Whole Life Insurance Premium Calculations

Several factors contribute to the calculation of whole life insurance premiums. These factors are carefully assessed by insurers to determine the appropriate premium for each individual. A higher premium generally reflects a higher level of risk.

- Age: Younger individuals typically receive lower premiums due to their longer life expectancy. The older the applicant, the higher the premium.

- Health: Applicants with pre-existing health conditions or a family history of certain diseases may face higher premiums due to increased risk. A thorough medical examination is usually part of the underwriting process.

- Death Benefit: The amount of the death benefit directly impacts the premium. A higher death benefit necessitates a higher premium to cover the increased risk for the insurer.

- Policy Type: Variations in whole life policies, such as those with added riders or different cash value accumulation rates, can influence premium costs. Policies with more features generally have higher premiums.

- Insurer’s Expenses and Profit Margins: The insurer’s operational costs and desired profit margins are also factored into the premium calculation. Different insurers have different cost structures.

Policy Loans and Withdrawals

Whole life insurance policies offer a valuable feature: access to the accumulated cash value. This is typically achieved through policy loans or withdrawals, providing policyholders with liquidity while maintaining their death benefit coverage. However, it’s crucial to understand how these actions affect premiums and the tax implications involved.

Policy loans and withdrawals directly impact the policy’s cash value, and consequently, future premiums. While the specific mechanics vary by policy and insurer, the general principle remains consistent: reducing the cash value reduces the policy’s overall value, which can influence premium calculations. For some policies, this reduction might not immediately impact premiums. However, for others, especially those with certain premium payment structures, a significant reduction in cash value could lead to increased future premiums or even policy lapse.

Tax Implications of Accessing Cash Value

Accessing the cash value of a whole life insurance policy through loans or withdrawals has different tax consequences. Loans are generally not taxed; however, interest accrued on the loan is usually taxable income. If you fail to repay the loan before your death, the outstanding loan amount will be deducted from the death benefit paid to your beneficiaries. Withdrawals, on the other hand, are subject to tax implications depending on the amount withdrawn relative to the policy’s cost basis. Any amount exceeding the cost basis is considered a taxable gain. This is because the growth within the cash value is considered to be a taxable return on investment.

Example: Cash Value, Loans, and Future Premiums

Let’s consider a hypothetical scenario. Suppose John has a whole life insurance policy with a current cash value of $50,000. He takes a $10,000 loan against his policy. This reduces his policy’s cash value to $40,000. While the loan itself isn’t immediately taxable, the interest he accrues on the loan will be taxable income annually. If John doesn’t repay the loan and passes away, the death benefit paid to his beneficiaries will be reduced by $10,000. Furthermore, depending on his policy’s terms, the reduced cash value of $40,000 might not significantly impact his premiums in the short term. However, continued substantial borrowing or withdrawals could lead to higher premiums in the future or even necessitate changes to the policy’s payment schedule. The exact impact on premiums would depend on the specific terms and conditions of John’s policy. For instance, if the policy is designed to maintain a certain level of cash value relative to the death benefit, continued withdrawals could trigger a premium increase to offset the reduced cash value.

Closing Summary

Ultimately, the flexibility of whole life insurance premiums varies considerably depending on the specific policy and insurer. While many policies offer limited adjustment options, understanding these options and their potential consequences is paramount. Careful consideration of individual financial goals, risk tolerance, and long-term planning is essential when navigating the complexities of whole life insurance and its premium structures. By weighing the potential benefits against the potential drawbacks of premium adjustments, policyholders can make informed decisions that align with their financial objectives.

Frequently Asked Questions

Can I pay my whole life insurance premiums annually instead of monthly?

Many whole life insurance policies allow for annual, semi-annual, or quarterly premium payments, in addition to monthly payments. The specific options available will depend on your insurer and policy.

What happens if I miss a whole life insurance premium payment?

Missing a premium payment can result in your policy lapsing, meaning the coverage ends. However, most insurers offer a grace period (typically 30-60 days) before taking this action. Contacting your insurer immediately if you anticipate difficulty making a payment is crucial.

Does increasing my premiums accelerate cash value growth?

Yes, generally increasing your premiums will lead to faster cash value accumulation, as more money is contributing to the policy’s cash value component.

Are there penalties for withdrawing cash value from my whole life insurance policy?

Penalties for withdrawing cash value vary depending on the policy and how long you’ve held it. Some policies may impose surrender charges, while others may not. Consult your policy documents or your insurer for specifics.