Securing your family’s financial future with life insurance is a crucial step, but understanding the intricacies of premiums is equally important. This guide delves into the factors that influence term life insurance costs, addressing the common question: does your premium increase over time? We’ll explore the various elements affecting your premium, from your age and health to the policy’s length and the insurer’s structure. Understanding these dynamics empowers you to make informed decisions about your life insurance coverage.

We’ll examine how age, health, lifestyle choices, and even your occupation can impact your premiums. We’ll also clarify the circumstances under which premiums might stay level or increase during your policy term, including renewal considerations. By the end, you’ll have a clear picture of what to expect and how to navigate the world of term life insurance premiums.

Factors Affecting Term Life Insurance Premiums

Several key factors influence the cost of term life insurance premiums. Understanding these factors allows individuals to make informed decisions when purchasing a policy and potentially find more affordable options. These factors are interconnected and insurers use sophisticated actuarial models to calculate premiums based on their assessment of risk.

Age

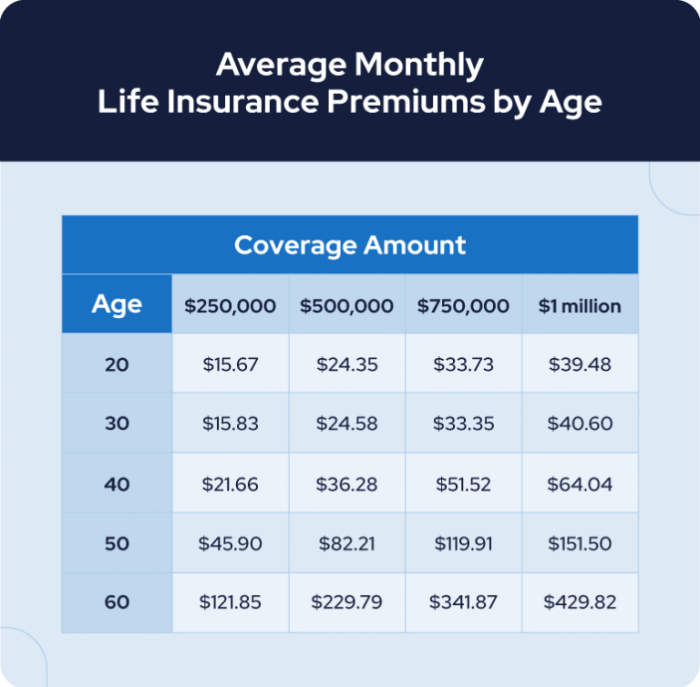

Age is a significant factor in determining term life insurance premiums. As individuals age, their risk of mortality increases. Insurers reflect this increased risk by charging higher premiums for older applicants. A 30-year-old will generally pay significantly less than a 50-year-old for the same coverage amount, reflecting the statistically higher probability of death for the older applicant within the policy term. This increase is not linear; the rate of premium increase accelerates as age progresses.

Health Status

An applicant’s health status plays a crucial role in premium calculation. Individuals with pre-existing conditions, such as heart disease, diabetes, or cancer, are considered higher risk and will generally face higher premiums. Insurers assess medical history, current health conditions, and the results of any required medical examinations to determine the level of risk. Conversely, those in excellent health with no significant medical history can expect lower premiums.

Smoking Habits

Smoking significantly increases the risk of various health problems, including heart disease, lung cancer, and stroke. As a result, smokers consistently pay substantially higher premiums for term life insurance than non-smokers. The increased risk associated with smoking is reflected in significantly higher premiums, often doubling or even tripling the cost compared to a non-smoker of the same age and health. Some insurers may even refuse coverage to applicants who are heavy smokers.

Gender

Historically, gender has been a factor in determining life insurance premiums. However, regulations in many jurisdictions are now promoting gender-neutral pricing. While some differences may still exist due to variations in life expectancy data, the gap is narrowing and many insurers are moving towards a more equitable approach based on individual risk factors rather than solely on gender.

Occupation

Certain occupations are considered more hazardous than others. Individuals working in high-risk professions, such as construction, mining, or firefighting, may face higher premiums. Insurers assess the risk associated with different occupations, considering the likelihood of injury, illness, or death related to the job. Conversely, individuals in less hazardous occupations may receive lower premiums. For example, an office worker is likely to pay less than a deep-sea diver.

Premium Differences Based on Policy Length

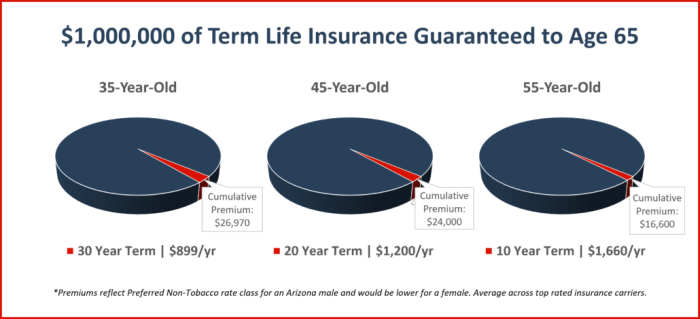

The length of the term policy also impacts premiums. Longer term policies, while providing coverage for a longer period, generally have higher annual premiums compared to shorter-term policies. This reflects the increased probability of a claim occurring over a longer duration.

| Policy Length | Premium (Age 30) | Premium (Age 40) | Premium (Age 50) |

|---|---|---|---|

| 10 Years | $200 | $350 | $600 |

| 20 Years | $300 | $500 | $850 |

| 30 Years | $400 | $650 | $1100 |

*(Note: These are illustrative examples only and actual premiums will vary widely depending on the insurer, coverage amount, and individual circumstances. These figures are not intended to be representative of any specific insurer’s pricing.)*

Premium Increases During the Policy Term

Understanding how term life insurance premiums behave over the policy’s lifespan is crucial for financial planning. While many associate term life insurance with fixed premiums, the reality is more nuanced. Premiums aren’t always static; several factors can influence whether your monthly or annual payments remain consistent or increase over time.

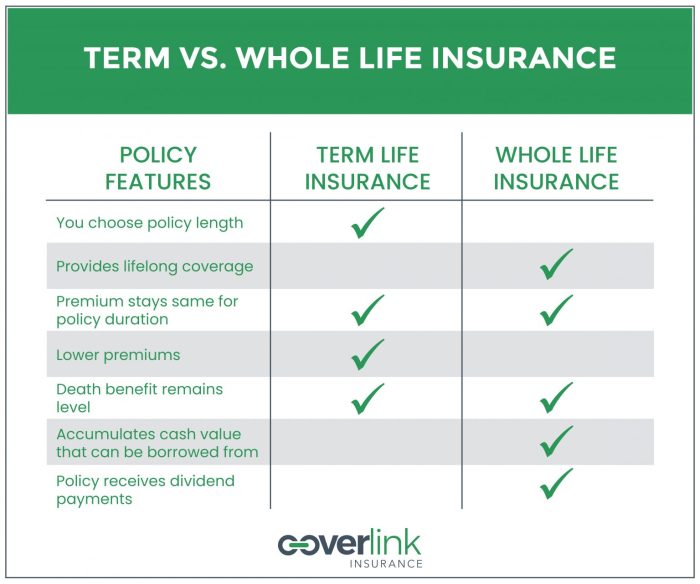

Premiums typically do not increase annually for standard term life insurance policies. The most common type of term life insurance offers a level premium, meaning the cost remains the same for the entire policy term, which is usually between 10 and 30 years. This predictability is a key advantage for many consumers.

Level Premiums Throughout the Policy Term

Level premiums are a standard feature of most term life insurance policies. Insurers calculate the premium based on your age, health, and other risk factors at the time of application. This premium then remains fixed for the duration of the policy term, providing budget stability. This is often the case for policies sold as “guaranteed level premium” policies. The insurer takes on the risk that your health might change during the term and accepts the premium as calculated upfront.

Mid-Term Premium Increases

While most term life insurance policies offer level premiums, some circumstances can lead to mid-term premium adjustments. These are less common than level premium policies and are usually explicitly Artikeld in the policy documents.

Factors Triggering Mid-Term Premium Adjustments

Several factors could trigger a mid-term premium increase. These are usually associated with specific policy types or add-ons, rather than the standard term life insurance policy. For example, a policy might include a rider that allows for an increase in coverage amount without requiring a new medical exam. The insurer may adjust the premium to reflect the increased risk. Another example is if the policyholder requests a change to the policy terms, such as extending the coverage period, this might also necessitate a premium adjustment. Finally, certain less common types of term life insurance policies may have built-in premium increases at specific intervals. These increases are usually clearly disclosed in the policy contract.

Guaranteed Level Premium vs. Potential Increases: A Scenario

Let’s consider two scenarios:

Scenario 1: Maria purchases a 20-year term life insurance policy with a guaranteed level premium of $500 per year. For the entire 20 years, her annual premium remains $500, regardless of any changes in her health or other factors (excluding the potential for non-payment due to missed payments).

Scenario 2: David purchases a similar 20-year term life insurance policy, but his policy has a clause that allows for premium adjustments based on changes in mortality rates or underwriting standards. After 10 years, due to updated actuarial data and a general increase in life expectancy, the insurer adjusts David’s premium upward by 10%, increasing his annual payment from $500 to $550.

This highlights the importance of carefully reading the policy documents and understanding the terms and conditions regarding premium adjustments. While level premiums are the norm, it’s essential to be aware of potential exceptions.

Comparing Term Life Insurance Policies from Different Providers

Choosing a term life insurance policy involves more than just comparing premiums; a thorough understanding of policy features and provider reputation is crucial. This section analyzes how premiums vary between providers and highlights the importance of a comprehensive comparison.

Premiums for term life insurance policies differ significantly between providers, even for individuals with similar profiles. This variation stems from several interconnected factors, including the insurer’s risk assessment methodology, administrative costs, claims experience, and profit margins. Understanding these factors allows consumers to make informed decisions and select a policy that aligns with their needs and budget.

Provider Premium Structure Comparison

Let’s examine the premium structures of three hypothetical providers: Provider A, Provider B, and Provider C. Each provider uses a slightly different approach to pricing, resulting in varying premium costs for identical coverage amounts.

| Provider | Coverage Amount ($1,000,000) | Term Length (Years) | Annual Premium | Key Features |

|---|---|---|---|---|

| Provider A | $1,000,000 | 20 | $1,200 | Guaranteed level premiums, no riders available. |

| Provider B | $1,000,000 | 20 | $1,350 | Guaranteed level premiums, option to add accidental death benefit rider. |

| Provider C | $1,000,000 | 20 | $1,100 | Premiums increase slightly after 10 years, offers several rider options. |

As the table illustrates, Provider C offers the lowest initial premium, but includes a small premium increase after ten years. Provider B has the highest premium but includes the option to add beneficial riders, such as an accidental death benefit. Provider A offers a simple, straightforward policy with guaranteed level premiums, but lacks rider options.

Factors Contributing to Premium Differences

Several key factors explain the differences in premiums observed across providers. These factors are often intertwined and difficult to isolate completely.

Risk Assessment: Each provider uses its own proprietary models and algorithms to assess risk. These models consider factors such as age, health, lifestyle, and family history. Variations in these models lead to different premium calculations.

Administrative Costs and Overhead: Insurers have different operational structures and administrative costs. Companies with higher overhead may pass these costs onto consumers through higher premiums.

Claims Experience: An insurer’s claims experience significantly impacts its pricing. A provider with a history of higher claims payouts may need to charge higher premiums to maintain profitability.

Profit Margins: Profitability goals vary among insurers. Companies aiming for higher profit margins may set higher premiums than those with more modest goals.

Analyzing Policy Features Beyond Premium Cost

While premium cost is a significant factor, focusing solely on it can be short-sighted. A thorough analysis requires considering additional policy features.

Rider Options: Some providers offer a wider range of riders, such as accidental death benefits, critical illness coverage, or waiver of premium options. These riders enhance the policy’s overall value, even if the base premium is slightly higher.

Financial Strength and Stability: It’s crucial to assess the financial stability and reputation of the insurer. A financially sound company is more likely to pay claims when needed. Independent rating agencies provide valuable assessments of insurers’ financial strength.

Customer Service and Claims Processing: Consider the insurer’s reputation for customer service and its efficiency in processing claims. A positive reputation in these areas can be invaluable if you ever need to file a claim.

Closure

In conclusion, while term life insurance premiums are influenced by numerous factors, understanding these variables allows for proactive planning. Whether your premiums remain level or increase depends on several interconnected elements, including your initial health assessment, your chosen policy length, and the insurer’s specific practices. By carefully considering these factors and comparing offerings from different providers, you can secure the most appropriate and affordable term life insurance policy to meet your needs.

Questions Often Asked

What happens if I develop a health condition after purchasing a term life insurance policy?

Your premium will likely not change unless you make a claim. However, if you renew the policy later, your health status at renewal will affect the new premium.

Can I change my term life insurance policy after purchase?

Typically, you can’t change the core aspects (like the death benefit) of your term life insurance policy once it’s in effect. However, some policies might allow you to increase coverage in certain circumstances.

How often are term life insurance premiums paid?

Premiums are typically paid annually, semi-annually, quarterly, or monthly. The frequency you choose may affect the total cost due to potential interest charges.

What is the difference between a guaranteed level premium and a variable premium?

A guaranteed level premium remains the same for the entire policy term, while a variable premium can fluctuate based on factors like interest rates or the insurer’s experience.