Navigating the complexities of health insurance and tax deductions can be daunting. Understanding whether your health insurance premiums are tax deductible significantly impacts your financial well-being. This guide clarifies the often-confusing landscape of health insurance premium deductibility, covering various scenarios for both self-employed individuals and employees, and exploring the influence of factors like Health Savings Accounts (HSAs) and state-specific regulations.

We’ll delve into the specifics of claiming deductions, examining eligible and ineligible expenses, and comparing the tax advantages of different health insurance plans. Through clear explanations and illustrative examples, we aim to empower you with the knowledge needed to optimize your tax situation regarding health insurance premiums.

Deductibility of Health Insurance Premiums

Self-employed individuals face unique challenges when it comes to securing health insurance and managing related tax obligations. Unlike employees who often have premiums deducted directly from their paychecks, the self-employed must handle these expenses independently. Fortunately, the IRS offers tax deductions to help offset the cost of health insurance for those who are self-employed. Understanding these deductions can significantly reduce your tax burden.

Tax Benefits for Self-Employed Individuals

The self-employed can deduct the amount they paid in health insurance premiums for themselves, their spouse, and their dependents. This deduction is taken above the line, meaning it reduces your adjusted gross income (AGI) before other deductions are applied. A lower AGI can lead to lower overall tax liability and potentially eligibility for other tax benefits. This deduction is claimed using Form 1040, Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming), depending on the nature of your self-employment.

Claiming the Deduction: A Step-by-Step Guide

- Gather your documentation: Collect all your health insurance premium payment receipts, statements, or 1099-MISC forms (if applicable).

- Determine your eligible expenses: Ensure you only include premiums paid for qualified health insurance plans. This excludes premiums for supplemental insurance like dental or vision unless bundled with a qualified health plan.

- Complete Schedule C or Schedule F: Report your business income and expenses. Include the total amount of your health insurance premiums paid during the tax year on the appropriate line.

- File your Form 1040: Attach Schedule C or Schedule F to your Form 1040 and file your tax return as usual.

Eligible and Ineligible Health Insurance Premium Expenses

Eligible expenses generally include premiums paid for health insurance plans that meet the requirements of the Affordable Care Act (ACA). These plans typically offer comprehensive coverage, including hospitalization, doctor visits, and prescription drugs.

Ineligible expenses include premiums for non-qualified health plans, such as short-term limited duration insurance or plans that primarily cover specific conditions (like only cancer treatment). Additionally, premiums paid for long-term care insurance, supplemental insurance (unless bundled with a qualified plan), and life insurance are not deductible.

Comparison of Self-Employed Health Insurance Deduction with Other Business Expenses

| Expense Type | Deductibility | Example | Impact on Taxes |

|---|---|---|---|

| Self-Employed Health Insurance Premiums | Above-the-line deduction | $10,000 in premiums paid | Reduces AGI by $10,000, lowering tax liability. |

| Office Rent | Deductible business expense | $12,000 annual rent | Reduces taxable business income. |

| Home Office Expenses | Deductible business expense (subject to limitations) | $2,000 in home office expenses | Reduces taxable business income. |

| Business Travel | Deductible business expense (subject to limitations) | $5,000 in travel expenses | Reduces taxable business income. |

Deductibility of Health Insurance Premiums

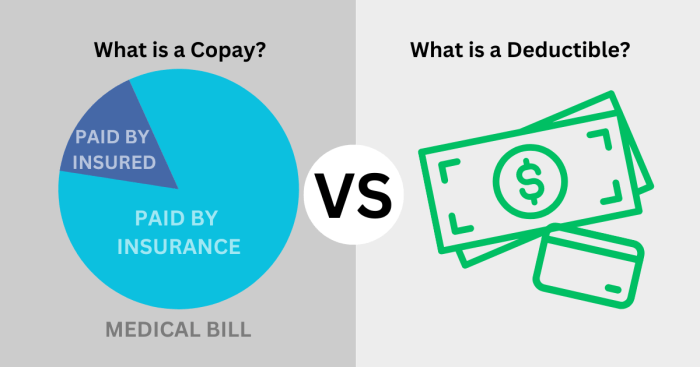

Generally, health insurance premiums paid by employers are not directly deductible by employees. The employer’s contribution is considered a non-taxable fringe benefit. However, there are exceptions and situations where certain premium payments might be deductible for the employee. Understanding these nuances is crucial for accurate tax filing.

Deductibility of Employee-Paid Supplemental Health Insurance Premiums

Employees may be able to deduct premiums paid for supplemental health insurance coverage that goes beyond what their employer provides. This could include things like dental, vision, or additional coverage for specific medical needs not covered under the basic employer-sponsored plan. The deductibility often depends on whether the supplemental coverage is considered part of a qualified health plan and whether it meets specific criteria set by the IRS. For example, if an employee has employer-sponsored health insurance covering basic medical expenses, but chooses to purchase a separate policy for long-term care, the premiums paid for the long-term care insurance might be deductible depending on individual circumstances and tax laws. The specifics can be complex, and consulting a tax professional is recommended for accurate determination.

Scenarios Where Health Insurance Premiums Are Not Deductible for Employees

Premiums paid by employers for employer-sponsored health insurance plans are generally not deductible by employees. This is because the employer’s contribution is considered a non-taxable benefit. Additionally, premiums paid for health insurance that is not considered a qualified health plan under the Affordable Care Act (ACA) may not be deductible. This could include some short-term or limited-benefit plans. Finally, penalties associated with failing to maintain minimum essential health coverage under the ACA are not deductible.

Types of Health Insurance Plans and Their Tax Implications for Employees

The tax implications for employees vary depending on the type of health insurance plan. It’s important to understand these differences to accurately report your income and expenses.

Understanding the tax implications of your health insurance plan is crucial for accurate tax filing. The following list Artikels some common plan types and their general tax implications. Remember, individual situations can be complex, and seeking professional tax advice is always recommended.

- Employer-Sponsored Health Insurance: Premiums paid by the employer are generally not taxable income to the employee. Premiums paid by the employee may be deductible only in limited circumstances (as discussed above).

- Individual Health Insurance Purchased Through the Marketplace: Premiums may be partially offset by tax credits or subsidies, depending on income and other factors. These credits reduce the overall tax liability.

- Self-Employed Health Insurance: Self-employed individuals can deduct the premiums paid for health insurance as a business expense. This deduction is taken on Schedule C (Profit or Loss from Business).

- Supplemental Health Insurance (e.g., Dental, Vision): Premiums paid for supplemental coverage might be deductible if they are considered qualified medical expenses and meet certain criteria, but this is not always the case.

Impact of Health Savings Accounts (HSAs) on Deductibility

Health Savings Accounts (HSAs) offer a powerful tool for managing healthcare costs, but their interaction with the deductibility of health insurance premiums can be complex. Understanding the interplay between HSA contributions and premium deductibility is crucial for maximizing tax advantages. This section will clarify the tax benefits associated with HSAs and how they affect the deductibility of your health insurance premiums.

HSA contributions are tax-deductible, meaning you can reduce your taxable income by the amount you contribute. This is a significant advantage, lowering your current tax burden. However, unlike directly deducting health insurance premiums (which isn’t always possible depending on your plan and tax situation), HSA funds grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This triple tax advantage – deduction for contributions, tax-free growth, and tax-free withdrawals – makes HSAs exceptionally attractive for long-term healthcare cost management. The key difference lies in the timing of the tax benefit: you receive an immediate tax break with premium deductions (if allowed), while the HSA tax benefits unfold over time.

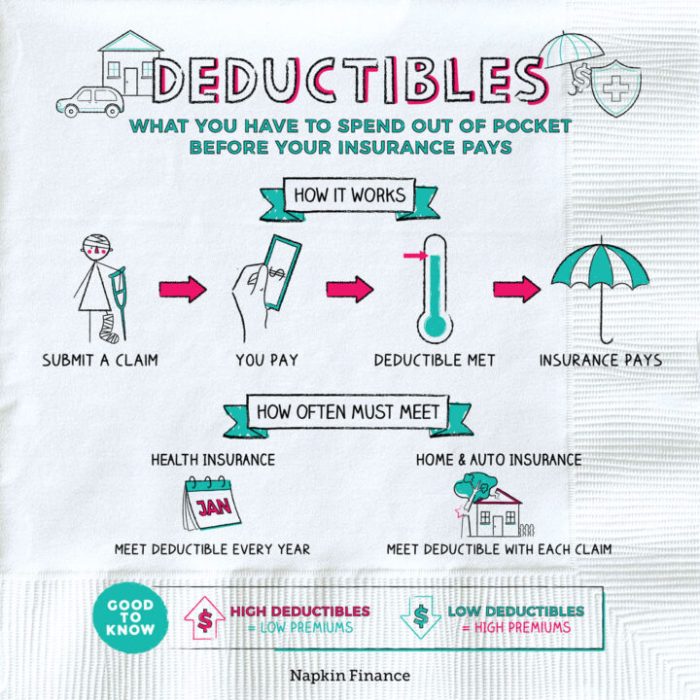

HSA Contribution Rules and Premium Deductibility

To contribute to an HSA, you must be enrolled in a high-deductible health plan (HDHP). The contribution limits are adjusted annually by the IRS and vary based on family status. Exceeding the annual contribution limit results in tax penalties. Crucially, the existence of an HSA doesn’t directly impact the deductibility of your health insurance premiums. The deductibility of premiums depends solely on your specific health insurance plan and whether it qualifies for premium deduction under existing tax laws. For instance, self-employed individuals often have the option to deduct health insurance premiums, regardless of whether they have an HSA. However, if you itemize deductions, the premium deduction might be limited by the adjusted gross income (AGI) thresholds. Therefore, the two are separate but potentially complementary tax-saving strategies.

Tax Benefits Comparison: HSAs vs. Direct Premium Deduction

The following table compares the tax benefits of contributing to an HSA versus directly deducting health insurance premiums, highlighting the key differences:

| Feature | HSA Contributions | Direct Premium Deduction |

|---|---|---|

| Tax Deductibility | Contributions are tax-deductible. | Premiums may be deductible (depending on plan and tax laws). |

| Tax-Free Growth | Funds grow tax-free. | Not applicable. |

| Tax-Free Withdrawals | Withdrawals for qualified medical expenses are tax-free. | Not applicable. |

| Timing of Tax Benefit | Immediate tax deduction for contributions; future tax benefits from tax-free growth and withdrawals. | Immediate tax deduction (if applicable). |

State-Specific Regulations on Health Insurance Premium Deductibility

While the federal government offers some deductions for health insurance premiums, particularly through the self-employed deduction and the ability to use HSAs, the specifics of deductibility often hinge on individual state tax laws. These laws can vary significantly, impacting how much taxpayers can reduce their state income tax liability. Understanding these variations is crucial for accurate tax preparation.

State tax codes frequently diverge from federal guidelines regarding health insurance premium deductibility. Some states may mirror federal rules, allowing deductions only under specific circumstances, such as self-employment. Others might offer more generous deductions, allowing for the deduction of premiums even for those employed by a company, or offer deductions for specific health plans. Conversely, some states might not allow any state-level deduction for health insurance premiums, regardless of the taxpayer’s employment status or the type of health insurance plan.

Variations in State Tax Laws

State tax laws regarding health insurance premium deductibility demonstrate considerable diversity. For example, California might allow a deduction for premiums paid by self-employed individuals, but not for those employed by a company. Conversely, New York might offer a tax credit for health insurance premiums paid by low-to-moderate-income individuals, irrespective of their employment status. Meanwhile, a state like Texas may not offer any state-level deduction for health insurance premiums at all. These differences underscore the importance of consulting state-specific resources.

Locating State-Specific Information

Individuals can find state-specific information on health insurance premium tax deductions through several reliable channels. State tax agency websites are the primary resource. These websites typically contain detailed instructions, publications, and forms related to state income tax, including information on allowable deductions. Additionally, consulting a qualified tax professional is highly recommended. Tax professionals possess up-to-date knowledge of state and federal tax laws and can offer personalized guidance based on individual circumstances. Finally, researching reputable financial websites and tax publications can provide helpful overviews and comparative analyses of state tax policies.

Researching State-Level Tax Implications

Researching the tax implications of health insurance premiums at the state level involves a systematic approach. Begin by identifying the relevant state tax agency website. Use s like “health insurance deduction,” “medical expense deduction,” or “tax credits for health insurance” in the website’s search function. Carefully review any publications or forms related to individual income tax. Pay close attention to eligibility requirements, such as income limits or employment status, and the documentation needed to claim the deduction. If uncertainty remains, consulting a tax professional is advisable to ensure compliance and maximize potential tax savings. Comparing state tax codes with federal regulations will highlight the areas of divergence and allow for a comprehensive understanding of the complete tax picture.

Illustrative Scenarios

Understanding the deductibility of health insurance premiums hinges on several factors, primarily your tax filing status and whether you or your employer are contributing to the cost. Let’s examine scenarios illustrating both deductible and non-deductible situations.

Scenario: Deductible Health Insurance Premiums

Sarah, a self-employed freelance writer, paid $7,200 in health insurance premiums during the tax year. She is single and itemizes her deductions. Because she is self-employed, she can deduct the full amount of her health insurance premiums as a business expense on Schedule C (Profit or Loss from Business) of her Form 1040. This directly reduces her taxable income, resulting in a lower tax liability. Assuming a 22% marginal tax bracket, this deduction saves her $1,584 ($7,200 x 0.22) in federal income taxes. Additional state tax benefits may apply depending on her state’s tax laws. Note that this scenario assumes she meets all other requirements for self-employment deductions.

Scenario: Non-Deductible Health Insurance Premiums

Mark is employed by a large corporation and receives comprehensive health insurance coverage as part of his employee benefits package. His employer pays a significant portion of the premium, and Mark contributes $100 per month, or $1200 annually. Mark cannot deduct his health insurance premiums because the premiums are considered part of his compensation, and he is not self-employed. The cost of his health insurance is factored into his overall taxable income. Even if he were to itemize his deductions, health insurance premiums paid by employees through payroll deductions are generally not deductible. The only exception might be if he were to have a health savings account (HSA) and meet the eligibility requirements. However, in this case, that is not the situation.

Ultimate Conclusion

Successfully navigating the tax implications of health insurance premiums requires a thorough understanding of your individual circumstances and applicable laws. While the rules can be intricate, this guide provides a solid foundation for making informed decisions. Remember to consult with a qualified tax professional for personalized advice tailored to your specific situation. By understanding the nuances of deductibility, you can effectively manage your healthcare costs and optimize your tax return.

Questions Often Asked

Can I deduct health insurance premiums if I’m on my spouse’s plan?

Generally, no. Deductions are typically only available for premiums you personally pay.

What if I have both employer-sponsored insurance and a supplemental plan?

You may be able to deduct premiums paid for supplemental coverage, but not the premiums covered by your employer.

Are there penalties for contributing too much to an HSA?

Yes, there are annual contribution limits for HSAs. Contributions exceeding these limits may be subject to penalties.

How do I prove my health insurance premium payments for tax purposes?

Retain all your premium payment receipts and statements as proof of payment. Your insurance provider can also often provide a summary of payments made.