Navigating the world of health insurance can feel like deciphering a complex code. One common point of confusion lies in understanding the relationship between your monthly premium and your deductible. Many individuals wonder: does the premium payment somehow cover the deductible? This exploration will clarify the distinct roles of premiums and deductibles, helping you make informed decisions about your healthcare coverage.

We’ll break down the components of a health insurance premium, explain how deductibles function within the system, and compare different plan types to illustrate how premiums and deductibles interact. By the end, you’ll have a clear understanding of how these crucial elements affect your overall healthcare costs.

Defining Health Insurance Premiums

Understanding health insurance premiums is crucial for navigating the healthcare system. Your premium is essentially the recurring payment you make to your insurance company in exchange for coverage. This payment secures your access to a range of healthcare services, subject to the terms and conditions Artikeld in your specific plan.

Components of Health Insurance Premiums

Several factors contribute to the overall cost of your health insurance premium. These can broadly be categorized as administrative costs (covering the insurer’s operational expenses), provider network costs (reimbursing healthcare providers for services rendered), and risk assessment (predicting and managing potential claims). The insurer’s profit margin is also factored into the final premium amount. These components work together to determine the monthly or annual payment you’ll make.

Premium vs. Out-of-Pocket Costs

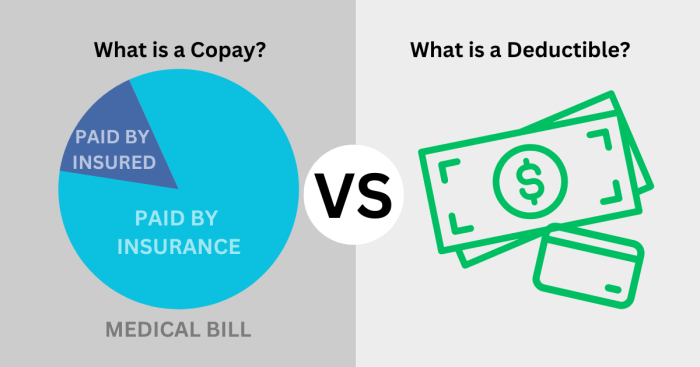

It’s important to distinguish between your premium and your out-of-pocket costs. Your premium is the regular payment you make to maintain your insurance coverage. Out-of-pocket costs, on the other hand, are the expenses you pay directly for healthcare services, such as your deductible, copayments, and coinsurance. These costs arise *after* you’ve already paid your premium. For example, you might pay a monthly premium of $300, but still have to pay a $1000 deductible before your insurance starts covering most expenses.

Factors Influencing Premium Costs

Numerous factors influence the cost of your health insurance premium. These include your age, location (premiums vary geographically), the type of plan you choose (HMO, PPO, EPO, etc.), your health status (pre-existing conditions can impact premiums), and the number of people covered under your plan (family plans are generally more expensive than individual plans). Tobacco use and your chosen level of coverage (e.g., higher deductibles often mean lower premiums) also significantly influence your premium. For instance, a smoker in a high-cost area might pay substantially more than a non-smoker in a rural area with the same plan.

Comparison of Health Insurance Plan Premiums

The following table compares monthly premiums across different health insurance plan types. Note that these are illustrative examples and actual premiums will vary widely based on the factors mentioned above.

| Plan Type | Monthly Premium | Deductible | Copay (Doctor Visit) |

|---|---|---|---|

| HMO | $250 | $1000 | $25 |

| PPO | $350 | $2000 | $40 |

| EPO | $300 | $1500 | $30 |

Understanding the Deductible

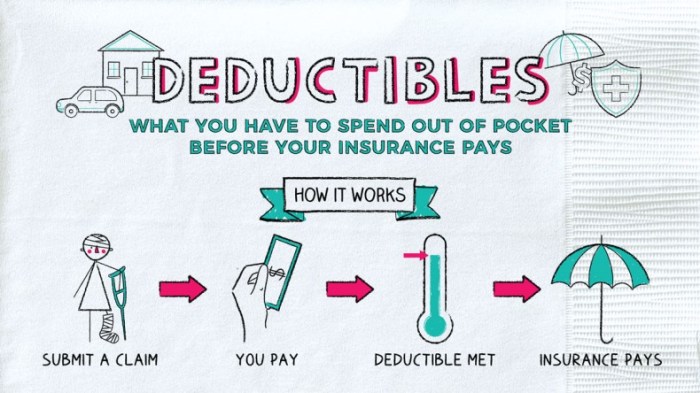

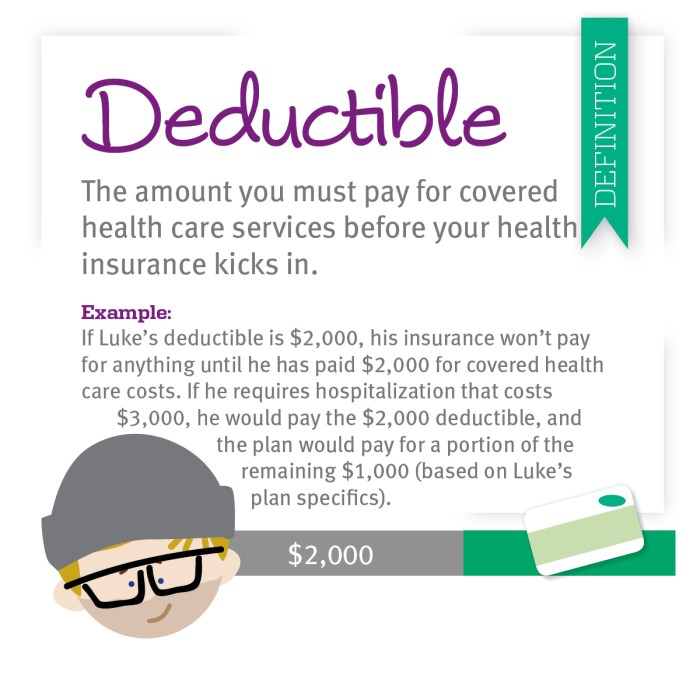

Your health insurance deductible is the amount of money you must pay out-of-pocket for covered healthcare services before your insurance company starts to pay. It acts as a buffer, requiring you to shoulder some initial costs before the plan’s benefits kick in. Understanding how your deductible works is crucial for managing healthcare expenses and avoiding unexpected bills.

The purpose of a health insurance deductible is to share the cost of healthcare between the insured individual and the insurance company. It encourages individuals to be more mindful of their healthcare spending and to utilize services responsibly. By requiring an upfront payment, deductibles help to control costs for the insurance provider, leading to potentially lower premiums for everyone. The deductible amount is typically an annual figure that resets at the beginning of each policy year.

Deductible Application to Covered Services

Deductibles apply only to covered services specified in your health insurance policy. This means that the cost of services explicitly listed as covered by your plan will count towards your deductible. Once you’ve met your deductible, your insurance company will typically begin to cover a percentage of the remaining costs, as Artikeld in your plan’s co-insurance details. However, even after meeting your deductible, you might still have co-pays or other cost-sharing responsibilities.

Examples of Deductible Application and Non-Application

Let’s consider two scenarios. In the first, Sarah has a $2,000 deductible. She visits her doctor for a routine check-up, costing $150. This $150 is applied towards her $2,000 deductible. Later, she needs an emergency appendectomy costing $10,000. The first $2,000 of the appendectomy bill goes towards her deductible. After that, her insurance will start to cover the remaining costs according to her plan’s co-insurance percentage.

In the second scenario, John also has a $2,000 deductible, but he receives a preventative care service – a flu shot – covered by his insurance. This service is usually exempt from the deductible. Therefore, the cost of the flu shot doesn’t reduce the amount he needs to pay before his insurance coverage kicks in for other medical expenses.

Flowchart Illustrating Deductible Fulfillment

Imagine a flowchart. The starting point is “Healthcare Service Required”. This branches into two paths: “Service Covered by Insurance” and “Service Not Covered by Insurance”. The “Service Not Covered” path leads to “Patient Pays Full Cost”.

The “Service Covered” path continues to “Deductible Met?”. If “No”, the flow goes to “Amount Applied to Deductible”, then back to “Healthcare Service Required”. If “Yes”, the flow moves to “Co-insurance Applies”, then to “Patient Pays Co-insurance and Co-pays”, and finally to “Insurance Pays Remaining Costs”. This visual representation simplifies the process of understanding how the deductible impacts out-of-pocket expenses.

Epilogue

Understanding the difference between your health insurance premium and your deductible is vital for effective healthcare financial planning. While your premium secures your coverage, the deductible represents your upfront responsibility before insurance benefits kick in. Choosing a plan with a high premium and low deductible offers greater immediate coverage, while a low-premium, high-deductible plan requires a larger upfront investment but may offer lower monthly costs. Careful consideration of your individual needs and risk tolerance is key to selecting the plan that best suits your circumstances.

Question Bank

What happens if I don’t meet my deductible?

You are responsible for paying all medical expenses until you meet your deductible. After meeting your deductible, your insurance will typically begin to cover a percentage of your expenses according to your plan’s coinsurance.

Can I pay my deductible in installments?

This depends entirely on your insurance provider and the specific terms of your policy. Some insurers may offer payment plans, while others may require full payment upfront. Contact your insurance company to inquire about payment options.

Does my deductible reset every year?

Generally, yes. Most health insurance plans reset the deductible at the beginning of each new plan year.

How does my deductible affect my out-of-pocket maximum?

Once you meet your out-of-pocket maximum, your insurance company covers 100% of your eligible medical expenses for the remainder of the plan year, regardless of whether you’ve met your deductible.