Securing your family’s financial future through life insurance is a significant decision. Whole life insurance, known for its lifelong coverage, often raises questions about premium costs. A key concern for many prospective policyholders is whether premiums increase with age, impacting long-term financial planning. This guide delves into the intricacies of whole life insurance premiums, exploring the relationship between age, premium adjustments, and other influential factors. We’ll examine guaranteed versus non-guaranteed premiums, the impact of policy riders, and provide clarity on this often-misunderstood aspect of life insurance.

Understanding how premiums behave over time is crucial for making informed decisions. This analysis will empower you to navigate the complexities of whole life insurance and choose a policy that aligns with your financial goals and long-term stability. We’ll explore the various components that contribute to premium costs, helping you understand what you’re paying for and how those costs might change over your lifetime.

Age and Premium Increases

Whole life insurance premiums are generally level, meaning they remain the same throughout the life of the policy. However, this doesn’t mean the cost of insurance doesn’t change with age; the insurer’s risk assessment changes, which is reflected in the initial premium calculation. While the premium itself doesn’t increase yearly like term life insurance, the underlying cost of insuring your life at an older age is factored into the initial premium.

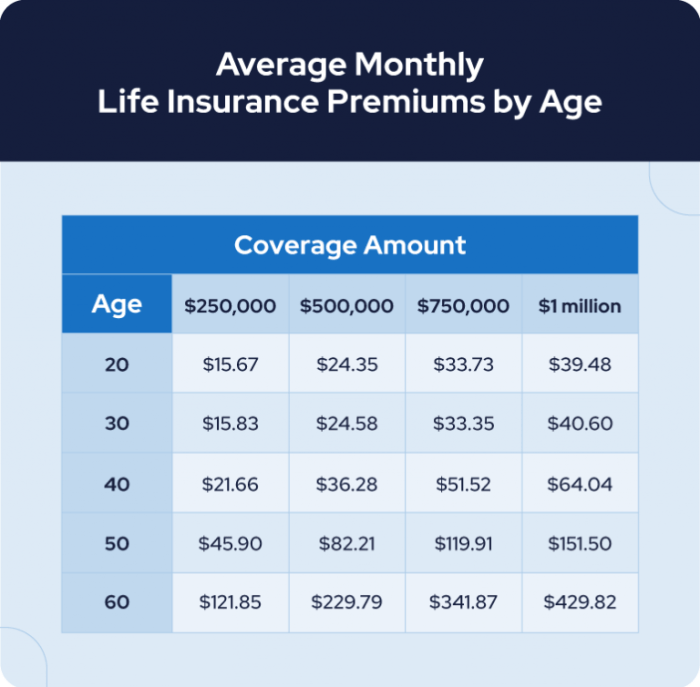

The relationship between a policyholder’s age and the premium is fundamentally about risk assessment. Insurers use actuarial tables and sophisticated models to predict the likelihood of a death claim at various ages. Statistically, the older a person gets, the higher the probability of death within a given timeframe. This increased risk is built into the premium calculation from the outset. The insurer essentially pools the premiums from all policyholders to cover claims. Since older individuals have a higher statistical probability of a claim, their inclusion in the pool contributes to a higher overall cost, which affects the premiums for everyone, although the premiums for individuals remain level throughout their lives.

Insurer Risk Assessment Based on Age

Insurers use a variety of factors to assess risk, with age being a primary one. Mortality tables, based on extensive demographic and mortality data, provide the statistical foundation for these assessments. These tables show the probability of death at different ages. Beyond basic age, other health factors, lifestyle choices (smoking, for instance), and family history also influence the assessment, but age is a fundamental component because it’s a strong predictor of mortality. A 30-year-old is statistically less likely to pass away within the next year than a 70-year-old. This difference in probability is reflected in the overall premium calculation, even though the premium itself is level for the policyholder.

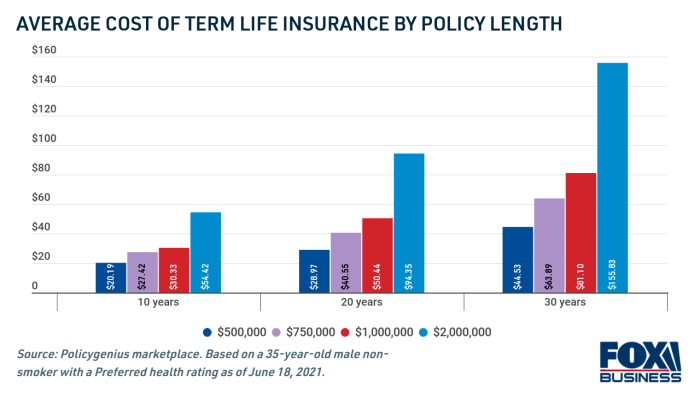

Premium Increase Patterns in Whole Life vs. Other Insurance Types

Unlike whole life insurance, term life insurance premiums typically increase at renewal. Term life insurance covers a specific period, and the premium reflects the risk for that period. As the policyholder ages, the risk increases, leading to higher premiums at each renewal. This is a key difference from whole life insurance, where the premium remains level throughout the policy’s duration. Universal life insurance offers more flexibility, and while premiums are not fixed, they are typically adjusted based on the performance of the underlying investment component, not solely based on age. Whole life’s level premium structure contrasts sharply with the fluctuating premiums seen in other life insurance types.

Typical Whole Life Premium Increase Curve

Imagine a graph with “Time (Years)” on the x-axis and “Underlying Cost of Insurance” on the y-axis. The curve would be a relatively flat, gently upward-sloping line. The slope would be minimal, representing the fact that the premium itself doesn’t increase. However, the underlying cost to the insurer for insuring that life does gradually increase due to the higher probability of a claim over time. The line would start at a relatively low point (representing the lower risk associated with younger ages) and gradually rise over the policyholder’s lifetime, although this rise is implicitly factored into the initial, level premium. It’s important to understand that this is a representation of the insurer’s underlying cost, not the premium paid by the policyholder, which remains constant.

Policy Riders and Premium Adjustments

Adding riders to a whole life insurance policy significantly impacts the overall premium. Riders provide additional coverage beyond the basic death benefit, offering protection against specific circumstances. Understanding how these riders affect your premiums is crucial for making informed decisions about your policy.

Policy riders are essentially add-ons that modify or enhance the benefits of your base whole life insurance policy. They are purchased separately and usually come with an additional cost. The cost of the rider depends on several factors, including your age, health, and the type of rider selected. The cumulative effect of multiple riders can substantially increase your premiums.

Impact of Common Riders on Premiums

Common riders, such as long-term care (LTC) or disability income benefits, increase premiums due to the added risk the insurance company assumes. An LTC rider provides coverage for expenses related to long-term care, such as nursing home or assisted living facility costs. A disability income rider offers income replacement if you become disabled and unable to work. These riders represent substantial financial obligations for the insurance company, leading to higher premiums. The exact increase depends on factors such as the benefit amount and the length of coverage. For example, a high benefit amount for a long-term care rider will result in a higher premium than a lower benefit amount. Similarly, a rider offering coverage for a longer duration will naturally cost more than one offering shorter-term coverage.

Premium Impact of Various Riders

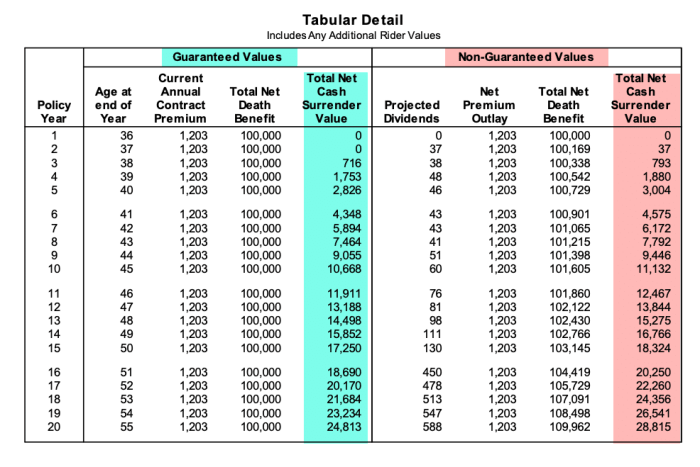

The following table illustrates the potential premium impact of adding various common riders to a whole life insurance policy. These figures are illustrative and will vary based on individual circumstances and the specific insurance company.

| Rider Type | Added Cost (Approximate Annual Percentage Increase) | Potential Benefits |

|---|---|---|

| Long-Term Care Rider | 10-30% | Covers long-term care expenses, such as nursing home or assisted living costs. |

| Disability Income Rider | 5-20% | Provides monthly income if you become disabled and unable to work. |

| Accelerated Death Benefit Rider | 2-10% | Allows access to a portion of your death benefit while you are still alive to cover terminal illness expenses. |

| Waiver of Premium Rider | 3-8% | Waives future premiums if you become totally disabled. |

Note: These percentage increases are estimates and can vary considerably depending on factors such as the policyholder’s age, health, the specific terms of the rider, and the insurance company. It is always advisable to consult with an insurance professional for personalized cost estimations.

Final Summary

In conclusion, while age is a significant factor influencing whole life insurance premiums, it’s not the sole determinant. The type of policy (guaranteed versus non-guaranteed), your health status, lifestyle choices, and added riders all play crucial roles in shaping your premium costs. By carefully considering these factors and understanding the potential for premium adjustments, you can make a well-informed decision that aligns with your financial circumstances and long-term objectives. Remember to consult with a qualified insurance professional to personalize your policy selection and ensure it meets your specific needs.

Top FAQs

What is the average rate of premium increase in whole life insurance?

There’s no single average rate. Increases depend on the policy type (guaranteed vs. non-guaranteed), the insurer, and individual factors. Some policies have level premiums, while others may see increases over time.

Can I reduce my whole life insurance premiums after I purchase the policy?

Generally, you cannot reduce your premiums after purchasing a whole life policy, especially if it has level premiums. However, you might be able to adjust your policy’s coverage amount, potentially affecting your premiums.

Does paying my premiums on time affect future increases?

While timely payments are crucial for maintaining your coverage, they generally don’t directly influence future premium increases, unless specified in your policy contract.

How often do whole life insurance premiums typically increase?

This depends on the policy. Some have level premiums throughout the policy’s life, while others may have increases at specified intervals or based on certain conditions.