Universal life insurance offers a flexible approach to life insurance coverage, allowing policyholders to adjust their death benefit and premium payments over time. However, a key question many prospective buyers have is whether premiums inevitably rise with age. This guide delves into the complexities of universal life insurance premiums, examining the factors that influence their fluctuations and providing clarity on how age plays a role.

Understanding the relationship between age and universal life insurance premiums is crucial for informed decision-making. This involves not only grasping the initial premium calculation but also anticipating potential future adjustments. We will explore the interplay of mortality charges, expenses, policy riders, and investment performance in shaping premium costs throughout the policy’s lifespan.

Universal Life Insurance Fundamentals

Universal life (UL) insurance offers a flexible approach to life insurance, combining a death benefit with a cash value component that grows tax-deferred. Unlike term life insurance, which provides coverage for a specified period, UL insurance offers lifelong coverage as long as premiums are paid and the policy remains in force. This flexibility makes it a potentially attractive option for those seeking long-term coverage and investment growth.

Universal life insurance policies operate on a foundation of two key elements: a death benefit and a cash value account. The death benefit is the amount paid to your beneficiaries upon your death, while the cash value component acts as a savings account that grows over time. Policyholders have a degree of control over their premiums and how the cash value is managed, making it a customizable option compared to traditional whole life insurance.

Cash Value Accumulation in Universal Life Insurance

The cash value in a universal life policy grows through the accumulation of premium payments minus mortality and expense charges. The insurer invests a portion of the premiums, and the earnings are credited to the cash value account. The growth rate is often tied to market-based interest rates, although some policies offer fixed interest rates. Policyholders can typically access the cash value through withdrawals or loans, although these actions may impact the death benefit or the policy’s overall performance. It’s crucial to understand the fees and charges associated with these transactions. For example, a policy might charge a surrender charge for early withdrawals, reducing the amount available to the policyholder.

Types of Universal Life Insurance Policies

Several variations of universal life insurance exist, each with its own characteristics and features. Two primary types are:

- Variable Universal Life (VUL): In VUL policies, the cash value is invested in sub-accounts that mirror various market indexes, such as stocks or bonds. This offers the potential for higher returns but also carries greater risk compared to fixed universal life policies. Investment choices within the sub-accounts are selected by the policyholder, influencing the growth potential of the cash value. A poorly performing investment strategy could result in lower cash value accumulation.

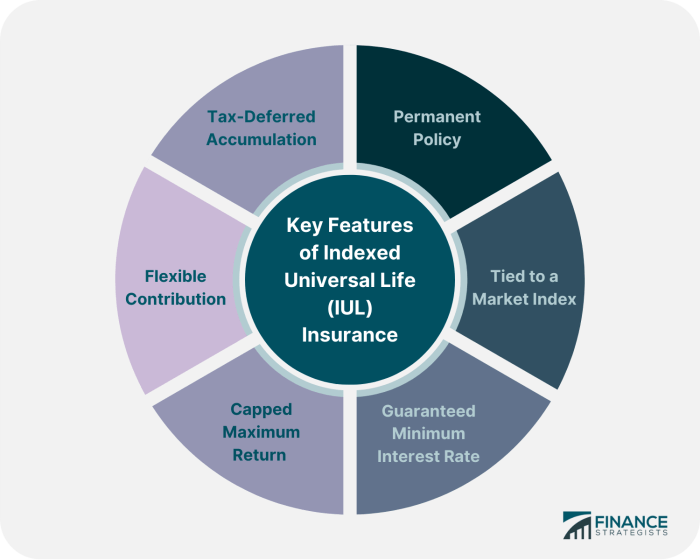

- Indexed Universal Life (IUL): IUL policies offer a balance between growth potential and risk mitigation. The cash value growth is linked to a market index (e.g., the S&P 500), but the returns are typically capped at a predetermined rate. This means you benefit from positive market performance up to the cap, protecting against significant losses if the market declines. The growth rate is not directly tied to market fluctuations but rather to a predetermined formula based on the performance of the selected index.

Term Life Insurance vs. Universal Life Insurance

The choice between term life and universal life insurance depends heavily on individual financial goals and risk tolerance. Here’s a comparison:

| Policy Type | Premium Structure | Coverage Duration | Cash Value |

|---|---|---|---|

| Term Life Insurance | Level premiums for a set period; premiums increase significantly or coverage ends upon renewal. | Specific term (e.g., 10, 20, 30 years) | None |

| Universal Life Insurance | Flexible premiums; can adjust payments within certain limits; potential for increasing premiums if cash value growth is insufficient to cover costs. | Lifelong, provided premiums are paid and policy remains in force. | Accumulates tax-deferred; can be accessed via withdrawals or loans. |

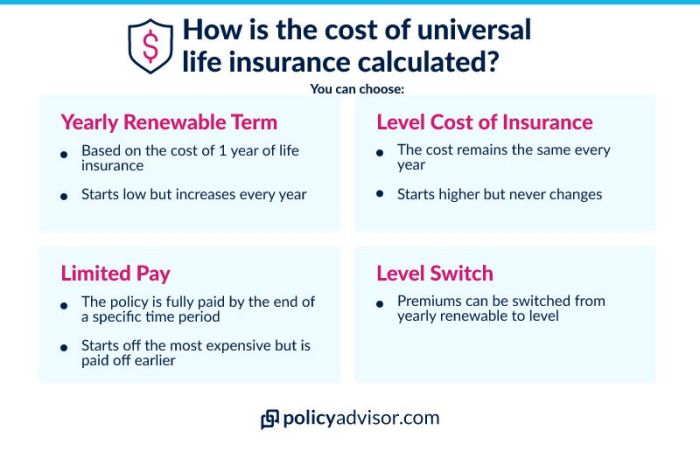

Premium Payment Structure in Universal Life Insurance

Universal life (UL) insurance premiums are designed for flexibility, but this flexibility comes with a complexity that impacts how much you pay and how your policy grows. Unlike term life insurance with fixed premiums, UL premiums can change over time based on several interacting factors. Understanding these factors is crucial for managing your policy effectively.

Factors Influencing Universal Life Insurance Premiums

Several key factors determine your universal life insurance premiums. The most significant are your age, health, the death benefit you choose, the cash value accumulation rate, and the policy’s expense charges. Your initial premium reflects an assessment of these factors at the time of policy issuance. Subsequent premium adjustments depend on how these factors evolve over the policy’s lifespan and your choices regarding premium payments and cash value withdrawals. It’s important to note that insurers use sophisticated actuarial models to calculate these premiums, incorporating vast datasets on mortality rates, interest rates, and expenses.

The Role of Age in Determining Initial Premiums

Age is a primary factor influencing your initial UL premium. Younger individuals generally receive lower premiums because they have a statistically longer life expectancy. Insurers assess a higher risk for older applicants due to their increased likelihood of claiming the death benefit sooner. This risk translates to higher premiums to offset the increased probability of a payout. This is a fundamental principle of life insurance pricing: the younger and healthier you are, the less expensive the insurance.

Examples of How Premiums Might Change Over Time

Let’s consider a few scenarios. If you consistently overfund your policy (paying more than the minimum premium), your cash value will grow faster, potentially lowering future minimum premiums or even allowing you to stop paying premiums altogether while still maintaining the death benefit. Conversely, if interest rates fall unexpectedly, or if you withdraw significant amounts from the cash value, your minimum premium might increase to maintain the death benefit coverage. Similarly, if you choose to increase your death benefit, your premiums will also likely increase to reflect the higher risk the insurer is assuming.

Premium Changes for a 30-Year-Old vs. a 50-Year-Old Over 20 Years

This example uses hypothetical values for illustrative purposes and does not reflect any specific insurer’s pricing. Actual premiums and cash value growth will vary significantly based on the policy’s specifics, interest rates, and insurer fees.

| Age | Year | 30-Year-Old Premium Amount | 50-Year-Old Premium Amount |

|---|---|---|---|

| 30 | 1 | $1,000 | $2,500 |

| 31 | 2 | $1,020 | $2,600 |

| 40 | 11 | $1,150 | $3,200 |

| 50 | 21 | $1,300 | $4,000 |

Note: This table only shows premium amounts. Cash value growth would be a separate calculation dependent on interest rates earned and fees charged, varying significantly for each policyholder. The 50-year-old’s significantly higher premium reflects the increased risk associated with their age. While the 30-year-old’s premium increases gradually, the 50-year-old’s premium increases more substantially over the same period, highlighting the impact of age on premium costs. It is important to remember that these are hypothetical examples, and actual results will vary.

Policy Adjustments and Rider Impact

Understanding how policy adjustments and added riders affect your universal life insurance premiums is crucial for long-term financial planning. These changes can significantly impact your monthly or annual outlays, and a thorough understanding will help you make informed decisions about your coverage.

Adding riders to your universal life insurance policy, such as long-term care or disability coverage, increases your premiums. This is because the insurance company is assuming additional risk and guaranteeing benefits beyond the basic death benefit. The extent of the premium increase depends on the type and scope of the rider, your age and health, and the specific terms of the rider itself. Policy adjustments, like increasing the death benefit or altering the premium payment schedule, similarly affect the cost.

Rider Premium Increases

Adding riders increases premiums because the insurance company is taking on more risk. For example, a long-term care rider adds a significant cost because it provides coverage for extensive and potentially expensive long-term care services. Similarly, a disability rider increases premiums as it covers income replacement should you become disabled. The premium increase for these riders varies widely based on factors like the benefit amount, your age and health status, and the specific terms of the rider. A younger, healthier individual might see a smaller increase compared to an older individual with pre-existing conditions. For instance, adding a $100,000 long-term care rider to a policy might increase premiums by $50-$200 per month, depending on the factors mentioned above.

Impact of Policy Adjustments on Premiums

Increasing your death benefit directly increases your premiums. A higher death benefit means the insurance company is obligated to pay a larger sum upon your death, necessitating a larger premium to cover this increased risk. Changing your premium payment schedule, such as switching from annual to monthly payments, might also lead to a slight increase due to administrative costs. For example, increasing a $500,000 death benefit to $1,000,000 could easily double the annual premium. Switching from annual to monthly payments might add a small percentage to the overall cost, perhaps 2-3%, due to the increased administrative burden on the insurance company.

Examples of Premium Increase Scenarios

Let’s consider a hypothetical scenario. John, age 45, has a $500,000 universal life insurance policy with an annual premium of $2,000. If he adds a long-term care rider with a $100,000 benefit, his annual premium might increase to $2,800. If he later decides to increase his death benefit to $1,000,000, his annual premium could jump to $5,000 or more. This illustrates how both riders and benefit increases significantly impact the overall cost. Another example could be Mary, age 55, who decides to change her payment schedule from annual to monthly. Her annual premium of $3,000 might become approximately $250 per month, a slight increase reflecting administrative costs.

Policy Management Strategies and Long-Term Premium Costs

Careful policy management can mitigate premium increases. For instance, maintaining a healthy lifestyle can help prevent premium increases associated with changes in health status. Regularly reviewing your policy needs and adjusting coverage accordingly can also prevent unnecessary premium increases. Choosing a lower death benefit or forgoing certain riders can significantly reduce your premiums. Conversely, delaying adjustments or ignoring potential needs can lead to substantially higher premiums in the long run. Proactive planning and understanding the implications of various adjustments are key to keeping premiums manageable over time.

Last Recap

In conclusion, while universal life insurance offers flexibility, it’s essential to recognize that premiums are not static. Age is a significant factor influencing premium increases, alongside mortality charges, expenses, and policy adjustments. By understanding these dynamics and carefully considering your long-term financial goals, you can make an informed decision about whether universal life insurance aligns with your needs and budget. Proactive financial planning and regular review of your policy are crucial for managing premium costs effectively.

Questions and Answers

What is the difference between level term and universal life insurance premiums?

Level term life insurance premiums remain constant throughout the policy term, while universal life insurance premiums can fluctuate based on factors like age, policy adjustments, and investment performance.

Can I reduce my universal life insurance premiums?

In some cases, you might be able to reduce your premiums by lowering your death benefit or changing your premium payment schedule. Consult with your insurance provider to explore these options.

How do investment returns affect universal life insurance premiums?

Favorable investment returns on the cash value component can potentially offset some premium increases, but this is not guaranteed and depends on market performance.

What happens if I stop paying premiums on my universal life insurance policy?

If premiums are not paid, the policy may lapse, resulting in the loss of coverage and cash value accumulation. The specific consequences depend on the policy’s terms and conditions.