The cost of term life insurance is a significant consideration for many. Understanding how and why premiums fluctuate is crucial for making informed decisions about financial protection. This guide explores the various factors influencing term insurance premium increases, providing clarity on this often-complex topic and empowering you to navigate the insurance landscape with confidence.

From the impact of age and health to market conditions and policy features, we delve into the intricacies of premium adjustments. We’ll examine how insurers calculate premiums, the role of economic factors, and the importance of regular policy review. By the end, you’ll possess a comprehensive understanding of what can cause your premiums to rise and how to proactively manage your insurance costs.

Factors Influencing Premium Increases

Several key factors influence how much you pay for term life insurance. Understanding these factors can help you make informed decisions about your policy and budget. These factors are not static; they can change over time, potentially affecting your premium payments.

Age’s Effect on Term Insurance Premiums

Age is a significant factor determining term life insurance premiums. As you get older, your risk of death increases, leading to higher premiums. Insurers base their calculations on actuarial tables that show the probability of death at different ages. A 30-year-old will generally pay considerably less than a 50-year-old for the same coverage because the insurer assesses a lower risk. This is a fundamental principle of life insurance pricing.

Health Conditions and Premium Costs

Pre-existing health conditions significantly impact premium costs. Insurers assess applicants’ medical history to determine their risk profile. Individuals with conditions like heart disease, diabetes, or cancer will generally face higher premiums than those with no significant health issues. The severity and type of condition play a crucial role in determining the premium increase. Some insurers may even decline coverage for applicants with certain severe health problems.

Smoking Habits and Premium Determination

Smoking is a major health risk and significantly increases the likelihood of premature death. Therefore, smokers typically pay substantially higher premiums than non-smokers. The increased risk associated with smoking is reflected in higher mortality rates used in actuarial calculations. Quitting smoking can, over time, lead to lower premiums in some cases, depending on the insurer’s policy.

Premiums for Different Policy Durations

The length of your term life insurance policy also affects the premium. Generally, longer-term policies (e.g., 20-year terms) will have higher annual premiums than shorter-term policies (e.g., 10-year terms). This is because the insurer is covering a longer period of risk. While the total cost over the policy’s lifetime might be higher for a longer term, the annual premium payment is typically lower in the shorter term.

Other Lifestyle Factors Influencing Premium Calculations

Beyond age, health, and smoking, other lifestyle factors can influence premiums. These include factors such as Body Mass Index (BMI), occupation (high-risk occupations may lead to higher premiums), and family history of certain diseases. Insurers consider a holistic picture of your lifestyle and risk profile when setting your premium.

Premium Comparison Table

| Age | Good Health | Moderate Health Issues | Poor Health |

|---|---|---|---|

| 30 | $200/year | $300/year | $500/year (or declined) |

| 40 | $350/year | $500/year | $800/year (or declined) |

| 50 | $600/year | $900/year | $1500/year (or declined) |

*Note: These are illustrative examples and actual premiums will vary significantly based on many factors, including the specific insurer, coverage amount, and policy details. Consult an insurance professional for accurate quotes.

Premium Adjustments Over Time

Life insurance premiums aren’t static; they fluctuate based on a complex interplay of factors. Insurers regularly review and adjust premiums to ensure the financial stability of their operations and to accurately reflect the evolving risks they underwrite. This adjustment process is crucial for maintaining a sustainable insurance market.

Insurers adjust premiums based on a variety of market conditions. These adjustments aim to balance the insurer’s need for profitability with the affordability of coverage for policyholders. This balancing act requires sophisticated actuarial modeling and a deep understanding of economic trends.

Economic Factors Influencing Premium Changes

Economic factors significantly influence the cost of life insurance. Inflation, for example, increases the cost of providing benefits, necessitating premium increases to maintain coverage levels. Similarly, changes in interest rates directly impact an insurer’s investment returns, which in turn affect their ability to pay claims and consequently influence premiums. A period of high inflation, coupled with low interest rates, could lead to substantial premium increases. Conversely, a period of low inflation and high interest rates could potentially lead to lower premiums or slower premium growth. For example, during periods of high inflation in the 1970s and early 1980s, life insurance premiums rose significantly to compensate for increased claim payouts and administrative costs.

Mortality Rate Impacts on Premiums

Mortality rates, representing the number of deaths within a specific population, are a cornerstone of life insurance pricing. Improvements in healthcare and lifestyle changes can lead to lower mortality rates. This positive trend allows insurers to potentially lower premiums, as the risk of paying out claims decreases. Conversely, an increase in mortality rates due to factors such as a pandemic or a significant shift in public health trends would likely lead to premium increases to offset the heightened risk. For instance, the COVID-19 pandemic initially caused some insurers to re-evaluate their mortality assumptions and adjust premiums accordingly, though this varied based on specific insurer models and risk assessments.

Regulatory Changes and Premium Costs

Government regulations play a substantial role in shaping the life insurance landscape. Changes in regulatory requirements, such as stricter capital adequacy standards or new solvency regulations, can increase an insurer’s operational costs. These increased costs are often passed on to policyholders in the form of higher premiums. For example, the implementation of stricter reserve requirements by a regulatory body would necessitate insurers to hold larger capital reserves, potentially leading to increased premiums to compensate for this added financial burden.

Hypothetical Scenario: Interest Rate Impact on Premiums

Let’s consider a hypothetical scenario. Imagine an insurer with a large portfolio of term life insurance policies. Initially, they assume a stable interest rate of 3% per annum for their investment portfolio. This allows them to price premiums competitively. However, if interest rates unexpectedly drop to 1% per annum, their investment returns significantly decrease. To maintain the same level of profitability and solvency, the insurer would likely need to increase premiums to compensate for the reduced investment income. This adjustment is necessary to ensure they can still meet their obligations to pay out death benefits to beneficiaries. The magnitude of the premium increase would depend on the insurer’s specific investment strategy and the extent of the interest rate decline. A similar, but opposite, effect would occur if interest rates rose significantly.

Understanding Your Policy and Premium Changes

Understanding your term life insurance policy and the factors influencing premium adjustments is crucial for maintaining adequate coverage and managing your financial planning. Regularly reviewing your policy and understanding your insurer’s communication regarding premium changes ensures you remain informed and can make necessary adjustments to your coverage or budget.

The process of reviewing your policy documents and understanding premium adjustments begins with careful examination of your policy document itself. Look for sections detailing the premium calculation methodology, factors that may influence premium changes (such as age, health status, and policy type), and any clauses regarding premium adjustments. Pay close attention to the frequency of premium reviews and any notification procedures your insurer uses. Many policies include a schedule illustrating projected premium increases over the policy’s term, which can help you plan for future expenses. Keep all correspondence from your insurer related to premium changes, including letters, emails, and policy updates, in a secure and organized location.

Contacting Your Insurer for Clarification

If you have any questions or require clarification regarding a premium increase, contacting your insurer directly is essential. This should be done through their official channels, such as phone, email, or a secure online portal. When contacting your insurer, clearly state your policy number and the specific details you require clarification on. Be prepared to provide relevant information, such as the date of the premium increase notification and any supporting documents. It’s advisable to keep a record of all communications with your insurer, including dates, times, and summaries of conversations. Many insurers offer dedicated customer service lines for policy inquiries, making it easier to get prompt and accurate responses.

Resources for Insurance Premium Transparency

Several resources provide information on insurance premium transparency and consumer protection. These often include government regulatory websites and independent consumer advocacy groups. These resources may offer tools to compare insurance premiums from different providers, explain policy terms, and guide you through filing complaints if necessary. Checking your state’s insurance department website is a good starting point, as they typically offer consumer information and complaint resolution services. Additionally, many independent financial websites provide comparative analysis of insurance products and discuss industry trends affecting premiums.

Comparing Quotes from Different Insurers

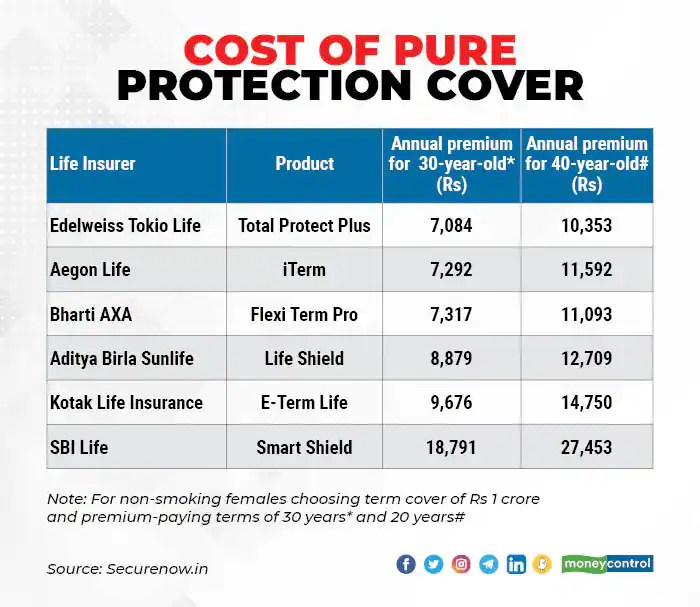

Comparing quotes from different insurers is a critical step in securing the best value for your term life insurance. This involves obtaining quotes from multiple insurers, ensuring you use consistent information for each application (such as age, health status, and desired coverage amount). Pay close attention not only to the initial premium but also to the projected increases over time. Some insurers may offer lower initial premiums but higher increases later, while others may have a more stable premium structure. Consider using online comparison tools that allow you to input your details and receive quotes from various insurers simultaneously. This can save you significant time and effort. Remember to carefully review the policy terms and conditions of each quote before making a decision.

Regularly Reviewing Insurance Needs and Coverage

Regularly reviewing your insurance needs and coverage is crucial to ensure your policy continues to meet your changing circumstances. Life events such as marriage, childbirth, the purchase of a home, or career changes can significantly alter your insurance needs. A periodic review allows you to assess whether your current coverage is still adequate, adjust the coverage amount if necessary, and explore alternative policy options that better align with your current financial situation and risk profile. This review should ideally occur annually or at least every few years, allowing you to proactively manage your insurance needs and make informed decisions.

Wrap-Up

Securing adequate life insurance is a vital aspect of financial planning, and understanding the dynamics of premium adjustments is key to maintaining appropriate coverage throughout your life. While premium increases are inevitable due to factors beyond your control, informed decision-making, regular policy review, and proactive communication with your insurer can help you mitigate unexpected costs and ensure your financial security. By understanding the factors that influence premium changes, you can make more informed choices and effectively manage your life insurance needs over time.

General Inquiries

What happens if I develop a health condition after purchasing my term insurance policy?

Your premiums will likely increase. Insurers reassess risk based on health changes. Contact your insurer to understand the potential impact.

Can I change my policy term after purchase?

Typically, yes, but this will often result in a premium adjustment. Switching to a shorter term might lower premiums, while extending the term will likely increase them.

How often are premiums reviewed and adjusted by insurance companies?

This varies by insurer and policy, but many companies review policies annually. Adjustments are typically made based on factors like claims experience, mortality rates, and market conditions.

Are there any ways to reduce my term insurance premiums?

Yes. Maintaining a healthy lifestyle, choosing a shorter policy term, and opting for a higher deductible (where applicable) can help lower your premiums.