Navigating the world of disability insurance can feel overwhelming. The prospect of unexpected illness or injury impacting your income is a significant concern, and understanding the associated costs is crucial for financial security. A disability insurance premium calculator offers a powerful tool to demystify this process, allowing individuals to estimate their premiums based on personalized factors. This guide provides a comprehensive overview of how these calculators work, the factors influencing your costs, and how to effectively interpret the results to make informed decisions about your financial protection.

Understanding the intricacies of disability insurance premiums is essential for securing your financial future. This guide will equip you with the knowledge to effectively utilize disability insurance premium calculators, enabling you to compare plans, understand the variables affecting your cost, and ultimately make confident choices about your coverage.

Understanding Disability Insurance Premium Calculators

Disability insurance premium calculators are valuable tools for individuals and businesses seeking to understand the cost of disability coverage. These online calculators provide quick estimates of premiums based on user-supplied information, allowing for informed decision-making before committing to a policy. They streamline the process of obtaining preliminary cost information, eliminating the need for multiple individual inquiries to insurance providers.

Disability Insurance Types Covered by Calculators

Disability insurance premium calculators typically encompass various types of disability insurance. The most common are short-term disability insurance, long-term disability insurance, individual disability insurance, and group disability insurance. Short-term disability provides coverage for a limited period, usually a few months, while long-term disability offers protection for extended periods, often until retirement age or the end of a specified timeframe. Individual plans are purchased by individuals directly, offering personalized coverage, while group plans are offered through employers, often as an employee benefit. The calculator will specify which types of coverage it can estimate.

Factors Influencing Disability Insurance Premiums

Several factors significantly impact the cost of disability insurance premiums. These factors are analyzed by the calculator to provide a personalized premium estimate. Understanding these factors helps individuals and businesses make informed choices about their coverage needs and budget.

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Age | Older applicants generally face higher premiums due to increased risk of disability. | High | A 45-year-old applicant will typically pay more than a 30-year-old applicant. |

| Occupation | High-risk occupations (e.g., construction worker) lead to higher premiums because of increased likelihood of disability. | High | A construction worker will likely pay more than an office worker. |

| Health Status | Pre-existing conditions or health issues can significantly increase premiums or even lead to policy denial. | High | A person with a history of back problems may pay a substantially higher premium. |

| Coverage Amount | Higher monthly benefit amounts result in higher premiums. | High | Choosing a $5,000 monthly benefit will cost more than a $3,000 monthly benefit. |

Key Input Variables for Premium Calculation

Accurately calculating your disability insurance premium requires providing a range of personal information. This data allows the insurer to assess your individual risk profile and determine a fair and appropriate premium. The more comprehensive and accurate the information, the more precise the premium calculation will be.

Understanding the key variables involved is crucial for obtaining a realistic quote and ensuring you have adequate coverage. This section will detail the essential information needed and explain how it impacts your premium.

Personal Information

Disability insurance premium calculators require several pieces of personal information to begin the assessment. This includes your age, gender, date of birth, and contact information. Your age is a significant factor, as the risk of disability increases with age. Gender may also play a role, as certain conditions affect men and women differently. Accurate contact information ensures efficient communication throughout the application process.

Health Information

Health information is arguably the most critical input for determining your disability insurance premium. Pre-existing conditions, current health status, and family medical history all significantly impact the risk assessment. Individuals with pre-existing conditions or a family history of serious illnesses may face higher premiums due to an increased likelihood of filing a claim. The insurer will review this information to assess your overall health risk. For example, someone with a history of back problems might pay more than someone with a clean bill of health. This is because back problems are a common cause of disability claims.

Occupation and Income

Your occupation and income level directly influence your disability insurance premium. Higher-income earners require higher coverage amounts to maintain their lifestyle in the event of disability. Therefore, their premiums will generally be higher. Additionally, the risk associated with your occupation plays a crucial role. Hazardous occupations, such as construction work or firefighting, carry a greater risk of injury and disability, resulting in higher premiums compared to less risky professions like office work.

For example, a surgeon earning $500,000 annually will pay a significantly higher premium than an administrative assistant earning $50,000 annually, even if both are the same age and have similar health profiles. The surgeon’s higher income necessitates a larger benefit amount, increasing the insurer’s potential payout and thus the premium. Furthermore, a surgeon’s occupation carries a higher inherent risk of injury or illness compared to the administrative assistant’s role. A construction worker, despite potentially earning less than the surgeon, may also pay a higher premium due to the inherent risks of their profession. This demonstrates the complex interplay between income and occupational risk in premium calculation.

Illustrative Examples

Understanding how disability insurance premiums are calculated can be challenging. These examples illustrate the process using hypothetical scenarios and highlight the impact of key variables. We’ll examine how different factors influence the final premium cost.

Premium Calculation Example for a Hypothetical Individual

Let’s consider Sarah, a 35-year-old software engineer earning $100,000 annually. She’s applying for a disability insurance policy with a 60% benefit level, a 2-year elimination period, and a benefit period of 2 years. Assuming a standard risk profile based on her occupation and health history, her insurer might use a base premium rate of, say, $2.50 per $1,000 of monthly benefit. Her desired monthly benefit would be $5,000 (60% of her average monthly income). This translates to a base premium of $12.50 per month ($2.50 x 5). However, several factors would adjust this. The 2-year elimination period and the 2-year benefit period would influence the final premium, likely reducing it slightly compared to a longer benefit period. Additional factors like her health history and the insurer’s underwriting guidelines will also come into play. The final premium could be somewhere between $10 and $15 per month, depending on the insurer’s specific pricing model. It’s crucial to obtain quotes from multiple insurers to compare premiums.

Impact of Different Benefit Periods on Premium Costs

The length of the benefit period significantly impacts the premium. A longer benefit period (e.g., to age 65) provides greater coverage but results in a substantially higher premium compared to a shorter period (e.g., 2 years or 5 years). Consider two individuals, both with identical characteristics except for their benefit period choice. Individual A chooses a 5-year benefit period, while Individual B opts for a benefit period to age 65. Individual B’s premium will be considerably higher due to the significantly extended coverage period. The insurer assumes a greater risk and consequently charges a higher premium to compensate for the prolonged potential payout. The difference could easily be several hundred dollars per year.

Relationship Between Age and Disability Insurance Premiums

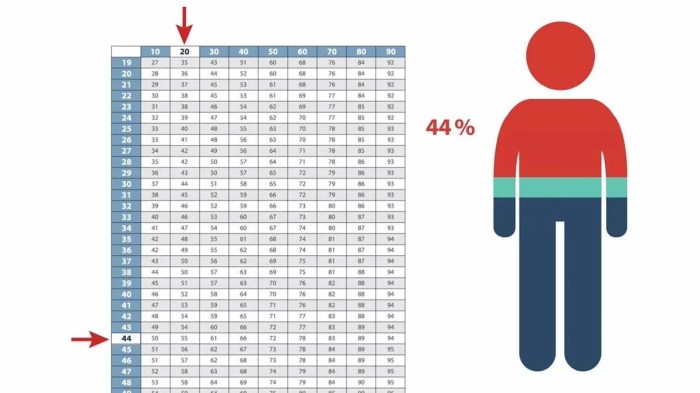

A visual representation would show a graph with age on the horizontal axis and premium cost on the vertical axis. The graph would depict a clear upward trend, demonstrating that premiums increase as age increases. This is because the likelihood of disability increases with age. Younger individuals are generally considered lower risk and thus receive lower premiums. The graph might show a relatively gentle incline initially, becoming steeper as age progresses towards the late 40s and 50s. This visually reinforces the concept that securing disability insurance at a younger age is generally more cost-effective. The steepness of the curve would also depend on other factors like health status and occupation.

End of Discussion

Ultimately, a disability insurance premium calculator serves as an invaluable resource for anyone seeking to understand and plan for their financial well-being in the face of unforeseen circumstances. By understanding the factors influencing premiums and utilizing these tools effectively, you can confidently select a disability insurance plan that aligns with your individual needs and budget, providing peace of mind and financial security for you and your loved ones.

FAQ Insights

What types of disability are covered by disability insurance?

Policies typically cover disabilities resulting from illness or injury, but specific exclusions may apply. It’s crucial to review the policy details carefully.

Can I use a calculator to compare different insurance providers?

Yes, but remember that calculators provide estimates. Always obtain quotes directly from insurers for accurate pricing and policy details.

What if my health status changes after I get a premium estimate?

Significant changes in health could impact your premium. You should inform your insurer of any relevant changes.

Are there age limits for purchasing disability insurance?

Yes, most insurers have age limits for both purchasing and renewing policies. The specific limits vary by provider.