Health insurance is a cornerstone of financial security, but understanding the intricacies of premiums can feel daunting. This guide unravels the definition of a health insurance premium, demystifying the costs associated with securing vital medical coverage. We’ll explore what constitutes a premium, the factors influencing its price, various payment methods, and how to interpret your premium statement, empowering you to make informed decisions about your health insurance.

From the fundamental concept of a premium as a regular payment for coverage to the complexities of individual versus family plans and the impact of age and health status, we provide a clear and concise explanation. We also delve into the various payment options available, offering practical advice on managing your premiums effectively and understanding the information provided on your premium statement.

What is a Health Insurance Premium?

A health insurance premium is essentially the recurring payment you make to a health insurance company in exchange for coverage of your medical expenses. Think of it as a membership fee that grants you access to a safety net should you face unexpected medical bills. It’s a predictable, monthly cost that protects you from potentially catastrophic financial burdens associated with illness or injury.

In simpler terms, a health insurance premium is the price you pay for your health insurance policy. This payment guarantees that the insurance company will cover a portion or all of your medical costs, depending on the terms of your plan. It’s a form of risk management, where you pay a regular fee to transfer the financial risk of unexpected healthcare costs to the insurance company.

Imagine a gym membership. You pay a monthly fee (premium) to access the gym’s facilities and services. If you need to use the facilities frequently, your membership is valuable. Similarly, if you need significant medical care, your health insurance premium provides significant value by covering a substantial portion of the cost. If you don’t use the gym or don’t need much medical care, it might seem like you’re paying more than you’re getting, but the peace of mind and protection against high costs are the key benefits.

Premium Components

Several factors contribute to the final cost of your health insurance premium. Understanding these components helps you make informed decisions about your coverage.

These components often interact and influence each other, making it difficult to assign a precise percentage to each. The exact breakdown will vary greatly depending on your plan, location, age, health status, and the insurer.

Generally, these components include:

- Administrative Costs: This covers the insurance company’s operational expenses, such as salaries, technology, and marketing.

- Claims Costs: This represents the money the insurance company pays out to cover your medical bills and those of other policyholders.

- Provider Networks and Negotiations: Insurers negotiate discounted rates with healthcare providers (doctors, hospitals) to keep costs down. The size and quality of the network influence premiums.

- Profit Margin: Insurance companies are businesses, and a portion of the premium goes towards their profit.

- Risk Assessment: Your age, health status, location, and lifestyle all contribute to your individual risk profile. Higher-risk individuals generally pay higher premiums.

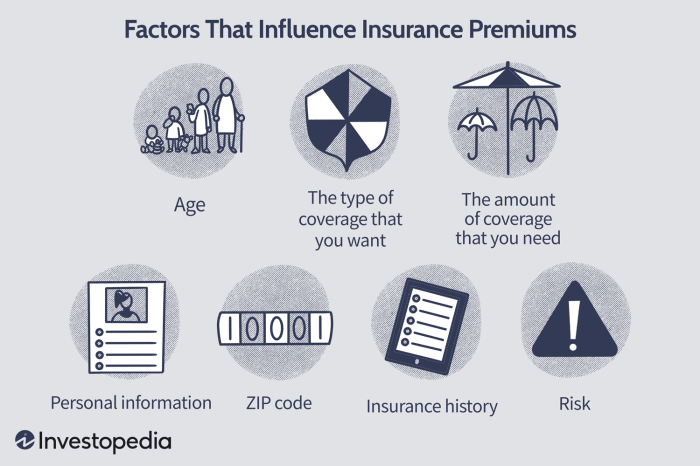

Factors Affecting Health Insurance Premiums

Several key factors contribute to the overall cost of health insurance premiums. Understanding these factors can help individuals make informed decisions when choosing a plan. These factors interact in complex ways, and the specific impact of each will vary depending on the insurer and the specifics of the plan.

Age

Age is a significant factor influencing premium costs. Generally, older individuals pay higher premiums than younger individuals. This is because the risk of needing more extensive healthcare increases with age. Statistically, older populations tend to have more pre-existing conditions and require more frequent medical attention, leading to higher healthcare utilization and therefore higher costs for insurers. This increased risk is reflected in the premium pricing structure. For example, a 60-year-old might pay significantly more than a 30-year-old for the same coverage.

Individual vs. Family Plans

Individual health insurance plans typically cost less than family plans covering multiple individuals. While family plans provide coverage for a larger group, the increased number of individuals covered significantly increases the potential for healthcare claims. The insurer must account for the possibility of multiple members requiring treatment simultaneously or throughout the year, resulting in a higher premium to cover this increased risk. A family plan covering four people will almost always be more expensive than four separate individual plans.

Health Status

Pre-existing conditions and current health status significantly impact premium costs. Individuals with pre-existing conditions, such as diabetes or heart disease, often face higher premiums because they represent a higher risk to the insurer. Insurers assess the likelihood of needing expensive treatments and incorporate that into the premium calculation. Someone with a history of serious illness will typically pay a higher premium than someone with a clean bill of health. Conversely, individuals who maintain a healthy lifestyle and have few health concerns may qualify for lower premiums through wellness programs or discounted rates.

Table Illustrating Impact of Factors on Premium Costs

| Factor | Impact | Example |

|---|---|---|

| Age | Higher premiums with increasing age | A 55-year-old pays more than a 35-year-old for the same plan. |

| Family Size | Higher premiums for larger families | A family plan for four costs more than an individual plan. |

| Geographic Location | Higher premiums in areas with higher healthcare costs | Premiums in a major metropolitan area are often higher than in rural areas. |

| Tobacco Use | Higher premiums for smokers | Smokers typically pay significantly more than non-smokers. |

Understanding Your Premium Statement

Your health insurance premium statement provides a detailed breakdown of your monthly or annual insurance costs. Understanding this statement is crucial for managing your finances and ensuring you’re paying the correct amount for your coverage. It’s a valuable tool for identifying any discrepancies and clarifying any billing questions you may have.

A typical premium statement will include several key pieces of information, presented in a clear and organized manner. This information allows you to verify the accuracy of your charges and understand exactly what you’re paying for each month. By familiarizing yourself with the common elements of a premium statement, you can proactively manage your health insurance costs and avoid potential billing issues.

Premium Statement Components

Several key elements are consistently found on health insurance premium statements. These elements, when understood, give you a complete picture of your insurance costs. This understanding promotes financial responsibility and ensures you are receiving the services you are paying for.

| Description | Amount | Total |

|---|---|---|

| Premium for Plan A | $300 | $300 |

| Deductible | $1000 | $1000 |

| Copay (Doctor Visit) | $25 | $25 |

| Coinsurance (20%) | $50 | $50 |

| Prescription Copay | $10 | $10 |

| Late Payment Fee (if applicable) | $15 | $15 |

| Total Amount Due | $1390 |

The above table illustrates a sample premium statement. The “Description” column details the specific cost components. The “Amount” column shows the individual cost for each item, and the “Total” column reflects the total cost for each item. The final row displays the total amount due for the billing period. Remember that your actual statement will reflect your specific plan details and any applicable charges.

Interpreting Key Elements

Interpreting your premium statement accurately requires understanding the different cost components. This section will break down the common elements, helping you to understand your bill more clearly.

For example, the “Premium for Plan A” represents the base cost of your chosen health insurance plan. The “Deductible” is the amount you must pay out-of-pocket before your insurance coverage kicks in. “Copay” refers to a fixed fee you pay for specific services, like a doctor’s visit. “Coinsurance” is the percentage of costs you share with your insurance company after meeting your deductible. Finally, any late payment fees will be clearly stated. By understanding these components, you can easily reconcile the charges on your statement.

Ultimate Conclusion

Navigating the world of health insurance premiums can be challenging, but with a clear understanding of the factors involved and the available payment options, you can confidently manage this essential aspect of your financial well-being. By understanding the definition of a health insurance premium and how it’s calculated, you are better equipped to choose a plan that aligns with your needs and budget. Remember to always review your premium statement carefully and utilize the various payment methods to ensure timely and efficient payments.

User Queries

What happens if I miss a health insurance premium payment?

Missing a payment can lead to a lapse in coverage, meaning you’ll be responsible for all medical expenses until your payment is made and coverage is reinstated. There may also be late payment fees.

Can I change my health insurance premium payment method?

Yes, most insurers allow you to change your payment method. Contact your insurer directly to update your preferences.

Are health insurance premiums tax deductible?

The deductibility of health insurance premiums depends on your country and specific circumstances. Consult a tax professional for personalized advice.

How often are health insurance premiums typically billed?

Premiums are typically billed monthly, but some insurers offer options for quarterly or annual payments.