Understanding health insurance premiums is crucial for navigating the complexities of healthcare financing. This guide demystifies the concept of health insurance premiums, exploring their components, influencing factors, and the relationship with out-of-pocket costs. We’ll delve into payment methods, the impact of health status, and the factors driving premium increases, providing a clear and concise understanding of this essential aspect of healthcare coverage.

From the fundamental building blocks of premium calculation to the various payment options and the interplay between premiums and out-of-pocket expenses, we aim to equip you with the knowledge needed to make informed decisions about your health insurance plan. We’ll examine how pre-existing conditions, lifestyle choices, and external economic forces influence the cost of your coverage, empowering you to navigate the often-confusing world of health insurance with confidence.

Defining “Premium” in the Context of Health Insurance

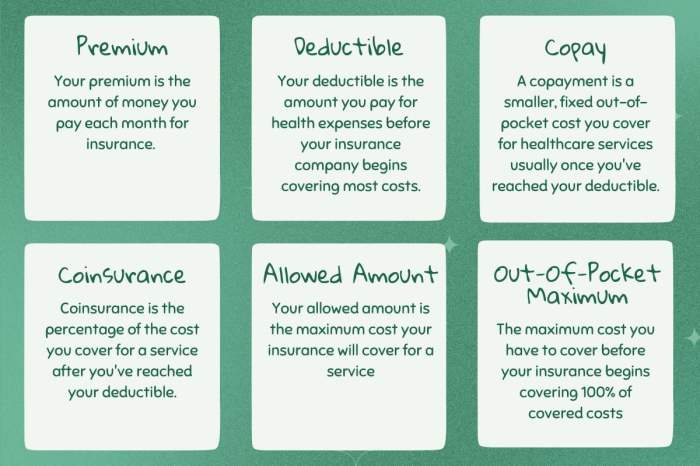

A health insurance premium is the recurring payment you make to your insurance company in exchange for coverage under your chosen health plan. Think of it as your monthly membership fee for access to the healthcare services Artikeld in your policy. This payment ensures that you have financial protection against unexpected medical expenses.

Fundamental Components of a Health Insurance Premium

Several factors contribute to the overall cost of your health insurance premium. These components often work together to determine your final monthly payment. While the exact breakdown varies by insurer and plan, key elements include administrative costs (covering the insurer’s operational expenses), provider network payments (compensating doctors and hospitals in the plan’s network), claims processing costs, and the insurer’s profit margin. Additionally, a portion of your premium may contribute to a reserve fund used to cover unforeseen large claims.

Factors Influencing Premium Costs

Several key factors significantly influence the cost of your health insurance premium. Understanding these factors can help you make informed decisions when choosing a plan.

- Age: Generally, older individuals tend to have higher premiums due to an increased likelihood of needing more healthcare services.

- Location: Premiums vary geographically, reflecting differences in healthcare costs and provider rates across regions. Areas with high healthcare costs typically have higher premiums.

- Health Status: Individuals with pre-existing conditions or a history of significant health issues may face higher premiums. Insurers assess risk based on this information.

- Plan Type: Different health insurance plans (HMO, PPO, EPO, etc.) have varying cost structures, leading to differences in premium amounts. Plans with more extensive coverage and broader provider networks often have higher premiums.

Examples of Premium Variations Across Health Insurance Plans

The cost of health insurance varies greatly depending on the type of plan. A plan with a lower premium might have higher out-of-pocket costs, while a plan with a higher premium might offer more comprehensive coverage and lower out-of-pocket expenses. For example, a Bronze plan typically has the lowest monthly premium but also the highest deductible and out-of-pocket maximum. Conversely, a Platinum plan typically has the highest monthly premium but the lowest out-of-pocket costs.

Premium Comparison Across Different Plan Types

The table below illustrates hypothetical premium costs for different plan types for a single individual in a specific location. Remember that these are examples and actual premiums vary widely based on the factors discussed above.

| Plan Type | Monthly Premium | Annual Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| HMO | $300 | $1,500 | $6,000 |

| PPO | $450 | $2,000 | $8,000 |

| EPO | $375 | $1,800 | $7,000 |

| HSA-Eligible High Deductible Plan | $200 | $5,000 | $10,000 |

Premium Payment Methods and Structures

Paying your health insurance premiums is crucial to maintaining continuous coverage. Understanding the various payment methods and the potential consequences of missed payments is essential for responsible healthcare management. This section details common payment options, the repercussions of late payments, and available financial assistance programs.

Several methods exist for paying health insurance premiums, offering flexibility to suit individual circumstances. Common options include automatic bank withdrawals, online payments via the insurer’s website or a payment portal, and mailing a check or money order. Many insurers also allow for installment payments, breaking down the premium into smaller, more manageable payments spread throughout the month or year. The specific payment options available may vary depending on the insurer and the chosen health plan.

Consequences of Late or Missed Premium Payments

Failure to pay premiums on time can lead to significant consequences. The most immediate consequence is the cancellation or suspension of your health insurance coverage. This means you’ll be responsible for the full cost of any medical services you receive, potentially leading to substantial out-of-pocket expenses. In addition, your credit score may be negatively impacted, making it more difficult to obtain loans or other financial products in the future. Some insurers may impose late payment fees, adding to the financial burden. The exact consequences will vary based on the insurer’s policies and the length of the delay in payment. For instance, a one-time late payment might only result in a late fee, while repeated late payments could lead to policy cancellation.

Premium Subsidies and Financial Assistance Programs

Many individuals and families struggle to afford health insurance premiums. Fortunately, several programs exist to help alleviate these financial burdens. The Affordable Care Act (ACA) offers premium tax credits, reducing the cost of monthly premiums for those who qualify based on income. These subsidies are applied directly to the cost of the insurance, lowering the amount the individual needs to pay. State-level programs and charitable organizations also often provide financial assistance for health insurance, often focusing on specific populations or needs. Eligibility criteria vary depending on the specific program, considering factors like income, household size, and citizenship status. For example, Medicaid provides healthcare coverage to low-income individuals and families, while CHIP (Children’s Health Insurance Program) covers children in families who earn too much to qualify for Medicaid but cannot afford private insurance.

Premium Payment Process Flowchart

The following describes a simplified flowchart illustrating the premium payment process and its potential outcomes:

[Imagine a flowchart here. The flowchart would begin with “Enroll in Health Insurance Plan.” This would branch into “Choose Payment Method” with options like “Automatic Payment,” “Online Payment,” “Mail Payment,” and “Installment Payment.” Each of these would lead to “Payment Processed?” A “Yes” answer would lead to “Coverage Maintained,” while a “No” answer would lead to “Late/Missed Payment.” “Late/Missed Payment” would branch into “Late Fee Applied” and “Coverage Suspended/Cancelled.” “Coverage Suspended/Cancelled” could further branch into “Reinstatement Possible” and “Policy Termination.” “Reinstatement Possible” would involve a path back to “Choose Payment Method,” highlighting the need to make the payment to reinstate coverage. ]

Impact of Health Status on Premiums

Your health significantly influences the cost of your health insurance premiums. Insurers assess risk to determine how much to charge, and this assessment directly reflects your individual health profile. Factors ranging from pre-existing conditions to lifestyle choices play a crucial role in premium calculations.

Pre-existing Conditions and Premiums

Pre-existing conditions, which are health issues you had before enrolling in a health insurance plan, can substantially affect your premium. In many countries, laws now prohibit insurers from denying coverage based solely on pre-existing conditions, but they may still consider them when setting premium rates. The severity and potential cost of managing a pre-existing condition directly impact the insurer’s risk assessment. For example, someone with a history of heart disease will likely pay more than someone with a clean bill of health because the insurer anticipates higher healthcare expenses.

Underwriting and Premium Determination

Underwriting is the process insurers use to assess risk. Underwriters review your medical history, including doctor’s notes, hospital records, and prescription information. They analyze this information to predict the likelihood of you needing expensive medical care. The more extensive and costly your medical history, the higher your premiums are likely to be. This process aims to fairly distribute risk across the insured population, balancing the cost of care with the premiums paid.

Lifestyle Factors and Premium Calculations

Lifestyle factors also play a considerable role in determining premiums. Insurers often consider factors such as smoking, alcohol consumption, diet, and exercise habits. Smokers, for instance, generally pay higher premiums because smoking increases the risk of various health problems, leading to higher healthcare utilization and costs. Conversely, individuals who maintain a healthy lifestyle through regular exercise and a balanced diet might qualify for lower premiums as they represent a lower risk to the insurer.

Hypothetical Scenario: Premium Cost Variations

Let’s consider two individuals, both applying for the same health insurance plan. Individual A is a 40-year-old non-smoker who exercises regularly and has no pre-existing conditions. Individual B is a 40-year-old smoker with a history of high blood pressure and high cholesterol. Individual A’s premium would likely be significantly lower than Individual B’s. The difference reflects the increased risk associated with Individual B’s health status and lifestyle choices. The exact premium difference would vary depending on the specific plan and insurer, but the principle remains consistent: higher risk equates to higher premiums.

Last Point

In conclusion, understanding health insurance premiums is paramount for responsible healthcare planning. By comprehending the factors that influence premium costs, available payment methods, and the relationship between premiums and out-of-pocket expenses, individuals can make informed choices that align with their financial situation and healthcare needs. This knowledge empowers consumers to advocate for themselves and secure the most suitable and affordable health insurance coverage.

FAQ Corner

What happens if I miss a premium payment?

Missing a premium payment can lead to your coverage being cancelled or suspended. You may face penalties and may need to re-apply for coverage, potentially at a higher rate.

Can I negotiate my health insurance premium?

Generally, you cannot directly negotiate the standard premium rates offered by insurance companies. However, you can explore options like choosing a plan with a higher deductible or a less comprehensive benefits package to lower your premium.

How often are health insurance premiums paid?

Premiums are typically paid monthly, but some insurers may offer options for quarterly or even annual payments.

Are there tax advantages to paying health insurance premiums?

In many countries, premiums paid for health insurance may be tax-deductible, either as part of your employer’s contributions or as a self-employed deduction. Consult a tax professional for specifics.