Understanding health insurance premiums is crucial for navigating the complexities of healthcare financing. This guide delves into the intricacies of premium calculation, the factors influencing their cost, and how to interpret your premium statement. We’ll explore different plan types, payment options, and the impact of government regulations, providing a clear and concise overview of this essential aspect of healthcare coverage.

From individual and group plans to the actuarial methods used in determining your monthly cost, we’ll demystify the often-confusing world of health insurance premiums. We’ll also provide practical advice on how to understand your premium statement, identify potential discrepancies, and even appeal a premium increase if necessary. By the end, you’ll have a solid grasp of how your health insurance premium is determined and what it covers.

Factors Affecting Premium Costs

Several interconnected factors influence the cost of health insurance premiums. Insurance companies utilize complex actuarial models to assess risk and determine appropriate pricing, balancing the need for profitability with the goal of providing accessible coverage. These factors can be broadly categorized into individual characteristics, plan features, and market conditions.

Individual Factors

Individual characteristics significantly impact premium calculations. These factors reflect the likelihood of an individual requiring healthcare services. Higher risk profiles translate to higher premiums.

- Age: Older individuals generally have higher premiums due to increased susceptibility to health issues. This is a widely accepted actuarial principle, reflecting the statistical increase in healthcare utilization with age.

- Geographic Location: Premiums vary by location due to differences in healthcare costs, provider availability, and the prevalence of certain diseases. For instance, premiums in urban areas with high healthcare costs tend to be higher than those in rural areas.

- Tobacco Use: Smoking and other tobacco use significantly increases the risk of various health problems, leading to higher premiums for tobacco users. Insurance companies consider this a substantial risk factor.

- Health Status: Pre-existing conditions and current health status are key considerations. Individuals with pre-existing conditions or chronic illnesses typically face higher premiums due to the anticipated higher healthcare utilization.

Plan Features

The features included in a health insurance plan directly influence the premium cost. More comprehensive plans with extensive benefits naturally command higher premiums.

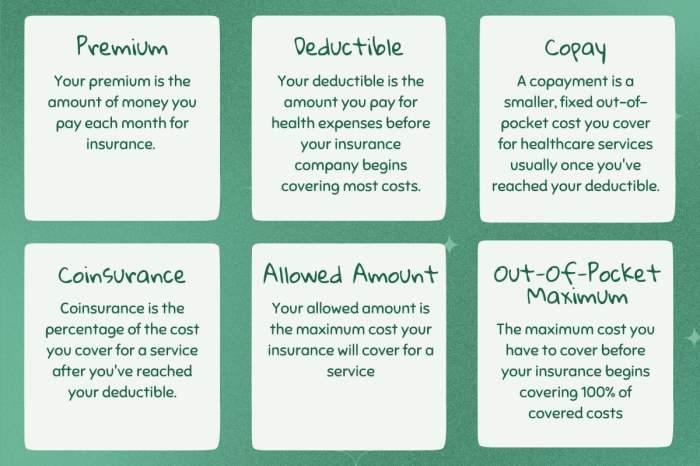

- Deductibles: Higher deductibles (the amount you pay out-of-pocket before insurance coverage begins) generally result in lower premiums. Conversely, lower deductibles lead to higher premiums.

- Co-pays and Coinsurance: These out-of-pocket costs influence premiums. Lower co-pays and coinsurance (your share of costs after the deductible) correlate with higher premiums.

- Network Size: Larger provider networks, offering more choice, generally result in higher premiums compared to plans with smaller, more limited networks.

- Prescription Drug Coverage: The extent of prescription drug coverage, including formularies and cost-sharing, significantly impacts premium costs. More comprehensive drug coverage tends to lead to higher premiums.

Market Conditions

External market forces also affect premium pricing. These factors are largely beyond the control of individuals but significantly influence the overall cost of insurance.

- Healthcare Inflation: Rising healthcare costs, including hospital charges, physician fees, and prescription drug prices, directly translate into higher premiums. This is a persistent upward pressure on insurance costs.

- Competition among Insurers: A competitive insurance market can help moderate premium increases. Conversely, limited competition may lead to higher premiums.

- Government Regulations: Government regulations, such as the Affordable Care Act (ACA) in the United States, aim to influence premium pricing by setting minimum standards for coverage and implementing regulations related to risk adjustment and medical loss ratios. These regulations can both increase and decrease premiums depending on their specific design and implementation.

Impact of Government Regulations on Premium Pricing

Government regulations play a complex role in shaping premium costs. While aiming to ensure affordability and access, regulations can impact premiums in several ways. For example, the ACA’s mandated essential health benefits increase the minimum level of coverage, potentially leading to higher premiums. However, the ACA also includes provisions to help mitigate cost increases, such as subsidies for low-income individuals and risk adjustment mechanisms to help balance the risk among insurers. The net effect on premiums is a result of the interplay of various regulatory elements. The impact varies significantly depending on the specific regulations and the design of the insurance market. For example, regulations that mandate specific benefits or limit insurer profit margins may increase premiums, while those promoting competition or providing subsidies may decrease them.

Premium Changes and Adjustments

Health insurance premiums, the regular payments made to maintain coverage, are not static. Several factors can influence their fluctuation, impacting the cost of your health plan. Understanding these factors and the processes for addressing changes is crucial for maintaining financial stability and adequate healthcare coverage.

Premium changes are governed by a complex interplay of factors, including insurer costs, market conditions, and regulatory changes. These changes can be either increases or, less frequently, decreases. Knowing your rights and the available options for appealing a change is essential for consumers.

Circumstances Leading to Premium Changes

Premiums can fluctuate due to various reasons. Insurers adjust premiums based on their claims experience – if the cost of healthcare services increases significantly, or if there’s a higher-than-anticipated number of claims within a particular demographic, premiums might rise to offset these increased expenses. Changes in the overall healthcare landscape, such as new drug approvals or advancements in medical technology, also influence premiums. Furthermore, legislative changes and government regulations impacting healthcare costs can also result in premium adjustments. Finally, changes within the insurer’s own operations, such as investments or administrative expenses, may necessitate premium modifications.

Appealing a Premium Increase

If you believe a premium increase is unjustified, you have the right to appeal the decision. The process typically involves contacting your insurance company’s customer service department and requesting a formal appeal. You should clearly state your reasons for disagreeing with the increase, providing any supporting documentation, such as evidence of similar plans with lower premiums or documentation showing a decrease in your healthcare utilization. The insurer will review your appeal and respond within a specified timeframe, often Artikeld in your policy documents. If the appeal is denied, you may have the option to contact your state’s insurance commissioner’s office to file a complaint. This office acts as an independent arbiter in disputes between consumers and insurance companies.

Examples of Situations Leading to Premium Adjustments

Several scenarios can lead to premium adjustments. For example, if you change your coverage plan to one with more comprehensive benefits (e.g., switching from a high-deductible plan to a lower-deductible plan), your premium will likely increase to reflect the expanded coverage. Conversely, downgrading to a plan with less coverage might lead to a lower premium. Changes in your health status can also affect premiums. If you develop a pre-existing condition that requires ongoing treatment, the insurer might adjust your premium accordingly, though this is usually regulated to prevent discrimination based on health status. Finally, adding or removing dependents from your plan will also typically trigger a premium adjustment.

Appealing a Premium Change: A Step-by-Step Guide

Understanding the process for appealing a premium change is vital. The following steps Artikel the typical procedure:

- Review your policy documents: Familiarize yourself with your policy’s terms and conditions regarding premium adjustments and the appeal process.

- Gather supporting documentation: Collect any relevant information, such as previous premium notices, explanations of benefits, or medical records that support your case.

- Contact your insurer: Reach out to your insurance company’s customer service department to initiate the appeal process. Document the date and time of your contact and the name of the representative you spoke with.

- Submit your appeal in writing: Formalize your appeal in a written letter, clearly stating your reasons for disagreement and including all supporting documentation.

- Follow up: Keep a record of all communication with the insurance company and follow up if you don’t receive a response within the timeframe specified in your policy.

- Contact your state’s insurance commissioner: If your appeal is denied and you believe the increase is unjustified, contact your state’s insurance commissioner’s office to file a formal complaint.

Epilogue

Navigating the world of health insurance premiums can seem daunting, but with a clear understanding of the factors involved and the resources available, it becomes significantly more manageable. This guide has provided a framework for understanding how premiums are calculated, the various factors that influence their cost, and how to interpret your premium statement. Remember, proactive engagement with your insurance provider and a thorough understanding of your policy are key to ensuring you receive the coverage you need at a price you can afford. Armed with this knowledge, you can confidently choose a plan that best suits your individual needs and budget.

Query Resolution

What happens if I miss a premium payment?

Missing a payment can lead to a lapse in coverage, potentially resulting in significant out-of-pocket expenses if you require medical care. Contact your insurance provider immediately to discuss payment options and avoid cancellation.

Can I change my health insurance plan during the year?

Generally, you can only change plans during open enrollment periods, unless you qualify for a special enrollment period due to a qualifying life event (e.g., marriage, job loss, birth of a child).

What is a deductible?

Your deductible is the amount you must pay out-of-pocket for covered healthcare services before your insurance coverage begins to pay.

What is coinsurance?

Coinsurance is the percentage of costs you share with your insurance company after you’ve met your deductible.