Understanding your car insurance premium is crucial for responsible vehicle ownership. It’s more than just a number; it’s a reflection of your risk profile as a driver and the coverage you’ve chosen. This guide will dissect the components of a car insurance premium, explaining how insurers assess risk and what factors influence the final cost. We’ll explore various coverage options, offer tips for comparing quotes, and empower you to make informed decisions about your auto insurance.

From the seemingly simple act of applying for insurance to the complex algorithms used to calculate your premium, the process involves a multifaceted evaluation of your driving history, vehicle characteristics, and even your credit score. This detailed explanation will illuminate the often opaque world of car insurance pricing, providing you with the knowledge to negotiate the best possible rate for your needs.

Core Components of a Car Insurance Premium

Understanding how your car insurance premium is calculated is crucial for making informed decisions about your coverage. The premium, essentially the price you pay for your insurance, is determined by a complex assessment of your risk profile. Insurers use sophisticated models to analyze various factors and arrive at a figure that reflects the likelihood of you making a claim.

Risk Assessment and Premium Calculation

The core principle behind car insurance premiums is risk assessment. Insurers evaluate the probability of you being involved in an accident or making a claim. Higher-risk drivers, statistically more likely to be involved in accidents, will pay higher premiums. This assessment is not arbitrary; it uses actuarial data and statistical modeling to predict future claims based on historical patterns. The more likely you are to file a claim, the higher your premium will be. This is why factors like driving history and age play a significant role.

Factors Influencing Premium Costs

Several factors significantly impact the cost of your car insurance premium. These factors are carefully weighted in the insurer’s risk assessment.

- Age: Younger drivers, particularly those with less driving experience, are generally considered higher risk and pay more. Statistically, they are involved in more accidents.

- Driving History: A clean driving record with no accidents or traffic violations translates to lower premiums. Conversely, accidents, speeding tickets, and DUI convictions significantly increase your premiums.

- Vehicle Type: The type of car you drive influences your premium. Sports cars and high-performance vehicles are often associated with higher accident rates and, consequently, higher insurance costs. Safer, less powerful vehicles typically result in lower premiums.

- Location: Where you live impacts your premium. Areas with higher crime rates or a greater frequency of accidents will generally have higher insurance costs due to the increased risk of claims.

Components of a Car Insurance Premium

Your car insurance premium is usually broken down into several components, each covering different aspects of potential losses.

- Liability Coverage: This covers damages you cause to others in an accident, including bodily injury and property damage. It’s usually legally mandated.

- Collision Coverage: This covers damage to your own vehicle resulting from a collision, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver.

- Medical Payments Coverage (Med-Pay): This covers medical expenses for you and your passengers, regardless of fault.

Sample Premium Comparison

The following table illustrates how premiums can vary based on coverage levels. These are hypothetical examples and actual premiums will depend on your specific circumstances and the insurer.

| Coverage Level | Liability | Collision | Comprehensive |

|---|---|---|---|

| Basic | $500 | $0 | $0 |

| Standard | $750 | $300 | $200 |

| Comprehensive | $1000 | $450 | $350 |

| Premium | $1200 | $600 | $500 |

How Insurance Companies Determine Risk

Insurance companies employ a multifaceted approach to assess the risk associated with insuring a driver and their vehicle. This assessment is crucial in determining the appropriate premium, balancing the company’s need for profitability with the fairness of pricing for individual customers. The process involves analyzing a range of factors, both directly related to driving history and more broadly encompassing lifestyle and financial responsibility.

Driver Risk Assessment Methods

Insurance companies use a variety of methods to evaluate driver risk. These methods go beyond simply looking at past accidents. They incorporate sophisticated statistical models that analyze vast amounts of data to predict the likelihood of future claims. These models consider many variables, allowing for a more nuanced and accurate risk profile for each individual. The use of advanced analytics and machine learning is becoming increasingly prevalent in this field, leading to more precise risk assessments.

Credit Scores and Driving Records in Premium Determination

Credit scores and driving records are two key factors significantly influencing car insurance premiums. A poor credit history can be an indicator of higher risk, as it suggests a potential lack of financial responsibility. This is because individuals with poor credit are statistically more likely to file claims and potentially struggle to pay premiums. Similarly, a driving record marred by accidents, speeding tickets, or DUI convictions points towards a higher likelihood of future incidents, thus justifying a higher premium. The weight given to credit scores and driving records can vary by insurance company and state regulations. For example, some states prohibit the use of credit scores entirely in premium calculations.

Comparison of Risk Assessment Models

Different insurance companies utilize various risk assessment models, each with its own strengths and weaknesses. Some models rely heavily on actuarial tables based on historical data, while others incorporate more sophisticated algorithms that consider a wider range of factors, such as the type of vehicle driven, location of residence, and even telematics data from in-car devices. The accuracy and fairness of these models are constantly being evaluated and refined. For instance, some models might be better at predicting high-risk drivers, while others might be more effective at differentiating between medium-risk drivers. The choice of model depends on the company’s specific goals and the data available to them.

Premium Calculation Process: A Step-by-Step Illustration

Let’s illustrate a simplified example of how a premium might be calculated. Assume an insurance company uses a points-based system.

- Gather Driver Information: The company collects data on the driver, including age, driving history (number of accidents, tickets), credit score, and location.

- Vehicle Information: Details about the vehicle are gathered: make, model, year, safety features.

- Assign Risk Points: Each factor receives a point value based on its perceived risk. For example, a young driver might receive more points, as would someone with multiple accidents or a low credit score. A vehicle with advanced safety features might receive fewer points.

- Calculate Base Premium: A base premium is determined based on factors such as the coverage level (liability, collision, comprehensive) and the state’s minimum requirements.

- Adjust for Risk Points: The base premium is adjusted upward or downward based on the total risk points accumulated in step 3. A higher risk score leads to a higher premium.

- Apply Discounts: Discounts for safe driving, bundling policies, or other factors are applied to reduce the premium.

- Final Premium Calculation: The final premium is calculated by adding the adjusted base premium and subtracting any applicable discounts.

For instance, a young driver with a poor credit score and a history of speeding tickets would likely accumulate many risk points, resulting in a significantly higher premium compared to an older driver with an excellent credit score and a clean driving record driving a vehicle with advanced safety features. The specific point values and the weight assigned to each factor are proprietary to each insurance company.

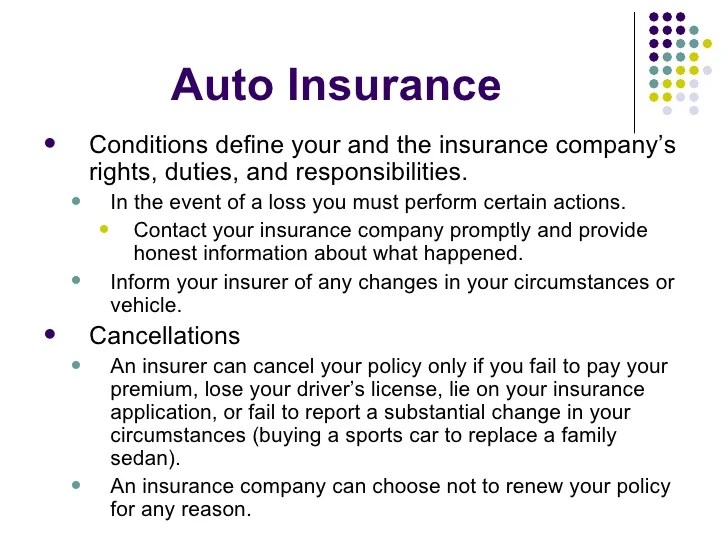

Understanding Policy Documents and Coverage

Your car insurance policy is a legally binding contract outlining the terms and conditions of your coverage. Understanding its contents is crucial to ensuring you’re adequately protected in the event of an accident or other covered incident. This section will break down key policy elements, enabling you to confidently navigate your insurance documents.

Key Terms and Definitions

Car insurance policies utilize specific terminology. Familiarizing yourself with these terms will aid in comprehension. For instance, “insured” refers to the policyholder, while “named insured” specifies individuals explicitly covered under the policy. “Policy period” denotes the duration of coverage, typically a year. “Premium” is the payment made for coverage, and “deductible” represents the amount the insured pays out-of-pocket before the insurer begins coverage. “Liability coverage” protects against financial responsibility for injuries or damages caused to others. “Uninsured/underinsured motorist coverage” protects you if involved in an accident with an uninsured or underinsured driver. “Collision coverage” pays for repairs to your vehicle regardless of fault, while “comprehensive coverage” covers damage from non-collision events like theft or vandalism.

Different Coverage Options and Their Implications

Several coverage options exist, each offering distinct levels of protection. Liability coverage is typically mandatory and covers bodily injury and property damage caused to others. Higher liability limits offer greater protection against significant financial losses. Collision coverage repairs or replaces your vehicle after an accident, irrespective of fault. Comprehensive coverage protects against non-collision damages such as hail, fire, or theft. Uninsured/underinsured motorist coverage is vital as it safeguards you if involved with an at-fault driver lacking sufficient insurance. Medical payments coverage helps pay for medical bills resulting from an accident, regardless of fault. Personal injury protection (PIP) provides coverage for medical expenses and lost wages for you and your passengers.

Interpreting Coverage Limits and Deductibles

Coverage limits define the maximum amount your insurer will pay for a covered claim. For example, a 100/300/100 liability limit means $100,000 per person for bodily injury, $300,000 total for bodily injury per accident, and $100,000 for property damage per accident. Deductibles represent your out-of-pocket expense before insurance coverage kicks in. A $500 deductible means you pay the first $500 of repair costs before your insurance company covers the rest. Higher deductibles generally result in lower premiums, while lower deductibles mean higher premiums.

Visual Representation of Coverage Payout Scenarios

Imagine a scenario: Your car is rear-ended. The other driver is at fault.

Scenario 1: You only have liability coverage. Your car is damaged, but your insurance won’t pay for your repairs. However, it would cover damages to the other driver’s vehicle and their medical bills, up to your policy’s limits.

Scenario 2: You have collision coverage. Your insurance will pay for the repairs to your car, less your deductible.

Scenario 3: A tree falls on your parked car. Your collision coverage won’t apply, but your comprehensive coverage will, minus your deductible.

Scenario 4: An uninsured driver hits your car. Your uninsured/underinsured motorist coverage would help cover your medical bills and vehicle repairs, up to the policy limits. The specifics depend on your policy’s terms and the other driver’s level of insurance.

Conclusion

In conclusion, defining your car insurance premium involves a thorough understanding of risk assessment, coverage options, and the numerous factors influencing cost. By actively engaging with your policy and comparing quotes, you can secure the most suitable and cost-effective car insurance protection. Remember, informed decision-making is key to obtaining the best value for your money and ensuring you have adequate coverage in case of an accident or unforeseen circumstances. Taking the time to understand your premium is an investment in your financial security.

FAQ Overview

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others in an accident. Collision coverage pays for repairs to your vehicle, regardless of fault.

How often are car insurance premiums reviewed?

Premiums are typically reviewed annually, but adjustments can be made more frequently based on changes in your risk profile (e.g., a traffic violation).

Can I get my car insurance premium lowered?

Yes, several factors can lower your premium, including safe driving records, completing defensive driving courses, bundling insurance policies, and maintaining a good credit score.

What happens if I don’t pay my car insurance premium?

Failure to pay your premium can result in policy cancellation, leaving you uninsured and potentially facing legal consequences.