Navigating the complexities of homeownership often involves understanding the intricacies of mortgage insurance. A significant aspect for many homeowners is the deductibility of these premiums, impacting their overall tax liability. This guide explores the eligibility criteria, tax implications, and practical considerations surrounding the deductibility of mortgage insurance premiums, offering clarity on this often-overlooked aspect of home financing.

From understanding the qualifying mortgage types and loan-to-value ratios to navigating the interplay with other tax deductions, this comprehensive overview aims to empower homeowners to make informed decisions and maximize their tax benefits. We’ll examine how factors like filing status and recent tax law changes influence deductibility, providing real-world examples to illustrate key concepts.

Eligibility Requirements for Deducting Mortgage Insurance Premiums

Deducting mortgage insurance premiums can significantly reduce your tax burden, but eligibility isn’t universal. Understanding the specific requirements is crucial for accurately claiming this deduction. This section Artikels the criteria for homeowners to claim this deduction, detailing the types of mortgages that qualify and providing examples to clarify the rules.

Mortgage Insurance Premium Deductibility Criteria

To deduct mortgage insurance premiums, several conditions must be met. Primarily, the mortgage must be a qualified mortgage, meaning it meets certain standards set by the IRS. This typically includes limitations on loan-to-value ratios (LTV), debt-to-income ratios (DTI), and loan terms. Additionally, the mortgage insurance must be required by the lender as a condition of the loan, and not optional coverage. The premiums paid must also be for the benefit of the taxpayer, meaning they are directly related to their home mortgage. Finally, the taxpayer must itemize deductions on their tax return; this deduction cannot be claimed under the standard deduction.

Types of Mortgages Qualifying for Premium Deductibility

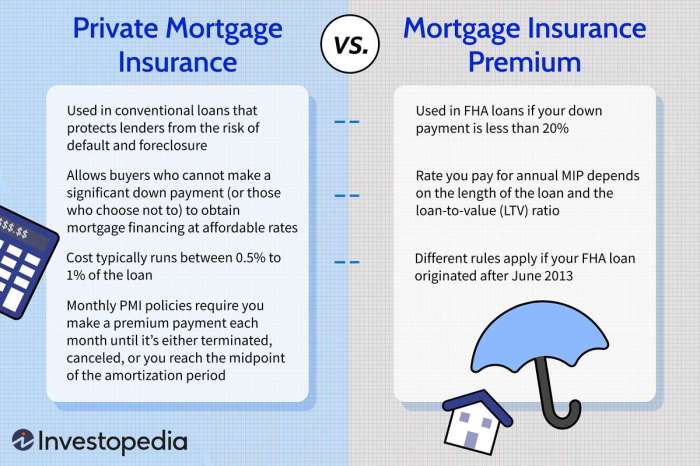

Several mortgage types may qualify for the mortgage insurance premium deduction. Generally, these are mortgages with a loan-to-value ratio (LTV) exceeding 80%, requiring the borrower to pay for private mortgage insurance (PMI). This includes conventional loans, FHA loans, and VA loans in some specific situations. However, the specifics can vary depending on the year the mortgage was originated and the type of mortgage insurance. For example, a jumbo loan, exceeding conforming loan limits, might also require mortgage insurance, but the deductibility rules could be different.

Examples of Deductible and Non-Deductible Mortgage Insurance Premiums

Let’s consider some examples. A homeowner with a conventional loan, with an LTV of 90%, is required to pay PMI. In this case, the PMI premiums are generally deductible, provided all other eligibility criteria are met. Conversely, a homeowner with a 75% LTV mortgage who purchases optional mortgage insurance wouldn’t be able to deduct the premiums, as it wasn’t required by the lender. Another example is a homeowner who refinanced their mortgage to a lower LTV and subsequently canceled their PMI. Premiums paid after the cancellation would not be deductible.

Deductibility Rules Comparison for Different Mortgage Types

| Mortgage Type | Loan-to-Value Ratio (LTV) | Mortgage Insurance Type | Deductibility |

|---|---|---|---|

| Conventional Loan | >80% | PMI (Private Mortgage Insurance) | Generally Deductible |

| FHA Loan | Various | MIP (Mortgage Insurance Premium) | Generally Deductible (with limitations) |

| VA Loan | 100% | Funding Fee | Not Deductible |

| Jumbo Loan | >80% | PMI (Private Mortgage Insurance) | Deductibility depends on specific circumstances and year of origination |

Interaction with Other Tax Deductions and Credits

The deductibility of mortgage insurance premiums (MIP) doesn’t exist in isolation; it interacts with other common tax deductions, primarily the deduction for home mortgage interest. Understanding this interplay is crucial for accurately calculating your tax liability. Improper accounting for these overlapping deductions could lead to either an underpayment or overpayment of taxes.

The primary interaction is with the deduction for home mortgage interest. Both MIP and home mortgage interest are itemized deductions, meaning they’re claimed on Schedule A of Form 1040. Since taxpayers can only deduct the total amount of itemized deductions exceeding the standard deduction, the combined effect of these deductions influences the overall tax benefit. A higher combined deduction from mortgage interest and MIP will result in a greater reduction in taxable income.

Relationship Between MIP Deduction and Home Mortgage Interest Deduction

Both the deduction for home mortgage interest and the deduction for MIP reduce your taxable income, leading to lower tax liability. However, the limits and rules for each deduction are different. The home mortgage interest deduction has limitations on the amount of loan principal that qualifies for the deduction and may also have restrictions on second homes. The MIP deduction, on the other hand, is subject to its own specific rules regarding the type of mortgage and the length of the insurance period. The total amount you can deduct will depend on your specific circumstances and the applicable tax laws for the year.

Scenario Illustrating Interaction of Multiple Deductions

Let’s consider a scenario. Suppose Sarah purchased a home in 2023 with a mortgage of $300,000. Her mortgage interest for the year was $18,000, and her MIP was $2,000. Assuming Sarah itemizes her deductions and has other itemized deductions totaling $5,000, her total itemized deductions would be $25,000 ($18,000 + $2,000 + $5,000). If the standard deduction for her filing status was $13,850, her taxable income would be reduced by $11,150 ($25,000 – $13,850). The tax savings would depend on her marginal tax bracket. For example, if her marginal tax rate is 22%, her tax savings would be $2,453 ($11,150 * 0.22). This illustrates how both the mortgage interest and MIP deductions contribute to her overall tax savings.

Calculating Total Tax Benefit with Multiple Deductions

Calculating the total tax benefit requires a step-by-step approach:

1. Determine the amount of each deduction: Accurately calculate your home mortgage interest and MIP payments for the tax year.

2. Calculate total itemized deductions: Sum up all your itemized deductions, including mortgage interest, MIP, and others (state and local taxes, charitable contributions, etc.).

3. Compare with the standard deduction: Compare your total itemized deductions to the standard deduction for your filing status. You can only deduct the greater amount.

4. Determine the reduction in taxable income: Subtract the larger of your total itemized deductions or the standard deduction from your gross income.

5. Calculate the tax savings: Multiply the reduction in taxable income by your marginal tax rate to determine your total tax savings from all itemized deductions.

Total Tax Benefit = (Total Itemized Deductions – Standard Deduction) * Marginal Tax Rate (if Total Itemized Deductions > Standard Deduction)

This calculation demonstrates the combined effect of multiple deductions, including the MIP deduction, on your overall tax liability. Remember to consult a tax professional for personalized advice, as tax laws and individual circumstances can significantly influence the outcome.

Impact of Loan-to-Value Ratio (LTV)

The Loan-to-Value ratio (LTV) plays a crucial role in determining the deductibility of mortgage insurance premiums. This ratio, calculated by dividing the loan amount by the home’s value, directly impacts whether you can deduct these premiums and, if so, to what extent. A higher LTV generally indicates a higher risk for the lender, leading to the requirement of mortgage insurance. Understanding how LTV affects deductibility is essential for accurate tax planning.

The Internal Revenue Service (IRS) allows the deduction of mortgage insurance premiums only under specific circumstances, and LTV is a key factor in these conditions. Generally, you can deduct premiums if your loan is for a qualified residence, and the LTV exceeds a certain threshold. The exact threshold can vary depending on the year and the type of mortgage. For example, in many cases, a loan with an LTV exceeding 80% would qualify for the deduction, while loans with a lower LTV might not.

LTV Thresholds and Deductibility

The deductibility of mortgage insurance premiums is directly tied to the LTV at the time the mortgage was originated. If the LTV was above the specified threshold (often 80% but subject to change based on IRS guidelines and the year the mortgage was taken out), the premiums are generally deductible. Conversely, if the LTV was below this threshold, the premiums are usually not deductible. It’s important to note that this refers to the initial LTV; refinancing or changes in home value after the mortgage origination do not retroactively affect deductibility.

Examples of LTV’s Impact on Deductibility

Let’s consider two scenarios:

Scenario 1: John purchases a home valued at $300,000 with a $250,000 mortgage. His LTV is 83.33% ($250,000/$300,000). Assuming the loan qualifies in other respects, John can likely deduct his mortgage insurance premiums because his LTV exceeds the typical 80% threshold.

Scenario 2: Jane purchases a home valued at $300,000 with a $200,000 mortgage. Her LTV is 66.67% ($200,000/$300,000). In this case, because her LTV is below the typical 80% threshold, she likely cannot deduct her mortgage insurance premiums.

High LTV and Deductibility Limitations

A high LTV doesn’t automatically guarantee deductibility. The mortgage must meet all other requirements established by the IRS for a qualified residence and the mortgage insurance premiums must be paid for a qualified mortgage. Even if the LTV is above the threshold, factors such as the type of mortgage, the loan amount, and the purpose of the loan can influence whether the premiums are deductible. For instance, a home equity loan might not qualify for the deduction even if it has a high LTV.

Scenarios Illustrating Deduction Amount Impact

The actual deduction amount is not simply the entire premium paid. It’s the amount of the premium attributable to the portion of the loan exceeding the 80% LTV threshold (or the applicable threshold for that year). This means that only the premium paid for the insurance covering that portion of the loan above the threshold is deductible.

Scenario 3: Sarah takes out a $300,000 mortgage on a $250,000 home (LTV 120%). Her annual mortgage insurance premium is $3,000. Let’s assume that $2,000 of the premium covers the portion of the loan above the 80% LTV threshold. Only this $2,000 portion is deductible, not the full $3,000. The exact calculation would depend on the specific details of the insurance policy and the loan.

It is crucial to consult with a tax professional or refer to the latest IRS guidelines to determine the deductibility of your mortgage insurance premiums based on your specific circumstances and LTV. The information provided here is for general understanding and may not encompass all situations.

Record Keeping and Documentation

Claiming the deduction for mortgage insurance premiums requires meticulous record-keeping. Maintaining accurate and complete documentation is crucial for a successful tax filing and can prevent potential delays or disputes with the tax authorities. Failing to keep proper records could result in the denial of your deduction.

Proper record-keeping ensures you have all the necessary information to support your deduction claim. This includes not only the amount paid but also details about the mortgage itself and the insurance policy. Having this documentation readily available simplifies the tax preparation process and strengthens your claim.

Necessary Documentation for Claiming the Deduction

To successfully claim the deduction for mortgage insurance premiums, you need to gather several key documents. These documents serve as evidence of your payments and the specifics of your mortgage insurance. It is recommended to keep these documents organized in a safe place for easy access during tax season.

- Mortgage Insurance Premiums Payment Records: This includes bank statements, canceled checks, or receipts showing payments made towards your mortgage insurance. These should clearly indicate the date, amount, and purpose of the payment.

- Mortgage Insurance Policy: The policy itself provides details about the coverage, premium amounts, and the term of the insurance. This is vital for verifying the legitimacy of your deduction.

- Mortgage Loan Documents: Your mortgage agreement or loan documents should confirm the terms of your loan, including the loan amount, interest rate, and the length of the loan. This helps to verify that the mortgage insurance was necessary for your loan.

- Form 1098: While not directly related to mortgage insurance premiums, this form reports mortgage interest paid and may provide context to your mortgage situation, potentially supporting your claim. It’s good practice to keep this with your other documentation.

Importance of Accurate Record-Keeping for Mortgage Insurance Premiums

Accurate record-keeping is paramount to avoid potential issues during tax audits. Inaccurate or incomplete records can lead to delays in processing your tax return or, worse, the denial of your deduction. Maintaining a well-organized system helps ensure a smooth and efficient tax filing process. This also helps in case of any discrepancies or questions from the tax authorities.

Maintaining organized records is not just a good practice; it’s essential for protecting your right to claim the mortgage insurance premium deduction.

Examples of Acceptable Documentation

Consider the following examples to illustrate acceptable documentation: A bank statement showing a debit entry for “Mortgage Insurance Premium” with the date and amount clearly visible is an excellent example. A canceled check payable to the mortgage insurance provider with the same information is equally acceptable. A digital copy of your mortgage insurance policy, downloaded from your provider’s online portal, is also considered acceptable documentation, provided it clearly shows all necessary details.

Record-Keeping Checklist for Taxpayers

This checklist will help ensure you have all the necessary documentation to support your deduction claim.

- Have I gathered all bank statements, canceled checks, or receipts showing payments for mortgage insurance premiums?

- Do I have a copy of my mortgage insurance policy, including details of coverage and premium amounts?

- Do I have my mortgage loan documents, confirming the loan terms and the necessity of mortgage insurance?

- Have I obtained Form 1098, which reports mortgage interest paid?

- Are all documents clearly labeled and organized for easy access?

Illustrative Examples with Detailed Explanations

Understanding the deductibility of mortgage insurance premiums requires examining specific scenarios. The following examples illustrate situations where premiums are fully deductible, partially deductible, or not deductible at all, highlighting the impact of various factors.

Scenario 1: Full Deductibility

This scenario depicts a taxpayer, Sarah, who purchased a home in 2023 with a mortgage loan amount of $300,000. Her annual mortgage insurance premium is $3,000. Sarah’s adjusted gross income (AGI) is $70,000, and her loan-to-value ratio (LTV) is 90% at the time of purchase. She meets all other eligibility requirements. In this case, Sarah can deduct the full $3,000 mortgage insurance premium on her tax return, reducing her taxable income and ultimately her tax liability. This is because her mortgage is considered a qualified mortgage, her LTV is above the threshold, and she meets all income requirements. The deduction is claimed on Schedule A (Form 1040), Itemized Deductions.

Scenario 2: Partial Deductibility

Consider John, who purchased a home in 2023 with a $400,000 mortgage. His annual mortgage insurance premium is $4,500, and his AGI is $120,000. His LTV at purchase was 80%. John’s mortgage is a qualified mortgage. However, due to his higher AGI, only a portion of his mortgage insurance premiums might be deductible. The specific amount would depend on the applicable tax laws and thresholds, which change periodically. For illustrative purposes, let’s assume that based on his AGI and the rules for the year, only 50% of his premiums are deductible. This would allow him to deduct $2,250 ($4,500 x 0.50). The calculation and exact amount deductible would need to be verified against the current IRS guidelines for that tax year.

Scenario 3: No Deductibility

Finally, let’s examine the case of Maria. Maria purchased a home in 2023 with a $250,000 mortgage. Her annual mortgage insurance premium is $2,000, and her AGI is $50,000. However, her LTV at purchase was only 70%. Furthermore, her mortgage is not a qualified mortgage as it does not meet certain criteria set by the IRS. In this situation, Maria cannot deduct her mortgage insurance premiums. Her LTV is too low to qualify for the deduction, and the mortgage type also fails to meet requirements. The premiums are considered a non-deductible expense.

Epilogue

Successfully navigating the deductibility of mortgage insurance premiums requires a thorough understanding of the relevant rules and regulations. By carefully considering factors such as mortgage type, loan-to-value ratio, and filing status, homeowners can optimize their tax situation and potentially reduce their overall tax burden. This guide serves as a valuable resource for homeowners seeking to understand and leverage this often-complex aspect of homeownership.

Q&A

What if I paid my mortgage insurance premiums in installments throughout the year?

You can deduct the total premiums paid during the tax year, regardless of when the payments were made.

Can I deduct mortgage insurance premiums if I rent out a portion of my home?

The deductibility may be affected. Consult a tax professional to determine the impact on your specific situation.

Are there any penalties for incorrectly claiming the deduction?

Yes, incorrect claims can lead to penalties and interest charges. Accurate record-keeping is crucial.

Where can I find the relevant tax forms and instructions?

The IRS website provides the necessary forms and detailed instructions for claiming deductions.

My mortgage insurance premiums are significantly high. Does that impact my deductibility?

The amount of the premium itself does not directly affect deductibility, but other factors such as LTV and mortgage type do.