In today’s digitally interconnected world, the risk of cyberattacks looms large over businesses of all sizes. The cost of a successful breach can be catastrophic, impacting not only finances but also reputation and operational continuity. Cyber insurance has emerged as a crucial safeguard, offering financial protection against these devastating events. However, understanding the complexities of cyber insurance premium calculation and policy selection is vital for effective risk management. This guide delves into the key factors influencing cyber insurance premiums, helping businesses navigate this critical aspect of their cybersecurity strategy.

From the size of your company and your industry sector to your claims history and implemented risk mitigation strategies, numerous factors influence the cost of your cyber insurance. This guide will unpack these elements, providing insights into how to optimize your cybersecurity posture to reduce premiums while ensuring comprehensive coverage. We will also compare different providers, outlining their pricing structures, coverage features, and customer feedback to empower informed decision-making.

Factors Influencing Cyber Insurance Premiums

Cyber insurance premiums are not a one-size-fits-all cost. Several key factors influence the price a business pays for this crucial protection. Understanding these factors can help businesses make informed decisions about their coverage and potentially reduce their premiums.

Company Size and Cyber Insurance Premium Costs

The size of a company significantly impacts its cyber insurance premium. Larger companies, with more complex IT infrastructure and a greater volume of sensitive data, generally face higher premiums. This is because the potential financial losses from a cyberattack are proportionally larger for larger organizations. Smaller businesses, while potentially less complex, may also face higher premiums if they lack robust security measures, making them higher-risk targets. The increased potential for disruption and data breaches associated with scale naturally increases the cost of insurance.

Industry Sector Impact on Premium Pricing

Different industries have varying levels of cyber risk. Highly regulated sectors like finance and healthcare typically face higher premiums due to the stringent compliance requirements and the sensitive nature of the data they handle. A data breach in these sectors can lead to significant fines and reputational damage, resulting in higher insurance costs to cover these potential liabilities. Industries with less stringent regulatory requirements or handling less sensitive data may enjoy lower premiums. The inherent risk profile of an industry directly correlates to the cost of insurance.

Claims History and its Effect on Premiums

A company’s claims history is a major determinant of its future premiums. A history of cyber incidents, even minor ones, can significantly increase premiums. Insurers view past claims as indicators of future risk. Conversely, a clean claims history can lead to lower premiums, reflecting the insurer’s assessment of reduced risk. This creates a strong incentive for businesses to invest in robust cybersecurity practices to avoid claims and maintain favorable premium rates.

Risk Mitigation Strategies to Lower Premiums

Implementing effective risk mitigation strategies is crucial for reducing cyber insurance premiums. These strategies demonstrate to insurers a commitment to minimizing risk, leading to lower premiums.

| Strategy | Premium Impact | Implementation Cost | Example |

|---|---|---|---|

| Multi-Factor Authentication (MFA) | Significant reduction | Low to Moderate (depending on existing infrastructure) | Implementing MFA across all employee accounts, requiring a password and a second verification factor (e.g., a code from a mobile app). |

| Employee Security Awareness Training | Moderate reduction | Low to Moderate (cost of training materials and time investment) | Regular training sessions educating employees on phishing scams, malware, and safe password practices. |

| Regular Security Audits and Penetration Testing | Moderate to Significant reduction | Moderate to High (depending on scope and frequency) | Hiring a cybersecurity firm to conduct regular vulnerability assessments and penetration testing to identify and address weaknesses in the system. |

| Incident Response Plan | Significant reduction | Moderate to High (depending on complexity and consulting fees) | Developing a detailed plan outlining steps to be taken in the event of a cyberattack, including communication protocols, data recovery procedures, and legal counsel engagement. |

Components of a Cyber Insurance Policy

Cyber insurance policies are complex documents, but understanding their key components is crucial for businesses seeking protection against cyber threats. A comprehensive policy goes beyond simple data breach coverage; it offers a multifaceted approach to mitigating financial and operational losses resulting from cyberattacks. This section details the essential elements typically found in such policies.

Data Breach Coverage

Data breach coverage is a cornerstone of any cyber insurance policy. This component addresses the costs associated with a data breach incident, including notification costs, credit monitoring services for affected individuals, legal and regulatory fees, forensic investigations, and public relations expenses. The extent of coverage varies widely depending on the policy, with some policies offering a fixed limit while others provide coverage based on the actual costs incurred, up to a specified maximum. For instance, a policy might cover up to $1 million in expenses related to notifying affected individuals and providing credit monitoring services following a breach of customer personal information. It’s crucial to understand the specific limits and exclusions within the policy regarding data breach response and remediation.

Business Interruption Coverage

Business interruption coverage compensates for financial losses incurred due to a cyberattack that disrupts business operations. This can include lost revenue, extra expenses incurred to restore operations, and the cost of replacing damaged systems or data. The policy typically Artikels the period for which coverage is provided, and the process for calculating lost revenue. For example, a company experiencing a ransomware attack that shuts down its operations for a week might receive compensation for lost sales during that period, as well as the cost of hiring external IT specialists to recover their systems and data. The extent of coverage often depends on factors such as the size of the business and the nature of the disruption.

Covered Cyber Threats

Typical cyber insurance policies cover a broad range of cyber threats. These commonly include ransomware attacks, phishing scams, denial-of-service (DoS) attacks, malware infections, data breaches resulting from hacking or employee negligence, and social engineering attacks. However, specific threats covered, and the extent of that coverage, will vary between policies. Some policies may exclude certain types of attacks, such as those caused by intentional acts of an insured party or those arising from a failure to implement reasonable security measures. It’s essential to review the policy wording carefully to understand the specific threats covered and any exclusions.

Claim Filing Process and Required Documentation

Filing a cyber insurance claim involves a systematic process. Prompt reporting is crucial. Understanding the required documentation is essential for a smooth claim process.

- Prompt Notification: Report the incident to the insurer as soon as possible after discovering a cyberattack or data breach. Many policies have specific time limits for reporting.

- Detailed Incident Report: Provide a comprehensive report detailing the nature of the incident, the date and time of discovery, the extent of the damage, and the steps taken to contain the breach.

- Forensic Investigation Report: Include a report from a qualified cybersecurity professional outlining the cause of the incident, the extent of the data compromised, and the steps taken to remediate the issue. This is crucial for substantiating claims.

- Financial Documentation: Provide supporting documentation for all financial losses claimed, including invoices, receipts, and financial statements demonstrating lost revenue or increased expenses.

- Legal Documentation: If legal action is involved, provide copies of relevant legal documents, such as lawsuits, settlements, or regulatory notices.

- Communication Records: Maintain records of all communications with the insurer, including emails, phone calls, and meeting minutes.

The Role of Cybersecurity in Premium Determination

Cyber insurance premiums are not a fixed cost; they are dynamically adjusted based on a company’s risk profile. A significant factor influencing this risk profile, and consequently the premium, is the organization’s cybersecurity posture. A robust security program demonstrably reduces risk, leading to lower premiums, while a weak program signals higher risk and increased costs.

A company’s cybersecurity posture directly impacts its cyber insurance premium. Insurers assess various aspects of an organization’s security infrastructure and practices to determine its risk level. This assessment considers the effectiveness of preventative measures, the strength of incident response plans, and the overall maturity of the organization’s security program. A company with a strong security posture, evidenced by proactive risk management, robust security controls, and a well-defined incident response plan, will generally qualify for lower premiums compared to a company with inadequate security measures. The stronger the security, the lower the perceived risk to the insurer, resulting in a more favorable premium.

Impact of Security Certifications on Premium Rates

Security certifications, such as ISO 27001, SOC 2, and NIST Cybersecurity Framework certifications, significantly influence premium rates. These certifications demonstrate a company’s commitment to established security best practices and provide independent validation of its security controls. Insurers often offer discounts or preferential rates to companies holding these certifications, reflecting a reduced risk assessment. The presence of these certifications indicates a lower likelihood of a cyber incident and a more efficient response in the event one occurs. This translates to lower payouts for the insurer and, therefore, lower premiums for the insured. The specific discount offered will vary depending on the certification type, scope, and the insurer’s underwriting guidelines.

Examples of Robust Cybersecurity Measures Reducing Risk and Premiums

Several robust cybersecurity measures contribute to lower premiums. Implementing multi-factor authentication (MFA) across all systems, regularly patching software vulnerabilities, conducting penetration testing and vulnerability assessments, and maintaining comprehensive data backups are examples of proactive measures that demonstrate reduced risk. Investing in security information and event management (SIEM) systems to monitor and detect threats in real-time also significantly impacts risk assessment. Furthermore, employee security awareness training programs, which educate staff on phishing scams and other social engineering tactics, are crucial in preventing human error – a leading cause of breaches. These measures collectively demonstrate a proactive and mature security posture, leading to a lower risk profile and lower premiums.

Hypothetical Scenario Illustrating Premium Reduction Through a Strong Security Program

Consider a hypothetical scenario involving two fictional companies: “SecureCorp” and “VulnerableInc.” SecureCorp invests heavily in cybersecurity, implementing MFA, regular patching, penetration testing, robust data backups, a SIEM system, and comprehensive employee training. VulnerableInc., on the other hand, has minimal security measures in place.

SecureCorp’s proactive approach leads to a significantly lower risk profile. Their insurer assesses this and offers a premium of $10,000 annually. VulnerableInc., due to its weak security posture and higher risk profile, receives a premium quote of $25,000 annually. This $15,000 difference clearly illustrates the financial benefits of a robust security program in reducing cyber insurance premiums. The difference reflects not only the lower likelihood of a breach but also the reduced potential cost of a breach should one occur, given SecureCorp’s superior incident response capabilities.

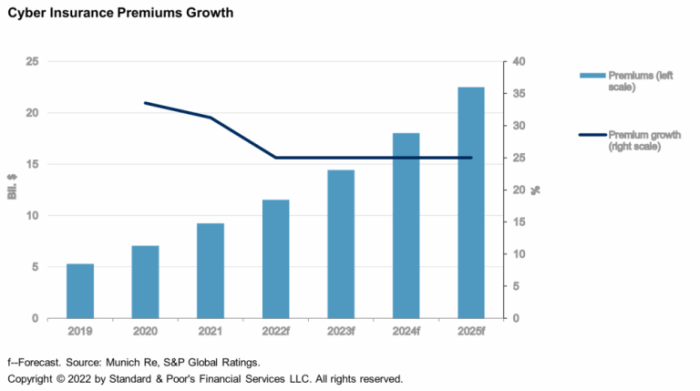

Future Trends in Cyber Insurance Premiums

Predicting the future of cyber insurance premiums requires considering several interconnected factors. The rapidly evolving threat landscape, coupled with increasing regulatory scrutiny and the growing sophistication of cyberattacks, points towards a complex and potentially volatile market. Premiums are likely to fluctuate significantly in response to these dynamic influences.

Rising premiums are expected due to a convergence of factors. The increasing frequency and severity of ransomware attacks, data breaches, and other cyber incidents are major drivers. Moreover, the expanding attack surface, fuelled by the proliferation of IoT devices and the increasing reliance on cloud-based services, further contributes to heightened risk.

Increased Cyberattack Severity and Frequency

The escalating sophistication and financial impact of cyberattacks will undoubtedly push premiums higher. Ransomware attacks, for instance, are becoming more targeted and demanding larger payouts, forcing insurers to increase reserves and, consequently, premiums. The emergence of advanced persistent threats (APTs), capable of remaining undetected for extended periods, also contributes to this upward trend. For example, the NotPetya ransomware attack in 2017 caused billions of dollars in damage, illustrating the potential for catastrophic losses that insurers must account for.

Emerging Cyber Threats and Their Impact

New threats constantly emerge, posing significant challenges to insurers. The rise of AI-powered attacks, capable of automating and scaling malicious activities, represents a significant concern. Similarly, the increasing use of deepfakes and other forms of synthetic media for social engineering and disinformation campaigns introduces novel risks that insurers are still grappling with. The impact of these emerging threats on premium pricing will be significant, as insurers develop more sophisticated risk assessment models to incorporate these factors.

Influence of Evolving Regulations

Stringent data privacy regulations, such as GDPR and CCPA, are forcing organizations to enhance their cybersecurity posture. Non-compliance can result in substantial fines, which in turn increases the risk for insurers. The growing expectation of robust cybersecurity practices from regulators will likely translate into stricter underwriting criteria and, consequently, higher premiums for organizations deemed to have inadequate security measures. For instance, companies failing to meet GDPR compliance standards may face significantly higher premiums than those with demonstrably robust security protocols.

Projected Premium Trends

A visual representation of projected premium trends over the next five years might show a steady upward trajectory. Imagine a graph with the x-axis representing years (2024-2028) and the y-axis representing average cyber insurance premiums. The line would start at a relatively moderate level in 2024, then gradually increase each year, demonstrating a steeper incline towards 2028. This reflects the cumulative effect of increasing cyber threats, regulatory pressures, and the growing awareness of cybersecurity risks. This increase wouldn’t be uniform; specific events (like major breaches or new regulations) could cause sharp spikes in the line, followed by a period of consolidation. For example, a major ransomware outbreak in 2026 might cause a noticeable surge in premiums before they stabilize again, albeit at a higher level than before.

Epilogue

Securing adequate cyber insurance is no longer a luxury; it’s a necessity for businesses operating in the digital age. By understanding the factors influencing cyber insurance premiums, proactively implementing robust cybersecurity measures, and carefully comparing providers, organizations can effectively manage their risk exposure and obtain cost-effective, comprehensive coverage. This guide serves as a starting point for a deeper exploration of this critical topic, empowering businesses to navigate the complexities of cyber insurance and protect their valuable assets in the face of ever-evolving cyber threats.

General Inquiries

What is the difference between cyber liability and cyber insurance?

Cyber liability refers to the legal responsibility a business faces for data breaches or other cyber incidents. Cyber insurance provides financial coverage to help mitigate the costs associated with those liabilities.

How often are cyber insurance premiums reviewed?

Premiums are typically reviewed annually, and adjustments are made based on factors like claims history, changes in risk profile, and market conditions.

Can I get cyber insurance if my company has had a previous data breach?

Yes, but the premium will likely be higher, and obtaining coverage might require more detailed risk assessment.

What types of cyber threats are typically covered?

Coverage varies by policy, but common threats include ransomware attacks, phishing scams, denial-of-service attacks, and data breaches.

What is the typical claims process?

It generally involves reporting the incident to the insurer, providing documentation (e.g., police reports, forensic analysis), and cooperating with the insurer’s investigation.