Navigating the world of car insurance can feel like deciphering a complex code. Premiums vary wildly, leaving drivers wondering how to find the best coverage at the most affordable price. This guide unravels the mysteries behind car insurance costs, empowering you to confidently compare premiums and secure the optimal policy for your needs. We’ll explore key factors influencing your rates, provide practical strategies for comparing quotes, and illuminate the often-overlooked details that can significantly impact your bottom line.

From understanding the nuances of different coverage types to leveraging discounts and navigating policy fine print, we equip you with the knowledge to make informed decisions. This isn’t just about finding the cheapest option; it’s about finding the best value – the right balance of coverage and cost that provides peace of mind on the road.

Factors Influencing Car Insurance Premiums

Car insurance premiums are not a one-size-fits-all proposition. Several key factors combine to determine the final cost you pay. Understanding these factors can empower you to make informed decisions and potentially save money.

Top Five Factors Impacting Car Insurance Costs

The most significant factors influencing your car insurance premium are your driving history, the type of car you drive, your age and driving experience, your location, and your credit history. These factors are weighted differently depending on your individual profile.

Comparison of Factor Importance Across Driver Profiles

Young drivers (typically under 25) face significantly higher premiums due to statistically higher accident rates. Their driving history, if limited, carries less weight than their age. Conversely, senior drivers (typically over 65) might pay more due to age-related factors impacting driving ability, even with a spotless driving record. The type of car and location remain consistently important across all age groups, while the impact of credit history is more pronounced for younger drivers with limited financial history.

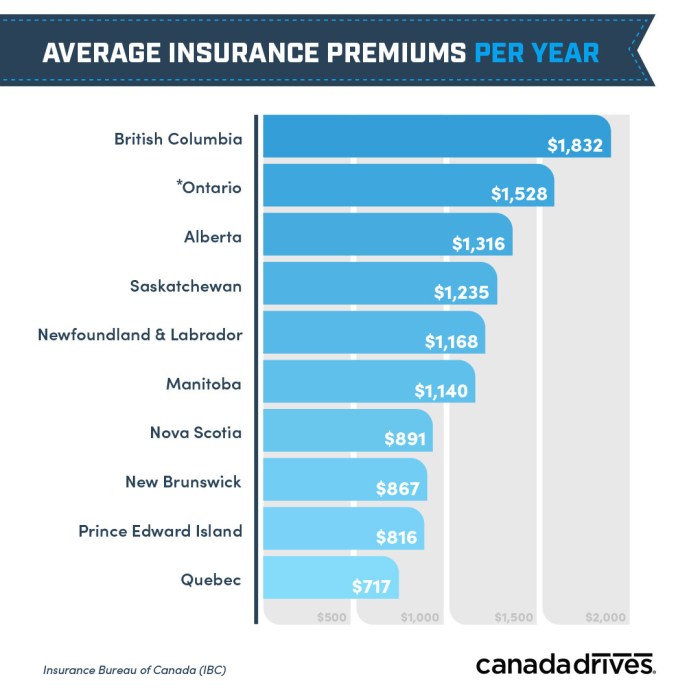

Geographic Location and Premium Rates

Geographic location plays a crucial role in determining insurance costs. Areas with high crime rates, traffic congestion, and a high frequency of accidents typically have higher premiums. For example, major metropolitan areas in states like California and Florida often have significantly higher rates compared to rural areas in states like Iowa or North Dakota. Conversely, areas with lower accident rates and lower population density tend to enjoy lower premiums. This is because insurers assess risk based on statistical data for each region.

Impact of Driving Records on Premium Costs

The following table illustrates how various driving infractions affect premium costs. These are illustrative examples and actual increases vary by insurer and location.

| Driving Record | Premium Increase (Illustrative Example %) | Explanation | Impact on Future Premiums |

|---|---|---|---|

| Accident (at fault) | 20-40% | Significant increase due to demonstrated risk. | Can persist for several years. |

| Speeding Ticket | 5-15% | Smaller increase, but multiple tickets can compound. | Typically affects premiums for 3-5 years. |

| DUI/DWI | 50-100%+ | Extremely high increase reflecting significant risk. | Can significantly impact premiums for many years, potentially resulting in policy cancellation. |

| Clean Record | 0% | No increase, often eligible for discounts. | Maintaining a clean record leads to lower premiums over time. |

Comparing Quotes from Different Insurers

Obtaining competitive car insurance quotes is crucial for securing the best possible coverage at a fair price. A systematic approach, comparing multiple insurers and understanding policy details, will help you make an informed decision. This section details a step-by-step process for comparing quotes and highlights key considerations beyond the premium amount.

Obtaining Car Insurance Quotes

Gathering quotes from multiple insurers involves a straightforward process. First, compile a list of insurers operating in your area. This can be done through online searches, recommendations, or by checking comparison websites. Next, visit each insurer’s website or contact them directly. You’ll typically need to provide basic information about yourself, your vehicle, and your driving history. Be sure to provide consistent information across all quotes to ensure accurate comparisons. Finally, request a quote from each insurer and carefully review the details provided.

Effective Comparison Strategies

Simply comparing prices isn’t sufficient. Several other factors significantly influence the value of a car insurance policy. Consider the level of coverage offered, including liability limits, collision and comprehensive coverage, and uninsured/underinsured motorist protection. Also, examine the insurer’s claims process, customer service reputation, and financial stability. Reading online reviews and checking independent ratings can provide valuable insights into these aspects. Lastly, consider additional features such as roadside assistance, rental car reimbursement, or accident forgiveness.

Understanding Policy Coverage Details

Before making a decision, thoroughly understand the coverage details of each policy. Pay close attention to the definitions of covered events, exclusions, and limitations. For example, some policies might have specific deductibles for different types of damage or limit coverage for certain types of vehicles or drivers. Don’t hesitate to contact the insurer directly to clarify any ambiguities or ask questions about specific scenarios. A clear understanding of the policy’s fine print is vital to ensure you are adequately protected.

Comparison of Hypothetical Insurance Policies

The following table compares three hypothetical car insurance policies, highlighting key features and pricing. Remember that these are examples and actual quotes will vary based on individual circumstances.

| Feature | Policy A | Policy B | Policy C |

|---|---|---|---|

| Annual Premium | $1200 | $1500 | $1000 |

| Liability Coverage | $100,000/$300,000 | $250,000/$500,000 | $100,000/$300,000 |

| Collision Deductible | $500 | $1000 | $250 |

| Comprehensive Deductible | $500 | $1000 | $250 |

| Roadside Assistance | Included | Not Included | Included |

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is crucial for protecting yourself and your vehicle financially. Choosing the right coverage depends on your individual needs, risk tolerance, and budget. This section will Artikel the key features of the most common types of coverage, highlighting their benefits and drawbacks.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party involved. The amount of liability coverage you carry is typically expressed as a three-number limit (e.g., 100/300/100), representing bodily injury per person, bodily injury per accident, and property damage per accident, respectively. Higher limits offer greater protection but come with higher premiums.

- Benefit: Protects you from potentially devastating financial losses resulting from accidents you cause.

- Drawback: Does not cover your own medical bills or vehicle repairs.

- Cost: Varies significantly based on your driving record, location, and the coverage limits selected. A standard liability policy might cost between $300 and $800 annually.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This is particularly helpful if you’re involved in a single-car accident or if the other driver is uninsured.

- Benefit: Covers repairs or replacement of your vehicle after a collision, regardless of fault.

- Drawback: Typically has a deductible (the amount you pay out-of-pocket before the insurance kicks in), and premiums can be substantial.

- Cost: The cost depends on the vehicle’s make, model, year, and your deductible. A collision coverage premium for a standard vehicle could range from $300 to $700 annually, depending on factors like the deductible amount.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. It essentially covers “everything else” not covered by collision insurance.

- Benefit: Provides broad protection against a wide range of risks that could damage your vehicle.

- Drawback: Often includes a deductible, and the premiums can be higher than collision coverage alone.

- Cost: Similar to collision, the cost is influenced by your vehicle’s characteristics and your deductible. Expect to pay anywhere from $100 to $400 annually for comprehensive coverage on a standard vehicle, depending on factors like location and risk profile.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver. It covers your medical bills, lost wages, and vehicle repairs, even if the other driver is at fault and lacks sufficient insurance.

- Benefit: Provides crucial protection in situations where the at-fault driver lacks adequate insurance to cover your losses.

- Drawback: While essential, it can add to the overall cost of your insurance policy.

- Cost: The cost varies depending on your location and coverage limits. It’s often a relatively small additional cost compared to other coverages, perhaps adding $50-$150 annually to your premium.

Summary

Ultimately, comparing car insurance premiums is a process that requires careful consideration and proactive engagement. By understanding the factors influencing your rates, employing effective comparison strategies, and meticulously reviewing policy details, you can secure a policy that aligns perfectly with your individual circumstances and budget. Remember, informed decision-making is the key to unlocking significant savings and ensuring you have the appropriate protection.

Clarifying Questions

What is the best way to get multiple car insurance quotes quickly?

Many comparison websites allow you to input your information once and receive quotes from multiple insurers simultaneously. Alternatively, you can visit each insurer’s website individually.

How often should I compare car insurance quotes?

It’s advisable to compare quotes annually, or even more frequently if your circumstances change (e.g., new car, moving, change in driving record).

Can I get car insurance without a driving history?

Yes, but expect higher premiums. Insurers will assess risk based on other factors, such as age and location.

What does “uninsured/underinsured motorist” coverage cover?

This coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver. It covers medical bills and property damage.