Navigating the world of car insurance can feel like driving through a maze, especially when considering the significant variations in premiums across different states. Factors ranging from state regulations and demographic profiles to geographic location and the specific coverage chosen all play a crucial role in determining your final cost. This guide provides a detailed exploration of these influential elements, offering a clearer understanding of why car insurance premiums vary so drastically from state to state.

Understanding these variations is key to making informed decisions about your car insurance. By examining the interplay of state-specific laws, demographic factors, geographic risks, and coverage options, you can gain a powerful advantage in securing the most suitable and cost-effective insurance policy. This analysis will equip you with the knowledge to compare rates effectively and choose the best coverage for your individual needs.

State-Specific Factors Influencing Premiums

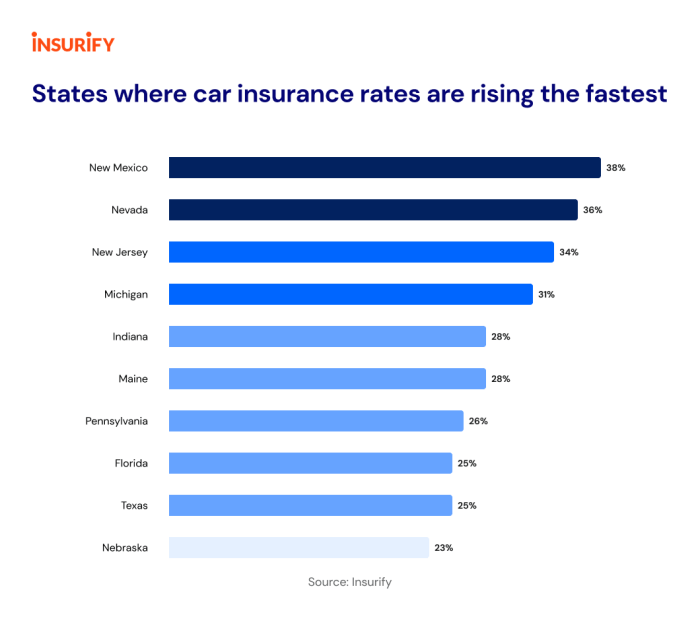

Car insurance premiums vary significantly across the United States, and understanding these variations requires examining the state-level factors that influence costs. These factors are complex and interconnected, but primarily revolve around state regulations, the risk profile of drivers within a state, and the competitive landscape of the insurance market.

State Regulations and Car Insurance Costs

State regulations play a crucial role in shaping car insurance premiums. These regulations encompass various aspects, including mandated minimum coverage levels, restrictions on insurance company pricing practices, and the availability of specific insurance products. States with stricter regulations, such as those requiring higher minimum coverage or prohibiting certain pricing practices, often see higher average premiums. Conversely, states with more lenient regulations may experience lower average premiums, although this can sometimes be accompanied by a higher number of uninsured drivers. The balance between consumer protection and affordability is a key consideration for state lawmakers when setting these regulations.

State-Mandated Minimum Coverage Levels and Premiums

State-mandated minimum coverage levels directly impact insurance premiums. Higher minimum coverage requirements translate to higher premiums because insurers must cover more significant potential payouts in the event of an accident. For example, a state requiring higher bodily injury liability coverage will necessitate higher premiums compared to a state with lower minimum requirements. This is because the potential cost of claims under the higher limits is naturally greater, forcing insurers to charge more to offset that increased risk. Conversely, states with lower minimum coverage levels generally have lower average premiums, but this comes at the expense of potentially inadequate protection for drivers and accident victims.

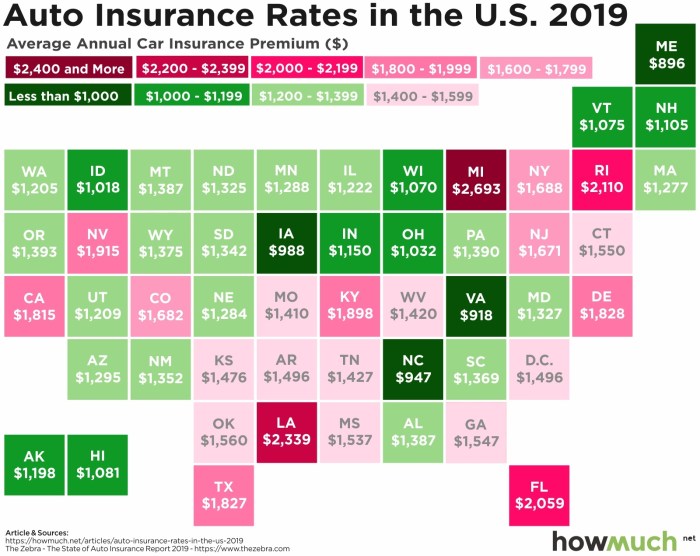

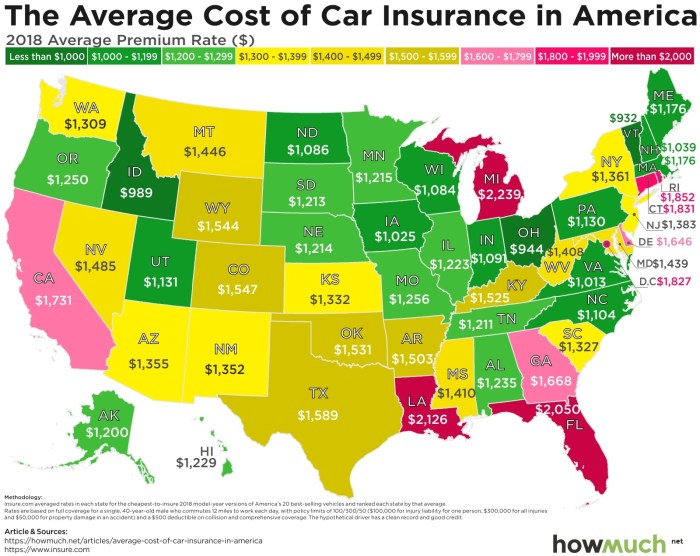

Examples of States with High and Low Average Premiums

Consider the contrast between states like Michigan and Maine. Michigan consistently ranks among states with the highest average car insurance premiums, partly due to a combination of factors including its no-fault insurance system (which mandates significant coverage for medical expenses regardless of fault), high litigation costs, and a history of high accident rates. In contrast, Maine often features among states with lower average premiums, potentially reflecting a combination of factors such as lower accident rates, less stringent regulatory requirements, and a less litigious environment. It’s important to note that these are generalizations, and individual premiums within these states can vary based on numerous personal factors.

Comparison of Average Premiums Across Five States

The following table provides a simplified comparison of average premiums, minimum coverage requirements, and the number of uninsured drivers across five diverse states. Note that the data presented here is for illustrative purposes and may vary based on the source and year of the data collection. Actual figures can fluctuate.

| State | Average Premium (Illustrative) | Minimum Coverage Requirements (Illustrative) | Estimated % of Uninsured Drivers (Illustrative) |

|---|---|---|---|

| California | $1500 | 15/30/5 | 10% |

| Florida | $1200 | 10/20/10 | 20% |

| Michigan | $2000 | 20/40/10 | 5% |

| Maine | $800 | 5/10/5 | 15% |

| Texas | $1400 | 30/60/25 | 12% |

Demographic Factors and Premium Variation

Car insurance premiums are not a one-size-fits-all proposition. While factors like location and the type of vehicle significantly influence costs, demographic characteristics play a substantial role in determining individual premiums across different states. Understanding these influences can help consumers make informed decisions and potentially find more affordable coverage.

Several demographic factors significantly impact car insurance rates. These factors are often analyzed by insurance companies to assess the risk associated with insuring a particular individual. This risk assessment directly translates into the premium a driver will pay.

Age and Car Insurance Premiums

Younger drivers generally pay higher premiums than older drivers. This is because statistically, younger drivers are involved in more accidents. Inexperience behind the wheel and a tendency to take more risks contribute to this higher accident rate. As drivers gain experience and age, their accident rates tend to decrease, leading to lower premiums. However, premiums may increase again in later years as reflexes and vision might decline. This age-related fluctuation is consistent across most states, although the specific pricing differences may vary. For example, a 20-year-old driver might pay significantly more than a 40-year-old driver with a similar driving record in the same state.

Gender and Car Insurance Premiums

Historically, gender has been a factor in determining car insurance rates. Studies have shown differences in accident rates and driving behaviors between men and women. However, the extent to which gender influences premiums varies considerably across states, and in some jurisdictions, using gender as a rating factor is prohibited due to fairness concerns and anti-discrimination laws. The impact of gender on premiums is a complex issue subject to ongoing debate and legal challenges.

Driving History and Car Insurance Premiums

Driving history is a paramount factor influencing car insurance rates. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, drivers with a history of accidents, speeding tickets, or DUI convictions will face significantly higher premiums. The severity of the incidents also impacts the premium increase. A minor fender bender will have a less severe impact than a serious accident involving injury or property damage. States generally consider the number and severity of incidents when calculating premiums.

Credit Scores and Car Insurance Premiums

In many states, credit scores are used as a factor in determining car insurance premiums. The rationale is that individuals with poor credit scores are considered higher risks, potentially indicating a higher likelihood of filing claims. However, the use of credit scores in insurance pricing is controversial and faces criticism for potentially penalizing individuals who may not pose a higher driving risk. The impact of credit scores on premiums varies significantly across states, with some states prohibiting or restricting their use. For example, California and Hawaii have stricter regulations regarding the use of credit scores in insurance pricing than some other states.

States with Significant Premium Variations Based on Demographic Factors

The degree to which demographic factors influence premiums varies significantly across states. States with less stringent regulations regarding the use of demographic data in pricing may see larger variations in premiums based on age, gender, and credit score. Conversely, states with stricter regulations aimed at promoting fairness and equity may exhibit smaller differences in premiums based on these factors. Specific data on the magnitude of these variations across different states would require a comprehensive analysis of publicly available rate filings from multiple insurance companies.

Key Demographic Factors and Their Impact on Premium Costs

The following list summarizes the key demographic factors and their typical impact on car insurance premiums:

- Age: Younger drivers typically pay more due to higher accident risk; premiums generally decrease with age and experience, then may increase slightly in later years.

- Gender: Historically, gender has been a factor, but its influence varies by state and is subject to legal and ethical challenges. Some states prohibit using gender in rate calculations.

- Driving History: A clean driving record leads to lower premiums; accidents, violations, and DUI convictions significantly increase premiums.

- Credit Score: In many states, a lower credit score correlates with higher premiums, though this practice is controversial and varies by state.

Geographic Location and Risk Assessment

Geographic location significantly influences car insurance premiums. Insurers assess risk based on various location-specific factors, leading to considerable premium variations across even short distances within a single state. This risk assessment considers not only the immediate surroundings but also broader geographic characteristics.

Insurers analyze a multitude of data points to determine the risk associated with a specific location. These include accident rates, crime statistics, the density of the population, and the prevalence of certain types of hazards like severe weather. Areas deemed higher risk result in higher premiums to compensate for the increased likelihood of claims.

Urban versus Rural Area Premiums

Urban areas generally have higher insurance premiums than rural areas. This is primarily due to increased traffic congestion, higher population density leading to more frequent accidents, and a greater likelihood of vehicle theft or vandalism. The sheer number of vehicles on the road in urban centers contributes to a higher frequency of collisions. Conversely, rural areas often have fewer vehicles and lower traffic density, resulting in fewer accidents and lower premiums. However, factors like longer distances to emergency services and the prevalence of wildlife can sometimes offset this advantage, resulting in slightly higher premiums than one might initially expect.

For example, a driver in a densely populated city like Los Angeles might pay significantly more for car insurance than a driver in a rural area of Montana, even if both drivers have similar driving records. This difference reflects the higher risk profile associated with urban driving.

Accident Rates and Crime Statistics Impact on Premiums

Accident rates and crime statistics directly influence insurance premiums. States with higher accident rates, reflecting factors such as aggressive driving habits or inadequate road infrastructure, will typically have higher average premiums. Similarly, states with high rates of vehicle theft or vandalism will also see increased premiums, as insurers need to account for these increased risks in their pricing models. These statistics are readily available through state-level departments of motor vehicles and law enforcement agencies, and insurers utilize this data extensively in their risk assessments.

For instance, a state with a high rate of uninsured drivers will likely experience higher premiums, as the risk of being involved in an accident with an uninsured motorist is greater. The cost of resolving such claims ultimately falls on insured drivers, pushing premiums upward.

Geographic Location, Accident Rates, and Average Premiums

The following table illustrates the correlation between geographic location (urban vs. rural), accident rates, and average premiums for three selected states. Note that these are simplified examples for illustrative purposes and actual data may vary considerably based on specific location, insurer, and driver profile. The data used here is hypothetical, intended to demonstrate the principle.

| State | Geographic Location | Accident Rate (per 100,000 population) | Average Annual Premium |

|---|---|---|---|

| California | Urban (Los Angeles) | 1200 | $1800 |

| California | Rural (Northern California) | 400 | $1200 |

| Florida | Urban (Miami) | 1500 | $2000 |

| Florida | Rural (Central Florida) | 500 | $1300 |

| Texas | Urban (Houston) | 1100 | $1700 |

| Texas | Rural (West Texas) | 300 | $1000 |

Final Thoughts

In conclusion, the cost of car insurance is far from uniform across the United States. A complex interplay of state regulations, demographic characteristics, geographic risk factors, and coverage choices ultimately shapes individual premiums. By understanding these influences, consumers can navigate the insurance market more effectively, securing the most appropriate and cost-effective coverage for their specific circumstances. Remember to compare quotes from multiple insurers to ensure you’re receiving the best possible rate.

Top FAQs

What is the impact of a DUI on my car insurance premiums?

A DUI conviction significantly increases car insurance premiums, often resulting in higher rates for several years. The impact varies by state and insurer.

How does my driving experience affect my car insurance rates?

Insurers generally offer lower premiums to drivers with a clean driving record and significant experience. New drivers typically pay more due to higher risk.

Can I lower my car insurance premiums?

Yes, several factors can help lower premiums, including safe driving, maintaining a good credit score, bundling insurance policies, and opting for higher deductibles.

What is the difference between liability and comprehensive coverage?

Liability coverage protects you financially if you cause an accident, while comprehensive coverage protects your vehicle from damage due to non-collision events (e.g., theft, vandalism).

How often should I shop around for car insurance?

It’s recommended to compare car insurance rates annually, or even more frequently, as rates can change significantly.