The rising cost of car insurance is a concern for many drivers. Premium increases can feel unpredictable and frustrating, leaving you wondering what factors are at play. This exploration delves into the complexities of car insurance pricing, examining the key influences behind premium adjustments and offering practical strategies to manage your costs effectively. We’ll unravel the mysteries behind rising premiums, empowering you to navigate this crucial aspect of car ownership with greater understanding and control.

From the impact of your driving record and vehicle type to the role of economic factors and technological advancements, we’ll provide a comprehensive overview. We’ll also explore how you can actively influence your premiums through proactive measures and informed decision-making, ultimately helping you secure the best possible coverage at a manageable price.

Factors Influencing Premium Increases

Several interconnected factors contribute to fluctuations in car insurance premiums. Understanding these elements can help you make informed decisions to potentially mitigate future cost increases. This section will detail the key aspects influencing your insurance rate.

Age and Driving History

Your age significantly impacts your insurance premium. Younger drivers, typically those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. Insurance companies consider this increased risk when setting rates. Conversely, as you gain experience and a clean driving record, your premiums generally decrease. A driver with a 20-year history of accident-free driving will likely pay considerably less than a new driver. The accumulation of years of safe driving demonstrates a lower risk profile to the insurer.

Claims History

Your claims history is a paramount factor in determining your premium. Filing a claim, regardless of fault, typically results in a premium increase. The severity of the claim further influences the increase; a minor fender bender will have a less significant impact than a major accident requiring extensive repairs or medical attention. Multiple claims within a short period will lead to more substantial increases. Maintaining a clean claims history is crucial for keeping premiums low.

Vehicle Type and Location

The type of vehicle you insure directly affects your premium. Sports cars and high-performance vehicles are often associated with higher risk and therefore command higher premiums than more economical models. This is due to factors like repair costs, potential for theft, and the perceived riskier driving associated with these vehicles. Your location also plays a crucial role. Areas with high crime rates, frequent accidents, or higher instances of vandalism will generally have higher insurance rates than safer, more rural areas.

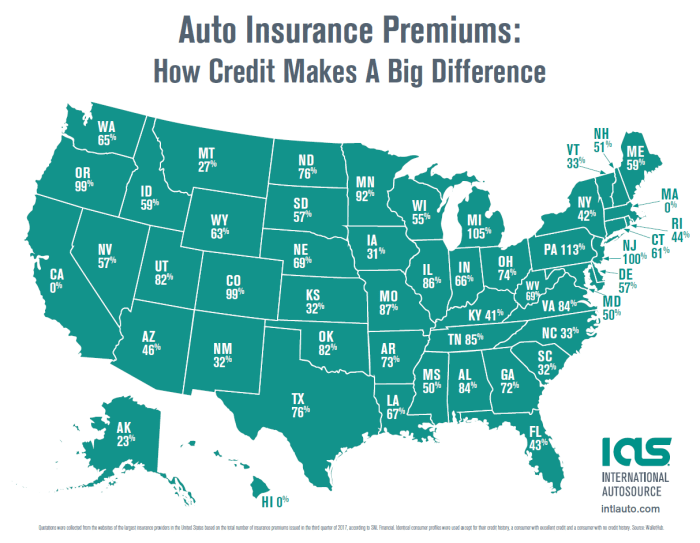

Credit Score Impact

In many regions, your credit score is a factor considered by insurance companies. A good credit score often correlates with responsible financial behavior, which insurers may associate with a lower risk of claims. Conversely, a poor credit score might indicate a higher risk profile, resulting in higher premiums. This practice is subject to regulations and varies by state or region. For example, California prohibits the use of credit scores in insurance rate calculations.

Driving Violations

Different driving violations carry varying levels of impact on your insurance premiums. The severity of the violation is the key determinant.

| Violation | Premium Increase (Estimate %) | Notes | Example |

|---|---|---|---|

| Speeding Ticket (Minor) | 5-15% | Varies based on speed and location. | A 10 mph over the speed limit ticket. |

| Speeding Ticket (Major) | 15-30% | Significant speeding, reckless driving. | 30+ mph over the speed limit. |

| DUI/DWI | 30-50% or more | Significant increase, potential policy cancellation. | Driving under the influence of alcohol or drugs. |

| At-Fault Accident | 20-50% or more | Varies based on severity of accident and damages. | Causing an accident resulting in significant damage. |

Understanding Policy Coverage and its Impact

Your car insurance premium isn’t a single, static number; it’s a reflection of the level of risk your insurer assesses based on your chosen coverage. Understanding the different types of coverage and how they influence your premium is crucial for making informed decisions. This section details how various coverage levels, deductibles, and optional add-ons affect your overall cost.

Different coverage levels directly impact your premium. Higher coverage limits generally mean higher premiums, but offer greater financial protection in the event of an accident. Conversely, lower coverage limits translate to lower premiums but leave you with a larger potential out-of-pocket expense should a claim arise.

Coverage Levels and Premium Costs

Liability coverage protects others involved in an accident you caused. Collision coverage repairs or replaces your vehicle after an accident, regardless of fault. Comprehensive coverage covers damage to your vehicle from events other than collisions, such as theft, vandalism, or weather-related damage. A policy with higher liability limits (e.g., $500,000/$1,000,000 bodily injury and property damage) will cost more than a policy with lower limits (e.g., $25,000/$50,000). Similarly, including collision and comprehensive coverage increases the premium compared to a liability-only policy. For example, a driver in a high-risk area might pay significantly more for collision coverage than a driver in a low-risk area with the same coverage level.

Deductibles and Premium Amounts

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible reduces your premium because you’re accepting more financial responsibility. A lower deductible means a higher premium because the insurance company will pay more in the event of a claim. For instance, a $500 deductible for collision coverage will typically result in a lower premium than a $1000 deductible for the same coverage. The difference in premium can vary depending on the insurer and the specific vehicle.

Optional Coverage and Cost Implications

Several optional coverages can enhance your policy but add to the premium. Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Rental reimbursement coverage pays for a rental car while your vehicle is being repaired. Roadside assistance covers towing, flat tire changes, and other roadside emergencies. Adding these optional coverages will increase your premium, with UM/UIM coverage often having a significant impact, especially in areas with a high percentage of uninsured drivers. For example, adding roadside assistance might add $10-$20 per month to your premium, while UM/UIM coverage could add substantially more, depending on the coverage limits chosen.

Factors Increasing the Cost of Specific Coverage Types

Several factors can influence the cost of specific coverage types. For uninsured/underinsured motorist coverage, the cost is often higher in areas with a high number of uninsured drivers. Similarly, the cost of collision and comprehensive coverage is affected by the vehicle’s value, make, model, and theft rate. A high-value vehicle or a vehicle prone to theft will generally command higher premiums for these coverages. Drivers with poor driving records will typically pay more for all coverage types.

Reducing Premiums Without Sacrificing Essential Coverage

Several strategies can help lower premiums without compromising essential coverage.

- Shop around and compare quotes from multiple insurers.

- Maintain a good driving record and avoid accidents and traffic violations.

- Consider increasing your deductible to reduce your premium.

- Bundle your car insurance with other types of insurance, such as homeowners or renters insurance.

- Take a defensive driving course to potentially earn a discount.

- Install anti-theft devices in your vehicle.

- Choose a less expensive vehicle.

Strategies for Managing Premium Costs

Facing a car insurance premium increase can be frustrating, but understanding how to manage these costs is crucial. Several effective strategies can help you control your expenses and potentially lower your premiums. This section Artikels practical approaches to reduce your insurance burden.

Comparing Insurance Quotes

Obtaining quotes from multiple insurance providers is the cornerstone of effective premium management. Different companies use varying algorithms to assess risk, leading to significant price differences for similar coverage. To effectively compare, use online comparison tools that allow you to input your information once and receive multiple quotes simultaneously. Pay close attention to the details of each policy, including deductibles, coverage limits, and any exclusions. Don’t just focus on the lowest price; ensure the coverage adequately meets your needs.

Improving Driving Habits

Your driving record is a major factor in determining your insurance premiums. Safe driving habits significantly reduce your risk profile and, consequently, your premiums. Maintaining a clean driving record, free from accidents and traffic violations, is paramount. Defensive driving courses can also demonstrate your commitment to safe driving and may result in discounts. Consider adopting strategies like avoiding distractions while driving, maintaining a safe following distance, and adhering strictly to speed limits. These simple adjustments can dramatically lower your risk of accidents and, in turn, your insurance costs.

Bundling Insurance Policies

Many insurance companies offer discounts for bundling multiple policies, such as combining your auto and home insurance. This practice often leads to substantial savings. Bundling leverages the insurer’s economies of scale and demonstrates your loyalty, often resulting in a lower overall premium than purchasing each policy separately. Contact your current provider or explore bundled options from other companies to determine the potential savings. For example, a hypothetical scenario could show a 15% discount on auto insurance when bundled with homeowners insurance.

Negotiating Lower Premiums

Don’t hesitate to negotiate your insurance premiums. Insurance is a competitive market, and companies are often willing to work with loyal customers or those who demonstrate a commitment to safety. Highlight your clean driving record, any safety features in your vehicle (like anti-theft devices), or participation in defensive driving courses. Be polite but firm in your request for a lower premium. Consider switching providers if your current insurer is unwilling to negotiate fairly. In some cases, simply threatening to switch providers can be enough to secure a better deal.

Cost Savings Comparison Chart

| Strategy | Potential Savings (Example) | Notes |

|——————————|—————————–|———————————————————————-|

| Comparing Quotes | $200 – $500 per year | Varies greatly depending on location, coverage, and driver profile. |

| Improved Driving Habits | $100 – $300 per year | Savings depend on the severity of past driving infractions and improvement. |

| Bundling Auto & Home Insurance | 10% – 20% off total premium | Savings vary based on the insurer and the specific policies bundled. |

| Negotiating with Insurer | $50 – $150 per year | Success depends on your negotiation skills and the insurer’s policies. |

The Role of Technology and Data

The insurance industry is undergoing a significant transformation driven by advancements in technology and the increasing availability of data. This has profoundly impacted how premiums are calculated and how insurers assess risk, leading to both benefits and ethical considerations. The use of technology and data allows for more personalized and potentially fairer pricing, but also raises questions about privacy and algorithmic bias.

Telematics and Usage-Based Insurance

Telematics, the use of technology to collect and transmit data about vehicle usage, is revolutionizing car insurance. Usage-based insurance (UBI) programs utilize telematics devices or smartphone apps to monitor driving behavior, such as speed, acceleration, braking, mileage, and time of day driving occurs. This data allows insurers to create a more accurate risk profile for individual drivers. Drivers with safer driving habits, as evidenced by the data collected, may qualify for lower premiums, while high-risk drivers may see their premiums increase. For example, a driver who consistently maintains a low speed and avoids harsh braking maneuvers might receive a significant discount compared to a driver with a history of speeding and aggressive driving.

Data Analytics in Determining Insurance Rates

Data analytics plays a crucial role in determining insurance rates. Insurers use sophisticated algorithms to analyze vast amounts of data, including driving records, demographics, location, vehicle type, and even credit scores, to predict the likelihood of an accident or claim. This allows for a more nuanced assessment of risk compared to traditional methods that rely heavily on broad actuarial tables. For instance, an insurer might use data analytics to identify specific geographic areas with higher accident rates, leading to adjusted premiums for drivers in those locations. Similarly, analyzing data on vehicle models can reveal which vehicles are more prone to accidents or costly repairs, impacting the premiums associated with those vehicles.

Driver-Assistance Technologies and Future Premium Adjustments

The proliferation of driver-assistance technologies, such as automatic emergency braking (AEB), lane departure warning (LDW), and adaptive cruise control (ACC), is expected to influence future premium adjustments. These technologies are designed to improve safety and reduce the likelihood of accidents. Insurers are likely to offer discounts to drivers who equip their vehicles with these safety features, reflecting the reduced risk they represent. For example, an insurer might offer a substantial discount to a driver with a vehicle equipped with AEB, recognizing its proven effectiveness in preventing collisions. The level of discount might even vary based on the specific features and their effectiveness ratings.

Ethical Concerns Regarding Data Usage in Insurance Pricing

The use of data in insurance pricing raises several ethical concerns. Concerns exist about data privacy, the potential for algorithmic bias leading to discriminatory pricing, and the transparency of the rating algorithms. For example, the use of credit scores in determining insurance premiums has been criticized for disproportionately affecting low-income individuals, even if their driving record is impeccable. Similarly, biases embedded in algorithms could unfairly penalize certain demographic groups. Ensuring fairness and transparency in the use of data for insurance pricing is crucial to maintaining public trust.

Traditional Insurance Methods vs. Usage-Based Insurance

A comparison of traditional insurance methods and usage-based insurance highlights the key differences:

- Traditional Insurance: Premiums are primarily based on broad demographic data, driving history (often limited to accidents and violations), and vehicle type. It offers less personalized pricing and may not accurately reflect individual driving behavior.

- Usage-Based Insurance: Premiums are adjusted based on individual driving behavior, as monitored through telematics. This allows for more personalized and potentially fairer pricing, rewarding safer drivers with lower premiums. It offers greater transparency in how premiums are determined, although data privacy concerns remain.

Last Recap

Managing car insurance costs requires a proactive approach, encompassing understanding the factors that influence premiums, comparing quotes from different providers, and adopting safe driving habits. By leveraging the insights provided and employing the strategies Artikeld, you can effectively navigate the complexities of car insurance pricing and secure the best possible coverage while mitigating premium increases. Remember, informed choices and proactive management can significantly impact your overall insurance costs.

Questions Often Asked

What is the average car insurance premium increase annually?

The average annual increase varies significantly depending on location, insurer, and individual risk factors. There’s no single definitive answer, and it’s best to check with your insurer for specifics.

Can I dispute a car insurance premium increase?

Yes, you can contact your insurance company to inquire about the reasons for the increase and explore options. Providing evidence of improved driving habits or safety features might help.

How often do car insurance premiums typically increase?

Premiums can be adjusted annually, or even more frequently depending on your policy and insurer. Review your policy documents for specifics on renewal cycles and potential adjustments.

Does paying my insurance annually lower my premium?

Some insurers offer discounts for paying annually, while others do not. Check with your insurer to see if this option is available and if it results in cost savings.