Navigating the world of car insurance can feel like deciphering a complex code. At the heart of this system lies the car insurance premium – the price you pay for coverage. This guide unravels the mysteries surrounding car insurance premium definition, explaining how it’s calculated, what factors influence it, and how you can make informed decisions about your coverage.

From understanding the core components of your premium to learning how to compare different policies and potentially lower your costs, this comprehensive overview empowers you to become a more savvy consumer of car insurance. We’ll explore the nuances of various coverage types, the impact of your driving history, and the role of demographic factors in determining your premium. Ultimately, understanding your car insurance premium is key to securing the right protection at a price that works for you.

Core Definition of Car Insurance Premium

A car insurance premium is the amount of money you pay to an insurance company in exchange for coverage against potential financial losses related to your vehicle. This payment secures your insurance policy and ensures that the insurer will pay for covered damages or losses if an accident or other covered event occurs. The premium is typically paid in installments, either monthly, quarterly, or annually.

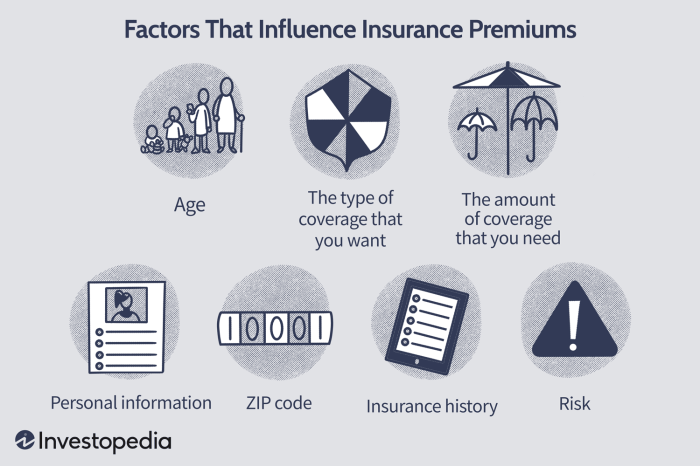

Factors Influencing Car Insurance Premiums

Several factors contribute to the calculation of your car insurance premium. These factors are carefully assessed by insurance companies to determine your risk profile and assign a corresponding premium. These factors often include your driving history (accidents, violations), age, location (crime rates, accident frequency), the type of vehicle you drive (make, model, safety features), your credit score, and the level of coverage you choose. For instance, a driver with multiple speeding tickets will generally pay a higher premium than a driver with a clean record. Similarly, a sports car typically commands a higher premium than a smaller, more economical vehicle due to higher repair costs and a perceived higher risk of accidents.

Premium vs. Deductible

It’s crucial to understand the difference between a premium and a deductible. The premium is the regular payment you make to maintain your insurance coverage. The deductible, on the other hand, is the amount of money you agree to pay out-of-pocket before your insurance coverage kicks in after an accident. For example, if you have a $500 deductible and incur $2,000 in damages, you would pay $500, and your insurance company would cover the remaining $1,500. A higher deductible typically results in a lower premium, while a lower deductible results in a higher premium. This is because you are accepting more financial responsibility upfront in exchange for lower monthly payments.

Comparison of Car Insurance Premiums

The table below compares three common types of car insurance premiums: comprehensive, liability, and collision. The specific costs will vary widely based on the factors mentioned earlier.

| Type of Coverage | What it Covers | Typical Premium Range | Deductible Applicability |

|---|---|---|---|

| Liability | Damages to other people’s property or injuries sustained by others in an accident you caused. | $200 – $500+ annually (varies significantly based on coverage limits) | Not applicable to liability claims; you’re responsible for paying the damages regardless of fault. |

| Collision | Damages to your vehicle in an accident, regardless of fault. | $200 – $600+ annually (varies based on vehicle value and deductible) | Applicable; you pay your deductible before insurance covers the rest. |

| Comprehensive | Damages to your vehicle from non-collision events such as theft, vandalism, fire, or weather damage. | $100 – $400+ annually (varies based on vehicle value and deductible) | Applicable; you pay your deductible before insurance covers the rest. |

Components of Car Insurance Premiums

Your car insurance premium isn’t a random number; it’s a carefully calculated figure based on several factors that assess your risk to the insurance company. Understanding these components can help you make informed decisions about your coverage and potentially lower your costs. This section details the key elements influencing your premium.

Risk Assessment in Premium Determination

Insurance companies employ sophisticated risk assessment models to predict the likelihood of you filing a claim. These models analyze a vast amount of data to quantify your risk profile. A higher risk profile translates to a higher premium, reflecting the increased probability of the insurer needing to pay out for an accident or other covered event. Factors considered include your driving history, vehicle type, location, and even your credit score in some jurisdictions. The more data points suggesting a higher likelihood of a claim, the higher your premium will be. For instance, someone with a history of speeding tickets and accidents will likely face a higher premium than someone with a spotless driving record.

Impact of Driving History on Premium Costs

Your driving history is a cornerstone of risk assessment. A clean driving record, free of accidents, traffic violations, and DUI convictions, significantly lowers your premium. Conversely, any incidents on your record, especially those resulting in significant damage or injury, will increase your premium. The severity and frequency of incidents heavily influence the premium increase. For example, a single minor fender bender might lead to a modest increase, while a DUI conviction could result in a substantial premium hike, potentially even leading to policy cancellation in some cases. Many insurers use a points system, assigning points for each incident. The accumulation of points directly impacts the premium calculation.

Demographic Factors Influencing Premium Calculations

Beyond driving history, demographic factors play a role. Age is often a significant factor, with younger drivers generally paying higher premiums due to statistically higher accident rates. Location also matters; premiums tend to be higher in areas with higher crime rates and more frequent accidents. Gender, while controversial and increasingly regulated, may still be a factor in some jurisdictions. Finally, occupation can indirectly influence premiums, as some professions may increase the risk of accidents or claims. For example, a long-haul trucker might pay more than a librarian due to higher mileage and potential exposure to hazardous road conditions.

Insurance Company Weighting of Factors

Different insurance companies employ varying algorithms and weighting systems for these factors. One company might heavily emphasize driving history, while another might place greater importance on location. Some insurers may use more sophisticated models that incorporate a wider range of data points. For instance, Company A might prioritize accident history and assign a higher weight to at-fault accidents, while Company B might focus more on credit score and geographic location. This variance explains why premiums can differ significantly between insurers, even for individuals with similar profiles. It’s beneficial to compare quotes from multiple companies to find the most competitive rate.

Understanding Your Car Insurance Policy

Your car insurance policy is a legally binding contract outlining the terms and conditions of your coverage. Understanding its intricacies is crucial for ensuring you receive the appropriate protection and manage your premiums effectively. This section will clarify key aspects of your policy related to premiums, payment schedules, and dispute resolution.

Key Policy Terms and Conditions Related to Premiums

Several key terms within your policy directly impact your premium. These include the coverage limits (liability, collision, comprehensive), deductible amounts, and any applicable discounts or surcharges. Your premium is calculated based on a risk assessment, factoring in these elements alongside your driving history, age, location, and the type of vehicle you insure. For example, a higher liability coverage limit will typically result in a higher premium, but offers greater financial protection in the event of an accident. Similarly, choosing a higher deductible will lower your premium but increases your out-of-pocket expense in the event of a claim. Understanding the interplay between these factors is vital for tailoring your coverage to your needs and budget.

Premium Payment Schedules

Your insurance policy will specify your premium payment schedule, typically monthly, quarterly, semi-annually, or annually. The payment method (e.g., automatic payment, mail, online portal) will also be detailed. Late payment fees are usually stipulated, so adhering to the payment schedule is essential to avoid penalties. Many insurers offer online portals or mobile apps that allow you to view your payment history, upcoming due dates, and manage your payment preferences. This provides transparency and convenience in managing your premium payments.

Appealing a Premium Increase

If you receive a notice of a premium increase, review your policy and the justification provided by your insurer. If you believe the increase is unwarranted, contact your insurer to discuss the reasons. Gather any relevant information that might support your case, such as a clean driving record or improvements to your vehicle’s safety features. You might be able to negotiate a lower premium or explore alternative coverage options. If you remain dissatisfied, consider seeking advice from an independent insurance agent or filing a complaint with your state’s insurance regulatory agency. Remember to maintain a respectful and professional tone throughout the appeal process.

Comparing Car Insurance Premiums from Different Providers

Before selecting a car insurance policy, comparing quotes from several providers is highly recommended. This ensures you obtain the most competitive premium for the desired coverage.

- Obtain quotes from at least three different insurers.

- Ensure you are comparing similar coverage levels and deductibles across providers.

- Review the policy details carefully, paying close attention to exclusions and limitations.

- Check customer reviews and ratings to gauge the insurer’s reputation for customer service and claims handling.

- Consider using online comparison tools to streamline the process of obtaining and comparing quotes.

- Don’t solely base your decision on price; consider the overall value and reputation of the insurer.

Epilogue

In conclusion, the car insurance premium, while seemingly a simple number, is a complex reflection of numerous factors. By understanding the components that contribute to your premium – your driving history, vehicle type, location, and chosen coverage – you gain control over your insurance costs. Armed with this knowledge, you can actively manage your risk and secure the best possible car insurance policy for your needs. Remember to regularly review your policy and shop around to ensure you’re receiving the most competitive rates.

Answers to Common Questions

What is the difference between a premium and a deductible?

Your premium is the regular payment you make for your car insurance coverage. The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in after an accident.

Can I get my car insurance premium lowered?

Yes, several factors can influence your premium. Maintaining a clean driving record, opting for higher deductibles, bundling insurance policies, and taking defensive driving courses can all lead to lower premiums. Shopping around and comparing quotes from different insurers is also crucial.

How often are car insurance premiums reviewed?

The frequency of premium reviews varies by insurer and policy type, but it’s common for premiums to be reviewed annually. Some insurers may adjust premiums more frequently based on changes in your risk profile.

What happens if I don’t pay my car insurance premium?

Failure to pay your premium can result in your policy being cancelled. This leaves you without insurance coverage and could result in legal consequences if you’re involved in an accident.