Navigating the complexities of tax deductions can feel like deciphering a secret code, especially when it comes to insurance premiums. Many wonder, “Can I deduct the cost of my insurance?” The answer, as with most tax questions, isn’t a simple yes or no. Deductibility hinges on several factors, including the type of insurance, your employment status, and how the insurance relates to your income-generating activities. This guide will unravel the intricacies of insurance premium deductions, providing clarity and insights into what you can and cannot write off.

We’ll explore the deductibility of various insurance types, from health and business insurance to homeowner’s, renter’s, auto, and life insurance. We’ll examine the relevant tax codes, highlight key differences for employees versus the self-employed, and provide practical examples to illustrate the rules. By the end, you’ll have a solid understanding of how to determine the deductibility of your insurance premiums and maximize your tax benefits.

Tax Deductibility of Insurance Premiums

Understanding the tax deductibility of insurance premiums is crucial for minimizing your tax liability. The rules governing deductibility vary depending on the type of insurance, your employment status, and other factors. This section will clarify these rules and provide examples to aid in your understanding.

Deductibility Rules for Insurance Premiums

Generally, insurance premiums are deductible if they are paid for insurance that protects your business or income-generating activities. Personal insurance premiums are usually not deductible. The specific requirements and limitations depend on the type of insurance and applicable tax laws. Accurate record-keeping is essential for claiming deductions. Failure to maintain proper documentation can result in the denial of a deduction.

Examples of Deductible and Non-Deductible Insurance Premiums

Deductible insurance premiums often include those for health insurance (for self-employed individuals), business liability insurance, professional malpractice insurance, and insurance protecting business property. Conversely, premiums for life insurance (generally), personal auto insurance, and homeowner’s insurance are typically not deductible. The exception for health insurance is specifically for self-employed individuals, as employees’ health insurance premiums are usually handled through employer-sponsored plans and tax-advantaged accounts.

Specific Requirements and Limitations for Deducting Insurance Premiums

Several requirements and limitations govern the deductibility of insurance premiums. For instance, premiums must be ordinary and necessary business expenses. They must also be paid during the tax year for which the deduction is claimed. Furthermore, limitations may apply depending on the type of insurance and the taxpayer’s income. For example, the amount of health insurance premiums a self-employed individual can deduct might be capped based on their adjusted gross income (AGI). It is advisable to consult the current IRS publications and relevant tax codes for precise limitations.

Deductibility of Insurance Premiums: Self-Employed vs. Employees

Self-employed individuals and employees have different rules regarding insurance premium deductibility. Self-employed individuals can often deduct the premiums for health insurance as a business expense. Employees, on the other hand, typically have their health insurance premiums covered through their employer or through pre-tax deductions from their paychecks, impacting the tax implications differently. Other business-related insurance premiums are generally deductible for both self-employed individuals and business owners, provided they meet the criteria of being ordinary and necessary business expenses.

Summary Table of Deductible and Non-Deductible Insurance Premiums

| Type of Insurance | Deductibility Status | Relevant Tax Code Sections (Example) | Supporting Documentation Needs |

|---|---|---|---|

| Health Insurance (Self-Employed) | Deductible | IRS Publication 463 | Premiums paid receipts, 1099-MISC (if applicable) |

| Business Liability Insurance | Deductible | IRC Section 162 | Insurance policy, premium payment receipts |

| Professional Malpractice Insurance | Deductible | IRC Section 162 | Insurance policy, premium payment receipts |

| Life Insurance | Generally Non-Deductible | N/A | N/A |

| Personal Auto Insurance | Non-Deductible | N/A | N/A |

| Homeowner’s Insurance | Non-Deductible | N/A | N/A |

Health Insurance Premiums

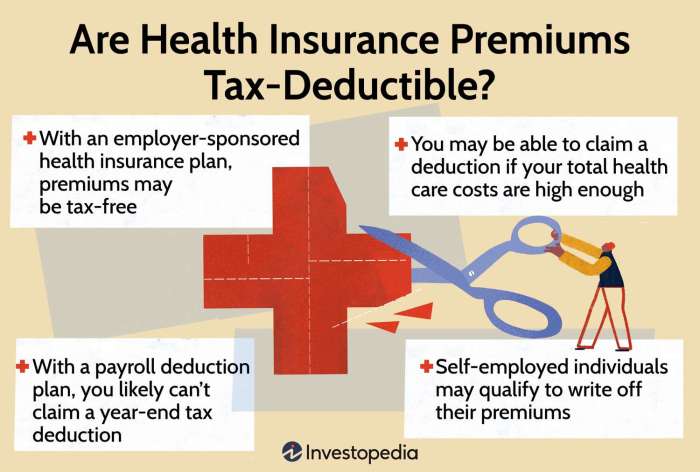

Understanding the tax implications of health insurance premiums is crucial for both individuals and families. The deductibility of these premiums can significantly impact your overall tax liability, offering potential savings. This section will explore the rules surrounding the deductibility of health insurance premiums, particularly in the context of the Affordable Care Act (ACA).

Health insurance premiums are generally not deductible as an itemized deduction for most taxpayers. However, there are exceptions, primarily for self-employed individuals, and those who receive premiums through certain employer-sponsored plans or through the ACA marketplace. The specifics depend heavily on individual circumstances and the type of health insurance plan.

Self-Employed Individuals

Self-employed individuals can deduct the amount they pay for health insurance premiums as an adjustment to income. This means the deduction reduces their adjusted gross income (AGI) directly, potentially lowering their tax liability more effectively than an itemized deduction. This deduction is available even if the taxpayer does not itemize other deductions. The amount deductible is the actual premiums paid during the tax year. Supporting documentation, such as receipts or statements from the insurance provider, is essential for claiming this deduction.

Affordable Care Act (ACA) and Health Insurance Premiums

The Affordable Care Act (ACA) significantly impacted the health insurance landscape, including tax implications. While the ACA doesn’t directly make health insurance premiums deductible for most individuals, it provides subsidies and tax credits to help individuals and families afford health insurance purchased through the ACA marketplaces. These credits reduce the cost of premiums, effectively lowering the out-of-pocket expense. The amount of the credit depends on income and the cost of insurance plans in the individual’s area. These credits are not a deduction but rather a direct reduction in the amount of tax owed.

Deductibility Scenarios

Let’s examine a few scenarios illustrating the deductibility of health insurance premiums:

Scenario 1: John is self-employed and paid $7,000 in health insurance premiums during the tax year. He can deduct the full $7,000 as an adjustment to income, reducing his AGI and consequently his tax liability.

Scenario 2: Sarah is employed by a company that offers a health insurance plan. Her employer pays a portion of the premium, and she pays the rest. Generally, the premiums paid by Sarah are not deductible. However, if her employer’s contribution is considered a taxable fringe benefit, there might be indirect tax implications.

Scenario 3: Maria purchased health insurance through the ACA marketplace and received a tax credit of $2,000 to offset her premium costs. This credit reduces her tax liability, but the premiums themselves are not deductible.

Determining Deductibility: A Flowchart

The following flowchart Artikels the decision-making process for determining the deductibility of health insurance premiums:

[Descriptive Flowchart Text]

Start –> Are you self-employed? Yes –> Deduct premiums as an adjustment to income. No –> Did you purchase insurance through the ACA marketplace and receive a tax credit? Yes –> Tax credit reduces tax liability; premiums not deductible. No –> Are you reimbursed for premiums by your employer (excluding taxable fringe benefits)? Yes –> Premiums generally not deductible. No –> Premiums generally not deductible. End

Business Insurance Premiums

Many business owners overlook the tax advantages associated with business insurance premiums. Understanding which premiums are deductible and how to properly account for them can significantly reduce your tax liability. This section clarifies the deductibility of various business insurance types and Artikels the accounting procedures for different business structures.

Deductible business insurance premiums are those covering risks directly related to your business operations. These premiums are generally considered ordinary and necessary business expenses, meaning they are common in your industry and helpful in running your business. However, personal insurance premiums are not deductible as business expenses.

Types of Deductible Business Insurance Premiums

The deductibility of business insurance premiums depends on the type of insurance and its relevance to business operations. A comprehensive understanding of these types is crucial for accurate tax reporting.

- General Liability Insurance: Protects your business from claims of bodily injury or property damage caused by your business operations. This is generally deductible.

- Professional Liability Insurance (Errors and Omissions Insurance): Covers claims of negligence or mistakes in professional services. Deductible for professionals like doctors, lawyers, and consultants.

- Commercial Property Insurance: Protects your business property (buildings, equipment, inventory) from damage or loss. Premiums are deductible.

- Workers’ Compensation Insurance: Covers medical expenses and lost wages for employees injured on the job. Generally deductible and often mandated by state law.

- Commercial Auto Insurance: Covers vehicles used for business purposes. Premiums for vehicles used exclusively for business are fully deductible. Premiums for vehicles used partly for business and partly for personal use require a pro-rata allocation.

- Product Liability Insurance: Protects your business from claims related to defective products. Deductible if your business manufactures or sells products.

- Cyber Liability Insurance: Protects against data breaches and other cyber-related risks. Deductible, particularly crucial for businesses handling sensitive customer data.

Accounting for and Deducting Business Insurance Premiums

Proper accounting is essential to claim the deduction. Premiums are typically expensed in the year they are paid, regardless of the policy’s coverage period. If you prepay insurance premiums, you may only deduct the portion that covers the current tax year. For example, if you pay $12,000 for a two-year policy in 2024, you can only deduct $6,000 in 2024 and the remaining $6,000 in 2025. This should be documented accurately in your business accounting records.

Business Structure and Insurance Premium Deductions

The method of deducting insurance premiums varies slightly depending on your business structure.

- Sole Proprietorship: Insurance premiums are deducted on Schedule C (Profit or Loss from Business) of Form 1040.

- Partnership: Premiums are deducted on Form 1065 (U.S. Return of Partnership Income) and then passed through to the partners’ individual tax returns.

- Corporation: Premiums are deducted on Form 1120 (U.S. Corporation Income Tax Return) and reduce the corporation’s taxable income.

Examples of Business Insurance Premium Deductions

Let’s consider a small bakery (sole proprietorship) that pays $3,000 annually for general liability insurance, $1,500 for commercial property insurance, and $1,000 for workers’ compensation insurance. These premiums totaling $5,500 would be reported as business expenses on Schedule C, reducing the bakery’s taxable income. Similarly, a larger corporation with a broader range of insurance policies (including product liability and cyber liability) would deduct the total premiums on its Form 1120. The specific treatment of premiums depends on the individual business’s insurance needs and accounting practices. Always consult with a tax professional for personalized guidance.

Auto Insurance Premiums

Generally, auto insurance premiums are considered a personal expense and are not deductible on your federal income tax return. However, there are specific exceptions where portions, or in some cases all, of your auto insurance premiums may be deductible as a business expense. This primarily depends on how the vehicle is used.

Auto Insurance Premiums Deductibility for Business Use

The deductibility of auto insurance premiums hinges on the primary use of the vehicle. If a vehicle is used exclusively or predominantly for business purposes, the associated insurance premiums are generally deductible as a business expense. This deduction is claimed on Schedule C (Profit or Loss from Business) or other relevant business tax forms, depending on your business structure. To be considered “predominantly” for business use, the IRS generally requires that over 50% of the vehicle’s total mileage be for business purposes. Accurate record-keeping of business and personal mileage is crucial for substantiating this claim.

Examples of Auto Insurance Premiums Deductibility

Let’s consider two scenarios:

Scenario 1: A self-employed plumber uses their van exclusively for business purposes, driving it to job sites and carrying tools. The entire cost of their auto insurance premiums is deductible as a business expense.

Scenario 2: A salesperson uses their personal car for both business and personal trips. They meticulously track their mileage, recording 7,000 business miles and 3,000 personal miles during the year. In this case, only the portion of the insurance premiums attributable to the business use (7,000 / 10,000 = 70%) is deductible.

Deductibility Comparison: Business vs. Personal Auto Insurance

| Usage Type | Deductibility | Supporting Documentation | Tax Implications |

|---|---|---|---|

| Exclusively Business Use | Fully deductible as a business expense | Insurance policy, mileage logs demonstrating 100% business use | Reduces taxable business income, lowering overall tax liability. |

| Predominantly Business Use (Over 50% Business Mileage) | Partially deductible, proportional to business use | Insurance policy, detailed mileage logs showing business and personal mileage | Reduces taxable business income proportionally, lowering overall tax liability to a lesser extent than exclusive business use. |

| Personal Use Only | Not deductible | N/A | No impact on business taxes. |

| Mixed Business and Personal Use (Under 50% Business Mileage) | Not deductible (unless specific exceptions apply, like a home office deduction where the vehicle is used for commuting to a home office). | N/A | No impact on business taxes. |

Closure

Successfully navigating the world of insurance premium deductions requires careful consideration of numerous factors. While the general rule is that premiums related to income-generating activities are deductible, the specifics can be nuanced and depend heavily on the type of insurance and your individual circumstances. This guide has aimed to provide a clear and comprehensive overview, empowering you to make informed decisions and potentially reduce your tax burden. Remember to consult with a qualified tax professional for personalized advice tailored to your specific situation, ensuring compliance and maximizing your tax advantages.

Clarifying Questions

Can I deduct insurance premiums paid for my spouse?

Generally, no. Deductibility is usually tied to the individual paying the premiums and their specific circumstances. However, there may be exceptions depending on the type of insurance and your filing status.

What documentation do I need to claim insurance premium deductions?

You’ll typically need your insurance policy and receipts or statements showing premium payments. Keep accurate records throughout the year for easy access during tax season.

Are premiums for pet insurance deductible?

Generally, no. Pet insurance premiums are not considered deductible unless the pet is used directly in a business context (e.g., a service animal).

What if I overpaid my insurance premiums and received a refund?

The refund will likely be considered a reduction in your insurance expense for the tax year. You may need to adjust your tax return accordingly.