Navigating the complexities of tax deductions can be daunting, especially when it comes to insurance premiums. Understanding which insurance costs are deductible and which aren’t is crucial for maximizing your tax return. This guide explores the deductibility of various insurance premiums, clarifying the rules for self-employed individuals, employees, and the impact of different filing statuses. We’ll demystify the process, providing clear examples and addressing common misconceptions.

From health and long-term care insurance to disability and life insurance, we’ll delve into the specific requirements and limitations for claiming these deductions. We’ll also compare the benefits of itemizing deductions versus using the standard deduction, helping you make informed decisions about your tax strategy. By the end, you’ll have a solid understanding of how to potentially reduce your tax burden through legitimate insurance premium deductions.

Deductibility of Health Insurance Premiums

Self-employed individuals often face unique tax situations, and understanding the deductibility of health insurance premiums is crucial for minimizing their tax burden. This section details the rules and requirements surrounding this deduction, comparing it to the situation for employees and providing examples for clarity.

Tax Implications of Health Insurance Premiums for the Self-Employed

The self-employed can deduct the cost of health insurance premiums as an above-the-line deduction. This means the deduction is taken before calculating adjusted gross income (AGI), offering a greater tax benefit than itemized deductions. This deduction helps offset the cost of health insurance, a significant expense for many individuals who are responsible for their own coverage. The deduction is reported on Form 1040, Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming), depending on the nature of their self-employment.

Requirements for Deducting Health Insurance Premiums

To deduct health insurance premiums, several conditions must be met. The individual must be self-employed or have income from a business, and the insurance must cover the taxpayer, their spouse, and/or dependents. The premiums must be paid for a health insurance plan that meets the requirements of the Affordable Care Act (ACA). Crucially, the taxpayer cannot be eligible to participate in an employer-sponsored health plan. Premiums paid for long-term care insurance are generally not deductible.

Comparison of Deductibility for Employees vs. the Self-Employed

Employees typically cannot deduct health insurance premiums if their employer offers a plan, even if they choose not to participate. The cost of the employer-sponsored health insurance is considered a non-taxable benefit. However, self-employed individuals, lacking access to an employer-sponsored plan, can deduct the full amount of their health insurance premiums as long as they meet the previously mentioned requirements. This significant difference highlights a key tax advantage for the self-employed.

Acceptable Documentation to Support the Deduction

Proper documentation is essential to substantiate the deduction. Acceptable forms of documentation include Form 1099-MISC (Miscellaneous Income) from the insurance company, which details the premiums paid, and cancelled checks or bank statements showing payments. Copies of the insurance policy itself, detailing coverage and premium amounts, can also serve as supporting documentation. Maintaining organized records is vital in case of an IRS audit.

Maximum Deductible Amount Based on Adjusted Gross Income (AGI)

The maximum deductible amount for health insurance premiums is not directly tied to AGI in a fixed formula. Instead, the deductibility hinges on meeting the eligibility requirements previously described. The entire amount of premiums paid for qualifying health insurance can be deducted, subject to these criteria. There is no AGI-based cap on the deduction itself, only eligibility requirements.

| AGI Range | Deduction Allowed? | Example | Additional Notes |

|---|---|---|---|

| Any AGI | Potentially, if eligible | Self-employed individual pays $10,000 in premiums and meets all requirements; they can deduct the full $10,000. | Eligibility is key; the AGI does not limit the deduction amount for eligible individuals. |

| N/A | No | Employee with employer-sponsored health insurance cannot deduct premiums. | This is regardless of AGI. |

Deductibility of Other Insurance Premiums

Beyond health insurance, several other types of insurance premiums may offer tax deductions, depending on specific circumstances and applicable tax laws. Understanding these nuances is crucial for maximizing tax benefits. This section will clarify the deductibility rules for various insurance premiums.

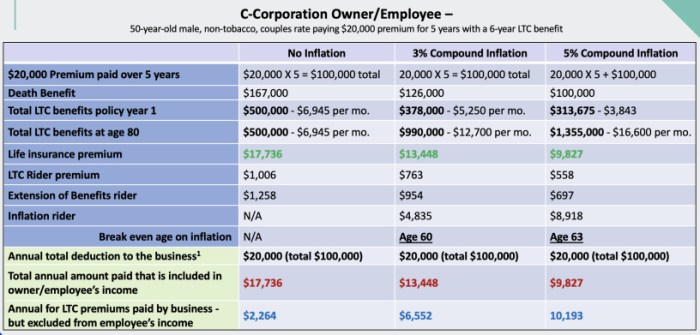

Long-Term Care Insurance Premiums

Deductibility of long-term care insurance premiums depends heavily on the policy’s structure and the taxpayer’s age. Generally, premiums paid for qualified long-term care insurance policies may be deductible as an itemized deduction on Schedule A of your tax return. However, the amount you can deduct is limited. The IRS provides specific guidelines and limitations, which often involve factors such as the policy’s benefits and the taxpayer’s age. These limitations can change, so consulting the latest IRS publications or a tax professional is advisable. For example, a taxpayer aged 50 might be able to deduct a larger portion of their premiums than a younger individual, reflecting the increased risk associated with older age.

Disability Insurance Premiums

The deductibility of disability insurance premiums hinges on whether the policy is for business or personal use. Premiums paid for disability insurance purchased as a business expense are usually deductible as an ordinary and necessary business expense. However, premiums for personal disability insurance policies are generally not deductible, unless the policy is part of a larger self-employment tax strategy, and even then, there are significant limitations and requirements. A self-employed individual might, under certain conditions, be able to deduct a portion of their disability insurance premiums as a business expense. The key is proving that the insurance is directly related to maintaining their income-generating capacity.

Life Insurance Premiums

Life insurance premiums are typically not deductible. There are, however, limited exceptions. For instance, premiums paid on a life insurance policy held by a business to cover the life of a key employee may be deductible as a business expense, provided the policy meets specific criteria Artikeld by the IRS. Additionally, certain life insurance policies with a cash value component might allow for the deduction of interest paid on policy loans. These exceptions are quite specific and require careful examination of the policy details and relevant tax regulations.

Non-Deductible Insurance Premiums

Many insurance premiums are not deductible. Examples include premiums for automobile insurance, homeowner’s insurance, and renter’s insurance. These are generally considered personal expenses and are not eligible for tax deductions. Similarly, premiums for most types of pet insurance, travel insurance, and other personal liability insurance policies are typically not deductible. It’s important to note that the rules can be complex, and consulting a tax advisor can provide clarity in specific situations.

Common Misconceptions about Deductible Insurance Premiums

It’s important to clarify some common misunderstandings regarding deductible insurance premiums:

- All health insurance premiums are deductible: While premiums for qualified health insurance plans are often deductible, this is not universally true. The deductibility can depend on factors like the type of plan and the taxpayer’s income.

- Disability insurance premiums are always deductible: As explained earlier, deductibility depends on whether the policy is business-related or personal.

- Long-term care insurance premiums are fully deductible: The deductibility is limited and subject to age-related restrictions and other criteria.

- Any insurance premium paid is a tax deduction: This is false. Many personal insurance premiums are not deductible.

Impact of Filing Status on Deductibility

Your filing status significantly impacts the deductibility of your insurance premiums. The rules surrounding itemized deductions, which include most insurance premiums, vary depending on whether you’re single, married filing jointly, or head of household. Understanding these differences is crucial for accurately calculating your tax liability.

The primary factor influencing deductibility is your adjusted gross income (AGI). Higher AGIs often lead to limitations or complete disallowance of certain deductions. Furthermore, the specific type of insurance (health, auto, etc.) also plays a role, as some premiums are more easily deductible than others.

Filing Status and Deductible Insurance Premiums

The following table summarizes how different filing statuses can affect the deductibility of insurance premiums. Remember that this is a simplified overview, and specific circumstances may require professional tax advice. Deductibility rules are subject to change, so always consult the most up-to-date IRS publications.

| Filing Status | Deductibility Implications |

|---|---|

| Single | Single filers use their individual AGI to determine eligibility for itemized deductions, including those related to insurance premiums. If their AGI exceeds certain thresholds, some deductions may be limited or phased out. For example, the medical expense deduction, which applies to health insurance premiums exceeding a certain percentage of AGI, may be reduced or eliminated entirely for high-income single filers. |

| Married Filing Jointly | Married couples filing jointly combine their incomes to calculate their AGI. This combined AGI is then used to determine eligibility for itemized deductions. Generally, a higher combined AGI could lead to more significant limitations on deductions compared to single filers with similar individual incomes. However, the higher AGI might also increase the total amount of medical expenses that qualify for deduction. |

| Head of Household | Head of household filers have a separate set of AGI thresholds for determining deduction eligibility. Their AGI is considered individually, similar to single filers, but the specific thresholds and limitations for deductions might differ. The head of household filing status often offers tax advantages, potentially resulting in a greater portion of insurance premiums being deductible compared to single filers with similar income. |

Itemized Deductions vs. Standard Deduction

Choosing between itemizing deductions and taking the standard deduction significantly impacts your tax liability. The standard deduction is a flat amount set by the IRS, while itemizing allows you to deduct specific expenses, including certain insurance premiums, if they exceed the standard deduction amount. This decision hinges on the total value of your itemized deductions.

Itemizing is more beneficial than taking the standard deduction when the sum of your itemized deductions, including eligible insurance premiums, surpasses your standard deduction amount. This means that if your total itemized deductions, which might include medical expenses, state and local taxes, mortgage interest, and eligible insurance premiums, are greater than the standard deduction for your filing status, itemizing will lower your taxable income and thus your tax liability.

Scenario Illustrating Lower Tax Liability Through Itemization

Let’s consider a single taxpayer with a standard deduction of $13,850 in 2023. Suppose this individual paid $10,000 in medical expenses exceeding 7.5% of their adjusted gross income (AGI), $5,000 in eligible unreimbursed health insurance premiums, and $2,000 in state and local taxes. Their total itemized deductions are $17,000 ($10,000 + $5,000 + $2,000). Since $17,000 exceeds the $13,850 standard deduction, itemizing would result in a lower taxable income and, consequently, a lower tax liability. The exact tax savings would depend on their tax bracket.

Factors Influencing the Choice Between Itemizing and Standard Deduction

Several factors influence the decision to itemize or take the standard deduction. These include the taxpayer’s filing status (single, married filing jointly, etc.), their total itemized deductions (including eligible insurance premiums), and the applicable standard deduction amount for their filing status. High medical expenses, significant state and local taxes, and substantial mortgage interest are common factors that often push taxpayers towards itemization. The standard deduction amount is adjusted annually by the IRS, and changes to tax laws may affect the value of various deductions. A taxpayer should carefully review their individual circumstances and consult a tax professional if needed to determine the most advantageous approach.

Self-Employment and Insurance Premiums

Self-employment presents unique tax considerations, particularly regarding insurance premiums. Unlike employees who often have premiums deducted directly from their paychecks, the self-employed must handle these deductions themselves. Understanding the process and relevant forms is crucial for accurate tax filing and maximizing deductions. This section details the deduction process for health insurance premiums and the necessary paperwork for self-employed individuals.

The process of deducting health insurance premiums for self-employed individuals involves several key steps. First, you must have self-employment income. Next, you must have paid health insurance premiums for yourself, your spouse, and/or your dependents. Crucially, you cannot be eligible to participate in an employer-sponsored health plan. The premiums are deductible as an adjustment to income, meaning they reduce your adjusted gross income (AGI) before other deductions are applied. This results in a larger tax reduction than itemized deductions.

Deduction Process for Self-Employed Individuals

To deduct health insurance premiums, you must complete Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), to report your business income and expenses. The health insurance premiums are reported as a business expense on Schedule C, line 28 (Other Expenses). You will then need to complete Form 8889, Health Savings Accounts (HSAs), if applicable, to report contributions made to a health savings account. It’s important to keep detailed records of all premium payments, including receipts and invoices, as these are necessary for substantiating the deduction during an audit.

Forms and Schedules Required

The primary forms required are Schedule C (Form 1040) and potentially Form 8889. Schedule C is used to report profit or loss from your business, including your health insurance premium payments. Form 8889 is needed if you contribute to a health savings account (HSA), as HSA contributions are also deductible. Accurate record-keeping is paramount; maintaining detailed records of all premium payments is crucial for successful deduction. These records should include dates of payments, amounts paid, and the payer’s name and address.

Implications of Self-Employment on Insurance Premium Deductions

A significant implication of self-employment is the sole responsibility for paying both the employee and employer portions of health insurance premiums. Unlike employed individuals, where the employer typically covers a portion, the self-employed individual bears the entire cost. This can lead to higher overall premiums, but the deductibility of these premiums provides a crucial tax advantage, offsetting some of the financial burden. Accurate calculation and reporting of these deductions are vital to ensure compliance and receive the appropriate tax benefits. Failure to accurately report these deductions can lead to penalties and interest charges. Consulting a tax professional is recommended to ensure compliance and maximize tax savings.

Final Conclusion

Successfully navigating insurance premium deductions requires careful consideration of your individual circumstances and the specific type of insurance involved. While the rules can seem intricate, understanding the key distinctions between deductible and non-deductible premiums, and the impact of your filing status and choice between itemizing and the standard deduction, empowers you to optimize your tax planning. Remember to maintain thorough records and consult with a tax professional if you need personalized guidance to ensure compliance and maximize your tax benefits.

Essential FAQs

Can I deduct premiums for pet insurance?

Generally, no. Pet insurance premiums are not deductible.

What if I overpaid my insurance premiums? Can I deduct the overpayment?

You can typically deduct the overpayment in the year you receive a refund or credit. Keep documentation of the overpayment and the refund.

Are premiums for renter’s insurance deductible?

No, renter’s insurance premiums are generally not deductible.

Do I need to itemize to deduct insurance premiums?

For most insurance premiums, itemizing is usually required, but there are exceptions, such as self-employed health insurance deductions. The standard deduction may be more beneficial in certain situations.