Navigating the tax landscape as an S corporation owner can be complex, particularly when it comes to deductions. One frequent question centers around life insurance premiums: Can they be legitimately deducted from your business’s taxes? The answer, as with most tax matters, isn’t a simple yes or no. The deductibility hinges on several factors, including the type of policy, the policy’s purpose, and meticulous record-keeping. This guide will delve into the intricacies of deducting life insurance premiums for S corp owners, providing clarity and insights to help you navigate this potentially advantageous area of tax planning.

Understanding the rules surrounding the deductibility of life insurance premiums is crucial for S corp owners seeking to optimize their tax strategy. Incorrectly claiming deductions can lead to significant penalties and audits, highlighting the importance of accurate record-keeping and a clear understanding of IRS regulations. This guide will explore the various scenarios where deductions are permitted, situations where they are not, and the best practices for ensuring compliance.

S Corp Ownership and Life Insurance Premiums

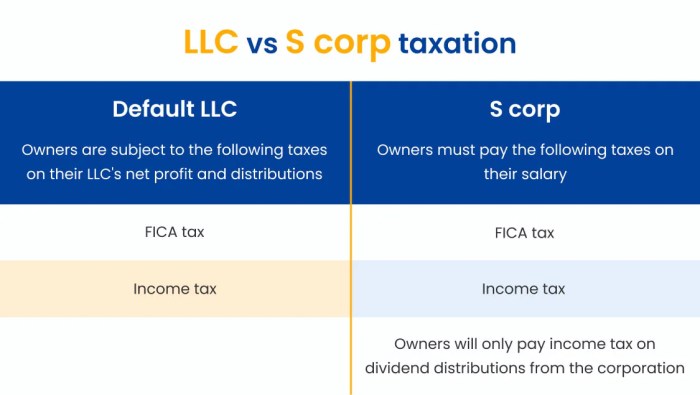

S corporations (S corps) offer pass-through taxation, meaning profits and losses are passed directly to the owners’ personal income tax returns. This impacts how life insurance premiums are treated, creating complexities not found in other business structures. Understanding these tax implications is crucial for S corp owners to minimize their tax burden.

Deductibility of Life Insurance Premiums for Shareholder-Employees

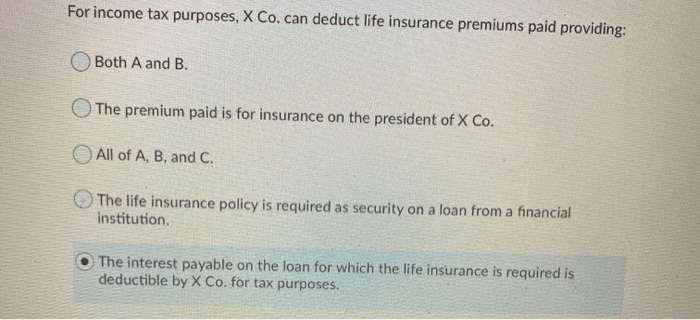

The deductibility of life insurance premiums paid by an S corporation on behalf of its shareholder-employees hinges on the policy’s beneficiary. If the policy’s beneficiary is the corporation, premiums are generally considered a business expense and are deductible. However, if the beneficiary is the shareholder-employee or their family, the deductibility is significantly restricted. In such cases, the premiums are typically considered a non-deductible personal expense for the corporation. The IRS scrutinizes these situations closely, requiring clear demonstration of a legitimate business purpose to justify the deduction.

Examples of Deductible and Non-Deductible Premiums

A deductible premium situation might involve a key-person life insurance policy. If the S corp insures a key employee whose loss would significantly impact the business, the premiums might be deductible as a business expense. The corporation can demonstrate a direct business interest in maintaining the employee’s continued contribution. Conversely, a non-deductible situation arises when the S corp pays premiums on a policy insuring the owner’s life, with the owner’s family as the beneficiary. This is considered a personal benefit to the owner and not a legitimate business expense.

Tax Treatment Compared to Other Business Structures

In contrast to S corps, C corporations can generally deduct premiums on life insurance policies regardless of the beneficiary, provided the policy is part of a qualified employee benefit plan. Sole proprietorships and partnerships face similar restrictions to S corps; premiums are typically deductible only if the policy benefits the business directly. The key difference lies in the pass-through taxation of S corps, which increases IRS scrutiny on expenses that benefit the owners personally.

Hypothetical Scenario: Deductible Premium for an S Corp Owner

Imagine Sarah, the sole owner and employee of “Sarah’s Sweets,” an S corp. Sarah’s expertise in pastry creation is crucial to the business’s success. The S corp purchases a key-person life insurance policy on Sarah’s life, naming the corporation as the beneficiary. The policy’s purpose is to protect the business from financial hardship should Sarah become incapacitated or die unexpectedly. In this scenario, the premiums paid by Sarah’s Sweets are likely deductible as a business expense because the policy directly protects the corporation’s financial stability and continuity. The corporation would need to maintain appropriate documentation to support this deduction during an audit.

Types of Life Insurance Policies and Deductibility

Understanding the deductibility of life insurance premiums for S corporation owners hinges significantly on the type of policy held. The IRS scrutinizes these deductions, and the rules vary depending on the policy’s features and the owner’s use of the policy. This section clarifies the tax treatment of different policy types.

Generally, premiums paid on life insurance policies are not deductible for tax purposes, with some key exceptions. These exceptions are usually tied to specific business purposes, and even then, deductibility is often limited.

Term Life Insurance Premiums and Deductibility

Term life insurance provides coverage for a specific period (the term), typically at a lower premium than permanent policies. For S corp owners, premiums paid on term life insurance policies are usually not deductible unless the policy is directly tied to a legitimate business expense, such as key person insurance. In such cases, a portion of the premium may be deductible as a business expense, but only if it’s demonstrably related to protecting the business from financial loss due to the death of a key employee or owner. The deduction would be limited to the portion directly attributable to the business interest.

Whole Life Insurance Premiums and Deductibility

Whole life insurance policies offer lifelong coverage and build cash value over time. The cash value component complicates the tax implications. Premiums are generally not deductible. However, any investment earnings within the cash value component are tax-deferred, meaning taxes are only paid upon withdrawal. Furthermore, distributions from the cash value may be subject to income tax, depending on the circumstances. The use of policy loans can also have tax implications, as the loan itself is not taxable, but interest paid on the loan may be deductible in certain situations.

Universal Life Insurance Premiums and Deductibility

Universal life insurance is a flexible permanent policy that allows for adjustable premiums and death benefits. Similar to whole life insurance, premiums are generally not deductible. The cash value component grows tax-deferred, but withdrawals and loans may have tax consequences. The flexibility of premium payments can be advantageous, but careful planning is needed to manage the tax implications of cash value growth and distributions.

Tax Implications of Policy Cash Value Accumulation

The cash value accumulation in permanent life insurance policies (whole and universal life) presents a double-edged sword. While the growth is tax-deferred, it’s essential to understand that this deferred tax liability isn’t eliminated. Upon withdrawal or policy surrender, the accumulated cash value may be subject to income tax, and potentially penalties if withdrawn before age 59 1/2. The tax implications of cash value growth must be carefully considered in the overall financial and tax planning strategy. It is crucial to consult with a qualified tax professional to ensure compliance.

Comparison of Tax Treatment

| Policy Type | Premium Deductibility | Cash Value Growth | Withdrawal/Loan Tax Implications |

|---|---|---|---|

| Term Life | Generally not deductible, except for key person insurance | No cash value | N/A |

| Whole Life | Generally not deductible | Tax-deferred | Taxable upon withdrawal; potential penalties for early withdrawal |

| Universal Life | Generally not deductible | Tax-deferred | Taxable upon withdrawal; potential penalties for early withdrawal |

Business Purpose and Deductibility

The deductibility of life insurance premiums for S corporation owners hinges entirely on establishing a clear and demonstrable business purpose. Simply purchasing a policy and hoping for a deduction won’t suffice; the IRS scrutinizes these deductions carefully. The policy must be directly linked to a legitimate business need, not simply a personal financial planning strategy.

The IRS requires a direct correlation between the insurance policy and the financial health or continuity of the S corporation. This means the benefit derived from the policy must directly benefit the business, not just the owner personally. This connection is crucial for successfully claiming the deduction.

Key Person Insurance and Deductibility

Key person insurance is a common example where life insurance premiums are considered a legitimate business expense. This type of policy insures the life of a crucial employee—someone whose loss would significantly impact the business’s operations and profitability. The death benefit acts as a financial cushion to cover costs associated with replacing the key employee, such as recruitment fees, training expenses, lost productivity, and potential client disruption. The premiums paid for this type of policy are typically deductible as a business expense because the death benefit directly mitigates a significant business risk. For example, a small software company might insure its lead programmer. Their loss would severely impact the company’s ability to deliver projects and maintain its client base. The death benefit could be used to hire and train a replacement, minimizing the financial impact of the loss.

Demonstrating a Legitimate Business Purpose

To successfully claim the deduction, the S corporation must maintain detailed records substantiating the business purpose of the life insurance policy. This documentation should clearly demonstrate the link between the policy and the corporation’s financial well-being. Key elements include:

- A clear identification of the insured individual and their crucial role within the company. This should include a description of their responsibilities and the potential financial impact of their loss.

- A detailed explanation of how the death benefit would be used to mitigate the negative financial consequences of the insured’s death. This might involve outlining specific expenses the death benefit would cover, such as recruiting, training, or temporary staffing.

- Documentation showing the calculation of the death benefit amount. This calculation should demonstrate that the benefit is reasonably related to the financial impact of the insured’s death, not excessive.

- Copies of the insurance policy and premium payment records.

Step-by-Step Process for Determining Deductibility

Determining the deductibility of life insurance premiums requires a systematic approach:

- Identify the insured individual: Determine if the insured is a key employee or someone whose loss would significantly impact the business.

- Assess the business risk: Quantify the potential financial impact of the insured individual’s death on the S corporation. This might involve estimating lost revenue, increased expenses, and other negative consequences.

- Determine the appropriate death benefit: Calculate a death benefit amount that reasonably addresses the identified business risk. The amount should not be excessive relative to the potential financial loss.

- Document the business purpose: Prepare a detailed explanation outlining the business rationale for the insurance policy, including how the death benefit would be used to mitigate the identified business risk. This should include supporting documentation.

- Maintain accurate records: Keep meticulous records of all premium payments and supporting documentation. This is crucial for IRS audits.

Potential Tax Penalties and Audits

Improperly deducting life insurance premiums as an S corp owner can lead to significant tax penalties and increased IRS scrutiny. Understanding the potential consequences and implementing preventative measures is crucial for maintaining tax compliance and avoiding costly repercussions. This section details the potential risks and offers strategies for mitigating them.

Consequences of Improper Deduction

Incorrectly claiming a deduction for life insurance premiums can result in several penalties. The IRS may disallow the deduction entirely, leading to an increased tax liability for the current year. This increased tax liability will include not only the disallowed deduction but also any applicable interest and penalties for underpayment. Furthermore, repeated instances of improper deductions could lead to more severe penalties, including additional fines and even potential criminal charges in cases of intentional tax fraud. The severity of the penalty depends on factors such as the amount of the improper deduction, the taxpayer’s intent, and their history of tax compliance. For example, a small, unintentional error might result in a relatively small penalty, while a large, deliberate misrepresentation could lead to substantial financial repercussions and legal consequences.

Types of Audits Focusing on Life Insurance Deductions

Several types of IRS audits may target the deductibility of life insurance premiums. A routine correspondence audit might involve a simple review of the taxpayer’s return, focusing on the specific line item related to the insurance premium deduction. More extensive audits, such as field audits, may involve a more thorough examination of the taxpayer’s financial records, including bank statements, insurance policies, and business records, to verify the business purpose of the insurance. These audits can be time-consuming and stressful, requiring significant documentation and potentially the assistance of a tax professional. Additionally, the IRS might conduct a specialized audit focusing on S corporation tax compliance, which could encompass a comprehensive review of all aspects of the business’s tax filings, including the treatment of life insurance premiums.

Minimizing IRS Scrutiny

Maintaining meticulous records is paramount in minimizing the risk of IRS scrutiny. This includes retaining copies of insurance policies, detailed records of premium payments, and comprehensive documentation demonstrating a clear business purpose for the insurance. Consulting with a qualified tax professional experienced in S corporation taxation is highly recommended. A tax professional can provide guidance on proper deduction procedures, ensuring compliance with IRS regulations and minimizing the risk of errors. Furthermore, having a clearly defined and documented business plan that justifies the need for life insurance further strengthens the case for deductibility in the event of an audit. Proactive tax planning, including regular reviews of the business’s tax strategies, can also help identify and address potential issues before they escalate.

Common Mistakes by S Corp Owners

One frequent mistake is failing to establish and document a clear business purpose for the life insurance policy. Simply stating that the policy is “for the business” is insufficient; a detailed explanation is needed, linking the policy directly to a legitimate business need, such as key person insurance or buy-sell agreements. Another common error is improperly allocating premiums between personal and business use, particularly if the policy has both personal and business components. Accurate allocation is essential for claiming only the business portion of the premium as a deduction. Finally, some S corp owners incorrectly classify the insurance premiums as a business expense without understanding the specific requirements for deductibility under IRS regulations. This often leads to incorrect reporting and potential penalties.

Last Word

Successfully navigating the complexities of deducting life insurance premiums as an S corp owner requires a thorough understanding of IRS regulations and meticulous record-keeping. While the potential tax benefits can be significant, improper deductions can lead to penalties and audits. By carefully considering the type of policy, its business purpose, and maintaining comprehensive documentation, S corp owners can confidently utilize life insurance strategies to minimize their tax burden while remaining compliant. Remember to consult with a qualified tax professional for personalized advice tailored to your specific circumstances.

Questions Often Asked

What if the life insurance policy has a cash value component?

The cash value accumulation in a life insurance policy can impact deductibility. Generally, premiums paid to build cash value are not deductible. However, the portion attributable to the death benefit may be deductible under certain circumstances.

Can I deduct premiums for a policy on a non-employee shareholder?

No, premiums for policies on non-employee shareholders are generally not deductible as a business expense.

What are the potential penalties for incorrectly deducting life insurance premiums?

Penalties for incorrect deductions can include back taxes, interest, and potentially penalties depending on the severity and intent. An audit may also occur.

How long should I keep records related to life insurance premiums?

The IRS generally recommends keeping tax records for at least three years, but it’s advisable to keep them longer, especially for significant deductions.