The question of whether S corporations can deduct life insurance premiums for shareholders is a complex one, navigating the intricate landscape of IRS regulations and corporate tax strategies. Understanding the deductibility of these premiums is crucial for S corporation owners seeking to optimize their tax burden and secure their financial future. This guide explores the nuances of this issue, examining relevant tax codes, outlining various scenarios, and offering insights into effective tax planning.

We’ll delve into the specific IRS codes governing these deductions, differentiating between policies owned by the corporation and those owned by individual shareholders. We’ll also analyze how different corporate structures influence the deductibility of premiums, providing clear examples and a hypothetical case study to illustrate the potential tax implications. The goal is to equip S corporation owners with the knowledge to make informed decisions and minimize potential tax liabilities.

S Corp Shareholder Benefits and Life Insurance

Life insurance within an S corporation structure offers several tax advantages for shareholders, primarily stemming from the corporation’s ability to pay premiums and receive death benefits without directly impacting shareholder income. This contrasts with individually owned policies where premiums are personal expenses and benefits are part of the estate, potentially subject to estate taxes. The strategic use of life insurance within an S corp can provide both financial protection and tax efficiency.

The tax advantages are significant because the corporation, not the shareholder, pays the premiums. These premiums are considered a business expense, deductible against the corporation’s income, reducing the overall tax burden. Upon the death of the insured shareholder, the corporation receives the death benefit, which is generally tax-free. This tax-free benefit can be used to fund buy-sell agreements, ensuring a smooth transition of ownership and providing liquidity for the remaining shareholders. Careful planning is essential to maximize these advantages and comply with all applicable tax regulations.

Types of Life Insurance Policies Used by S Corporations

S corporations often utilize several types of life insurance policies to achieve different objectives. The choice of policy depends on the specific needs and financial situation of the corporation and its shareholders.

Term Life Insurance: This provides coverage for a specific period, typically at a lower premium than permanent policies. It’s a cost-effective solution for shorter-term needs, such as covering a loan or bridging a gap until other funding sources become available. For example, an S corp might use term life insurance to cover a short-term loan used to purchase new equipment. If the insured shareholder passes away during the term, the death benefit can repay the loan, protecting the corporation’s assets.

Whole Life Insurance: This provides lifelong coverage and builds cash value over time. The cash value component can be borrowed against or withdrawn, providing a source of funds for the corporation. For instance, an S corp could use the cash value from a whole life policy to fund future expansion or cover unexpected expenses. The death benefit remains tax-free to the corporation upon the insured shareholder’s death.

Universal Life Insurance: This offers flexible premiums and death benefits, allowing adjustments based on changing financial circumstances. This flexibility makes it adaptable to the evolving needs of an S corporation. For example, an S corp could adjust the premiums paid on a universal life policy depending on its profitability in a given year, ensuring that the premiums remain manageable without compromising coverage.

Examples of Life Insurance Premiums Benefiting Corporations and Shareholders

The benefits extend to both the corporation and the shareholders. For the corporation, the deductibility of premiums reduces taxable income, improving profitability. The death benefit provides liquidity, allowing for business continuity and facilitating a smooth transition of ownership in the event of a shareholder’s death. For shareholders, it offers peace of mind, knowing that their families will be financially protected, and the business will continue without disruption.

Example 1: Buy-Sell Agreement Funding: An S corp with three equal shareholders establishes a buy-sell agreement funded by life insurance policies on each shareholder. If one shareholder dies, the death benefit from their policy provides the funds for the remaining shareholders to purchase the deceased shareholder’s shares, preventing disputes and maintaining business stability. The premiums are deductible business expenses for the S corp.

Example 2: Key Person Insurance: A key employee who is also a shareholder is insured. If this individual dies, the death benefit compensates the S corp for the loss of their expertise and contributions, allowing for a smoother transition and reduced financial impact on the business. Again, the premiums are deductible business expenses.

Deductibility of Life Insurance Premiums

The deductibility of life insurance premiums for S corporations is a complex area governed by specific sections of the Internal Revenue Code and accompanying regulations. Understanding these rules is crucial for S corporations to ensure they are claiming legitimate deductions and avoiding potential IRS scrutiny. Incorrectly claiming deductions can lead to penalties and adjustments.

The Internal Revenue Code section primarily relevant to the deductibility of life insurance premiums for S corporations is Section 162, which addresses ordinary and necessary business expenses. However, the application of Section 162 to life insurance premiums is heavily restricted. The IRS carefully scrutinizes these deductions to prevent tax avoidance schemes where premiums are disguised as business expenses. Further regulations and rulings provide more specific guidance.

Requirements and Limitations on Deductions

The IRS generally disallows the deduction of life insurance premiums paid on policies covering the lives of S corporation shareholders unless the corporation can demonstrate a clear business purpose beyond the mere benefit to the shareholder. This business purpose must be directly related to the corporation’s operations and not merely incidental. For instance, a key-person life insurance policy, where the corporation is the beneficiary, might be deductible if the insured individual’s death would significantly impact the business’s profitability or operations. The corporation needs to show a direct financial loss would result from the key employee’s death. This could involve demonstrating a loss of revenue, increased operational costs, or a need to replace the individual with significant recruitment and training expenses. Conversely, premiums on policies where the shareholder is the beneficiary are rarely deductible.

Deductibility: Corporate-Owned vs. Shareholder-Owned Policies

A significant distinction exists between life insurance policies owned by the corporation and those owned by the shareholder. If the S corporation owns the policy and is the beneficiary, premiums may be deductible if the policy serves a legitimate business purpose, as described above. This is because the corporation directly incurs a financial loss upon the death of a key employee. The payout can be used to cover the costs of replacing the employee, paying off debts, or otherwise mitigating the financial impact of their loss. Documentation demonstrating this direct business relationship is critical for successful deduction claims.

In contrast, if the shareholder owns the policy, the premiums are generally not deductible by the S corporation, even if the corporation is a named beneficiary. The rationale is that the primary beneficiary is the shareholder, providing them with a personal financial benefit. The IRS views this as a personal expense rather than a legitimate business expense. The corporation might receive a benefit from the policy proceeds, but this benefit is secondary to the personal benefit accruing to the shareholder. There are very limited exceptions to this rule, and these are generally only applicable under very specific circumstances, requiring substantial evidence of a direct and significant business purpose that outweighs the personal benefit to the shareholder.

Key Considerations for Deductibility

Determining the deductibility of life insurance premiums for S corporation shareholders hinges on several crucial factors. The primary considerations revolve around the beneficiary of the policy and the overall purpose for which the insurance is maintained. Misunderstanding these aspects can lead to incorrect deductions and potential IRS scrutiny. Careful planning and adherence to IRS guidelines are paramount.

The Internal Revenue Service (IRS) closely examines the relationship between the corporation, the shareholder, and the life insurance policy. The key is to establish a legitimate business purpose for the policy. If the policy primarily benefits the shareholder, deductibility is significantly reduced or eliminated. Conversely, if the policy demonstrably protects the corporation’s interests, a deduction may be allowed. This distinction is critical and requires careful consideration of the specific circumstances.

Policy Ownership and Beneficiary Designation

The ownership of the life insurance policy and the designation of the beneficiary are key determinants of deductibility. If the S corporation owns the policy and the corporation is the beneficiary, the premiums are generally more likely to be deductible as a business expense. This is because the policy directly protects the corporation’s financial interests, such as covering the loss of a key employee. However, if the shareholder is the policy owner and/or beneficiary, the deductibility is significantly more complex and often disallowed. The IRS may view this as a personal benefit to the shareholder rather than a legitimate business expense.

Scenarios Illustrating Deductibility

The following table Artikels various scenarios, highlighting the impact of policy ownership and beneficiary designation on the deductibility of life insurance premiums.

| Scenario | Policy Ownership | Deductibility Status | Rationale |

|---|---|---|---|

| Scenario 1: Key Employee Insurance | S Corporation | Fully Deductible | The policy insures the life of a key employee, protecting the corporation from significant financial loss upon the employee’s death. The corporation is the beneficiary. |

| Scenario 2: Shareholder-Owned Policy, Corporation as Beneficiary (Partial Benefit) | Shareholder | Partially Deductible (Potentially) | The corporation is the beneficiary, but the shareholder owns the policy. A portion of the premiums might be deductible if a business purpose, such as a buy-sell agreement protecting the corporation from a shareholder’s unexpected death, is clearly established and demonstrably outweighs the personal benefit to the shareholder. Careful documentation is crucial. |

| Scenario 3: Shareholder-Owned Policy, Shareholder as Beneficiary | Shareholder | Not Deductible | The policy benefits the shareholder directly. The premiums are considered a personal expense and are not deductible by the S corporation. |

Impact of Corporate Structure and Ownership

The deductibility of life insurance premiums for shareholder benefits varies significantly depending on the business’s legal structure. Understanding these differences is crucial for tax planning and optimizing financial outcomes. Different structures expose the business and its owners to varying levels of personal liability and tax consequences related to insurance premiums.

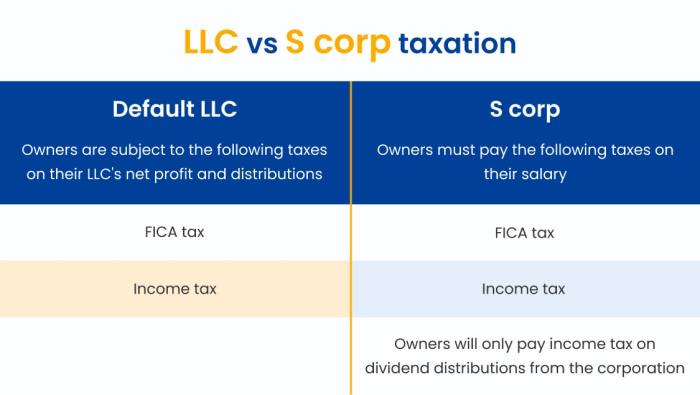

The tax treatment of life insurance premiums differs substantially between an S corporation and other structures like sole proprietorships and partnerships. This stems from the distinct legal and tax identities each structure possesses. An S corporation, for example, maintains a separate legal entity from its shareholders, leading to different rules regarding the deductibility of expenses compared to pass-through entities.

Deductibility in Different Corporate Structures

Sole proprietorships and partnerships are considered pass-through entities. This means that the business’s income and expenses flow directly to the owners’ personal income tax returns. In these structures, life insurance premiums paid on policies benefiting the business owner are generally not deductible as a business expense. The premiums are considered personal expenses, unless the policy is specifically structured as a buy-sell agreement with a demonstrable business purpose. Even then, deductibility can be complex and often depends on the specific details of the agreement. Conversely, S corporations, being separate legal entities, have the potential to deduct premiums paid on policies insuring key employees, including shareholder-employees, if the premiums meet specific criteria (as discussed previously).

Tax Implications for Shareholders

Shareholders in different structures face varied tax implications. In a sole proprietorship or partnership, the income generated by the business, net of any allowable deductions, is reported on the owner’s personal income tax return. The lack of deductibility for life insurance premiums increases the owner’s taxable income. For S corporations, the situation is more nuanced. While the corporation can potentially deduct premiums, the shareholder-employee still faces potential tax consequences related to any benefits received from the policy (e.g., death benefits paid to beneficiaries). This is because the distribution of those benefits would be subject to individual income tax. The corporation itself may also face taxes on any earnings generated by the life insurance policy.

Hypothetical Case Study

Consider two scenarios: In Scenario A, Sarah is a sole proprietor of a small bakery. She purchases a life insurance policy naming her business as the beneficiary. The premiums are not deductible, increasing her personal taxable income. In Scenario B, John and Mary are shareholders in a bakery structured as an S corporation. They purchase a life insurance policy on a key employee (not necessarily a shareholder). If the policy meets the requirements for business purpose, the S corporation can potentially deduct the premiums, reducing the corporation’s taxable income. However, if the policy is on a shareholder and does not meet the requirements, then the S corporation would not be able to deduct premiums. The difference in tax outcomes between these scenarios highlights the significant impact of corporate structure on the deductibility of life insurance premiums and overall tax liability.

Concluding Remarks

Successfully navigating the complexities of deducting life insurance premiums for shareholders in an S corporation requires careful consideration of IRS regulations, policy ownership, and overall corporate structure. While potential tax benefits exist, understanding the specific rules and potential penalties is paramount. This guide has provided a framework for understanding these complexities, but consulting with qualified tax professionals is strongly recommended to develop a comprehensive tax strategy tailored to your specific circumstances and to ensure compliance with all applicable laws and regulations. Proactive planning and accurate record-keeping are essential for minimizing audit risk and maximizing tax efficiency.

Question Bank

What are the potential penalties for incorrectly deducting life insurance premiums?

Incorrectly deducting life insurance premiums can result in penalties including interest charges, additional taxes, and in some cases, even criminal prosecution for intentional tax evasion.

Can I deduct premiums for a policy on a key employee who isn’t a shareholder?

Premiums paid on policies insuring key employees (who are not shareholders) may be deductible as a business expense if the policy serves a legitimate business purpose, such as protecting against the loss of key personnel.

How does the death benefit impact deductibility?

The death benefit itself isn’t directly deductible. The deductibility focuses on the premiums paid, and whether those premiums meet the criteria for business expense deductions under IRS guidelines.

What types of life insurance are commonly used by S corporations?

Common types include term life insurance (offering temporary coverage), whole life insurance (providing lifelong coverage), and universal life insurance (offering flexibility in premium payments and death benefit).