The question of whether life insurance premiums are tax-deductible is a complex one, varying significantly depending on individual circumstances and the specific type of policy. Understanding the nuances of these tax laws can save you considerable money, but navigating the regulations requires careful consideration of several factors. This guide aims to clarify the intricacies of life insurance premium deductibility, providing a clear path towards maximizing your tax benefits.

From the general rules governing deductibility across different tax jurisdictions to the specific regulations surrounding business insurance, self-employment, and various policy types, we will explore the key aspects that determine whether you can claim a deduction. We will also examine real-world scenarios to illustrate the practical application of these rules and help you determine your eligibility.

Deductibility of Life Insurance Premiums

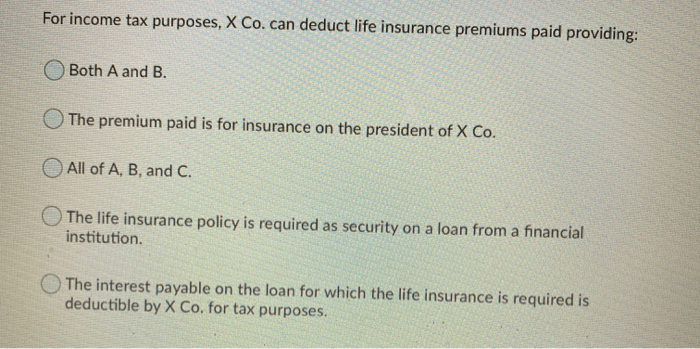

The deductibility of life insurance premiums is a complex issue, varying significantly depending on the tax jurisdiction and the specific type of insurance policy. Generally, premiums are not considered deductible as a business expense in most countries unless they meet specific criteria related to the purpose of the insurance and the insured individual. Understanding these rules is crucial for individuals and businesses to manage their tax liabilities effectively.

General Rules Regarding Deductibility

The general rule in many countries is that life insurance premiums are not tax-deductible for personal life insurance policies. This is because such premiums are considered personal expenses, not business expenses. However, exceptions exist, particularly for policies related to business activities or employee benefits. The specific rules and exceptions vary widely depending on the country’s tax code. For instance, some countries allow deductions for premiums paid on life insurance policies held to secure business loans, while others might offer deductions for policies covering key employees. Conversely, policies primarily focused on personal wealth accumulation or estate planning are generally not eligible for premium deductions.

Examples of Deductible and Non-Deductible Premiums

A common example of deductible premiums is when a business takes out a life insurance policy on a key employee. The premiums paid might be deductible as a business expense if the policy is designed to protect the business against financial losses should the key employee die. The loss of the employee’s expertise and the potential disruption to the business would justify the deduction. Conversely, premiums paid on a personal whole life policy intended to build cash value for retirement would typically not be deductible, as it serves a personal financial goal. Another example is a mortgage insurance policy, where premiums might be deductible as part of homeownership expenses in certain jurisdictions. In contrast, premiums for a universal life policy with investment components are usually not deductible, as the investment aspects are considered personal financial decisions.

Comparison of Tax Laws Across Countries

Tax laws regarding life insurance premium deductibility differ significantly across countries. In the United States, for example, the deductibility often depends on the type of policy and whether it’s connected to a business purpose. Canada also has specific rules regarding deductibility, often focusing on business-related insurance. The United Kingdom generally does not allow deductions for personal life insurance premiums. In many European countries, similar restrictions apply, with limited exceptions for business-related policies or policies linked to specific financial instruments. The specific regulations vary greatly and are subject to change, making it crucial to consult local tax laws and professionals for accurate guidance.

Factors Affecting Deductibility of Life Insurance Premiums

| Tax Jurisdiction | Type of Policy | Deductibility Rules | Examples |

|---|---|---|---|

| United States | Business-related life insurance | May be deductible as a business expense under specific circumstances | Key person insurance, insurance securing a business loan |

| Canada | Personal life insurance | Generally not deductible | Whole life insurance for personal wealth accumulation |

| United Kingdom | Most life insurance policies | Generally not deductible | Term life insurance, whole life insurance |

| Germany | Business-related life insurance | Deductibility depends on specific criteria | Insurance linked to a business loan, key person insurance |

Business Life Insurance Premiums

The deductibility of life insurance premiums hinges significantly on the purpose of the insurance. While personal life insurance premiums are generally not deductible, premiums paid on policies covering key employees or business partners can often be deducted, offering valuable tax advantages for businesses. Understanding the specific rules and requirements is crucial for correctly claiming these deductions.

Premiums paid for life insurance policies on key employees or business partners are deductible as a business expense under certain conditions. These conditions primarily center around the policy’s ownership and beneficiary designation, ensuring the policy serves a legitimate business purpose rather than a personal one. Incorrectly classifying a personal policy as a business expense can lead to significant tax penalties.

Policy Ownership and Beneficiary Designations

The IRS scrutinizes the ownership and beneficiary designation of the life insurance policy to determine its business purpose. If the business owns the policy and the beneficiary is the business itself, or a designated business entity, the premiums are more likely to be considered deductible business expenses. Conversely, if the policy is owned by an individual and the beneficiary is a family member, the premiums are generally not deductible. A key aspect is demonstrating a direct business connection—the loss of a key employee or partner would significantly impact the business’s profitability or operations. This impact needs to be demonstrably significant and not simply hypothetical. For example, a small business heavily reliant on a single partner’s expertise would have a much stronger case for deducting premiums on a policy covering that partner than a large corporation with many employees of similar skill sets.

Documentation for Business Life Insurance Premiums

Meticulous record-keeping is paramount when claiming deductions for business life insurance premiums. Maintain detailed records of all premium payments, including dates, amounts, and policy numbers. Additionally, documentation supporting the business purpose of the insurance is crucial. This may include: a copy of the insurance policy itself; a detailed description of the insured individual’s role within the business and the potential financial consequences of their death; and any internal business documents that demonstrate the rationale behind securing the life insurance policy. This documentation serves as evidence to substantiate the deduction should an IRS audit occur. Failing to maintain comprehensive records can result in the disallowance of the deduction.

Common Situations Where Business Life Insurance Premiums Are Deductible

Proper documentation is crucial in all scenarios. Here are some common situations where business life insurance premiums are generally considered deductible:

- Key Person Insurance: Policies insuring the life of a key employee whose loss would severely impact the business’s profitability.

- Buy-Sell Agreements: Policies used to fund buy-sell agreements between business partners, ensuring a smooth transition of ownership in the event of a partner’s death.

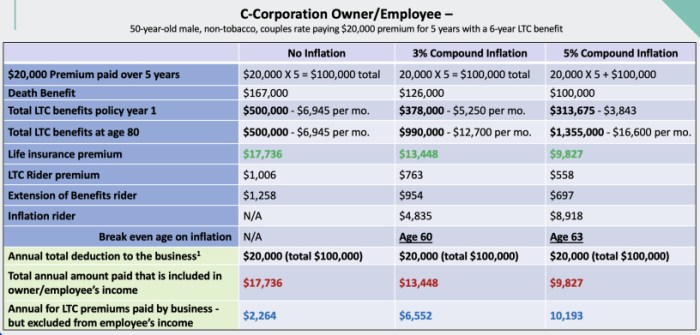

- Executive Compensation: Life insurance policies provided as part of an executive compensation package, where the premiums are considered a business expense.

- Debt Retirement: Policies used to pay off business debts in the event of a key person’s death.

Illustrative Examples and Scenarios

Understanding the deductibility of life insurance premiums hinges on the specific circumstances of the policyholder and the type of policy. The following scenarios illustrate how different situations can impact the tax treatment of these premiums.

Business Owner Scenario

This scenario involves a sole proprietor, Sarah, who owns a small bakery. She purchased a $500,000 life insurance policy naming her business as the beneficiary. The premiums are paid from the business’s bank account. Sarah operates her bakery in the United States, falling under the jurisdiction of the IRS. In this case, the premiums are generally deductible as a business expense, provided they are properly documented and are reasonable in relation to the business’s overall financial picture. This is because the policy benefits the business by providing financial protection in the event of Sarah’s death, safeguarding the business’s future.

Self-Employed Individual Scenario

Consider Mark, a freelance graphic designer operating as a sole proprietor in Canada. He purchased a $250,000 life insurance policy for himself, with his spouse as the beneficiary. The premiums are paid personally from his business account. In Canada, the deductibility of life insurance premiums for self-employed individuals is generally limited. While some specific business-related insurance might be deductible, personal life insurance premiums are typically not considered a deductible business expense. Therefore, Mark likely cannot deduct these premiums from his business income.

Employee Scenario

David, an employee of a large corporation in the UK, purchased a $100,000 life insurance policy through his employer’s group plan. His employer contributes a portion of the premiums, while David pays the remainder. The UK tax system generally does not allow employees to deduct premiums paid for personal life insurance policies, even those obtained through group plans. David’s contributions are considered personal expenses and are not deductible against his employment income. However, the employer’s contribution might be treated differently depending on specific employment and benefits rules.

Summary of Scenarios and Tax Outcomes

| Scenario | Policyholder | Policy Type | Tax Jurisdiction | Premiums Deductible? | Reasoning |

|---|---|---|---|---|---|

| 1 | Sarah (Business Owner) | Business Life Insurance | United States (IRS) | Yes | Premiums are a business expense protecting the business’s value. |

| 2 | Mark (Self-Employed) | Personal Life Insurance | Canada | No | Personal life insurance premiums are generally not deductible business expenses in Canada. |

| 3 | David (Employee) | Group Life Insurance | United Kingdom | No (Employee Portion) | Employee contributions to personal life insurance are not deductible. |

Ultimate Conclusion

Successfully navigating the complexities of life insurance premium deductibility requires a thorough understanding of your specific situation and the relevant tax laws. While the general rules provide a framework, the details can be intricate, varying across jurisdictions and policy types. By carefully considering the factors Artikeld in this guide, including the type of policy, your employment status, and the purpose of the insurance, you can accurately determine your eligibility for deductions and potentially reduce your overall tax burden. Remember to consult with a qualified tax professional for personalized advice.

FAQ Overview

Can I deduct life insurance premiums if I have a term life insurance policy?

Generally, premiums for term life insurance are not deductible, unless the policy is part of a business expense.

What documents do I need to claim a deduction for life insurance premiums?

You’ll typically need your life insurance policy documents, tax forms (like a 1040 in the US), and any supporting documentation proving the business purpose (if applicable).

Are there any penalties for incorrectly claiming a life insurance premium deduction?

Yes, claiming deductions incorrectly can result in penalties, including interest and additional taxes. It’s crucial to accurately report your deductions.

How do policy loans affect the deductibility of premiums?

Policy loans generally don’t directly affect the deductibility of premiums, but the interest on the loan may be deductible in some cases. Consult a tax professional for clarification.