Navigating the complex world of tax deductions can be daunting, especially when it comes to specialized financial products like life insurance. Many wonder, “Can I claim my life insurance premiums on my taxes?” The answer, unfortunately, isn’t a simple yes or no. The deductibility of life insurance premiums hinges on several factors, including the type of policy, your tax jurisdiction, and the purpose for which the insurance was purchased. This guide will delve into the intricacies of these factors, providing clarity and insights into this often-misunderstood area of tax law.

We’ll explore the diverse landscape of life insurance policies – term, whole life, and universal life – and their respective tax implications. We’ll also examine the deductibility of premiums for business owners and self-employed individuals, considering various business structures. Understanding these nuances is crucial for accurately reporting your income and avoiding potential tax penalties. This guide aims to equip you with the knowledge to make informed decisions about your life insurance and its tax implications.

Tax Deductibility of Life Insurance Premiums

The deductibility of life insurance premiums for tax purposes is a complex issue, varying significantly depending on the specific circumstances and the tax jurisdiction. Generally, premiums are not considered deductible as a standard expense, unlike some other business costs. However, there are specific exceptions and situations where deductions may be allowed. Understanding these nuances is crucial for individuals and businesses to ensure tax compliance.

General Rules Regarding Deductibility

The general rule across most countries is that life insurance premiums paid on personal policies are not tax deductible. This is because the primary purpose of personal life insurance is to provide financial security for dependents, not to generate a business profit. Conversely, the rules change when the life insurance policy is linked to a business purpose, such as a key-person insurance policy or a policy held within a retirement plan. The specific criteria for deductibility differ between countries, impacting both self-employed individuals and corporations.

Examples of Deductible and Non-Deductible Premiums

A key-person life insurance policy, protecting a business from financial loss due to the death of a crucial employee, often allows for the deduction of premiums. The policy’s benefits are tied directly to the business’s financial health. Conversely, premiums paid on a personal policy to protect a family’s financial future are typically not deductible. Another example is life insurance held within a qualified retirement plan; premiums may be tax-deductible depending on the specific plan’s rules and the applicable tax laws.

Tax Laws for Self-Employed Individuals and Business Owners

Self-employed individuals and business owners may be able to deduct premiums paid on life insurance policies under specific circumstances. For instance, if the policy is a key-person policy protecting the business from the loss of a vital employee, or if the policy is part of a qualified retirement plan, premiums may be deductible as a business expense. However, strict documentation and adherence to tax regulations are essential to claim these deductions. Accurate record-keeping of all premium payments and related documentation is crucial for a successful claim. Consulting with a tax professional is strongly advised to ensure compliance with all applicable laws.

International Comparison of Deductibility Rules

| Country | Deductibility Rules | Exceptions | Relevant Tax Forms |

|---|---|---|---|

| United States | Generally not deductible for personal policies; may be deductible for business purposes (key-person insurance, business continuation plans) or within qualified retirement plans. | Premiums paid on policies with a cash value component may have limitations on deductibility. | Form 1040, Schedule C (for self-employed individuals) |

| United Kingdom | Generally not deductible for personal policies; business premiums may be deductible as a business expense. | Specific rules apply to policies held within pension schemes. | SA100, SA103F |

| Canada | Generally not deductible for personal policies; business premiums may be deductible as a business expense under specific conditions. | Deductibility may depend on the type of business and the policy’s purpose. | T2125, T776 |

Types of Life Insurance and Tax Implications

Understanding the tax implications of different life insurance policies is crucial for financial planning. The tax treatment varies significantly depending on the type of policy and how it’s used. This section will clarify the tax aspects of common life insurance options.

Tax Treatment of Term Life Insurance Premiums

Premiums paid for term life insurance are generally not tax-deductible. This is because term life insurance only provides a death benefit; it doesn’t accumulate cash value. The death benefit paid to beneficiaries is typically tax-free, provided it’s paid as a lump sum. However, if the death benefit is paid out in installments, a portion might be subject to income tax.

Tax Treatment of Whole Life Insurance Premiums

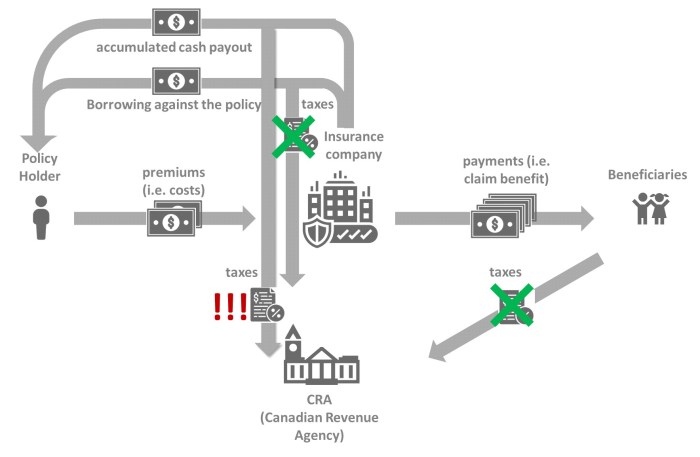

Whole life insurance premiums are also generally not tax-deductible. However, unlike term life insurance, whole life insurance builds cash value over time. This cash value grows tax-deferred, meaning you won’t pay taxes on the growth until you withdraw it. Withdrawals from the cash value are generally taxed as ordinary income to the extent they exceed the cost basis (the total premiums paid).

Tax Treatment of Universal Life Insurance Premiums

Similar to whole life insurance, premiums paid for universal life insurance are typically not tax-deductible. Universal life insurance also accumulates cash value, which grows tax-deferred. The tax implications of withdrawals are similar to whole life insurance; withdrawals exceeding the cost basis are taxed as ordinary income.

Comparison of Tax Implications Across Policy Types

The primary tax difference between term and permanent life insurance (whole and universal life) lies in the tax treatment of cash value. Term life insurance doesn’t build cash value, resulting in simpler tax implications (generally no tax benefits or deductions). Permanent life insurance policies, with their cash value component, introduce complexities related to tax-deferred growth and the tax implications of withdrawals or loans. The tax advantages of permanent policies are realized only upon death or when withdrawing accumulated cash value, and then only to the extent of accumulated gains.

Tax Consequences of Policy Loans and Withdrawals from Cash Value Life Insurance

Policy loans against the cash value of a life insurance policy are generally not considered taxable income. However, interest accrued on the loan is typically taxable. Withdrawals from cash value policies are taxed differently. If the withdrawal amount is less than or equal to the cost basis, it’s generally tax-free. However, withdrawals exceeding the cost basis are taxed as ordinary income. This means the portion exceeding the premiums paid will be subject to income tax in the year of the withdrawal. For example, if $100,000 in premiums were paid and a $150,000 withdrawal was made, $50,000 would be considered taxable income.

Key Tax Differences Between Term and Permanent Life Insurance

The following points highlight the key tax differences:

- Premiums: Premiums for both are generally not tax-deductible.

- Cash Value: Term life insurance has no cash value; permanent life insurance does, and this cash value grows tax-deferred.

- Death Benefit: The death benefit is generally tax-free for both, when paid as a lump sum.

- Withdrawals: Withdrawals from permanent life insurance are taxed only on the amount exceeding the cost basis; term life insurance doesn’t allow withdrawals.

- Loans: Loans against cash value in permanent policies are not taxed, but interest accrued is taxable. Term policies don’t allow loans.

Business-Related Life Insurance Premiums

Life insurance premiums paid by businesses can have significant tax implications, depending on the policy structure and the business’s legal form. Understanding these implications is crucial for effective tax planning and financial management. This section will explore the deductibility of premiums for key employee policies and the differences in tax treatment across various business structures.

Business-owned life insurance policies, often used for key person insurance or executive benefits, can offer tax advantages when structured correctly. However, the deductibility of premiums varies significantly based on the policy’s purpose and the type of business.

Tax Deductibility of Premiums for Key Employee Policies

Premiums paid for life insurance policies on key employees are generally not deductible as ordinary business expenses. However, there are exceptions. For example, if the policy is part of a qualified employee benefit plan that meets specific IRS requirements, some premium payments might be deductible. Furthermore, if the policy’s proceeds are used to fund a buy-sell agreement to ensure business continuity upon the death of a key employee, certain premium payments may be deductible as a business expense related to the agreement. The specific rules are complex and depend heavily on the details of the policy and the agreement.

Situations Where Premiums Are Deductible

Several situations allow for the deduction of premiums on business-owned life insurance policies. These typically involve policies where the death benefit is used to offset a business-related loss, such as the death of a key employee impacting business operations. This often includes situations involving buy-sell agreements, where the insurance proceeds are used to purchase the deceased owner’s shares from their estate. Another instance might be a creditor using life insurance as collateral for a loan, where the premium payments could be considered part of the debt servicing. In these scenarios, the deductibility is linked directly to the business purpose of the policy and its financial impact on the company.

Tax Treatment Differences Based on Policy Structure

The tax treatment of business life insurance premiums can differ significantly based on whether the policy is corporate-owned or privately-owned. For example, if a corporation owns the policy, the premiums are generally not deductible, but the death benefit is received tax-free by the corporation. Conversely, if a sole proprietor or partner owns the policy personally, premiums may not be deductible, and the death benefit may be taxable income to the beneficiary. This underscores the importance of careful planning and professional advice to optimize tax efficiency.

Tax Implications for Different Business Structures

| Business Structure | Premium Deductibility | Death Benefit Taxability | Notes |

|---|---|---|---|

| Sole Proprietorship | Generally not deductible | Taxable to beneficiary | Often treated as personal insurance |

| Partnership | Generally not deductible | Taxable to beneficiary(ies) | Similar to sole proprietorships, unless specifically structured within a buy-sell agreement |

| Corporation (C-Corp) | Generally not deductible | Tax-free to corporation | Death benefit can be used to offset business losses |

| S-Corporation | Generally not deductible | Taxable to shareholders | Similar to a partnership, with the death benefit passing through to shareholders |

Summary

While the deductibility of life insurance premiums is a multifaceted issue with varying rules across different jurisdictions, understanding the fundamentals is paramount for responsible financial planning. This guide has provided a foundational overview of the key factors influencing the tax treatment of life insurance premiums. Remember, the information presented here is for general guidance only. Consulting with a qualified tax professional is crucial for personalized advice tailored to your specific circumstances to ensure compliance with all applicable tax laws and regulations. Accurate record-keeping is equally important to support your tax filings.

FAQ Resource

Can I deduct life insurance premiums if I’m self-employed?

Potentially, depending on the type of policy and how it’s structured. Some business-related life insurance premiums may be deductible as a business expense. Consult a tax professional for personalized guidance.

What about life insurance premiums paid within a retirement plan?

The tax implications vary significantly depending on the specific retirement plan and the type of life insurance policy. Professional tax advice is highly recommended in these situations.

Are there penalties for incorrectly claiming life insurance premium deductions?

Yes, incorrectly claiming deductions can result in penalties, including interest and additional taxes. Accurate record-keeping and professional advice are crucial to avoid such penalties.

Do the tax rules regarding life insurance premiums change frequently?

Tax laws can and do change. It’s important to stay updated on any relevant changes and seek professional advice to ensure your compliance.