Navigating the complexities of tax deductions can be daunting, especially when it comes to healthcare expenses. Many individuals wonder if they can claim their health insurance premiums on their taxes, a question with a nuanced answer depending on several factors. This guide will delve into the intricacies of claiming health insurance premium deductions, clarifying eligibility criteria, outlining necessary documentation, and comparing the scenarios for self-employed versus employed individuals. We’ll explore various health insurance plans and their tax implications, helping you understand how to maximize your tax benefits.

Understanding the rules surrounding health insurance premium deductions can significantly impact your tax liability. Whether you’re self-employed, employed, or considering different health insurance plans, this guide provides a clear roadmap to help you determine your eligibility and navigate the process successfully. We’ll examine the key differences in claiming premiums based on your employment status and explore the potential tax advantages associated with various health insurance plan types.

Types of Health Insurance Plans

Understanding the different types of health insurance plans is crucial, not only for accessing healthcare but also for managing your tax obligations. The tax implications of your chosen plan can significantly impact your annual tax return, so careful consideration is essential. This section will explore the most common plan types and their respective tax advantages and disadvantages.

Health Maintenance Organizations (HMOs)

HMOs typically offer lower premiums in exchange for a more limited network of doctors and hospitals. You generally need a referral from your primary care physician to see specialists. While premiums for HMOs may be lower, making them potentially more affordable upfront, the deductibility of these premiums for tax purposes follows the general rules for health insurance premiums; they are generally deductible only as an itemized deduction if your total medical expenses exceed a certain percentage of your adjusted gross income (AGI). This threshold varies annually.

Preferred Provider Organizations (PPOs)

PPOs provide more flexibility than HMOs. You can generally see any doctor or specialist within or outside the network, although costs will be significantly higher if you choose out-of-network providers. PPO premiums are usually higher than HMO premiums. Similar to HMOs, PPO premiums are generally deductible only if your total medical expenses surpass the AGI threshold for itemized deductions.

Health Savings Accounts (HSAs)

HSAs are tax-advantaged savings accounts specifically designed for use with high-deductible health plans (HDHPs). Contributions to HSAs are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free. This creates a triple tax advantage. The HDHP paired with an HSA often results in lower premiums compared to traditional plans with lower deductibles. The tax benefits of an HSA are substantial, making it an attractive option for those who are healthy and can afford to save for potential future medical expenses. However, it’s important to note that using HSA funds for non-medical expenses results in taxation and penalties.

Tax Implications Summary

| Plan Type | Premium Deductibility | Other Tax Advantages | Considerations |

|---|---|---|---|

| HMO | Generally deductible only as an itemized deduction if medical expenses exceed AGI threshold. | Lower premiums than PPOs. | Limited network of providers. |

| PPO | Generally deductible only as an itemized deduction if medical expenses exceed AGI threshold. | More flexible network of providers. | Higher premiums than HMOs. |

| HSA-compatible HDHP | Premiums deductible only as itemized deduction if medical expenses exceed AGI threshold. HSA contributions are tax-deductible. | Triple tax advantage (contributions, growth, and withdrawals for qualified expenses are tax-free). | Higher deductible than HMOs and PPOs. Requires disciplined saving. |

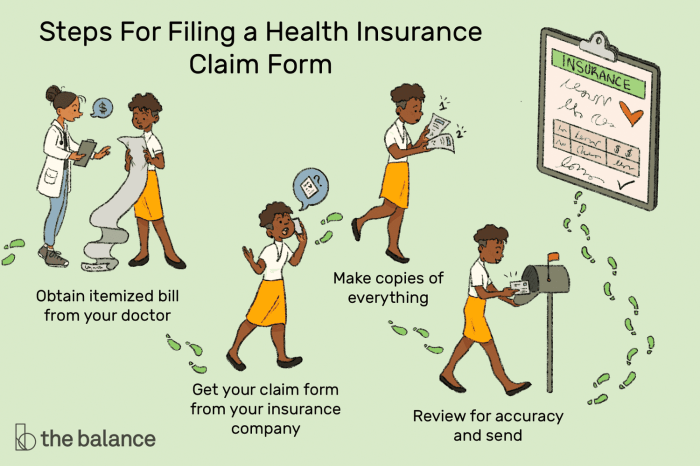

Required Documentation and Forms

Claiming a deduction for health insurance premiums requires careful documentation to support your claim and ensure a smooth tax filing process. Accurate and complete documentation is crucial to avoid delays or potential penalties. This section details the necessary forms and supporting evidence.

Necessary Documents for Premium Deduction

To successfully claim the health insurance premium deduction, you will need to gather several key documents. These documents serve as proof of payment and eligibility for the deduction. Failing to provide these could result in your claim being rejected.

- Form 1095-A: This form, issued by your insurance marketplace, details the coverage you had throughout the year. It provides essential information about your plan, including the dates of coverage and the amount of your premiums. You’ll need this form regardless of whether you itemize or take the standard deduction.

- Proof of Payment: This is crucial evidence that you actually paid your premiums. Acceptable forms of proof include canceled checks, bank statements showing electronic payments, money order receipts, or payment confirmations from your insurance provider. Keep detailed records of all payments throughout the year.

- Tax Return (Form 1040 and Schedule A): You will need Form 1040, the main U.S. Individual Income Tax Return, and Schedule A (Itemized Deductions). Schedule A is where you will itemize your medical expenses, including your health insurance premiums, if they exceed 7.5% of your adjusted gross income (AGI).

Obtaining and Completing Relevant Tax Forms

The IRS website (www.irs.gov) is the primary source for obtaining tax forms. You can download Form 1040 and Schedule A directly from their site, or you can order them by mail. Form 1095-A is provided to you by the marketplace where you purchased your insurance. Completing these forms accurately is critical. Many tax preparation software programs can guide you through the process and help ensure accuracy. If you are unsure about any aspect of completing the forms, it is advisable to seek assistance from a tax professional.

Examples of Acceptable Proof of Insurance Premiums Paid

Several types of documentation can serve as proof of premium payments. The key is to ensure the documentation clearly shows the date of payment, the amount paid, and that the payment was for health insurance premiums.

- Canceled Checks: Checks written to your insurance company with the “paid” stamp from your bank.

- Bank Statements: Bank statements showing electronic payments made to your insurance company, clearly identifying the transaction as a health insurance premium payment.

- Money Order Receipts: Receipts showing the purchase of money orders used to pay health insurance premiums.

- Payment Confirmations from Insurance Provider: Emails, online account statements, or other confirmations from your insurance company verifying premium payments.

Consequences of Incomplete or Inaccurate Documentation

Submitting incomplete or inaccurate documentation can lead to delays in processing your tax return, and in some cases, penalties. The IRS may request additional information, delaying your refund. In cases of intentional misrepresentation, significant penalties and interest charges can apply. It’s essential to maintain meticulous records and ensure all information is accurate.

Preparing and Filing the Tax Return with Supporting Documentation

Organize all your tax documents, including Form 1040, Schedule A, Form 1095-A, and your proof of premium payments. Carefully review all information for accuracy before filing. You can file your tax return electronically through tax preparation software or through a tax professional. Keep copies of all filed documents for your records. If you mail your return, be sure to send it via certified mail with return receipt requested to ensure confirmation of receipt by the IRS. The IRS website offers guidance on the proper mailing address for your location.

Self-Employment vs. Employer-Sponsored Insurance

Understanding the tax implications of health insurance premiums significantly differs depending on whether you’re self-employed or have employer-sponsored coverage. This distinction arises from the fundamental difference in how the cost of health insurance is handled – as a business expense for the self-employed and as a pre-tax benefit for employees.

Self-employed individuals and those with employer-sponsored health insurance enjoy different tax advantages related to their health insurance premiums. Self-employed individuals can deduct their health insurance premiums as a business expense, reducing their taxable income. Employees, on the other hand, often have premiums deducted pre-tax from their paychecks, resulting in lower taxable income. However, the specifics and potential tax benefits differ.

Deductibility of Premiums for Self-Employed Individuals

Self-employed individuals can deduct the amount they paid in health insurance premiums as a business expense on Schedule C (Profit or Loss from Business) of Form 1040. This deduction reduces their net business income, thus lowering their overall taxable income and ultimately reducing their tax liability. To claim this deduction, they must be self-employed, actively participating in a trade or business, and not eligible to participate in an employer-sponsored health plan. Crucially, the deduction is only for the self-employed individual, their spouse, and their dependents covered under the plan. They cannot deduct premiums for other individuals. Accurate record-keeping, including receipts and policy statements, is crucial for substantiating these deductions.

Tax Benefits Comparison: Self-Employed vs. Employed

The tax advantages differ significantly. Self-employed individuals receive a direct deduction from their business income, while employees benefit from pre-tax premium deductions. The self-employed individual’s deduction directly impacts their net profit, while the employee’s pre-tax deduction lowers their gross income before taxes are calculated. This means that the tax savings for self-employed individuals can vary depending on their tax bracket, while the savings for employees are less directly tied to their overall tax bracket, although higher earners may see larger dollar savings due to higher premiums.

Examples of Tax Differences

Let’s consider two individuals: Sarah, a self-employed consultant, and John, an employee at a large corporation. Sarah paid $10,000 in health insurance premiums during the year. She can deduct this full amount on her Schedule C, reducing her taxable income by $10,000. Assuming a 22% tax bracket, this translates to a tax savings of $2,200 ($10,000 x 0.22). John, on the other hand, had $10,000 in premiums deducted pre-tax from his paycheck. While this also reduces his taxable income, the exact tax savings would depend on his overall income and tax bracket, but it’s likely to be less than Sarah’s due to the progressive nature of the tax system. In simpler terms, the higher John’s overall income, the higher his tax bracket, and the more his pre-tax deduction saves him.

Tax Implications Comparison Table

| Factor | Self-Employed | Employed |

|---|---|---|

| Premium Deduction | Deducted as a business expense (Schedule C) | Deducted pre-tax from paycheck |

| Tax Impact | Directly reduces taxable business income | Reduces gross income before taxes are calculated |

| Tax Savings | Dependent on tax bracket and deductible amount | Dependent on tax bracket and overall income |

| Record Keeping | Requires detailed records of premium payments | Typically handled by employer; employee receives documentation |

Illustrative Examples

Understanding the tax implications of health insurance premiums requires examining specific scenarios. The following examples illustrate how different income levels, premium amounts, and employment statuses affect the tax deduction. These are simplified examples and do not account for all possible tax situations or deductions. Consult a tax professional for personalized advice.

Self-Employed Individual Tax Calculation Examples

This section presents examples of tax calculations for self-employed individuals who can deduct their health insurance premiums. The examples assume a simplified tax system for illustrative purposes. Actual tax calculations may be more complex.

Example 1: Lower Income

Let’s assume a self-employed individual with a net profit of $30,000 and annual health insurance premiums of $3,600. Assuming a 20% tax bracket, the deductible premium reduces their taxable income by $3,600, resulting in a tax saving of $3,600 * 0.20 = $720. Without the deduction, their tax liability would be higher.

Example 2: Higher Income

Consider a self-employed individual with a net profit of $100,000 and annual premiums of $7,200. If this individual is in a 30% tax bracket, the deduction reduces their taxable income by $7,200, leading to a tax saving of $7,200 * 0.30 = $2,160. The higher income results in a larger absolute tax saving due to the higher tax bracket.

Employed Individual Tax Calculation Examples

This section illustrates the impact of claiming health insurance premiums on taxes for employed individuals, who may be able to deduct premiums paid under certain circumstances (e.g., if they itemize deductions and the total exceeds the standard deduction).

Example 1: Itemizing Deductions

An employed individual with an adjusted gross income (AGI) of $60,000 pays $5,000 in health insurance premiums. They itemize their deductions and their total itemized deductions exceed the standard deduction. The $5,000 premium is included in their itemized deductions, reducing their taxable income and consequently their tax liability. The exact tax savings depend on their marginal tax rate.

Example 2: Standard Deduction

Another employed individual with a similar AGI also pays $5,000 in health insurance premiums. However, they choose to take the standard deduction because their itemized deductions are less than the standard deduction. In this case, the health insurance premiums are not deductible, and there is no tax benefit from paying them.

Impact of Income Levels and Premium Amounts

The tax benefits from deducting health insurance premiums are directly influenced by both income and premium amounts.

Income Level Impact

Higher income levels generally lead to greater tax savings because individuals in higher tax brackets pay a larger percentage of their income in taxes. A $5,000 premium deduction will result in a larger tax savings for someone in the 35% tax bracket than for someone in the 12% tax bracket.

Premium Amount Impact

Larger premium amounts naturally result in larger tax savings, assuming the premiums are deductible. A $10,000 premium deduction will generate more tax savings than a $2,000 premium deduction, all other factors being equal.

Final Conclusion

Successfully claiming health insurance premium deductions requires careful consideration of your employment status, the type of health insurance plan you have, and adherence to specific documentation requirements. While the process may seem intricate, understanding the eligibility criteria and available resources can simplify the task significantly. By carefully reviewing the information provided in this guide and consulting with a tax professional if needed, you can confidently navigate the process and potentially reduce your tax burden. Remember, maximizing your tax benefits requires proactive planning and accurate record-keeping.

Query Resolution

What if I have both employer-sponsored insurance and a supplemental plan? Can I deduct premiums for both?

Generally, no. You can typically only deduct premiums for health insurance you purchased yourself, not premiums paid by your employer or through employer-sponsored plans.

Are there income limits for claiming the health insurance premium deduction?

The ability to deduct health insurance premiums for self-employed individuals isn’t directly tied to a specific income limit. However, the amount you can deduct is limited by your adjusted gross income (AGI) and other factors. Higher AGI may reduce the deduction amount.

What happens if I make a mistake on my tax return related to health insurance premiums?

If you discover a mistake, file an amended tax return (Form 1040-X) as soon as possible. The IRS has guidelines on correcting errors. Penalties may apply depending on the nature and extent of the mistake.

Where can I find the necessary tax forms?

You can download most tax forms directly from the IRS website (irs.gov).