Health Savings Accounts (HSAs) offer a powerful tool for managing healthcare costs, but understanding their nuances is crucial. One frequently asked question revolves around the use of HSA funds for insurance premiums. This guide delves into the regulations, benefits, and potential drawbacks of using your HSA to cover these costs, providing clarity on this often-misunderstood aspect of HSA utilization.

We’ll explore the specific rules governing HSA premium payments, compare HSAs to other savings vehicles like FSAs, and present real-world scenarios illustrating the financial implications of this strategy. By the end, you’ll possess a thorough understanding of whether leveraging your HSA for insurance premiums aligns with your financial goals.

HSA Eligibility and Enrollment

Opening a Health Savings Account (HSA) offers significant tax advantages for those who qualify. Understanding the eligibility requirements and enrollment process is crucial to maximizing the benefits of this valuable healthcare savings tool. This section details the steps involved in establishing and contributing to an HSA.

HSA Eligibility Requirements

To be eligible for an HSA, you must be enrolled in a High Deductible Health Plan (HDHP). This is a health insurance plan with a higher deductible than traditional plans, but often lower premiums. Crucially, the HDHP must meet specific requirements set by the IRS regarding minimum deductible and out-of-pocket maximum amounts. In addition to having an HDHP, you cannot be enrolled in other health coverage, such as Medicare or Medicaid, except for limited exceptions such as dental or vision plans. You also cannot be claimed as a dependent on someone else’s tax return. Finally, you must not have been claimed as a dependent in any prior year and must be a legal resident of the United States.

HSA Enrollment Process

The enrollment process for an HSA is generally straightforward. First, you need to choose an HSA provider. Many banks, credit unions, and investment firms offer HSA accounts. Each provider offers various features and fee structures. Once you’ve selected a provider, you’ll typically need to complete an application, providing personal information and selecting an account type. After your application is approved, you can begin making contributions. Some employers may offer HSA enrollment through payroll deduction, simplifying the contribution process.

Contributing to an HSA

Contributing to your HSA is typically done through your chosen provider’s online portal or mobile app. You can set up automatic transfers from your bank account or schedule regular contributions. Many providers also allow you to contribute via check or mail. The contribution limits are set annually by the IRS and are adjusted for inflation. For 2023, the maximum contribution for individuals is $3,850 and for families, it’s $7,750. Individuals age 55 and older can make an additional “catch-up” contribution of $1,000. It’s important to stay within these limits to avoid penalties. Remember to keep records of all your HSA contributions for tax purposes.

HSA Provider Comparison

Choosing the right HSA provider is important, as fees and features can vary significantly. The following table provides a comparison of several providers (Note: This is a simplified example and actual fees and features may vary. Always check the provider’s website for the most up-to-date information.):

| Provider | Fees | Features | Minimum Contribution |

|---|---|---|---|

| Example Bank 1 | $0 monthly fee, $25 for paper statements | Online banking, debit card, investment options | $100 |

| Example Credit Union | No fees | Online banking, debit card, mobile app | $25 |

| Example Investment Firm | $3 monthly fee, $10 for paper statements, investment management fees may apply | Online banking, debit card, investment options, robust online tools | $500 |

| Example HSA Provider 4 | Variable fees depending on account balance and features | High yield savings account, debit card, robust mobile app | $0 |

HSA-Qualified Expenses

Understanding which expenses qualify for reimbursement from your Health Savings Account (HSA) is crucial for maximizing its benefits. HSA funds can only be used for eligible medical expenses for you, your spouse, and your dependents. Improper use can lead to penalties, so careful planning and record-keeping are essential.

Eligible expenses are broadly defined and cover a wide range of healthcare costs, but there are also specific exclusions. This section will clarify what qualifies and what doesn’t, as well as the necessary documentation for submitting claims.

Eligible Medical Expenses

HSA-eligible medical expenses encompass a broad spectrum of healthcare costs. These include, but are not limited to, doctor visits, prescription drugs, hospital stays, dental and vision care, and certain over-the-counter medications. Many preventive care services are also covered. For example, routine checkups, vaccinations, and screenings are generally considered eligible. The IRS provides a comprehensive list of eligible expenses, and it’s advisable to consult this resource for the most up-to-date and detailed information. Remember, the key is that the expense must be for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body.

Examples of Ineligible Medical Expenses

Not all healthcare-related expenses are HSA-eligible. Some common examples of ineligible expenses include cosmetic surgery (unless medically necessary), weight-loss programs (unless medically supervised for a specific condition), over-the-counter medications not directly related to a specific medical condition, and most long-term care insurance premiums. Similarly, items considered personal convenience, such as gym memberships or health supplements, are generally not eligible for reimbursement. Additionally, expenses paid with funds from other sources, such as insurance reimbursements, cannot be claimed again using HSA funds.

Required Documentation for HSA Claims

To successfully submit an HSA claim, you’ll need adequate documentation to support your expenses. This typically includes receipts, Explanation of Benefits (EOB) statements from your insurance provider, and any other relevant documentation that clearly shows the date of service, the provider’s name and address, a description of the services rendered, and the total amount paid. Maintaining organized records is critical for efficient claim processing and avoiding potential disputes. Failing to provide sufficient documentation may result in claim denial.

Common Misconceptions Regarding HSA-Qualified Expenses

Several misconceptions surround HSA-eligible expenses. One common misunderstanding is that all dental and vision care is automatically eligible. While many services are, some procedures, such as cosmetic dentistry, might not be. Another misconception is that over-the-counter medications are always eligible. Generally, only those prescribed by a doctor or directly related to a specific medical condition are covered. Finally, many mistakenly believe that HSA funds can be used for any health-related expense. This is false; only expenses meeting the IRS’s definition of “qualified medical expenses” are eligible for reimbursement. Carefully reviewing the IRS guidelines is crucial to avoid penalties and ensure proper usage of your HSA funds.

Tax Implications of HSA Usage

Health Savings Accounts (HSAs) offer significant tax advantages, making them a powerful tool for saving for healthcare expenses. Understanding these tax implications is crucial for maximizing the benefits of an HSA. This section details the tax benefits associated with contributions, withdrawals, and potential penalties.

Tax Implications of HSA Contributions

Contributions to an HSA are made pre-tax, meaning they reduce your taxable income for the year. This directly lowers your tax liability, resulting in immediate tax savings. The amount you can contribute annually is determined by the IRS and depends on your coverage level. For example, if you contribute $3,850 to your HSA and are in a 22% tax bracket, your tax savings would be $847 ($3,850 x 0.22). This money is not taxed when it’s contributed, grows tax-free, and can be withdrawn tax-free for qualified medical expenses.

Tax Implications of HSA Withdrawals for Qualified Medical Expenses

Distributions from your HSA used to pay for eligible medical expenses are tax-free. This means you won’t owe any income tax on the money you withdraw. Remember, however, that only expenses that meet IRS guidelines for qualified medical expenses are eligible for tax-free withdrawals. These expenses include doctor visits, hospital stays, prescription drugs, and many other healthcare costs. Keeping detailed records of your medical expenses is essential to support tax-free withdrawals.

Tax Penalties for Non-Qualified HSA Withdrawals

Withdrawing funds from your HSA for non-qualified expenses before age 65 incurs a 20% tax penalty, in addition to paying income tax on the withdrawn amount. For instance, if you withdraw $1,000 for a non-qualified expense, you would owe $200 in penalties plus income tax on the full $1,000. After age 65, the penalty is waived, but you will still owe income taxes on the withdrawn amount. This highlights the importance of only using HSA funds for qualified medical expenses.

Calculating HSA Tax Savings

Calculating the tax savings from an HSA involves considering your tax bracket and the amount you contribute. The formula is straightforward: Tax Savings = HSA Contribution x Your Marginal Tax Rate. For example, a $4,000 contribution in a 25% tax bracket would yield a tax saving of $1,000 ($4,000 x 0.25). This calculation illustrates the significant tax advantages of using an HSA, particularly for individuals in higher tax brackets. Remember that this calculation only reflects the tax savings from contributions; the tax-free nature of qualified withdrawals further enhances the overall benefit.

Alternative Payment Methods for Insurance Premiums

Choosing how to pay for your health insurance premiums involves considering various options, each with its own set of advantages and disadvantages. Understanding the differences between using a Health Savings Account (HSA), a Flexible Spending Account (FSA), or paying directly from your personal funds is crucial for effective financial planning. This section will compare and contrast these methods, highlighting their key features and implications.

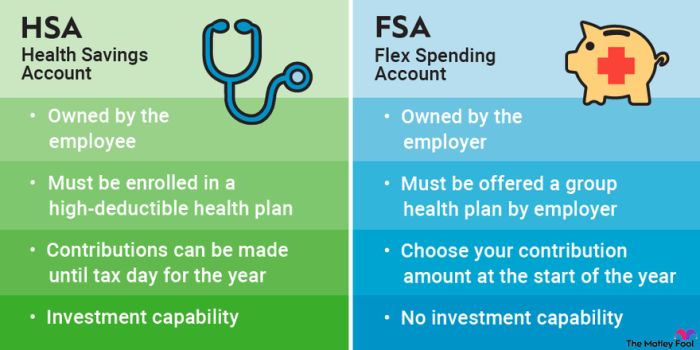

HSA versus FSA for Insurance Premium Payments

Both HSAs and FSAs can offer tax advantages, but they differ significantly in their structure and usage. HSAs are linked to high-deductible health plans (HDHPs), allowing pre-tax contributions to accumulate and grow tax-free. FSAs, on the other hand, are employer-sponsored accounts with a use-it-or-lose-it provision for annual contributions. While some FSAs may allow for limited carryover, the flexibility is considerably less than with an HSA. Crucially, neither HSAs nor FSAs are typically directly used to pay insurance premiums. They are used to pay for eligible medical expenses *after* the deductible has been met, which could indirectly lower your out-of-pocket costs associated with health insurance. The actual premium payments still need to be made separately.

Advantages and Disadvantages of Using an HSA versus Direct Payment

Using an HSA to pay for eligible medical expenses *after* meeting your deductible offers tax advantages, allowing you to save money on your overall healthcare costs. However, it requires discipline to contribute regularly and remember that the funds are only accessible for qualified medical expenses. Direct payment of insurance premiums, while straightforward, doesn’t offer any tax advantages and can create a significant financial burden.

| Plan Type | Premium Payment Options | Tax Implications | Eligibility |

|---|---|---|---|

| HSA | Direct payment from bank account, debit card. HSA funds can be used for *eligible medical expenses after deductible*, not premiums directly. | Contributions are tax-deductible, earnings grow tax-free, withdrawals for qualified medical expenses are tax-free. | Must be enrolled in a high-deductible health plan (HDHP). |

| FSA | Typically not used for premium payments; funds are used for eligible medical expenses before the deductible. | Contributions are pre-tax, but unused funds are generally forfeited at the end of the plan year. | Offered by employers; eligibility varies by employer. |

| Traditional Health Insurance Plan | Direct payment from bank account, debit card, or payroll deduction. | Premiums are typically not tax-deductible unless you itemize and meet specific criteria. | Generally available to anyone, regardless of income or health status. |

Illustrative Scenarios

Understanding the financial implications of using an HSA to pay insurance premiums requires careful consideration of individual circumstances. The following scenarios illustrate situations where this strategy may be beneficial or detrimental.

Financially Advantageous HSA Premium Payment

Imagine Sarah, a 35-year-old with a high-deductible health plan and an HSA. Her annual deductible is $5,000, and her monthly insurance premium is $300 ($3600 annually). She contributes the maximum annual HSA contribution of $3,850 (for 2023, assuming self-only coverage). By paying her premiums with HSA funds, she reduces her out-of-pocket expenses for the year. Her remaining deductible to meet is $5000 – $3600 = $1400. If her actual medical expenses for the year are $2,000, she would only pay $2000 – $3600 (HSA used) = -$1600 (meaning she is effectively $1600 ahead after covering her premium and medical expenses). The remaining $3850-$3600 = $250 in her HSA remains for future medical expenses. This scenario demonstrates a significant financial advantage, effectively lowering her total healthcare costs for the year.

Financially Disadvantageous HSA Premium Payment

Consider John, a 60-year-old with a high-deductible health plan and an HSA. His annual deductible is $6,000, and his monthly premium is $400 ($4800 annually). He contributes $1,000 annually to his HSA. If he uses his HSA to pay his premiums, he depletes his HSA account completely. If his medical expenses for the year total $7,000, he will still need to pay $2,000 out-of-pocket ($7000 – $5000 deductible). This scenario shows that using his HSA for premiums didn’t offer significant savings because his medical expenses far exceeded his HSA contributions. He would have been in the same position financially if he’d paid his premiums directly and kept his HSA contributions separate for potential future medical costs.

Impact of Varying HSA Contribution Levels

Let’s analyze the impact of different HSA contribution levels on total healthcare costs. We’ll use Maria as an example. Maria has a $4,000 deductible and a $300 monthly premium ($3600 annually).

| Annual HSA Contribution | HSA Funds Used for Premiums | Remaining Deductible | Scenario |

|---|---|---|---|

| $1,000 | $1,000 | $3,000 | Maria still has a significant deductible to meet. |

| $2,000 | $2,000 | $2,000 | Maria’s deductible is reduced, but still substantial. |

| $3,600 | $3,600 | $400 | Maria’s deductible is significantly reduced, improving her financial position. |

| $4,000 | $3,600 | $0 | Maria’s premiums are covered, and she has $400 left in her HSA for future medical expenses. |

This table highlights that higher HSA contributions lead to lower out-of-pocket costs, provided medical expenses are within the range of the HSA contribution and deductible. However, it is crucial to remember that maximizing HSA contributions is only beneficial if the funds are likely to be used for qualified medical expenses.

Last Word

Ultimately, the decision of whether to use your HSA for insurance premiums requires careful consideration of your individual circumstances and financial objectives. While the tax advantages are undeniable in many situations, a comprehensive understanding of the rules and regulations, coupled with a realistic assessment of your healthcare spending, is paramount. This guide provides the necessary information to make an informed choice, empowering you to maximize the benefits of your HSA.

FAQ Corner

Can I use my HSA for COBRA premiums?

Generally, yes, if COBRA premiums are for minimum essential coverage. However, always check with your HSA provider for clarification.

What happens if I use HSA funds for non-qualified expenses?

You’ll be subject to income tax on the withdrawn amount, plus a 20% penalty, unless you are age 65 or older.

Are there any limits on how much I can contribute to my HSA each year?

Yes, contribution limits are set annually by the IRS and vary based on your coverage level.

Can I use my HSA to pay for my spouse’s or dependents’ insurance premiums?

Yes, provided they are covered under a health plan that qualifies for an HSA.

Does my employer’s contribution to my HSA affect the amount I can contribute?

No, your employer’s contribution is in addition to your own contribution limit.