Navigating the complexities of tax deductions can feel like deciphering a secret code, especially when it comes to healthcare expenses. Understanding whether you can deduct health insurance premiums is crucial for maximizing your tax return and ensuring you’re taking advantage of all available benefits. This guide will unravel the intricacies of deducting health insurance premiums, exploring the eligibility criteria, specific rules for the self-employed, the impact of employer-sponsored plans, and the role of the Affordable Care Act. We’ll provide clarity on the necessary tax forms and documentation, offering a comprehensive overview to empower you with the knowledge needed to confidently navigate this aspect of your taxes.

The landscape of health insurance and tax deductions is multifaceted, varying based on your employment status, the type of insurance plan, and even your state of residence. This guide aims to simplify this process by providing clear explanations, practical examples, and a step-by-step approach to claiming deductions, ensuring a smoother and more informed tax filing experience.

Eligibility for Deduction

Deducting health insurance premiums on your taxes depends on several factors, primarily your employment status and the type of health insurance plan you have. Understanding these factors is crucial for accurately calculating your tax liability. The rules surrounding premium deductibility can be complex, so consulting a tax professional is always recommended if you have any uncertainties.

Requirements for Deducting Health Insurance Premiums

To deduct health insurance premiums, you generally need to be self-employed, a freelancer, or have a qualifying self-employment situation. This means you’re not an employee of a company that provides health insurance as part of your compensation package. The premiums paid must be for health insurance coverage for yourself, your spouse, and/or your dependents. Furthermore, the premiums must be for a plan that meets minimum essential coverage requirements as defined by the Affordable Care Act (ACA). This ensures the plan provides a sufficient level of medical coverage. Plans that meet these standards typically include HMOs, PPOs, and EPOs. However, specific requirements may vary, and consulting the IRS guidelines is vital for accurate assessment.

Examples of Deductible and Non-Deductible Premiums

Deductible premiums commonly involve self-employed individuals paying for their own health insurance plans. For instance, a freelance writer paying for a private health insurance policy can generally deduct the premiums. Another example is a self-employed consultant who purchases a family health plan; the premiums are often deductible. Conversely, premiums are typically not deductible if you are an employee and your employer provides health insurance as part of your compensation package, even if you contribute to the plan. Likewise, if you have received a health insurance subsidy through the Marketplace, the subsidy amount might affect the deductibility of your premiums. It’s important to note that specific circumstances can impact deductibility, and the rules can change.

Deductibility for Self-Employed vs. Employed Individuals

Self-employed individuals have a significant advantage when it comes to deducting health insurance premiums. They can deduct the premiums paid for themselves and their families as a business expense, reducing their taxable income. This deduction is claimed on Schedule C (Profit or Loss from Business) of Form 1040. In contrast, employees whose employers provide health insurance generally cannot deduct premiums, as the cost is already considered part of their compensation package. This means their taxable income remains unaffected by the cost of their health insurance. The only exception for employees might be if they have a separate self-employment activity with related health insurance premiums, which they could then deduct.

Summary Table of Deductibility

| Taxpayer Status | Type of Plan | Deductibility | Relevant Tax Form |

|---|---|---|---|

| Self-Employed | Individual or Family Plan (meeting minimum essential coverage) | Deductible | Schedule C (Form 1040) |

| Employee (with employer-sponsored insurance) | Employer-sponsored plan | Generally Not Deductible | N/A |

| Self-Employed | Plan that does not meet minimum essential coverage | Generally Not Deductible | N/A |

| Employee (with separate self-employment activity) | Plan for self-employment activity (meeting minimum essential coverage) | Deductible (for self-employment portion) | Schedule C (Form 1040) |

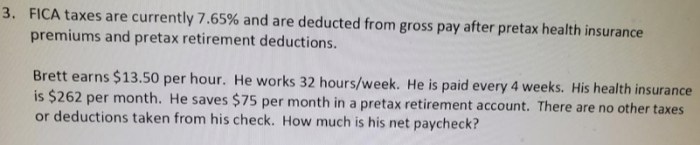

Self-Employed Individuals

Self-employed individuals, unlike employees, are responsible for paying both the employer and employee portions of self-employment taxes, including Social Security and Medicare taxes. This also extends to their health insurance premiums. The self-employed can deduct the amount they pay for health insurance as a business expense, potentially reducing their overall tax liability. However, specific rules and regulations govern this deduction.

The deduction for self-employed health insurance premiums is taken on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss from Farming. It’s crucial to accurately calculate the deductible amount and maintain proper documentation to support the claim.

Calculating the Deductible Amount

The deductible amount for self-employed health insurance premiums is the total amount paid during the tax year for health insurance coverage for yourself, your spouse, and your dependents. This includes premiums paid for Medicare Part B, but generally excludes premiums paid for Medicare Part A, long-term care insurance, and supplemental health insurance (such as Medigap). The amount is entered on the appropriate line of Schedule C or Schedule F. You cannot deduct premiums if you or your spouse were eligible to participate in an employer-sponsored health plan.

For example, if a self-employed individual paid $7,200 in health insurance premiums during the year, they would deduct $7,200 on their tax return. This deduction is above-the-line, meaning it reduces your adjusted gross income (AGI) before other deductions are applied.

Supporting Documentation

To successfully claim the deduction, maintain thorough records of your health insurance payments. This documentation should clearly show the following:

- The total amount paid for health insurance premiums during the tax year.

- The dates of payment.

- The names of the insured individuals (yourself, spouse, and dependents).

- The insurance company’s name and policy number.

Examples of acceptable documentation include:

- Insurance premium payment receipts or statements.

- Cancelled checks or bank statements showing payments.

- Form 1099-MISC, if applicable.

Step-by-Step Guide for Claiming the Deduction

Claiming the deduction involves several straightforward steps:

- Gather your documentation: Collect all your health insurance premium payment records for the tax year.

- Calculate the total amount paid: Sum up all your health insurance premium payments.

- Complete Schedule C or Schedule F: Enter the total amount of premiums paid on the appropriate line of Schedule C (for sole proprietorships) or Schedule F (for farming businesses).

- Attach supporting documentation: Keep a copy of your supporting documents for your records. The IRS may request them during an audit.

- File your tax return: File your Form 1040 with the completed Schedule C or Schedule F.

Note: It’s recommended to consult a tax professional for personalized advice, especially in complex situations. Tax laws can be intricate, and a professional can ensure you’re taking advantage of all available deductions and credits.

Employer-Sponsored Health Insurance

Employer-sponsored health insurance represents a significant portion of health insurance coverage in many countries. Understanding the tax implications of these plans is crucial for both employees and employers. While employees generally don’t directly deduct premiums from their taxes (as the employer pays), there are still important tax considerations related to the employer’s contributions.

Employer contributions towards health insurance premiums are generally not considered taxable income to the employee. This is a significant tax advantage, as the employee receives the benefit of health insurance without having to pay taxes on the value of the employer’s contribution. This non-taxable benefit effectively increases the employee’s compensation without increasing their taxable income.

Tax Treatment of Employer Contributions

The employer’s contribution to the health insurance premium is considered a tax-deductible business expense for the employer. This reduces the employer’s taxable income, thus lowering their overall tax burden. This deduction is a crucial aspect of employer-sponsored health insurance plans, making them a financially attractive benefit to offer employees. The specific rules governing this deduction may vary slightly depending on the country and specific regulations, but the general principle remains consistent. For example, in the United States, the employer can deduct the premiums paid as an ordinary and necessary business expense.

Comparison of Tax Treatment: Employer-Sponsored vs. Individually Purchased Plans

The key difference lies in the tax treatment of the premiums. With employer-sponsored plans, the employee doesn’t pay taxes on the employer’s contribution. However, with individually purchased plans, the premiums are often deductible (depending on the country and specific circumstances, as discussed in previous sections), but only to the extent allowed by law, and this deduction is applied to the individual’s personal income tax return. This means the individual is directly responsible for paying taxes on the total premium, even though the deduction may lower their tax bill. The tax benefits of employer-sponsored health insurance plans are thus more advantageous for the employee, while the employer benefits from the deduction of the premiums as a business expense.

Tax Benefits of Employer-Sponsored Health Insurance

The tax benefits associated with employer-sponsored health insurance are substantial. For the employee, the primary benefit is the non-taxable nature of the employer’s contribution. This effectively increases their disposable income. For the employer, the deduction of premiums as a business expense reduces their tax liability. These combined tax advantages make employer-sponsored health insurance a mutually beneficial arrangement. For example, a hypothetical scenario could involve an employee receiving $10,000 worth of health insurance coverage from their employer. This $10,000 would not be taxed as income for the employee, representing a significant savings compared to purchasing a similar plan individually and paying taxes on the premium. The employer, in turn, can deduct this $10,000 from their taxable income, reducing their tax burden.

Tax Forms and Documentation

Claiming a deduction for health insurance premiums requires accurate completion of the relevant tax forms and the submission of supporting documentation. The specific forms and required information may vary slightly depending on your filing status and the type of health insurance coverage you have. This section will Artikel the key forms and documentation needed to support your deduction.

Form 1040 and Schedule 1 (Additional Income and Adjustments to Income)

Form 1040 is the primary tax return form used by most individuals to file their annual income tax return. Schedule 1 is where you report adjustments to income, including the deduction for self-employed health insurance premiums. The deduction is claimed on line 29 of Schedule 1. You will need to enter the total amount of premiums you paid during the tax year that are eligible for the deduction. This amount should be supported by the documentation Artikeld below. Incorrect reporting on either form can lead to delays or rejection of your tax return.

Supporting Documentation

To substantiate the deduction claimed on Schedule 1, you must provide supporting documentation. Acceptable documentation generally includes Form 1099-MISC (if applicable), and copies of your health insurance premium payment receipts or statements. These documents should clearly show the dates of payment, the amount paid, and the name of the insurance provider. Bank statements showing payments made to the insurance company are also acceptable. For self-employed individuals, detailed records of business income and expenses are crucial for proper documentation. For employer-sponsored plans, documentation may include a summary plan description or statements showing the employee’s contribution to the plan. Maintaining organized records throughout the year is highly recommended to simplify the tax preparation process.

Example of Completing Schedule 1

Let’s imagine John is self-employed and paid $5,000 in health insurance premiums during the tax year. On Schedule 1, he would enter “$5,000” on line 29 (Adjusted Gross Income). He would then attach copies of his health insurance premium payment receipts or bank statements as supporting documentation to his tax return. This documentation provides verifiable proof of the expense, ensuring a smooth and accurate tax filing. Failure to provide adequate documentation could result in the IRS questioning the deduction and potentially disallowing it. Accuracy and completeness of documentation are crucial for successful claim processing.

State-Specific Regulations

While the federal government provides a framework for deducting health insurance premiums, state tax laws can introduce variations impacting the deductibility for individuals and businesses. These differences stem from individual state tax codes and how they interact with federal regulations. Understanding these variations is crucial for accurate tax filing and maximizing potential deductions.

State tax laws regarding the deductibility of health insurance premiums often mirror federal rules but may include additional stipulations or limitations. Some states might offer additional deductions beyond the federal allowance, while others may impose stricter limitations or specific requirements for eligibility. This inconsistency underscores the importance of consulting each state’s specific tax guidelines.

Variations in State Tax Laws

State tax codes concerning health insurance premium deductions vary significantly. Some states may allow deductions for self-employed individuals that are more generous than federal provisions, offering a higher percentage of premium costs as a deduction. Others may have stricter rules about what qualifies as a deductible expense, limiting deductions to only those premiums paid for qualifying dependents or specific types of health plans. Furthermore, some states may not allow any deduction for health insurance premiums at the state level, regardless of the federal deduction.

Examples of States with Different Rules

For instance, California might allow a broader range of self-employed individuals to deduct health insurance premiums compared to Texas, which may have stricter requirements on income levels or types of plans eligible for the deduction. New York, on the other hand, might have specific rules related to the deduction for small business owners, differing from the federal guidelines or the rules in other states. These examples highlight the lack of uniformity across state tax laws. The absence of a standardized approach necessitates careful review of individual state tax instructions.

Importance of Consulting State-Specific Tax Guidelines

Failure to account for state-specific regulations can lead to inaccurate tax filings and potential penalties. Each state’s Department of Revenue website provides the most up-to-date and accurate information regarding the deductibility of health insurance premiums within that state’s tax code. Consulting these resources is crucial to ensure compliance and maximize potential tax benefits.

Summary Table of State Regulations

| State | Deductibility for Self-Employed | Deductibility for Employees (Employer-Sponsored) | Additional Notes |

|---|---|---|---|

| California | Generally allowed, may have income limitations | Not deductible at the state level | Consult the Franchise Tax Board for details. |

| Texas | Allowed, potentially subject to specific plan requirements | Not deductible at the state level | Refer to the Texas Comptroller of Public Accounts for precise guidelines. |

| New York | Allowed, with potential limitations based on business type and income | Generally not deductible at the state level | Consult the New York State Department of Taxation and Finance for specifics. |

| Florida | No state income tax, therefore no state deduction available | Not applicable | Florida does not have a state income tax. |

Final Conclusion

Successfully navigating the deduction of health insurance premiums hinges on a thorough understanding of your specific circumstances and the relevant regulations. While the process may seem daunting at first, armed with the information provided in this guide, you can confidently approach tax season with a clear understanding of your eligibility and the necessary steps to claim your deductions. Remember to maintain meticulous records and consult with a tax professional if needed to ensure accuracy and maximize your tax benefits. Proper planning and documentation are key to a successful outcome.

Essential FAQs

Can I deduct premiums for my spouse’s health insurance?

This depends on your filing status and whether your spouse is covered under your plan or has their own separate plan. If they are covered under your plan, the rules for deducting your premiums apply. If they have a separate plan, the same rules apply to their premiums, depending on their employment status (self-employed or employed).

What if I overpaid my health insurance premiums?

If you overpaid your premiums, you may be able to claim a refund. Contact your insurance provider to determine the process for receiving a refund of the overpayment. This is separate from tax deductions.

Are there penalties for claiming a deduction incorrectly?

Yes, claiming deductions incorrectly can result in penalties, including interest and potential audits. It’s crucial to accurately report all information and keep thorough records.

What happens if I don’t have all the necessary documentation?

It is strongly recommended to obtain all necessary documentation. Without it, your deduction may be denied. Contact your insurance provider or employer if you are missing any required forms or information.