Navigating the complexities of tax deductions can feel like deciphering a secret code, especially when it comes to healthcare costs. Understanding whether you can deduct health insurance premiums is crucial for maximizing your tax benefits and minimizing your overall tax burden. This guide provides a clear and concise overview of the rules and regulations surrounding the deductibility of health insurance premiums, empowering you to make informed decisions during tax season.

From eligibility criteria and different health insurance plan types to the necessary tax forms and potential pitfalls, we’ll explore every facet of this important topic. We’ll also address the impact of Health Savings Accounts (HSAs) and highlight state-specific regulations that may affect your eligibility. By the end, you’ll have a solid grasp of how to navigate the complexities of deducting your health insurance premiums and potentially saving money.

Eligibility for Deduction

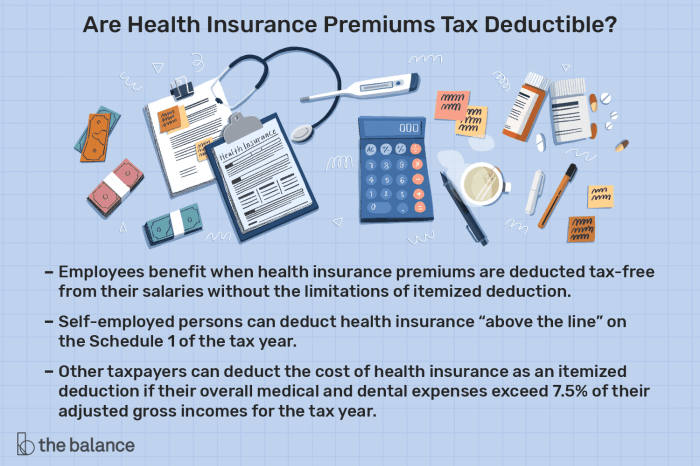

Understanding the deductibility of health insurance premiums hinges on your employment status and specific circumstances. The rules differ significantly between employees and self-employed individuals, impacting the amount you can deduct and the process involved. This section clarifies these differences and provides examples to illustrate the criteria.

Deduction Criteria for Individuals

To deduct health insurance premiums, taxpayers must generally itemize their deductions on Schedule A (Form 1040). This means their total itemized deductions must exceed the standard deduction amount for their filing status. Furthermore, the premiums must be for health insurance coverage for yourself, your spouse, or your dependents. Premiums paid for long-term care insurance or other types of insurance are generally not deductible as medical expenses. The insurance must also be purchased from a qualified provider, not an informal arrangement.

Deduction Requirements for Self-Employed Individuals

Self-employed individuals can deduct the full amount of health insurance premiums they paid for themselves, their spouse, and their dependents, provided they are not eligible to participate in an employer-sponsored health plan. This deduction is taken above the line, meaning it reduces your adjusted gross income (AGI) before calculating your taxable income. The self-employed individual must be considered self-employed and must file Schedule C or Schedule F to report their business income. They will report this deduction on Form 1040, Schedule 1.

Comparison of Deduction Rules: Employees vs. Self-Employed

Employees who are offered health insurance through their employer typically cannot deduct the premiums they pay, even if they choose a higher-deductible plan. This is because the employer’s contribution towards the insurance is considered a form of compensation, and the employee’s contribution is often factored into the employee’s overall compensation package. However, if an employee is uninsured and pays for their own coverage, they may be able to deduct their premiums as a medical expense, but only if they itemize deductions and meet the criteria mentioned earlier. Self-employed individuals, on the other hand, have a more straightforward deduction, provided they meet the criteria for self-employment and aren’t eligible for employer-sponsored coverage.

Examples of Deductible and Non-Deductible Premiums

Deductible: A self-employed freelance writer pays $7,000 in health insurance premiums for themselves and their family. They can deduct the full $7,000. A small business owner with no employer-sponsored health plan pays $12,000 in premiums; they can deduct the full amount.

Non-Deductible: An employee with employer-sponsored health insurance pays $200 monthly towards their premium; this is generally not deductible. A retiree covered under Medicare pays additional supplemental insurance premiums; these supplemental premiums may be deductible as a medical expense if they itemize deductions and meet other requirements. An individual pays premiums for long-term care insurance; this is generally not deductible as a medical expense.

Eligibility Summary Table

| Eligibility Status | Income Level | Deduction Type | Limitations |

|---|---|---|---|

| Self-Employed | Any | Above-the-line deduction | Must not be eligible for employer-sponsored health insurance. |

| Employee (with employer-sponsored plan) | Any | Generally not deductible | Premiums are usually considered part of the compensation package. |

| Employee (without employer-sponsored plan) | Itemized deductions exceed standard deduction | Itemized deduction (medical expense) | Subject to the 7.5% AGI threshold for medical expense deductions. |

| Retiree (Medicare) | Itemized deductions exceed standard deduction | Itemized deduction (medical expense) – supplemental premiums | Subject to the 7.5% AGI threshold for medical expense deductions. |

Types of Health Insurance Plans

Understanding the type of health insurance plan you have is crucial for determining the deductibility of your premiums. Different plans offer varying levels of coverage and cost-sharing, which directly impacts whether and how much of your premiums are deductible. This section will explore the deductibility of premiums for common health insurance plan types.

Deductibility of Premiums for HMO, PPO, and HSA Plans

The deductibility of health insurance premiums generally depends on whether you itemize deductions on your tax return, not the specific type of plan (HMO, PPO, or HSA). While the plan type itself doesn’t directly affect deductibility, certain plan features *can* indirectly influence it. For example, if your employer contributes to your HSA, that contribution might be tax-advantaged, affecting your overall tax situation and potentially influencing the value of itemizing. However, the premiums themselves are generally treated the same regardless of whether the plan is an HMO, PPO, or HSA. The key determinant is whether you meet the IRS criteria for itemizing medical expenses.

Impact of Plan Features on Premium Deductibility

Several plan features, while not directly impacting premium deductibility, can indirectly influence your overall tax situation. High deductibles, for example, might lead to higher out-of-pocket medical expenses, potentially making itemized deductions more beneficial. Conversely, a plan with low deductibles and comprehensive coverage may result in lower overall medical expenses, reducing the likelihood of exceeding the threshold for itemizing medical expenses. This is because only medical expenses exceeding a certain percentage of your adjusted gross income (AGI) are deductible.

Limitations and Restrictions Based on Plan Type

There are no specific limitations or restrictions on premium deductibility based solely on the type of plan (HMO, PPO, or HSA). The IRS rules for deducting medical expenses apply equally to all types of health insurance plans. However, the plan’s cost-sharing features, such as deductibles, co-pays, and out-of-pocket maximums, can indirectly affect whether itemizing medical expenses is advantageous. For example, a high-deductible health plan (HDHP) paired with a health savings account (HSA) offers tax advantages on contributions and growth, but the high deductible might mean higher out-of-pocket expenses before insurance coverage kicks in.

Examples of Specific Plan Features and Their Effect on Deductibility

Let’s consider two scenarios:

Scenario 1: An individual with a PPO plan paying $600 monthly premiums and incurring $10,000 in medical expenses. If their AGI is $50,000, and the threshold for itemizing medical expenses is 7.5% of AGI ($3,750), they may be able to deduct a portion of their medical expenses exceeding that threshold. The premiums themselves are not directly deductible, but the high medical expenses increase the likelihood of itemizing.

Scenario 2: An individual with an HMO plan paying $400 monthly premiums and incurring only $2,000 in medical expenses. With the same AGI and threshold as above, they are unlikely to itemize because their medical expenses are far below the threshold. Their premiums, again, are not directly deductible.

In both scenarios, the type of plan (PPO vs. HMO) doesn’t affect premium deductibility. The deductibility is primarily influenced by the amount of medical expenses incurred relative to the AGI and the applicable threshold for itemizing.

Potential Penalties for Incorrect Reporting

Claiming deductions for health insurance premiums incorrectly can lead to significant tax-related problems. The Internal Revenue Service (IRS) carefully scrutinizes these deductions, and inaccurate reporting can result in penalties, interest charges, and even legal action in severe cases. Understanding the potential consequences is crucial for responsible tax filing.

The penalties associated with inaccurate reporting on tax forms related to health insurance premium deductions vary depending on the nature and severity of the error. These penalties can include substantial financial fines, interest accruing on the underpaid tax amount, and in cases of intentional misrepresentation or tax fraud, criminal prosecution. The IRS may also initiate an audit, requiring you to provide extensive documentation to justify your claimed deductions. Furthermore, your reputation as a responsible taxpayer could be negatively affected, potentially impacting future loan applications or business dealings.

Consequences of Incorrectly Claiming Deductions

Incorrectly claiming health insurance premium deductions can result in several penalties. The most common include:

- Accuracy-related penalty: This penalty applies if the IRS determines that the error was due to negligence or disregard of rules and regulations. The penalty is typically 20% of the underpayment.

- Fraud penalty: If the IRS determines that the error was intentional, the penalty can be as high as 75% of the underpayment. This penalty also carries the potential for criminal prosecution.

- Interest charges: Interest accrues on any unpaid tax liability from the due date of the return until the tax is paid in full. The interest rate is determined by the IRS and can be substantial.

Correcting Errors in Tax Filings

If you discover an error in your tax filing related to health insurance premium deductions, it’s crucial to correct it promptly. The best course of action is to file an amended tax return using Form 1040-X, Amended U.S. Individual Income Tax Return. This form allows you to correct the error and provide the necessary documentation to support your amended claim. It’s important to attach all relevant documentation, such as corrected W-2 forms, updated 1095-A forms, and any other supporting evidence. Filing an amended return demonstrates your commitment to tax compliance and may help mitigate potential penalties. Delaying correction can increase the severity of any penalties incurred.

Common Mistakes to Avoid

To prevent penalties, it’s essential to avoid common mistakes when claiming health insurance premium deductions. These mistakes often stem from misunderstandings about eligibility requirements or inaccurate record-keeping.

- Incorrect reporting of premiums paid: Double-check your premium payments against your tax documents and insurance statements to ensure accuracy. A simple mathematical error can lead to an incorrect deduction.

- Failure to meet eligibility requirements: Ensure you meet all the requirements for claiming the deduction. For example, you must have self-employment income or be eligible for the Affordable Care Act (ACA) marketplace subsidies to claim certain deductions.

- Improper documentation: Maintain detailed records of all health insurance premium payments, including receipts, bank statements, and insurance policy details. This documentation is crucial if the IRS audits your return.

- Mixing up dependent and self-paid premiums: If you claim premiums for dependents, ensure you accurately report their status and related expenses. Incorrectly claiming dependents or their associated premiums can lead to penalties.

Illustrative Examples

Understanding the deductibility of health insurance premiums often requires examining specific scenarios. The following examples illustrate various situations and their tax implications, highlighting the nuances of the rules. Remember that these are simplified examples and individual circumstances may require professional tax advice.

Scenario 1: Self-Employed Individual

This scenario involves a self-employed individual who pays for their own health insurance. The deductibility depends on several factors, primarily whether they itemize deductions or use the standard deduction.

- Facts: Sarah, a self-employed consultant, paid $7,000 in health insurance premiums during the tax year. She itemizes her deductions and her adjusted gross income (AGI) is $60,000.

- Outcome: Sarah can deduct the full $7,000 in health insurance premiums as an above-the-line deduction. This reduces her AGI, potentially leading to a lower tax liability.

Scenario 2: Employee with Employer-Sponsored Health Insurance

This example shows the situation of an employee with employer-sponsored health insurance and additional out-of-pocket costs.

- Facts: John works for a company that provides health insurance, but he also pays for a supplemental plan costing $2,000 annually to cover additional expenses. His AGI is $80,000.

- Outcome: John cannot deduct the premiums paid to his employer-sponsored plan, as these premiums are considered a non-taxable fringe benefit. However, he may be able to deduct the $2,000 paid for the supplemental plan if he itemizes and meets the other requirements for medical expense deductions. This deduction is subject to a 7.5% AGI threshold.

Scenario 3: Family Coverage

This scenario illustrates the deductibility of premiums for family health insurance plans.

- Facts: Maria and David are married and file jointly. They paid $12,000 in health insurance premiums for their family plan. Their AGI is $95,000. They itemize deductions.

- Outcome: Similar to the self-employed individual, Maria and David can deduct the full $12,000 in health insurance premiums as an above-the-line deduction if they are self-employed or if they are eligible for the self-employed health insurance deduction. If they are employed, the deductibility may depend on other factors, such as the nature of the plan and whether it’s a supplemental plan.

Scenario 4: Exceeding the AGI Threshold for Medical Expense Deduction

This example highlights the limitation on deducting medical expenses, including those for health insurance premiums.

- Facts: David is self-employed and paid $4,000 in health insurance premiums. His AGI is $40,000. He also had other unreimbursed medical expenses of $8,000. The 7.5% AGI threshold for medical expense deductions is $3,000 ($40,000 x 0.075).

- Outcome: David can deduct his health insurance premiums ($4,000) as an above-the-line deduction. However, he can only deduct the amount of his other medical expenses that exceed the 7.5% AGI threshold. In this case, he can deduct $5,000 ($8,000 – $3,000).

Final Wrap-Up

Successfully navigating the landscape of health insurance premium deductions requires careful attention to detail and a thorough understanding of applicable regulations. While the process may seem daunting at first, with proper planning and record-keeping, you can confidently claim your eligible deductions and optimize your tax liability. Remember to consult with a qualified tax professional if you have specific questions or require personalized guidance. By understanding the intricacies of this deduction, you can effectively manage your healthcare expenses and ensure compliance with tax laws.

Quick FAQs

What if I’m employed and my employer offers health insurance? Can I still deduct premiums?

Generally, no. If your employer provides health insurance, you typically cannot deduct the premiums. However, there might be exceptions in very specific circumstances, so it’s best to consult a tax professional.

What if I have multiple health insurance plans?

The deductibility rules generally apply to each plan individually. You would need to determine the deductibility of premiums for each plan separately based on the criteria Artikeld in this guide.

Are there any penalties for claiming a deduction I’m not eligible for?

Yes, claiming deductions you are not eligible for can result in penalties, including interest and potential audits. Accurate record-keeping is essential to avoid these penalties.

Where can I find the relevant tax forms?

The specific tax forms will depend on your individual circumstances and the type of deduction you’re claiming. The IRS website (irs.gov) is a valuable resource for finding the necessary forms and instructions.