Navigating the complexities of employer-sponsored health insurance can be challenging, especially when unexpected circumstances arise. One common question employees face is whether their employer can demand repayment of insurance premiums if they leave their job before a certain point. This guide delves into the legal nuances surrounding premium repayment, exploring the situations where such demands are legitimate and those where they might be unlawful. We’ll examine employee rights, employer obligations, and best practices for both parties to ensure a clear understanding of this critical aspect of employment.

Understanding the contractual agreements surrounding your health insurance, including clauses related to early termination and premium repayment, is crucial. This guide will equip you with the knowledge to navigate potential disputes and protect your rights. We will cover various scenarios, legal precedents, and practical advice to help you understand your options and make informed decisions.

Situations Warranting Premium Repayment

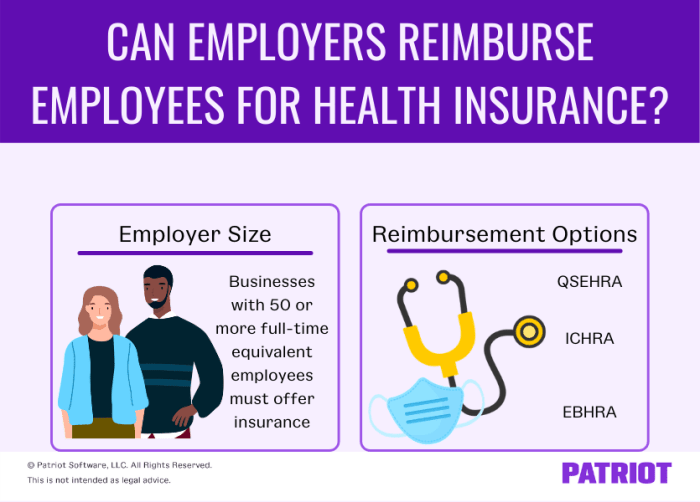

Employers generally have the right to recoup insurance premium costs under specific circumstances, primarily when an employee’s actions violate the terms of their employment contract or company policy. This usually involves situations where the employee has obtained a benefit fraudulently or has acted in a way that directly increases the employer’s insurance costs. However, the legal grounds for such recovery are crucial and must be carefully examined.

An employer’s ability to reclaim insurance premiums hinges on the existence of a clear and legally sound agreement within the employment contract or a separate policy document. This agreement must explicitly Artikel the conditions under which premium repayment is required. Vague or ambiguous clauses are unlikely to hold up in court. Furthermore, the employer must demonstrate that the employee’s actions directly led to the need for premium repayment, providing sufficient evidence to support their claim. Simply stating that an employee’s actions are grounds for repayment is insufficient; concrete evidence linking the action to increased costs is necessary.

Legal Requirements for Successful Premium Repayment

To successfully demand premium repayment, an employer must adhere to several legal requirements. Firstly, they must provide clear and unambiguous notification to the employee regarding the specific breach of contract or policy and the resulting financial implications. This notification should clearly Artikel the amount due, the basis for the calculation, and the timeline for repayment. Secondly, the employer needs to demonstrate a direct causal link between the employee’s actions and the increased insurance premiums. This often requires detailed documentation, such as medical records or police reports, depending on the nature of the breach. Finally, the employer must follow all applicable laws and regulations regarding wage deductions and employee rights. Failure to do so could lead to legal challenges and potential penalties.

Implications of Non-Compliance

Failure by an employer to comply with the legal requirements for demanding premium repayment can have significant repercussions. The employer may face legal challenges from the employee, potentially leading to lawsuits and financial penalties. This could include the employee successfully contesting the repayment demand, resulting in the employer having to pay legal fees and potentially face reputational damage. Furthermore, non-compliance might expose the employer to claims of unfair dismissal or breach of contract if the demand for repayment is linked to disciplinary action or termination. In some jurisdictions, employers who violate wage deduction laws may face fines or other penalties.

Examples of Employee Actions Triggering Premium Repayment

The following examples illustrate situations where an employee’s actions might trigger a premium repayment clause. It’s crucial to remember that the specifics will depend on the exact wording of the employment contract and company insurance policies.

- Fraudulent claims submission: Submitting false or exaggerated claims for insurance benefits, such as workers’ compensation or health insurance.

- Intentional injury or self-harm: Deliberately injuring oneself or another to obtain insurance benefits.

- Violation of company safety policies: Negligence or reckless behavior that results in workplace accidents and increased workers’ compensation premiums.

- Misrepresentation during the application process: Providing false information on an insurance application, such as pre-existing conditions, that leads to increased premiums.

- Driving under the influence resulting in an accident: An accident caused by driving under the influence that impacts company vehicle insurance costs.

Illustrative Scenarios

Understanding the legality of employer premium recovery requires examining specific situations. The following scenarios illustrate instances where premium repayment is justified, unlawful, and successfully contested.

Legitimate Premium Repayment

An employee, Sarah, received health insurance premiums paid by her employer, Acme Corp., for a period when she was ineligible due to a failure to provide necessary documentation (e.g., proof of dependent coverage). Acme Corp.’s employee handbook explicitly states that employees are responsible for maintaining eligibility. Upon discovering Sarah’s ineligibility, Acme Corp. requested repayment of the premiums paid on her behalf during the period of non-compliance. This is legally sound because Sarah violated the terms of her employment contract and company policy regarding insurance eligibility, creating an overpayment that Acme Corp. is entitled to recover. The legal reasoning centers on contract law: the implied contract between employer and employee regarding insurance benefits includes conditions of eligibility, and Sarah’s breach of these conditions justifies premium recovery.

Unlawful Premium Recovery Attempt

John, an employee of Beta Industries, was terminated unexpectedly. Beta Industries subsequently attempted to deduct a substantial sum from his final paycheck, claiming it represented repayment for health insurance premiums paid during his employment. However, Beta Industries failed to provide John with any prior notification of this policy or obtain his written consent for such deductions. Furthermore, no contractual agreement existed specifying that John was responsible for reimbursing premiums upon termination. This attempt to recover premiums is unlawful because it violates several employment laws concerning wage garnishment and notice requirements. Without a valid contract or explicit agreement, the deduction is an unauthorized reduction of wages, potentially violating state and federal wage and hour laws.

Successful Contestation of Premium Repayment

Maria, employed by Gamma Solutions, was asked to repay health insurance premiums after a period of short-term disability leave. Gamma Solutions argued that Maria’s disability was not covered under the policy. Maria, however, presented evidence demonstrating that her disability was indeed covered under the policy’s definition of eligible conditions, supported by her doctor’s documentation and the policy wording itself. She successfully contested the premium repayment demand by presenting this evidence to HR and then, when necessary, to her attorney. The legal arguments centered on the interpretation of the insurance policy and the employer’s failure to provide clear and accurate information regarding policy coverage. The outcome was that Gamma Solutions withdrew its demand for premium repayment, acknowledging the error in their interpretation of the policy.

Last Word

The question of whether an employer can demand premium repayment is multifaceted, heavily dependent on the specifics of employment contracts, insurance agreements, and applicable laws. While employers do have recourse in certain situations, such as fraud or breach of contract, they must adhere strictly to legal requirements. Employees, conversely, possess rights to challenge unfair demands. By understanding these rights and obligations, and by carefully reviewing employment contracts and insurance enrollment forms, both employers and employees can minimize the risk of disputes and ensure a fair and transparent process.

FAQ Insights

What if I leave my job due to unforeseen circumstances, such as a family emergency? Does that affect premium repayment?

The specifics depend on your employment contract and state laws. While some contracts might allow for exceptions in cases of hardship, others may not. It’s crucial to review your contract and consult with legal counsel if faced with this situation.

Can an employer demand repayment of premiums if I was terminated for cause?

Yes, if your termination was due to a violation of company policy or contract terms (e.g., gross misconduct, fraud), the employer might be able to legally demand premium repayment. The specifics will be detailed in your employment contract.

Where can I find more information about the specific laws in my state regarding premium repayment?

Your state’s department of labor or a legal professional specializing in employment law can provide information about relevant state laws and regulations concerning employer-sponsored insurance and premium repayment.

My employer is demanding repayment but hasn’t provided any legal basis. What should I do?

Seek legal advice immediately. An employer must have a valid legal basis to demand premium repayment, and their failure to provide one is a significant red flag.