Navigating the world of life insurance can feel overwhelming, especially when considering the added benefit of a return of premium (ROP). This comprehensive guide unravels the complexities of term life insurance with ROP, empowering you to make informed decisions about protecting your loved ones and securing your financial future. We’ll explore the key features, cost comparisons, and crucial factors to consider when selecting a policy that best aligns with your individual needs and circumstances.

Understanding the nuances of ROP policies is crucial. This involves examining the mechanics of premium returns, potential tax implications, and a thorough comparison of offerings from different providers. We’ll delve into real-world scenarios to illustrate the benefits and potential drawbacks, helping you weigh the advantages against the higher premiums typically associated with ROP policies. By the end, you’ll possess the knowledge to confidently choose the best term life insurance with return of premium for your specific requirements.

Defining “Best” Term Life Insurance with Return of Premium (ROP)

Finding the “best” term life insurance with Return of Premium (ROP) depends heavily on individual needs and financial circumstances. There’s no single perfect policy, but understanding the key features and comparing options allows for informed decision-making. This section will clarify what constitutes a strong ROP policy and how it differs from traditional term life insurance.

Term life insurance with a Return of Premium (ROP) rider offers a unique combination of life insurance protection and a savings component. The core feature is the return of premiums paid over the policy’s term, provided the insured survives. This means that after the policy expires, the policyholder receives a lump-sum payment equal to all the premiums paid, effectively turning the insurance into a form of investment. The ROP rider is an added feature, increasing the overall cost compared to a standard term life insurance policy.

Key Features of Term Life Insurance with ROP

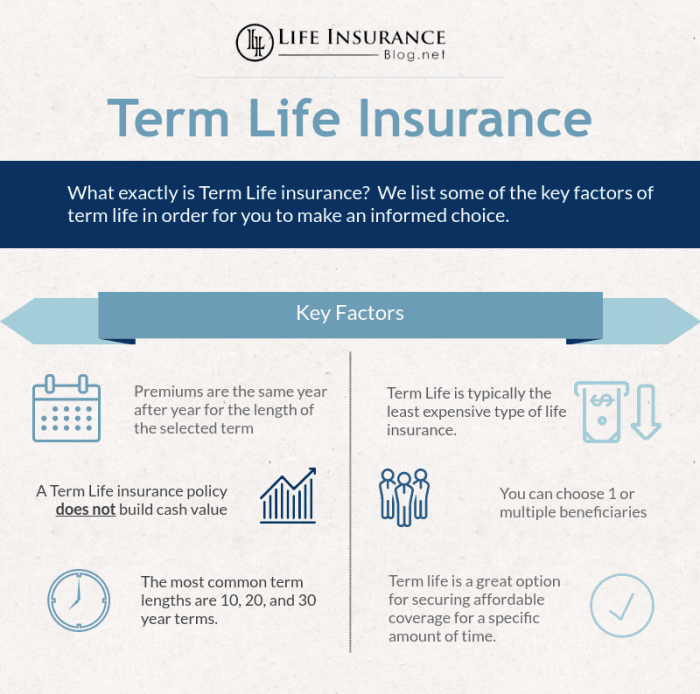

ROP policies share the fundamental characteristics of traditional term life insurance – providing a death benefit for a specified term (e.g., 10, 20, or 30 years). However, the crucial difference lies in the return of premiums. The premiums are generally higher than those for a comparable term life insurance policy without the ROP rider. The return of premium is typically paid out at the end of the policy term if the insured is still alive. The payout amount is usually tax-free. Other features may include options for adjusting coverage amounts or extending the term during the policy’s duration, but these options often come with additional costs.

ROP vs. Traditional Term Life Insurance

The primary distinction between ROP and traditional term life insurance lies in the return of premiums. Traditional term life insurance provides a death benefit only if the insured dies within the policy term. If the insured survives the term, the policy simply expires. Conversely, ROP policies offer the death benefit and a guaranteed return of premiums paid, acting as a form of investment alongside life insurance protection. This means ROP policies are more expensive due to the added benefit.

Cost and Benefit Comparison of ROP and Other Life Insurance Types

ROP policies are more expensive than traditional term life insurance because of the guaranteed return of premiums. Comparing them to whole life or universal life insurance requires careful consideration. Whole life and universal life policies offer cash value accumulation, but they are significantly more expensive than term life insurance, even ROP. The cost of ROP should be weighed against the benefits of guaranteed premium return versus the potential for higher returns (and greater risk) with whole or universal life policies. The best choice depends on individual risk tolerance and financial goals.

Comparison of Four ROP Term Life Insurance Policies

The following table presents a hypothetical comparison of four different ROP term life insurance policies. Remember that actual premiums and benefits vary significantly depending on factors such as age, health, smoking status, and the insurer. These figures are for illustrative purposes only and should not be considered a definitive representation of market offerings.

| Policy | Premium (Annual) | Death Benefit | Return of Premium Schedule |

|---|---|---|---|

| Policy A (10-year term) | $1,500 | $250,000 | Full return at year 10 |

| Policy B (20-year term) | $1,000 | $200,000 | Full return at year 20 |

| Policy C (30-year term) | $750 | $150,000 | Full return at year 30 |

| Policy D (20-year term, higher coverage) | $2,000 | $500,000 | Full return at year 20 |

Factors Influencing the Choice of a ROP Policy

Choosing the right term life insurance policy with a return of premium (ROP) requires careful consideration of several key factors. Understanding these factors will help you make an informed decision that aligns with your financial goals and risk tolerance. This section will explore the crucial elements to consider before purchasing an ROP policy.

Health and Age

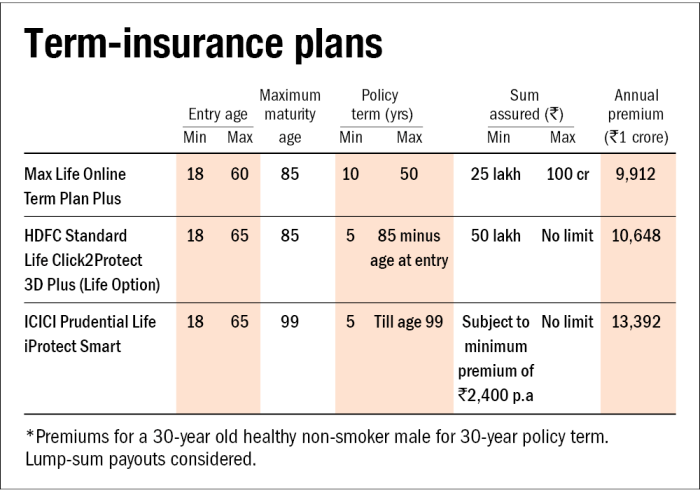

Your health and age are paramount in determining your eligibility for an ROP policy and significantly impact the premium you’ll pay. Insurers assess your health status through a medical underwriting process, which involves reviewing your medical history, lifestyle, and potentially requiring a medical examination. Individuals with pre-existing health conditions or engaging in high-risk activities may face higher premiums or even be denied coverage. Age also plays a crucial role; younger individuals generally qualify for lower premiums due to their statistically lower risk of mortality compared to older applicants. For example, a 30-year-old non-smoker in excellent health will likely receive a significantly lower premium than a 50-year-old with a history of heart disease. The older you are when you apply, the higher your premium will be, reflecting the increased risk to the insurer.

Insurance Company Financial Stability and Ratings

Selecting a financially sound and reputable insurance company is critical when purchasing any insurance policy, especially a long-term commitment like an ROP policy. The insurer’s financial strength directly impacts their ability to pay out claims when the time comes. Independent rating agencies, such as A.M. Best, Moody’s, and Standard & Poor’s, provide ratings that reflect the financial stability and creditworthiness of insurance companies. Choosing a company with a high rating minimizes the risk of the insurer’s inability to fulfill its obligations under the policy. For example, an insurer with an A+ rating from A.M. Best demonstrates a superior level of financial strength and security compared to a company with a lower rating. Thorough research into the insurer’s financial stability is a crucial step in the decision-making process.

ROP Policy Suitability: Scenarios

ROP policies are suitable in specific scenarios, while less advantageous in others. A suitable scenario would be for individuals who want life insurance coverage but also desire a return of their premiums if they outlive the policy term. This offers a financial hedge, essentially acting as a form of long-term savings. For example, a young professional aiming to build wealth while securing their family’s financial future could benefit from an ROP policy. However, ROP policies are generally more expensive than traditional term life insurance policies because of the premium return feature. Therefore, a scenario where an ROP policy might not be the best choice would be for someone prioritizing the lowest possible premiums, particularly those with a limited budget or a shorter-term need for coverage. In this case, a traditional term life insurance policy would be a more cost-effective solution. The decision hinges on weighing the benefits of premium return against the higher cost of the policy.

Comparing ROP Policies from Different Providers

Choosing the “best” ROP policy requires careful comparison of offerings from various insurance providers. While features and pricing can vary significantly, a systematic approach ensures you select a policy that aligns with your individual needs and financial goals. This comparison focuses on key aspects to aid in your decision-making process.

Direct comparison of Return of Premium (ROP) term life insurance policies from different providers necessitates analyzing several key factors. These include the premium amounts, the length of the coverage term, the death benefit, the riders available, and the specific terms and conditions of the policy. It’s crucial to remember that the “best” policy is subjective and depends on your unique circumstances.

ROP Policy Features and Benefits from Three Providers

This section illustrates a comparison of hypothetical ROP policies from three major insurance providers—Provider A, Provider B, and Provider C. Note that these are examples for illustrative purposes only and do not reflect actual policy offerings, which are subject to change. Always refer to the provider’s official documentation for the most up-to-date information.

The following table summarizes key features and benefits, allowing for a direct comparison between the three hypothetical providers. Remember that these are illustrative examples and actual policies will vary. Always obtain quotes and review policy documents directly from the insurers.

| Feature | Provider A | Provider B | Provider C |

|---|---|---|---|

| Premium (Annual, $1M Death Benefit, 20-Year Term) | $3,500 | $3,800 | $3,200 |

| Return of Premium | Full premium at end of term | Full premium at end of term, less any outstanding loans or fees | Full premium at end of term, with potential for interest depending on performance of the underlying investment accounts (This option is less common in standard ROP policies, but included here for illustration) |

| Riders Available | Accidental Death Benefit, Waiver of Premium | Accidental Death Benefit, Waiver of Premium, Terminal Illness Benefit | Accidental Death Benefit, Waiver of Premium, Critical Illness Benefit |

| Policy Term Options | 10, 15, 20, 25, 30 years | 10, 15, 20, 30 years | 10, 15, 20 years |

| Underwriting Requirements | Standard | Standard to Preferred Plus | Standard to Preferred |

Key Differences in Policy Terms and Conditions

Understanding the nuances of policy terms is critical for making an informed decision. Variations in policy conditions can significantly impact the overall value and suitability of the policy for your specific needs.

- Premium Payment Flexibility: Provider A might offer monthly payment options, while Provider B and C may only allow annual or semi-annual payments. This can impact cash flow management.

- Policy Loan Provisions: The availability and terms of policy loans can vary. Some providers may allow loans against the cash value (if applicable), while others may not offer this option.

- Grace Periods: The length of the grace period for late premium payments can differ. A longer grace period offers more flexibility.

- Renewability and Convertibility: Check if the policy allows for renewal or conversion to a different type of policy at the end of the term. This provides options for continued coverage.

- Exclusions and Limitations: Carefully review the policy’s exclusions and limitations, as these can affect coverage in specific circumstances. Compare the specifics of each provider’s exclusions.

Comparing Premiums and Death Benefit Amounts

A direct comparison of premiums and death benefits for similar policies from different providers is essential. This allows for an apples-to-apples comparison of value.

To illustrate, let’s consider a $1 million death benefit, 20-year term policy. Provider A quotes $3,500 annually, Provider B quotes $3,800, and Provider C quotes $3,200. While Provider C offers the lowest annual premium, a thorough review of the policy terms and conditions (as discussed above) is crucial before making a decision. The seemingly lower premium might be offset by less favorable terms or fewer rider options. A higher premium from another provider might be justified by superior benefits or more flexible policy terms.

Remember to obtain personalized quotes from multiple providers based on your specific age, health, and desired coverage amount. This ensures you’re comparing like-for-like policies and can make an informed decision based on your individual needs.

Potential Drawbacks of ROP Policies

While Return of Premium (ROP) term life insurance offers the attractive benefit of receiving back your premiums if you outlive the policy term, it’s crucial to understand the potential downsides. These policies, while seemingly advantageous, come with certain trade-offs that require careful consideration before purchasing. Understanding these drawbacks will allow you to make a fully informed decision.

ROP policies typically carry higher premiums than standard term life insurance policies. This is because the insurance company is essentially making a bet that you will not die during the policy term. They need to charge more to cover the risk of paying out the premiums you’ve invested. This higher cost should be weighed against the potential benefit of receiving your premiums back.

Higher Premiums Compared to Traditional Term Life Insurance

The increased cost associated with ROP policies is a significant drawback. Consider a hypothetical scenario: a 35-year-old male purchasing a 20-year, $500,000 term life insurance policy. A standard term policy might cost him $50 per month, while an equivalent ROP policy could cost $75 per month, a 50% increase. Over 20 years, this represents a substantial difference in total cost. This higher premium represents the cost of the insurance company’s commitment to return the premiums. While you’ll get your money back if you live, you pay a premium for that guarantee. This means that if your primary concern is affordability, a traditional term life policy might be a more suitable choice.

Impact of Lapses or Policy Cancellations on Return of Premium

One of the most critical aspects to understand about ROP policies is what happens if you cancel the policy before the end of the term. In most cases, you will not receive the full return of premium if you cancel early. The insurance company will likely keep a portion of the premiums to cover their administrative costs and any accumulated profits during the time the policy was in effect. Furthermore, some policies may stipulate that the return of premium is only applicable if the policy is maintained until the end of the term. A lapse in payments due to unforeseen circumstances could significantly impact your ability to recover your premiums, potentially negating the perceived benefit of the ROP feature. Therefore, maintaining consistent premium payments is paramount to realizing the full return of premium.

Concluding Remarks

Ultimately, the decision of whether or not to invest in term life insurance with a return of premium hinges on a careful assessment of your individual financial situation, risk tolerance, and long-term goals. While the higher premiums are a significant consideration, the potential for a full premium refund offers considerable peace of mind for those who prioritize this financial safety net. By understanding the intricacies of ROP policies and comparing offerings from various providers, you can confidently choose a plan that provides optimal protection and aligns with your unique circumstances. Remember to consult with a financial advisor for personalized guidance.

Essential Questionnaire

What happens if I die before the policy term ends with a ROP policy?

Your beneficiaries receive the death benefit, as with any term life insurance policy. The return of premium feature becomes irrelevant in this scenario.

Can I cancel my ROP policy and still get the return of premium?

Generally, no. Most ROP policies require the policy to remain in force until the end of the term to receive the return of premium. Early cancellation typically forfeits the ROP benefit.

Are there any health requirements for ROP policies?

Yes, insurers assess your health status to determine eligibility and premium rates. Pre-existing conditions can impact your approval and premium cost.

How is the return of premium taxed?

The tax implications depend on your jurisdiction. In many cases, the returned premium is considered taxable income.